See more : Metallica Minerals Limited (MLMZF) Income Statement Analysis – Financial Results

Complete financial analysis of JinkoSolar Holding Co., Ltd. (JKS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of JinkoSolar Holding Co., Ltd., a leading company in the Solar industry within the Energy sector.

- Shanghai Feilo Acoustics Co.,Ltd (600651.SS) Income Statement Analysis – Financial Results

- Marksans Pharma Limited (MARKSANS.BO) Income Statement Analysis – Financial Results

- Bowen Acquisition Corp (BOWNR) Income Statement Analysis – Financial Results

- Alpine 4 Holdings, Inc. (ALPP) Income Statement Analysis – Financial Results

- Bliss Intelligence Public Company Limited (BLISS.BK) Income Statement Analysis – Financial Results

JinkoSolar Holding Co., Ltd. (JKS)

About JinkoSolar Holding Co., Ltd.

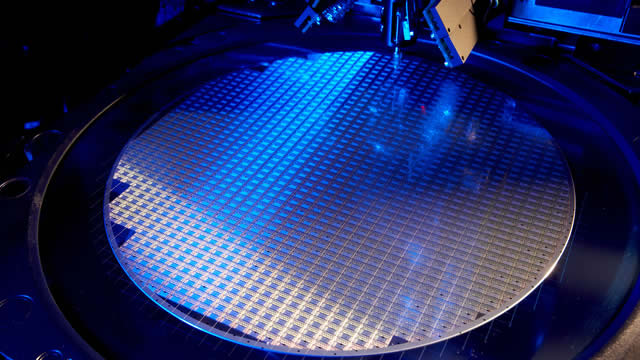

JinkoSolar Holding Co., Ltd., together with its subsidiaries, engages in the design, development, production, and marketing of photovoltaic products. The company offers solar modules, silicon wafers, solar cells, recovered silicon materials, and silicon ingots. It also provides solar system integration services; and develops commercial solar power projects. The company sells its products to distributors, project developers, system integrators, and manufacturers of solar power products under the JinkoSolar brand. As of March 31, 2022, it had an integrated annual capacity of 40 gigawatts (GW) for mono wafers; 40.0 GW for solar cells; and 50.0 GW for solar modules. The company has operations in the People's Republic of China, the United States, Mexico, Australia, Japan, United Arab Emirates, Turkey, Jordan, Vietnam, Egypt, Spain, and Germany. JinkoSolar Holding Co., Ltd. was founded in 2006 and is based in Shangrao, the People's Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 118.68B | 83.13B | 40.83B | 35.13B | 29.75B | 25.04B | 26.47B | 21.40B | 15.45B | 9.74B | 7.08B | 4.79B | 7.38B | 4.65B | 1.57B | 2.18B | 709.15M |

| Cost of Revenue | 99.63B | 70.85B | 34.17B | 28.96B | 24.31B | 21.53B | 23.48B | 17.53B | 12.52B | 7.64B | 5.64B | 4.23B | 6.24B | 3.30B | 1.34B | 1.87B | 621.02M |

| Gross Profit | 19.05B | 12.28B | 6.66B | 6.17B | 5.43B | 3.51B | 2.99B | 3.87B | 2.93B | 2.10B | 1.44B | 564.57M | 1.15B | 1.36B | 230.21M | 311.53M | 88.13M |

| Gross Profit Ratio | 16.05% | 14.77% | 16.31% | 17.57% | 18.26% | 14.03% | 11.30% | 18.08% | 18.97% | 21.53% | 20.30% | 11.77% | 15.57% | 29.16% | 14.68% | 14.27% | 12.43% |

| Research & Development | 911.87M | 724.77M | 461.59M | 389.19M | 324.43M | 366.58M | 294.10M | 181.11M | 143.67M | 106.63M | 65.48M | 68.96M | 29.99M | 31.62M | 5.90M | 441.79K | 50.83K |

| General & Administrative | 4.58B | 3.48B | 1.95B | 1.40B | 1.05B | 768.38M | 461.91M | 770.87M | 515.12M | 362.45M | 223.46M | 754.26M | 465.59M | 166.03M | 85.11M | 38.66M | 11.18M |

| Selling & Marketing | 6.82B | 7.24B | 2.86B | 2.47B | 2.25B | 1.71B | 1.90B | 1.43B | 1.14B | 768.26M | 492.63M | 343.41M | 338.38M | 169.82M | 16.73M | 1.17M | 1.31M |

| SG&A | 11.40B | 10.75B | 4.82B | 3.88B | 3.31B | 2.49B | 2.37B | 2.21B | 1.67B | 1.14B | 722.75M | 1.10B | 803.97M | 335.85M | 101.84M | 39.83M | 12.49M |

| Other Expenses | 640.00M | 7.41M | 1.91M | 2.29M | 17.87M | 25.82M | 59.65M | 8.77M | -14.98M | -1.69M | 6.87M | 4.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 12.96B | 9.62B | 4.88B | 5.12B | 3.75B | 2.82B | 2.58B | 2.26B | 1.75B | 1.28B | 1.01B | 1.90B | 833.97M | 367.46M | 107.74M | 40.27M | 12.54M |

| Cost & Expenses | 112.59B | 80.47B | 39.05B | 34.08B | 28.06B | 24.35B | 26.06B | 19.79B | 14.28B | 8.93B | 6.65B | 6.13B | 7.07B | 3.66B | 1.45B | 1.91B | 633.56M |

| Interest Income | 553.53M | 588.71M | 214.29M | 216.62M | 170.98M | 83.46M | 402.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -30.15M | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.17B | 490.70M | 624.03M | 459.23M | 391.58M | 295.69M | 245.53M | 364.76M | 385.94M | 252.40M | 223.38M | 221.72M | 182.50M | 64.27M | 29.94M | 6.32M | 0.00 |

| Depreciation & Amortization | 8.19B | 2.76B | 1.80B | 1.38B | 978.95M | 817.28M | 616.05M | 788.39M | 630.66M | 441.74M | 363.24M | 335.60M | 269.63M | 100.89M | 46.09M | 15.54M | 1.62M |

| EBITDA | 16.85B | 3.43B | 3.04B | 3.14B | 2.63B | 1.48B | 941.32M | 2.26B | 1.75B | 1.29B | 1.01B | -500.07M | 806.53M | 1.19B | 168.56M | 331.61M | 77.21M |

| EBITDA Ratio | 14.20% | 4.13% | 7.45% | 8.93% | 8.85% | 5.90% | 3.56% | 10.57% | 11.34% | 13.26% | 14.30% | -10.43% | 1.28% | 19.07% | 10.75% | 15.19% | 10.78% |

| Operating Income | 6.09B | 802.98M | 1.38B | 1.90B | 1.80B | 659.47M | 325.26M | 1.47B | 1.12B | 850.27M | 649.12M | -835.67M | 315.89M | 989.92M | 122.47M | 271.25M | 75.59M |

| Operating Income Ratio | 5.13% | 0.97% | 3.37% | 5.41% | 6.04% | 2.63% | 1.23% | 6.89% | 7.26% | 8.73% | 9.17% | -17.43% | 4.28% | 21.27% | 7.81% | 12.42% | 10.66% |

| Total Other Income/Expenses | 1.62B | 1.74B | -226.51M | -1.27B | -527.30M | -234.94M | -178.44M | -101.38M | -254.73M | -281.30M | -437.52M | -717.06M | 38.51M | 38.08M | -38.41M | -51.13M | 456.90K |

| Income Before Tax | 7.71B | 2.17B | 1.15B | 513.67M | 1.20B | 409.99M | 146.82M | 1.25B | 867.07M | 562.75M | 208.02M | -1.55B | 354.40M | 1.03B | 84.07M | 220.12M | 76.05M |

| Income Before Tax Ratio | 6.50% | 2.61% | 2.82% | 1.46% | 4.04% | 1.64% | 0.55% | 5.83% | 5.61% | 5.78% | 2.94% | -32.38% | 4.80% | 22.08% | 5.36% | 10.08% | 10.72% |

| Income Tax Expense | 1.26B | 605.28M | 194.14M | 178.41M | 277.98M | 4.41M | 4.63M | 257.49M | 100.53M | 135.39M | 18.53M | 8.92M | 81.07M | 146.13M | -1.34M | 822.28K | -456.90K |

| Net Income | 3.45B | 620.51M | 721.02M | 230.39M | 898.66M | 406.48M | 141.71M | 990.67M | 683.75M | 673.02M | 188.01M | -1.54B | 273.34M | 881.87M | 85.41M | 218.72M | 76.05M |

| Net Income Ratio | 2.90% | 0.75% | 1.77% | 0.66% | 3.02% | 1.62% | 0.54% | 4.63% | 4.42% | 6.91% | 2.66% | -32.17% | 3.70% | 18.95% | 5.45% | 10.02% | 10.72% |

| EPS | 60.89 | 12.54 | 15.13 | 5.15 | 21.22 | 10.57 | 4.40 | 30.53 | 24.61 | 22.71 | 8.00 | -69.52 | 11.64 | 44.64 | -2.92 | 15.72 | 6.00 |

| EPS Diluted | 60.99 | 12.40 | 8.02 | 5.15 | 21.22 | 10.51 | 4.32 | 30.34 | 24.00 | 16.08 | 7.84 | -69.52 | -4.92 | 43.68 | -2.92 | 15.72 | 6.00 |

| Weighted Avg Shares Out | 56.62M | 49.50M | 51.43M | 44.73M | 42.34M | 38.45M | 32.80M | 32.45M | 31.94M | 43.42M | 23.98M | 22.19M | 23.49M | 18.72M | 12.68M | 13.93M | 12.68M |

| Weighted Avg Shares Out (Dil) | 56.53M | 50.10M | 51.43M | 44.73M | 42.34M | 38.68M | 32.92M | 32.65M | 31.95M | 38.45M | 24.01M | 22.19M | 25.67M | 20.19M | 12.68M | 13.93M | 12.68M |

Historic JinkoSolar Donation Powers Projects in Native American Communities

JinkoSolar Schedules 2024 Annual General Meeting to be Held on December 27, 2024

JinkoSolar Holding Co., Ltd. (JKS) Q3 2024 Earnings Conference Call Transcript

JinkoSolar Announces Third Quarter 2024 Financial Results

JinkoSolar to Report Third Quarter 2024 Results on October 30, 2024

JinkoSolar's Subsidiary Jiangxi Jinko Proposed to Offer and List up to 1,000,519,986 A Shares in the Form of GDRs on the Frankfurt Stock Exchange in Germany

JinkoSolar: Still Time To Buy On Deep Value

JinkoSolar Holding Co Ltd (JKS) Shares Up 1.78% on Oct 2

Red, Blue, And Green Energy: JinkoSolar's Future In The Election Crossfire

JinkoSolar Unveils its First Climate White Paper at 2024 New York Climate Week

Source: https://incomestatements.info

Category: Stock Reports