Complete financial analysis of The Korea Fund, Inc. (KF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The Korea Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- Henderson EuroTrust plc (HNE.L) Income Statement Analysis – Financial Results

- Global Ports Holding Plc (GPH.L) Income Statement Analysis – Financial Results

- Trident Limited (TRIDENT.NS) Income Statement Analysis – Financial Results

- Aura Minerals Inc. (ORA.TO) Income Statement Analysis – Financial Results

- Groupe LDLC société anonyme (ALLDL.PA) Income Statement Analysis – Financial Results

The Korea Fund, Inc. (KF)

About The Korea Fund, Inc.

The Korea Fund, Inc. is a closed-ended equity mutual fund launched and managed by Allianz Global Investors U.S. LLC. The fund invests in the public equity markets of Korea. It seeks to invest in stocks of companies operating across diversified sectors. The fund primarily invests in growth stocks of companies. It employs fundamental analysis with a bottom-up stock picking approach, focusing on such factors as price-to-earnings ratios, dividend yields, and earnings-per-share growth to create its portfolio. The fund benchmarks the performance of its portfolio against the MSCI Korea 25/50 Index. It uses 'Grassroots Research' to make its investments. The Korea Fund, Inc. was formed on August 29, 1984 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.35M | 7.76M | -81.96M | 121.17M | -7.85M | -23.40M | 9.98M | 40.11M | 1.29M | 3.72M | 2.94M | 3.22M | 0.00 |

| Cost of Revenue | 0.00 | 1.17M | 1.77M | 1.86M | 1.31M | 1.49M | 1.95M | 2.13M | 2.18M | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.35M | 6.59M | -83.73M | 119.31M | -9.15M | -24.89M | 8.02M | 37.97M | -892.84K | 3.72M | 2.94M | 3.22M | 0.00 |

| Gross Profit Ratio | 100.00% | 84.89% | 102.16% | 98.47% | 116.67% | 106.37% | 80.42% | 94.68% | -69.23% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | -0.65 | -2.78 | 2.55 | 1.55 | -13.99 | 0.22 | 1.30 | -22.84 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.79M | 977.90K | 1.05M | 863.11K | 704.89K | 935.39K | 958.06K | 3.00M | 3.11M | 3.73M | 3.94M | 4.23M | 0.00 |

| Selling & Marketing | 109.07K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -3.00M | 0.00 | 171.35K | 188.15K | 157.44K | 0.00 |

| SG&A | 1.90M | 977.90K | 1.05M | 863.11K | 704.89K | 935.39K | 958.06K | 1.30 | -22.84 | 3.90M | 4.13M | 4.39M | 0.00 |

| Other Expenses | 0.00 | 16.95M | 878.34K | 762.86K | 25.91K | 25.69K | 25.45K | 6.59M | 6.99M | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.90M | 1.61M | 1.92M | 1.63M | 730.79K | 961.08K | 983.51K | 47.86M | 33.50M | 26.63M | 68.11M | 21.99M | 0.00 |

| Cost & Expenses | 1.90M | 1.61M | 1.92M | 1.63M | 730.79K | 961.08K | 983.51K | 37.97M | -892.84K | 26.63M | 68.11M | 21.99M | 0.00 |

| Interest Income | 2.35K | 2.09K | 105.00 | 655.00 | 2.35K | 3.91K | 3.73K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 29.00 | 2.00 | 0.00 | 207.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 10.07M | -925.21K | -1.61M | -1.03M | -816.18K | -1.18M | -1.12M | -1.07M | -774.53K | 175.92K | 1.19M | 1.18M | 0.00 |

| EBITDA | 10.60M | 0.00 | -85.06M | 118.39M | -9.32M | -25.46M | 0.00 | -11.42M | -29.57M | -21.90M | 71.10M | -17.60M | 0.00 |

| EBITDA Ratio | 451.55% | 79.31% | 102.35% | 98.66% | 109.31% | 104.11% | 90.14% | -28.46% | 2,392.85% | -610.68% | 2,460.04% | -547.33% | 0.00% |

| Operating Income | 527.98K | 6.16M | -83.88M | 119.55M | -8.58M | -24.36M | 8.99M | 1.07M | 774.53K | -175.92K | -1.19M | -1.18M | 0.00 |

| Operating Income Ratio | 22.49% | 79.31% | 102.35% | 98.66% | 109.31% | 104.11% | 90.14% | 2.66% | 60.05% | -4.73% | -40.67% | -36.59% | 0.00% |

| Total Other Income/Expenses | 9.99M | 5.23M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 51.02M | -30.23M | -22.73M | 1.15M | -17.60M | 0.00 |

| Income Before Tax | 10.52M | 6.16M | -83.88M | 119.55M | -8.58M | -24.36M | 8.99M | 52.09M | -29.45M | -22.91M | 71.05M | -18.77M | 0.00 |

| Income Before Tax Ratio | 448.00% | 79.31% | 102.35% | 98.66% | 109.31% | 104.11% | 90.14% | 129.88% | -2,283.67% | -615.41% | 2,419.36% | -583.93% | 0.00% |

| Income Tax Expense | 0.00 | 6.16M | 1.18M | 1.16M | 743.87K | 1.09M | 8.68M | 51.52M | -29.57M | -22.73M | 72.25M | -17.60M | 0.00 |

| Net Income | 10.52M | 6.16M | -83.88M | 119.55M | -8.58M | -24.36M | 8.99M | 51.52M | -29.57M | -22.91M | 71.05M | -18.77M | 0.00 |

| Net Income Ratio | 448.00% | 79.31% | 102.35% | 98.66% | 109.31% | 104.11% | 90.14% | 128.46% | -2,292.85% | -615.41% | 2,419.36% | -583.93% | 0.00% |

| EPS | 2.18 | 1.25 | -16.73 | 23.79 | -1.69 | -4.75 | 1.33 | 0.99 | 1.00 | -3.11 | 8.89 | -2.16 | 0.00 |

| EPS Diluted | 2.18 | 1.25 | -16.73 | 23.79 | -1.69 | -4.75 | 1.33 | 6.51M | 7.02M | -3.11 | 8.89 | -2.16 | 0.00 |

| Weighted Avg Shares Out | 4.83M | 4.93M | 5.01M | 5.03M | 5.07M | 5.13M | 6.76M | 52.09M | -29.45M | 7.35M | 7.99M | 8.69M | 10.21M |

| Weighted Avg Shares Out (Dil) | 4.83M | 4.93M | 5.01M | 5.03M | 5.07M | 5.13M | 6.76M | 7.91 | -4.21 | 7.35M | 7.99M | 8.69M | 10.21M |

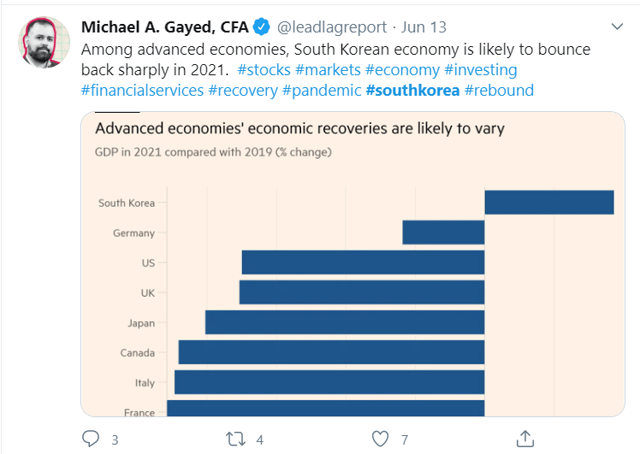

South Korea: Well Positioned To Bounce

PCTEL to Present Virtually and Host 1x1 Investor Meetings at 10th Annual East Coast IDEAS Investor Conference June 23 and 24

Oranj adds individual equities to model marketplace - InvestmentNews

Ooma to Present Virtually and Host 1x1 Investor Meetings at the 10th Annual East Coast IDEAS Investor Conference on June 23rd & 24th

Oranj Adds Liberty One to Model Marketplace

Park Systems, Weltmarktführer für Rasterkraftmikroskopie (AFM), kündigt die Eröffnung einer neuen Niederlassung in Großbritannien an

Source: https://incomestatements.info

Category: Stock Reports