See more : Intelligent Medicine Acquisition Corp. (IQMDU) Income Statement Analysis – Financial Results

Complete financial analysis of Ziff Davis, Inc. (JCOM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ziff Davis, Inc., a leading company in the Software – Infrastructure industry within the Technology sector.

- NFiniTi inc. (NFTN) Income Statement Analysis – Financial Results

- Japan Securities Finance Co., Ltd. (8511.T) Income Statement Analysis – Financial Results

- BCPL Railway Infrastructure Li (BCPL.BO) Income Statement Analysis – Financial Results

- Brunswick Corporation (BC) Income Statement Analysis – Financial Results

- Zhejiang Xinhua Chemical Co.,Ltd (603867.SS) Income Statement Analysis – Financial Results

Ziff Davis, Inc. (JCOM)

About Ziff Davis, Inc.

J2 Global, Inc., together with its subsidiaries, provides Internet services worldwide. The company operates through three segments: Fax and Martech; Voice, Backup, Security, and Consumer Privacy and Protection; and Digital Media. It offers cloud services, which includes online fax services under the eFax, sFax, MyFax, eFax Plus, eFax Pro, eFax Secure, eFax Corporate, and eFax Developer brands; on-demand voice, cloud phone, and unified communications services under the eVoice, Line2, and Onebox names; online backup and disaster recovery, sync storage, veeam services, and synchronization and sharing solutions under the KeepItSafe, LiveDrive, LiveVault, OffsiteDataSync, and SugarSync names; email security, web security, and endpoint protection services under the VIPRE and Excel Micro brands; email marketing and delivery services under the Campaigner and SMTP names; virtual private network services under the IPVanish and Encrypt.me; IP licensing services; and customer support services. The company also operates a portfolio of Web properties and applications, including IGN, Mashable, PC Mag, Humble Bundle, Speedtest, Offers, Black Friday, AskMen, MedPageToday, Everyday Health, What to Expect, and others that offer technology products, gaming and lifestyle products and services, news and commentary related products, speed testing for Internet and network connections, online deals and discounts for consumers, interactive tools and mobile applications, and tools and information for healthcare professionals, as well as professional networking tools, targeted emails, and white papers for IT professionals. It serves sole proprietors, small to medium-sized businesses and enterprises, and government organizations. The company was formerly known as j2 Global Communications, Inc. and changed its name to j2 Global, Inc. in December 2011. J2 Global, Inc. was founded in 1995 and is headquartered in Los Angeles, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.36B | 1.39B | 1.42B | 1.49B | 1.37B | 1.21B | 1.12B | 874.26M | 720.82M | 599.03M | 520.80M | 371.40M | 330.16M | 255.39M | 245.57M | 241.51M | 220.70M | 181.08M | 143.94M | 106.34M | 71.62M | 48.21M | 33.25M | 13.93M | 7.60M | 3.50M |

| Cost of Revenue | 197.29M | 195.55M | 188.05M | 231.78M | 237.32M | 201.07M | 172.31M | 147.10M | 122.96M | 105.99M | 86.89M | 67.01M | 60.61M | 44.09M | 44.73M | 46.25M | 43.99M | 36.72M | 29.76M | 16.51M | 13.32M | 11.20M | 13.41M | 4.70M | 2.70M | 2.30M |

| Gross Profit | 1.17B | 1.20B | 1.23B | 1.26B | 1.13B | 1.01B | 945.53M | 727.16M | 597.86M | 493.04M | 433.91M | 304.38M | 269.55M | 211.31M | 200.84M | 195.26M | 176.71M | 144.36M | 114.18M | 89.83M | 58.30M | 37.01M | 19.84M | 9.23M | 4.90M | 1.20M |

| Gross Profit Ratio | 85.54% | 85.94% | 86.73% | 84.44% | 82.70% | 83.35% | 84.59% | 83.17% | 82.94% | 82.31% | 83.32% | 81.96% | 81.64% | 82.74% | 81.79% | 80.85% | 80.07% | 79.72% | 79.32% | 84.47% | 81.40% | 76.77% | 59.67% | 66.27% | 64.47% | 34.29% |

| Research & Development | 68.86M | 74.09M | 78.87M | 64.30M | 54.40M | 48.37M | 46.00M | 38.05M | 34.33M | 30.68M | 25.49M | 18.62M | 16.37M | 12.83M | 11.66M | 12.03M | 11.83M | 8.77M | 6.87M | 5.25M | 4.20M | 3.19M | 2.53M | 2.76M | 1.80M | 1.20M |

| General & Administrative | 421.05M | 404.26M | 457.69M | 445.43M | 424.07M | 375.27M | 323.52M | 239.67M | 205.14M | 134.19M | 101.68M | 60.77M | 58.16M | 48.23M | 45.28M | 44.03M | 39.68M | 23.46M | 20.97M | 13.40M | 13.40M | 13.49M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 487.37M | 490.78M | 493.05M | 413.47M | 379.18M | 338.30M | 330.30M | 206.87M | 159.01M | 141.97M | 131.32M | 62.83M | 59.07M | 46.33M | 37.01M | 41.27M | 38.77M | 23.03M | 22.93M | 6.42M | 6.42M | 6.42M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 908.42M | 895.04M | 950.74M | 858.91M | 803.26M | 713.57M | 653.81M | 446.54M | 364.15M | 276.16M | 233.00M | 123.60M | 117.22M | 94.56M | 82.28M | 85.30M | 78.45M | 69.55M | 45.89M | 38.54M | 26.75M | 19.91M | 18.51M | 24.06M | 14.30M | 9.90M |

| Other Expenses | 56.85M | 8.44M | 1.29M | 31.63M | -7.94M | -4.71M | 22.04M | 10.24M | -5.00K | 165.00K | -11.47M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.03B | 969.13M | 1.03B | 923.20M | 857.65M | 761.94M | 699.82M | 484.59M | 398.48M | 306.84M | 258.49M | 142.22M | 133.60M | 107.39M | 96.38M | 97.33M | 90.28M | 78.32M | 52.76M | 43.79M | 31.05M | 23.21M | 28.56M | 33.80M | 18.00M | 12.20M |

| Cost & Expenses | 1.23B | 1.16B | 1.22B | 1.15B | 1.09B | 963.02M | 872.13M | 631.69M | 521.43M | 412.82M | 345.38M | 209.23M | 194.21M | 151.47M | 141.11M | 143.58M | 134.27M | 115.04M | 82.52M | 60.31M | 44.37M | 34.41M | 41.97M | 38.50M | 20.70M | 14.50M |

| Interest Income | 0.00 | 33.84M | 72.02M | 56.19M | 26.89M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.81M | 1.31M | 6.71M | 2.66M | 4.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 20.03M | 33.84M | 79.03M | 131.98M | 69.55M | 61.99M | 67.78M | 41.37M | 42.46M | 31.20M | 21.25M | 7.24M | 147.00K | 104.00K | 439.00K | 559.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 236.97M | 246.81M | 259.79M | 246.42M | 253.45M | 187.17M | 162.04M | 122.09M | 93.21M | 62.95M | 39.79M | 22.16M | 19.76M | 14.51M | 14.71M | 13.18M | 10.13M | 8.23M | 7.11M | 4.55M | 3.91M | 3.49M | 9.69M | 6.99M | 1.90M | 1.10M |

| EBITDA | 353.54M | 411.81M | 683.16M | 380.96M | 522.60M | 426.75M | 410.05M | 369.51M | 292.60M | 249.32M | 203.74M | 186.13M | 156.87M | 125.25M | 112.49M | 114.85M | 96.56M | 74.27M | 81.75M | 50.59M | 27.25M | 17.30M | 972.55K | -17.58M | -11.20M | -9.90M |

| EBITDA Ratio | 25.92% | 33.66% | 32.37% | 39.94% | 38.09% | 35.35% | 38.45% | 42.88% | 40.59% | 41.62% | 39.12% | 49.63% | 47.16% | 46.37% | 52.33% | 46.01% | 43.75% | 41.01% | 40.80% | 47.57% | 43.51% | 35.87% | 4.72% | -126.20% | -146.05% | -142.86% |

| Operating Income | 132.61M | 198.94M | 166.43M | 334.61M | 277.08M | 244.28M | 245.71M | 242.57M | 199.38M | 186.21M | 175.42M | 162.16M | 135.95M | 103.92M | 104.46M | 97.93M | 86.43M | 66.04M | 61.42M | 46.04M | 27.25M | 13.81M | -8.72M | -24.57M | -13.10M | -11.00M |

| Operating Income Ratio | 9.72% | 14.30% | 11.75% | 22.46% | 20.19% | 20.23% | 21.98% | 27.75% | 27.66% | 31.08% | 33.68% | 43.66% | 41.18% | 40.69% | 42.54% | 40.55% | 39.16% | 36.47% | 42.67% | 43.29% | 38.05% | 28.63% | -26.23% | -176.34% | -172.37% | -314.29% |

| Total Other Income/Expenses | -57.64M | -67.79M | 219.86M | -59.99M | -77.48M | -66.69M | -45.74M | -31.13M | -42.46M | -31.04M | -32.73M | -7.24M | 1.17M | 6.71M | -6.68M | 4.22M | 9.04M | 7.20M | 13.15M | 1.87M | 419.00K | 437.75K | 890.79K | 2.36M | -100.00K | -4.90M |

| Income Before Tax | 74.97M | 131.15M | 335.76M | 230.40M | 199.60M | 177.59M | 199.97M | 211.44M | 156.92M | 155.17M | 142.70M | 154.92M | 137.12M | 110.64M | 97.78M | 102.15M | 95.46M | 73.23M | 74.57M | 47.22M | 27.67M | 14.24M | -7.83M | -22.22M | -13.20M | -15.90M |

| Income Before Tax Ratio | 5.50% | 9.43% | 23.70% | 15.47% | 14.55% | 14.71% | 17.89% | 24.19% | 21.77% | 25.90% | 27.40% | 41.71% | 41.53% | 43.32% | 39.82% | 42.30% | 43.25% | 40.44% | 51.81% | 44.40% | 38.63% | 29.54% | -23.55% | -159.44% | -173.68% | -454.29% |

| Income Tax Expense | 24.14M | 57.96M | -15.94M | 68.39M | -19.38M | 44.76M | 60.54M | 59.00M | 23.28M | 29.84M | 35.18M | 33.26M | 22.35M | 27.59M | 30.95M | 29.59M | 27.00M | 20.10M | 23.31M | 15.61M | -8.14M | 151.36K | 4.00K | 4.00K | 4.30M | 6.20M |

| Net Income | 41.50M | 63.76M | 351.70M | 150.67M | 218.81M | 128.69M | 139.43M | 152.44M | 133.64M | 125.33M | 107.52M | 121.58M | 114.77M | 83.05M | 66.83M | 72.56M | 68.46M | 53.13M | 51.26M | 31.61M | 35.81M | 14.32M | -7.83M | -22.22M | -17.40M | -17.20M |

| Net Income Ratio | 3.04% | 4.58% | 24.83% | 10.11% | 15.95% | 10.66% | 12.47% | 17.44% | 18.54% | 20.92% | 20.65% | 32.74% | 34.76% | 32.52% | 27.21% | 30.04% | 31.02% | 29.34% | 35.61% | 29.72% | 49.99% | 29.70% | -23.56% | -159.47% | -228.95% | -491.43% |

| EPS | 0.89 | 1.36 | 7.66 | 3.25 | 4.52 | 2.68 | 2.89 | 3.15 | 2.76 | 2.60 | 2.31 | 2.63 | 2.46 | 1.86 | 1.52 | 1.63 | 1.40 | 1.08 | 1.05 | 0.66 | 0.79 | 0.32 | -0.17 | -0.61 | -0.62 | -0.78 |

| EPS Diluted | 0.89 | 1.36 | 7.35 | 3.20 | 4.39 | 2.63 | 2.83 | 3.13 | 2.73 | 2.58 | 2.28 | 2.61 | 2.43 | 1.81 | 1.48 | 1.58 | 1.35 | 1.04 | 0.99 | 0.61 | 0.73 | 0.29 | -0.17 | -0.61 | -0.62 | -0.78 |

| Weighted Avg Shares Out | 46.40M | 46.95M | 45.89M | 46.31M | 47.65M | 47.95M | 47.59M | 47.67M | 47.63M | 46.78M | 45.55M | 45.46M | 45.80M | 44.58M | 43.94M | 44.61M | 48.95M | 49.21M | 48.22M | 46.63M | 45.46M | 43.30M | 45.12M | 36.48M | 28.10M | 22.18M |

| Weighted Avg Shares Out (Dil) | 46.46M | 47.03M | 47.86M | 47.12M | 49.03M | 48.93M | 48.67M | 47.96M | 48.09M | 47.11M | 46.14M | 45.78M | 46.38M | 45.94M | 45.14M | 45.94M | 50.76M | 51.05M | 51.17M | 49.83M | 49.15M | 46.70M | 45.12M | 36.48M | 28.10M | 22.18M |

DEADLINE TOMORROW: The Schall Law Firm Announces the Filing of a Class Action Lawsuit Against J2 Global, Inc. and Encourages Investors with Losses in Excess of $100,000 to Contact the Firm

JCOM 2-DAY DEADLINE ALERT: Hagens Berman, National Trial Attorneys, Reminds J2 Global (JCOM) Investors of Application Deadline in Securities Class Action, Encourages Investors with Losses to Contact the Firm Now

JCOM FINAL DEADLINE: ROSEN, A TRUSTED AND TOP RANKED LAW FIRM, Reminds J2 Global, Inc. Investors of Important September 8 Deadline in Securities Class Action - JCOM

Wall Street Breakfast: The Week Ahead

HAGENS BERMAN, NATIONAL TRIAL ATTORNEYS, Alerts J2 Global (JCOM) Investors: 3 Days to Application Deadline in Securities Class Action, Investors with Losses Encouraged to Contact the Firm Now

Stocks To Watch: Tech Reboots And Eyes On Lululemon, Peloton & GameStop

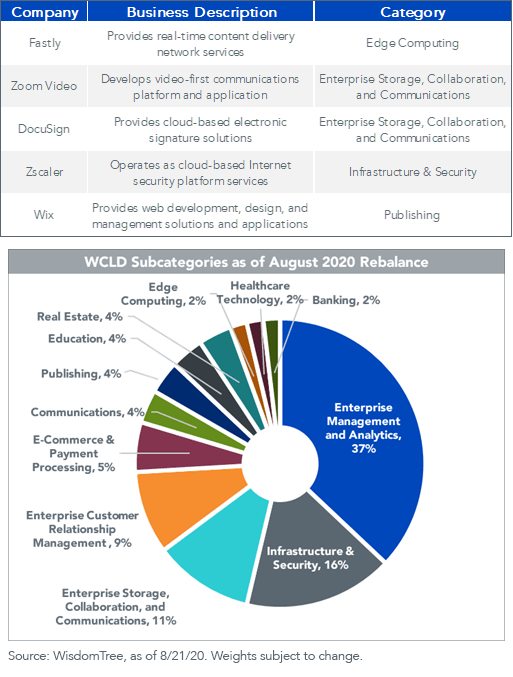

Cloud Industry Update: Rebalancing An Equal Weighted Strategy Amidst Momentum

JCOM ALERT: The Klein Law Firm Announces a Lead Plaintiff Deadline of September 8, 2020 in the Class Action Filed on Behalf of J2 Global, Inc. Limited Shareholders

TUESDAY DEADLINE NOTICE: The Schall Law Firm Announces the Filing of a Class Action Lawsuit Against J2 Global, Inc. and Encourages Investors with Losses in Excess of $100,000 to Contact the Firm

The Law Offices of Frank R. Cruz Reminds Investors of Looming Deadline in the Class Action Lawsuit Against J2 Global, Inc.

Source: https://incomestatements.info

Category: Stock Reports