See more : Allkem Limited (AKE.TO) Income Statement Analysis – Financial Results

Complete financial analysis of Johnson & Johnson (JNJ) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Johnson & Johnson, a leading company in the Drug Manufacturers – General industry within the Healthcare sector.

- Salmon Evolution ASA (SALME.OL) Income Statement Analysis – Financial Results

- Fidelity Holding Corp. (FDHC) Income Statement Analysis – Financial Results

- Selina Hospitality PLC (SLNAW) Income Statement Analysis – Financial Results

- MagForce AG (MF6.DE) Income Statement Analysis – Financial Results

- Chesser Resources Limited (CHZ.AX) Income Statement Analysis – Financial Results

Johnson & Johnson (JNJ)

About Johnson & Johnson

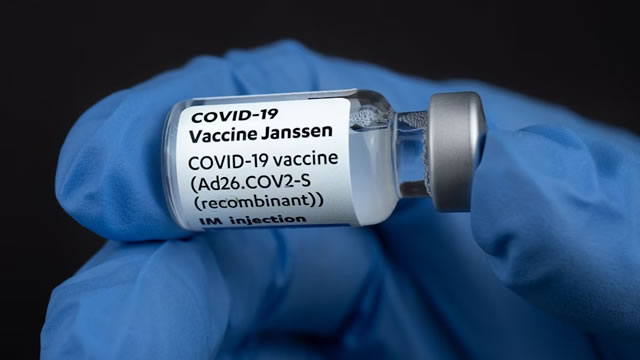

Johnson & Johnson, together with its subsidiaries, researches and develops, manufactures, and sells various products in the healthcare field worldwide. The company's Consumer Health segment offers baby care products under the JOHNSON'S and AVEENO Baby brands; oral care products under the LISTERINE brand; skin health/beauty products under the AVEENO, CLEAN & CLEAR, DR. CI:LABO, NEUTROGENA, and OGX brands; TYLENOL acetaminophen products; SUDAFED cold, flu, and allergy products; BENADRYL and ZYRTEC allergy products; MOTRIN IB ibuprofen products; NICORETTE smoking cessation products; and PEPCID acid reflux products. It also offers STAYFREE and CAREFREE sanitary pads; o.b. tampons; adhesive bandages under the BAND-AID brand; and first aid products under the NEOSPORIN brand. It serves general public, retail outlets, and distributors. The company's Pharmaceutical segment offers products for rheumatoid arthritis, psoriatic arthritis, inflammatory bowel disease, and psoriasis; HIV/AIDS and COVID-19 infectious diseases; mood disorders, neurodegenerative disorders, and schizophrenia; prostate cancer, hematologic malignancies, lung cancer, and bladder cancer; thrombosis, diabetes and macular degeneration; and pulmonary arterial hypertension. This segment serves retailers, wholesalers, distributors, hospitals, and healthcare professionals directly for prescription use. Its MedTech segment provides electrophysiology products to treat cardiovascular diseases; neurovascular care products to treat hemorrhagic and ischemic stroke; orthopaedics products in support of hips, knees, trauma, spine, sports, and other; advanced and general surgery solutions that focus on breast aesthetics, ear, nose, and throat procedures; and disposable contact lenses and ophthalmic products related to cataract and laser refractive surgery under the ACUVUE brand. This segment serves wholesalers, hospitals, and retailers. The company was founded in 1886 and is based in New Brunswick, New Jersey.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 85.16B | 79.99B | 78.74B | 82.58B | 82.06B | 81.58B | 76.45B | 71.89B | 70.07B | 74.33B | 71.31B | 67.22B | 65.03B | 61.59B | 61.90B | 63.75B | 61.10B | 53.32B | 50.51B | 47.35B | 41.86B | 36.30B | 33.00B | 29.14B | 27.47B | 23.66B | 22.63B | 21.62B | 18.84B | 15.73B | 14.14B | 13.75B | 12.45B | 11.23B | 9.76B | 9.00B | 8.01B | 7.00B | 6.42B |

| Cost of Revenue | 26.55B | 24.60B | 23.40B | 28.43B | 27.56B | 27.09B | 25.35B | 21.69B | 21.54B | 22.75B | 22.34B | 21.66B | 20.36B | 18.79B | 18.45B | 18.51B | 17.75B | 15.06B | 13.95B | 13.42B | 12.18B | 10.45B | 9.54B | 7.35B | 7.00B | 6.19B | 6.09B | 6.01B | 5.38B | 4.58B | 4.17B | 4.12B | 3.71B | 3.46B | 3.07B | 2.90B | 2.60B | 2.35B | 2.34B |

| Gross Profit | 58.61B | 55.39B | 55.34B | 54.16B | 54.50B | 54.49B | 51.10B | 50.21B | 48.54B | 51.59B | 48.97B | 45.57B | 44.67B | 42.80B | 43.45B | 45.24B | 43.34B | 38.27B | 36.56B | 33.93B | 29.69B | 25.85B | 23.47B | 21.79B | 20.47B | 17.47B | 16.54B | 15.61B | 13.46B | 11.16B | 9.96B | 9.64B | 8.74B | 7.77B | 6.69B | 6.10B | 5.41B | 4.65B | 4.08B |

| Gross Profit Ratio | 68.82% | 69.25% | 70.28% | 65.58% | 66.42% | 66.79% | 66.84% | 69.84% | 69.27% | 69.40% | 68.67% | 67.78% | 68.69% | 69.49% | 70.20% | 70.96% | 70.95% | 71.76% | 72.38% | 71.65% | 70.91% | 71.22% | 71.11% | 74.79% | 74.53% | 73.83% | 73.11% | 72.21% | 71.46% | 70.92% | 70.48% | 70.06% | 70.19% | 69.17% | 68.58% | 67.77% | 67.52% | 66.37% | 63.50% |

| Research & Development | 15.05B | 14.14B | 14.28B | 12.34B | 11.36B | 10.78B | 10.55B | 9.10B | 9.05B | 8.49B | 8.18B | 7.67B | 7.55B | 6.84B | 7.17B | 7.76B | 7.68B | 7.13B | 6.31B | 5.20B | 4.68B | 3.96B | 3.59B | 2.93B | 2.60B | 2.27B | 2.14B | 0.00 | 0.00 | 1.28B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 20.11B | 19.05B | 20.12B | 22.08B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 20.11B | 19.05B | 20.12B | 22.08B | 22.18B | 22.54B | 21.42B | 19.95B | 21.20B | 21.95B | 21.83B | 20.87B | 20.97B | 19.42B | 19.80B | 21.49B | 20.45B | 17.43B | 16.88B | 15.86B | 14.13B | 12.22B | 11.99B | 10.88B | 10.50B | 8.91B | 8.72B | 10.30B | 9.10B | 6.35B | 6.95B | 6.80B | 6.08B | 5.30B | 4.62B | 4.30B | 3.85B | 3.39B | 2.99B |

| Other Expenses | 0.00 | 500.00M | -526.00M | -2.90B | -2.53B | -1.41B | -183.00M | -484.00M | 2.06B | 70.00M | -2.50B | -1.63B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 35.56B | 33.18B | 34.40B | 34.42B | 33.53B | 33.32B | 31.97B | 29.04B | 30.25B | 30.45B | 30.01B | 28.53B | 28.52B | 26.27B | 26.97B | 29.25B | 28.13B | 24.56B | 23.19B | 21.06B | 18.82B | 16.17B | 15.58B | 15.32B | 14.55B | 12.42B | 11.92B | 11.31B | 9.95B | 8.35B | 7.57B | 7.36B | 6.57B | 5.78B | 5.03B | 4.70B | 4.20B | 3.66B | 3.24B |

| Cost & Expenses | 61.81B | 57.78B | 57.80B | 62.85B | 61.09B | 60.41B | 57.33B | 50.73B | 51.79B | 53.19B | 52.36B | 50.19B | 48.88B | 45.06B | 45.42B | 47.76B | 45.88B | 39.62B | 37.14B | 34.49B | 30.99B | 26.62B | 25.12B | 22.66B | 21.55B | 18.61B | 18.01B | 17.32B | 15.33B | 12.93B | 11.74B | 11.48B | 10.28B | 9.24B | 8.10B | 7.60B | 6.80B | 6.02B | 5.58B |

| Interest Income | 1.26B | 490.00M | 53.00M | 111.00M | 357.00M | 611.00M | 385.00M | 368.00M | 128.00M | 67.00M | 74.00M | 64.00M | 91.00M | 107.00M | 90.00M | 361.00M | 452.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 772.00M | 276.00M | 183.00M | 201.00M | 318.00M | 1.01B | 934.00M | 726.00M | 552.00M | 533.00M | 482.00M | 532.00M | 571.00M | 348.00M | 451.00M | 435.00M | 296.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.49B | 6.97B | 7.39B | 7.23B | 7.01B | 6.93B | 5.64B | 3.75B | 3.75B | 3.90B | 4.10B | 3.67B | 3.16B | 2.94B | 2.77B | 2.83B | 2.78B | 2.18B | 2.09B | 2.12B | 1.87B | 1.66B | 1.61B | 1.52B | 1.44B | 1.25B | 1.07B | 1.01B | 857.00M | 724.00M | 617.00M | 560.00M | 493.00M | 474.00M | 414.00M | 391.00M | 356.00M | 275.20M | 250.50M |

| EBITDA | 23.73B | 27.17B | 30.93B | 27.50B | 28.27B | 28.10B | 24.54B | 24.92B | 22.12B | 25.03B | 23.16B | 17.96B | 16.05B | 20.35B | 18.96B | 20.20B | 16.36B | 15.77B | 15.61B | 15.02B | 13.27B | 11.82B | 9.78B | 8.08B | 7.59B | 6.96B | 5.62B | 5.46B | 4.42B | 3.58B | 2.93B | 2.78B | 2.65B | 2.63B | 2.08B | 1.70B | 1.47B | 1.79B | 985.40M |

| EBITDA Ratio | 27.86% | 37.71% | 35.38% | 29.27% | 26.96% | 27.64% | 25.95% | 30.16% | 27.15% | 28.68% | 27.40% | 27.07% | 29.93% | 26.84% | 27.51% | 27.84% | 32.86% | 29.58% | 30.91% | 31.72% | 31.71% | 32.57% | 29.63% | 27.73% | 27.64% | 29.41% | 24.81% | 25.24% | 23.45% | 22.72% | 20.73% | 20.24% | 21.32% | 23.45% | 21.33% | 18.88% | 18.29% | 25.50% | 15.35% |

| Operating Income | 23.41B | 23.19B | 20.47B | 16.95B | 15.12B | 15.62B | 14.20B | 17.93B | 15.28B | 17.42B | 15.43B | 14.53B | 16.31B | 13.59B | 14.26B | 14.92B | 17.30B | 13.60B | 13.52B | 12.90B | 11.40B | 10.16B | 8.18B | 6.57B | 6.15B | 5.71B | 4.55B | 4.45B | 3.56B | 2.85B | 2.31B | 2.22B | 2.16B | 2.16B | 1.67B | 1.31B | 1.11B | 1.51B | 734.90M |

| Operating Income Ratio | 27.49% | 28.99% | 26.00% | 20.52% | 18.42% | 19.15% | 18.57% | 24.94% | 21.80% | 23.44% | 21.64% | 21.61% | 25.08% | 22.06% | 23.03% | 23.40% | 28.31% | 25.50% | 26.76% | 27.24% | 27.24% | 27.99% | 24.77% | 22.53% | 22.38% | 24.14% | 20.10% | 20.57% | 18.90% | 18.12% | 16.37% | 16.16% | 17.36% | 19.23% | 17.09% | 14.53% | 13.84% | 21.57% | 11.44% |

| Total Other Income/Expenses | -8.35B | -2.85B | -1.77B | -3.24B | 2.21B | 2.38B | -1.22B | -1.09B | 907.00M | -574.00M | 38.00M | -3.26B | -3.79B | 420.00M | -908.00M | 760.00M | -1.93B | 990.00M | 137.00M | 482.00M | -563.00M | -387.00M | -277.00M | 303.00M | -108.00M | -846.00M | -46.00M | -270.00M | -194.00M | -126.00M | -62.00M | -70.00M | -126.00M | -369.00M | -147.00M | -8.00M | -16.00M | -592.80M | 164.30M |

| Income Before Tax | 15.06B | 19.36B | 19.18B | 16.50B | 17.33B | 18.00B | 17.67B | 19.80B | 19.20B | 20.56B | 15.47B | 13.78B | 12.36B | 16.95B | 15.76B | 16.93B | 13.28B | 14.59B | 13.66B | 12.84B | 10.31B | 9.29B | 7.90B | 6.62B | 5.75B | 4.27B | 4.58B | 4.03B | 3.32B | 2.68B | 2.33B | 2.21B | 2.04B | 1.62B | 1.51B | 1.40B | 1.19B | 390.80M | 899.20M |

| Income Before Tax Ratio | 17.69% | 24.20% | 24.36% | 19.98% | 21.12% | 22.06% | 23.12% | 27.55% | 27.39% | 27.66% | 21.69% | 20.49% | 19.01% | 27.52% | 25.45% | 26.56% | 21.74% | 27.36% | 27.03% | 27.11% | 24.62% | 25.60% | 23.93% | 22.73% | 20.94% | 18.05% | 20.22% | 18.65% | 17.60% | 17.04% | 16.49% | 16.05% | 16.37% | 14.45% | 15.52% | 15.51% | 14.89% | 5.58% | 14.00% |

| Income Tax Expense | 1.74B | 2.99B | 1.38B | 1.78B | 2.21B | 2.70B | 16.37B | 3.26B | 3.79B | 4.24B | 1.64B | 3.26B | 2.69B | 3.61B | 3.49B | 3.98B | 2.71B | 3.53B | 3.25B | 4.33B | 3.11B | 2.69B | 2.23B | 1.82B | 1.59B | 1.21B | 1.27B | 1.15B | 914.00M | 675.00M | 545.00M | 582.00M | 577.00M | 480.00M | 432.00M | 422.00M | 360.00M | 61.30M | 285.50M |

| Net Income | 35.15B | 17.94B | 20.88B | 14.71B | 15.12B | 15.30B | 1.30B | 16.54B | 15.41B | 16.32B | 13.83B | 10.85B | 9.67B | 13.33B | 12.27B | 12.95B | 10.58B | 11.05B | 10.41B | 8.51B | 7.20B | 6.60B | 5.67B | 4.80B | 4.17B | 3.06B | 3.30B | 2.89B | 2.40B | 2.01B | 1.79B | 1.03B | 1.46B | 1.14B | 1.08B | 974.00M | 833.00M | 329.50M | 613.70M |

| Net Income Ratio | 41.28% | 22.43% | 26.52% | 17.82% | 18.42% | 18.75% | 1.70% | 23.01% | 21.99% | 21.96% | 19.40% | 16.14% | 14.87% | 21.65% | 19.82% | 20.31% | 17.31% | 20.73% | 20.61% | 17.97% | 17.19% | 18.17% | 17.17% | 16.47% | 15.17% | 12.93% | 14.60% | 13.35% | 12.75% | 12.75% | 12.64% | 7.49% | 11.74% | 10.18% | 11.09% | 10.82% | 10.40% | 4.71% | 9.56% |

| EPS | 13.88 | 6.86 | 7.93 | 5.59 | 5.74 | 5.75 | 0.48 | 6.08 | 5.57 | 5.86 | 4.90 | 3.91 | 3.54 | 4.86 | 4.45 | 4.67 | 3.67 | 3.76 | 3.38 | 2.75 | 2.42 | 2.20 | 1.87 | 1.65 | 1.43 | 1.08 | 1.24 | 1.09 | 0.93 | 0.78 | 0.69 | 0.17 | 0.55 | 0.43 | 0.41 | 0.36 | 0.31 | 0.12 | 0.21 |

| EPS Diluted | 13.73 | 6.73 | 7.81 | 5.51 | 5.63 | 5.61 | 0.47 | 5.93 | 5.48 | 5.70 | 4.81 | 3.86 | 3.49 | 4.78 | 4.40 | 4.57 | 3.63 | 3.73 | 3.35 | 2.74 | 2.29 | 2.16 | 1.84 | 1.61 | 1.39 | 1.06 | 1.21 | 1.09 | 0.93 | 0.78 | 0.68 | 0.16 | 0.54 | 0.43 | 0.40 | 0.35 | 0.31 | 0.12 | 0.21 |

| Weighted Avg Shares Out | 2.53B | 2.61B | 2.63B | 2.63B | 2.63B | 2.66B | 2.68B | 2.71B | 2.76B | 2.78B | 2.82B | 2.78B | 2.72B | 2.74B | 2.76B | 2.81B | 2.88B | 2.94B | 2.98B | 2.97B | 2.97B | 3.00B | 3.03B | 2.99B | 2.99B | 2.78B | 2.67B | 2.66B | 2.58B | 2.57B | 2.61B | 2.63B | 2.66B | 2.66B | 2.67B | 2.74B | 2.73B | 2.75B | 2.92B |

| Weighted Avg Shares Out (Dil) | 2.56B | 2.66B | 2.67B | 2.67B | 2.68B | 2.73B | 2.75B | 2.79B | 2.81B | 2.86B | 2.88B | 2.81B | 2.78B | 2.79B | 2.79B | 2.84B | 2.91B | 2.96B | 3.00B | 2.99B | 3.14B | 3.05B | 3.08B | 3.10B | 3.07B | 2.83B | 2.74B | 2.73B | 2.58B | 2.61B | 2.63B | 2.63B | 2.71B | 2.69B | 2.71B | 2.78B | 2.73B | 2.75B | 2.92B |

Johnson & Johnson Enters Oversold Territory

5 Relatively Secure And Cheap Dividend Stocks - November 2024: Yields Up To 9%

Johnson & Johnson submits applications in the U.S. and EU seeking approval of DARZALEX FASPRO® / DARZALEX® as subcutaneous monotherapy for high-risk smoldering multiple myeloma

Johnson & Johnson submits applications in the U.S. and EU seeking approval of DARZALEX FASPRO®/DARZALEX® (daratumumab) as subcutaneous monotherapy for high-risk smouldering multiple myeloma

Want Decades of Passive Income? 2 Stocks to Buy Now and Hold Forever

My Top 10 High Dividend Yield Companies For November 2024: 2 Yield More Than 8%

US FDA approves Johnson & Johnson's device for heart condition

Johnson & Johnson advances leadership in rheumatic disease innovation with 43 abstracts at ACR 2024

Johnson & Johnson (JNJ) Is a Trending Stock: Facts to Know Before Betting on It

2 Great Dividend Aristocrats to Buy in November

Source: https://incomestatements.info

Category: Stock Reports