See more : Endo International plc (ENDP) Income Statement Analysis – Financial Results

Complete financial analysis of Kraton Corporation (KRA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Kraton Corporation, a leading company in the Chemicals – Specialty industry within the Basic Materials sector.

- Ava Risk Group Limited (AVA.AX) Income Statement Analysis – Financial Results

- JTNB Bancorp, Inc. (JTNB) Income Statement Analysis – Financial Results

- Avid Bioservices, Inc. (CDMO) Income Statement Analysis – Financial Results

- Lefroy Exploration Limited (LEX.AX) Income Statement Analysis – Financial Results

- Lifan Technology (Group) Co., Ltd. (601777.SS) Income Statement Analysis – Financial Results

Kraton Corporation (KRA)

About Kraton Corporation

Kraton Corporation manufactures and sells styrenic block copolymers, specialty polymers, and bio-based products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It operates in two segments, Polymer and Chemical. The Polymer segment offers performance products, including styrene-butadiene-styrene for paving and roofing application; styrene-isoprene-styrene for personal care application; ethylene-vinyl acetate, polyolefins, and metallocene polyolefins for adhesives application; and specialty polymers, such as hydrogenated styrenic block copolymer, isoprene rubber, and isoprene rubber latex for use in medical and personal care products, adhesives, tackifiers, paints, and coatings. The Chemical segment provides pine-based specialty products that include rosin-based tackifiers for packaging and pressure-sensitive adhesive applications; terpene-based tackifiers for bookbinding, hygiene, and pressure-sensitive adhesive applications; alpha-methyl-styrene (AMS) resins; and hot melt polyamides for flexible packaging, industrial and road making applications. This segment also provides tall oil fatty acids, tall oil rosin, distilled tall oil, tall oil pitch, and rosin-based binders for the thermoplastic pavement marking submarket, as well as produces insoluble maleic-based tackifiers. The Chemical segment also offers terpene-based tread enhancement resins and AMS-based tread enhancement additives; and dimer acids and terpene fractions for fuel additives, oilfield chemicals, mining fluids, coatings, metalworking fluids, and lubricants. The company sells its products through various channels, including direct sales force, marketing representatives, and distributors under the Kraton brand. The company was formerly known as Kraton Performance Polymers, Inc. and changed its name to Kraton Corporation in September 2016. Kraton Corporation was incorporated in 2009 and is based in Houston, Texas.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.97B | 1.56B | 1.80B | 2.01B | 1.96B | 1.74B | 1.03B | 1.23B | 1.29B | 1.42B | 1.44B | 1.23B | 968.00M | 1.23B | 1.09B | 1.05B | 975.60M |

| Cost of Revenue | 1.38B | 1.17B | 1.39B | 1.43B | 1.42B | 1.27B | 805.97M | 993.37M | 1.07B | 1.19B | 1.12B | 927.93M | 792.47M | 971.28M | 938.56M | 843.70M | 766.00M |

| Gross Profit | 588.76M | 397.87M | 414.43M | 580.61M | 541.90M | 479.03M | 228.66M | 237.07M | 225.83M | 231.44M | 316.19M | 300.49M | 175.53M | 254.75M | 151.03M | 204.50M | 209.60M |

| Gross Profit Ratio | 29.88% | 25.45% | 22.97% | 28.86% | 27.64% | 27.47% | 22.10% | 19.27% | 17.48% | 16.26% | 22.00% | 24.46% | 18.13% | 20.78% | 13.86% | 19.51% | 21.48% |

| Research & Development | 40.41M | 40.74M | 41.07M | 41.30M | 40.73M | 39.49M | 31.02M | 31.37M | 32.01M | 31.01M | 28.00M | 23.63M | 21.21M | 27.05M | 24.87M | 24.60M | 26.20M |

| General & Administrative | 0.00 | 0.00 | 149.80M | 153.90M | 161.89M | 177.63M | 117.31M | 104.21M | 105.56M | 98.56M | 101.61M | 92.31M | 79.50M | 101.43M | 69.02M | 73.80M | 72.70M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 164.17M | 0.00 | 149.80M | 153.90M | 161.89M | 177.63M | 117.31M | 104.21M | 105.56M | 98.56M | 101.61M | 92.31M | 79.50M | 101.43M | 69.02M | 73.80M | 72.70M |

| Other Expenses | 126.48M | 287.97M | 136.17M | 141.41M | 137.16M | 125.66M | 62.09M | 66.24M | 63.18M | 64.55M | 62.74M | 49.22M | 66.75M | 53.16M | 51.92M | 43.60M | 88.30M |

| Operating Expenses | 331.05M | 328.71M | 327.04M | 336.60M | 339.78M | 342.77M | 210.43M | 201.82M | 200.75M | 194.12M | 192.34M | 165.15M | 167.47M | 181.64M | 145.80M | 142.00M | 187.20M |

| Cost & Expenses | 1.71B | 1.49B | 1.72B | 1.77B | 1.76B | 1.61B | 1.02B | 1.20B | 1.27B | 1.39B | 1.31B | 1.09B | 959.94M | 1.15B | 1.08B | 985.70M | 953.20M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 41.84M | 57.93M | 75.78M | 93.77M | 132.46M | 138.95M | 24.22M | 24.59M | 30.47M | 29.30M | 29.88M | 0.00 | 33.96M | 0.00 | 0.00 | -66.50M | -33.94M |

| Depreciation & Amortization | 126.48M | 126.02M | 136.17M | 141.41M | 137.16M | 125.66M | 62.09M | 66.24M | 63.18M | 64.55M | 62.74M | 49.22M | 66.75M | 53.16M | 51.92M | 43.60M | 44.10M |

| EBITDA | 378.04M | -73.68M | 251.45M | 305.77M | 309.29M | 279.96M | 82.72M | 98.37M | 89.15M | 96.97M | 184.13M | 161.08M | 99.05M | 90.01M | 14.29M | -26.90M | 13.04M |

| EBITDA Ratio | 19.19% | -4.71% | 13.93% | 15.20% | 15.78% | 16.05% | 8.00% | 7.99% | 6.90% | 6.81% | 12.81% | 13.11% | 10.23% | 7.34% | 1.31% | -2.57% | 1.34% |

| Operating Income | 251.57M | -331.59M | 119.46M | 250.73M | 202.12M | 136.25M | 18.23M | 30.52M | 25.08M | 31.89M | 123.85M | 135.34M | 8.07M | 73.11M | 5.23M | 62.40M | 22.40M |

| Operating Income Ratio | 12.77% | -21.21% | 6.62% | 12.46% | 10.31% | 7.81% | 1.76% | 2.48% | 1.94% | 2.24% | 8.62% | 11.02% | 0.83% | 5.96% | 0.48% | 5.95% | 2.30% |

| Total Other Income/Expenses | -36.48M | 77.87M | -75.46M | -176.64M | -167.36M | -123.57M | -23.82M | -24.19M | -29.94M | -28.77M | -32.34M | -23.48M | -9.72M | -36.26M | -42.86M | -66.40M | 0.00 |

| Income Before Tax | 215.09M | -253.72M | 44.00M | 74.10M | 34.76M | 12.69M | -5.59M | 6.33M | -4.86M | 3.12M | 91.51M | 111.86M | -1.66M | 36.85M | -37.63M | -4.00M | 22.40M |

| Income Before Tax Ratio | 10.92% | -16.23% | 2.44% | 3.68% | 1.77% | 0.73% | -0.54% | 0.51% | -0.38% | 0.22% | 6.37% | 9.11% | -0.17% | 3.01% | -3.45% | -0.38% | 2.30% |

| Income Tax Expense | 39.50M | -32.03M | -11.81M | 3.57M | -57.88M | -91.95M | 6.94M | 5.12M | -3.89M | 19.31M | 584.00K | 15.13M | -1.37M | 8.43M | 6.12M | 29.80M | -11.52M |

| Net Income | 175.59M | -225.60M | 51.31M | 67.02M | 97.55M | 107.31M | -10.54M | 2.42M | -618.00K | -16.19M | 90.93M | 96.73M | -290.00K | 28.42M | -43.75M | -33.80M | 14.40M |

| Net Income Ratio | 8.91% | -14.43% | 2.84% | 3.33% | 4.98% | 6.15% | -1.02% | 0.20% | -0.05% | -1.14% | 6.33% | 7.87% | -0.03% | 2.32% | -4.02% | -3.22% | 1.48% |

| EPS | 5.38 | -7.11 | 1.61 | 2.11 | 3.18 | 3.56 | -0.34 | 0.08 | -0.02 | -0.51 | 2.86 | 3.14 | -0.01 | 1.46 | -2.26 | -1.74 | 0.74 |

| EPS Diluted | 5.38 | -7.11 | 1.61 | 2.11 | 3.13 | 3.50 | -0.34 | 0.07 | -0.02 | -0.51 | 2.82 | 3.08 | -0.01 | 1.45 | -2.25 | -1.74 | 0.74 |

| Weighted Avg Shares Out | 32.64M | 31.75M | 31.88M | 31.79M | 30.65M | 30.18M | 30.57M | 32.16M | 32.10M | 31.94M | 31.79M | 30.83M | 19.86M | 19.41M | 19.39M | 19.40M | 19.40M |

| Weighted Avg Shares Out (Dil) | 32.64M | 31.75M | 31.88M | 31.79M | 31.14M | 30.62M | 30.57M | 32.48M | 32.10M | 31.94M | 32.21M | 31.38M | 19.86M | 19.59M | 19.47M | 19.40M | 19.40M |

Principal Financial Group Inc. Has $6.12 Million Stock Position in Kraton Corp (NYSE:KRA)

U.S. IPO Weekly Recap: Health And Tech Dominate The Calendar In An 11 IPO Week

Pine Capital's Catalist sponsor to drop the firm over compliance concerns

From air purifiers to holiday gifts: Experts say these are the products to buy before fall and winter

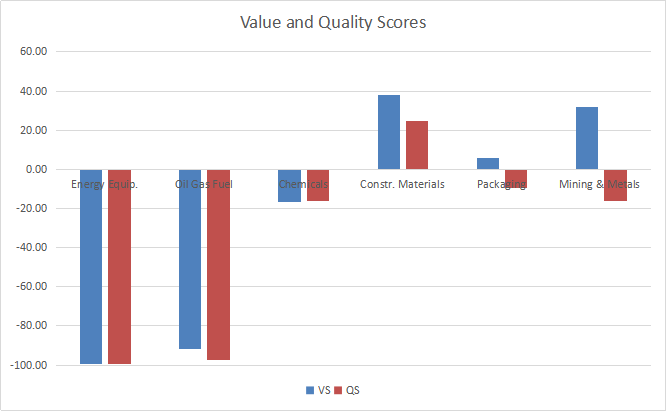

Energy And Materials Dashboard For August

Dupont Capital Management Corp Invests $626,000 in Kraton Corp (NYSE:KRA)

Kraton Corporation (KRA) CEO Kevin Fogarty on Q2 2020 Results - Earnings Call Transcript

Kraton Corporation 2020 Q2 - Results - Earnings Call Presentation

Source: https://incomestatements.info

Category: Stock Reports