See more : Carnival Corporation & plc (CUK) Income Statement Analysis – Financial Results

Complete financial analysis of Kilroy Realty Corporation (KRC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Kilroy Realty Corporation, a leading company in the REIT – Office industry within the Real Estate sector.

- Nanning Chemical Industry Co., Ltd. (600301.SS) Income Statement Analysis – Financial Results

- Beijing ConST Instruments Technology Inc. (300445.SZ) Income Statement Analysis – Financial Results

- Medicure Inc. (MPH.V) Income Statement Analysis – Financial Results

- Peak Minerals Ltd. (PEK.CN) Income Statement Analysis – Financial Results

- Chongqing Port Co.,Ltd. (600279.SS) Income Statement Analysis – Financial Results

Kilroy Realty Corporation (KRC)

About Kilroy Realty Corporation

Kilroy Realty Corporation (NYSE: KRC, the company, KRC) is a leading West Coast landlord and developer, with a major presence in San Diego, Greater Los Angeles, the San Francisco Bay Area, and the Pacific Northwest. The company has earned global recognition for sustainability, building operations, innovation and design. As pioneers and innovators in the creation of a more sustainable real estate industry, the company's approach to modern business environments helps drive creativity, productivity and employee retention for some of the world's leading technology, entertainment, life science and business services companies. KRC is a publicly traded real estate investment trust (REIT) and member of the S&P MidCap 400 Index with more than seven decades of experience developing, acquiring and managing office and mixed-use projects. As of September 30, 2020, KRC's stabilized portfolio totaled approximately 14.3 million square feet of primarily office and life science space that was 92.2% occupied and 95.5% leased. The company also had 808 residential units in Hollywood and San Diego, which had a quarterly average occupancy of 85.0% and 37.5%, respectively. In addition, KRC had seven in-process development projects with an estimated total investment of $1.9 billion, totaling approximately 2.3 million square feet of office and life science space. The office and life science space was 90% leased.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.13B | 1.10B | 955.04M | 898.40M | 837.45M | 747.30M | 719.00M | 642.57M | 581.28M | 521.73M | 465.10M | 404.91M | 367.13M | 301.98M | 279.43M | 289.97M | 258.47M | 251.24M | 241.72M | 221.40M | 227.79M | 202.10M | 209.65M | 187.11M | 159.70M | 136.28M | 69.18M | 39.18M |

| Cost of Revenue | 351.07M | 321.06M | 269.58M | 260.72M | 253.86M | 210.78M | 202.76M | 172.58M | 158.70M | 148.79M | 140.27M | 117.00M | 72.87M | 85.56M | 49.71M | 70.98M | 62.85M | 61.80M | 57.44M | 51.83M | 49.65M | 46.35M | 45.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 778.62M | 775.93M | 685.46M | 637.68M | 583.59M | 536.52M | 516.24M | 470.00M | 422.58M | 372.94M | 324.83M | 287.91M | 294.26M | 216.42M | 229.73M | 218.99M | 195.63M | 189.44M | 184.27M | 169.57M | 178.13M | 155.75M | 164.35M | 187.11M | 159.70M | 136.28M | 69.18M | 39.18M |

| Gross Profit Ratio | 68.92% | 70.73% | 71.77% | 70.98% | 69.69% | 71.79% | 71.80% | 73.14% | 72.70% | 71.48% | 69.84% | 71.10% | 80.15% | 71.67% | 82.21% | 75.52% | 75.69% | 75.40% | 76.24% | 76.59% | 78.20% | 77.07% | 78.39% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.24 | 0.69 | 0.23 | 0.26 | 0.37 | 0.25 | 0.47 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 46.00K | 650.00K |

| General & Administrative | 93.43M | 93.64M | 92.75M | 99.26M | 88.14M | 90.47M | 60.58M | 57.03M | 48.27M | 46.15M | 39.66M | 36.19M | 28.15M | 28.95M | 39.94M | 38.26M | 36.58M | 22.80M | 66.46M | 34.02M | 19.14M | 12.56M | 12.44M | 11.11M | 9.09M | 7.74M | 5.03M | 2.38M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 93.43M | 93.64M | 92.75M | 99.26M | 88.14M | 90.47M | 60.58M | 57.03M | 48.27M | 46.15M | 39.66M | 36.19M | 29.93M | 28.95M | 39.94M | 38.26M | 36.58M | 22.80M | 66.46M | 34.02M | 19.14M | 12.56M | 12.44M | 11.11M | 9.09M | 7.74M | 5.03M | 2.38M |

| Other Expenses | 0.00 | 357.61M | 310.04M | 299.31M | 273.13M | 259.97M | 249.16M | 217.23M | 204.84M | 202.48M | 193.14M | 163.07M | 133.86M | 102.75M | 112.53M | 159.93M | 139.32M | 136.06M | 125.82M | 112.56M | 108.77M | 107.48M | 98.72M | 80.71M | 68.23M | 57.98M | 27.53M | 21.12M |

| Operating Expenses | 93.43M | 451.25M | 402.79M | 398.57M | 361.27M | 350.44M | 309.74M | 274.26M | 253.10M | 248.63M | 232.80M | 199.26M | 196.31M | 131.69M | 154.06M | 198.19M | 175.90M | 158.86M | 192.28M | 146.59M | 127.91M | 120.04M | 111.15M | 91.82M | 77.32M | 65.72M | 32.60M | 24.15M |

| Cost & Expenses | 799.78M | 772.31M | 672.37M | 659.29M | 615.13M | 561.22M | 512.49M | 446.84M | 411.80M | 397.41M | 373.06M | 316.26M | 269.18M | 217.25M | 203.77M | 198.19M | 175.90M | 158.86M | 192.28M | 146.59M | 127.91M | 120.04M | 111.15M | 91.82M | 77.32M | 65.72M | 32.60M | 24.15M |

| Interest Income | 22.59M | 1.77M | 3.92M | 3.42M | 4.64M | 0.00 | 5.50M | 1.76M | 243.00K | 561.00K | 1.64M | 848.00K | 571.00K | 964.00K | 1.30M | 0.00 | 1.61M | 1.65M | 0.00 | 0.00 | 196.00K | 513.00K | 1.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 114.22M | 84.28M | 78.56M | 70.77M | 48.54M | 50.28M | 66.04M | 55.80M | 57.68M | 67.57M | 75.87M | 79.11M | 89.41M | 59.94M | 46.12M | 40.37M | 37.50M | 43.54M | 39.15M | 37.65M | 33.39M | 35.64M | 41.68M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 356.30M | 772.31M | 672.37M | 659.29M | 615.13M | 561.31M | 512.59M | 448.84M | 204.29M | 202.42M | 192.73M | 162.92M | 136.60M | 103.81M | 87.63M | 83.28M | 86.42M | 69.75M | 67.83M | 62.07M | 59.83M | 64.50M | 54.10M | 42.38M | 33.79M | 26.20M | 14.02M | 9.11M |

| EBITDA | 686.21M | 684.05M | 596.63M | 538.41M | 500.09M | 440.36M | 452.39M | 521.03M | 442.90M | 261.73M | 208.57M | 168.36M | 234.55M | 122.75M | 123.38M | 81.13M | 156.99M | 156.91M | 329.34M | 290.59M | 141.05M | 179.10M | 108.73M | 250.95M | 221.95M | 192.53M | 108.50M | 63.50M |

| EBITDA Ratio | 60.74% | 62.36% | 62.47% | 60.31% | 59.72% | 58.93% | 63.69% | 64.54% | 64.34% | 62.73% | 61.58% | 62.34% | 63.92% | 64.69% | 56.68% | 60.37% | 65.38% | 64.37% | 48.21% | 61.59% | 70.03% | 72.07% | 70.54% | 73.58% | 72.75% | 71.00% | 73.15% | 61.61% |

| Operating Income | 329.91M | 326.44M | 286.58M | 242.53M | 226.96M | 186.08M | 206.51M | 195.73M | 169.47M | 57.30M | 17.80M | 88.65M | 97.95M | 84.73M | 30.85M | -198.19M | -175.90M | -158.86M | -192.28M | -146.59M | -127.91M | -120.04M | -111.15M | -91.82M | -77.32M | -65.72M | -32.60M | -24.15M |

| Operating Income Ratio | 29.20% | 29.76% | 30.01% | 27.00% | 27.10% | 24.90% | 28.72% | 30.46% | 29.16% | 10.98% | 3.83% | 21.89% | 26.68% | 28.06% | 11.04% | -68.35% | -68.05% | -63.23% | -79.55% | -66.21% | -56.15% | -59.40% | -53.02% | -49.07% | -48.42% | -48.22% | -47.12% | -61.65% |

| Total Other Income/Expenses | -91.62M | -65.18M | 66.20M | -31.81M | -7.09M | 91.85M | -25.89M | -102.27M | 69.13M | -65.22M | -72.63M | -77.37M | -89.27M | -85.15M | -47.63M | -45.93M | -84.18M | 1.16M | 33.41M | 727.00K | 56.52M | 896.00K | -16.99M | 138.67M | 117.22M | 104.54M | 57.36M | -63.50M |

| Income Before Tax | 238.29M | 259.49M | 658.91M | 207.29M | 215.23M | 277.93M | 180.62M | 303.80M | 238.60M | 59.31M | 15.84M | 5.45M | 5.06M | 18.94M | 36.99M | 44.12M | 113.82M | 81.86M | 33.82M | 29.94M | 49.61M | 40.31M | 38.43M | 46.85M | 39.90M | 38.82M | 24.76M | 13.27M |

| Income Before Tax Ratio | 21.09% | 23.66% | 68.99% | 23.07% | 25.70% | 37.19% | 25.12% | 47.28% | 41.05% | 11.37% | 3.41% | 1.35% | 1.38% | 6.27% | 13.24% | 15.22% | 44.04% | 32.58% | 13.99% | 13.52% | 21.78% | 19.95% | 18.33% | 25.04% | 24.98% | 28.49% | 35.79% | 33.87% |

| Income Tax Expense | 0.00 | 84.28M | 109.32M | 90.96M | 68.32M | 19.51M | 16.00M | 10.01M | 4.52M | -120.91M | -28.04M | -265.47M | -60.96M | -771.00K | -36.99M | -44.12M | -113.82M | -81.86M | -33.82M | -29.94M | -49.61M | -40.31M | -38.43M | -46.85M | -39.90M | -38.82M | -24.76M | -13.27M |

| Net Income | 212.24M | 175.22M | 628.14M | 116.33M | 146.91M | 258.42M | 164.61M | 293.79M | 234.08M | 180.22M | 43.88M | 270.91M | 66.02M | 19.71M | 36.99M | 44.12M | 113.82M | 81.86M | 33.82M | 29.94M | 49.61M | 40.31M | 38.43M | 46.85M | 39.90M | 38.82M | 24.76M | 13.27M |

| Net Income Ratio | 18.79% | 15.97% | 65.77% | 12.95% | 17.54% | 34.58% | 22.89% | 45.72% | 40.27% | 34.54% | 9.43% | 66.91% | 17.98% | 6.53% | 13.24% | 15.22% | 44.04% | 32.58% | 13.99% | 13.52% | 21.78% | 19.95% | 18.33% | 25.04% | 24.98% | 28.49% | 35.79% | 33.87% |

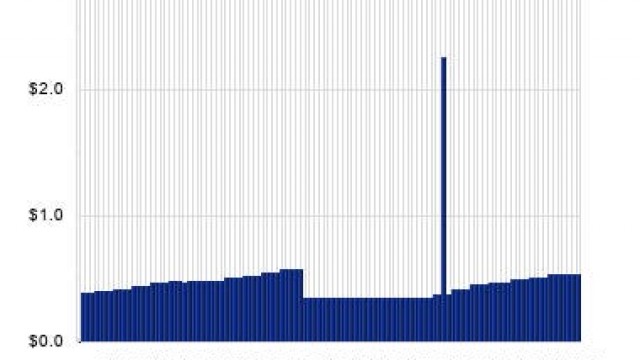

| EPS | 1.80 | 1.50 | 5.38 | 1.03 | 1.42 | 2.58 | 1.52 | 3.00 | 2.44 | 1.99 | 0.37 | 3.56 | 0.87 | 0.07 | 0.53 | 1.06 | 3.22 | 2.31 | 0.84 | 1.06 | 1.81 | 1.40 | 1.13 | 1.76 | 1.44 | 1.44 | 1.20 | -0.52 |

| EPS Diluted | 1.80 | 1.49 | 5.36 | 1.02 | 1.41 | 2.57 | 1.51 | 2.97 | 2.42 | 1.95 | 0.36 | 3.56 | 0.87 | 0.07 | 0.53 | 1.06 | 3.20 | 2.30 | 0.84 | 1.06 | 1.79 | 1.39 | 1.12 | 1.75 | 1.44 | 1.43 | 1.19 | -0.52 |

| Weighted Avg Shares Out | 117.16M | 116.81M | 116.43M | 113.24M | 103.20M | 99.97M | 98.11M | 92.34M | 89.85M | 83.09M | 77.34M | 69.02M | 56.72M | 49.50M | 38.71M | 32.47M | 32.38M | 31.24M | 28.71M | 28.24M | 27.53M | 27.45M | 27.17M | 26.60M | 27.70M | 26.99M | 18.42M | 14.48M |

| Weighted Avg Shares Out (Dil) | 117.51M | 117.22M | 116.95M | 113.72M | 103.85M | 100.48M | 98.73M | 93.02M | 90.40M | 84.97M | 79.11M | 69.64M | 56.72M | 49.50M | 38.73M | 32.67M | 32.53M | 31.39M | 28.71M | 28.42M | 27.74M | 27.72M | 27.37M | 26.76M | 27.73M | 27.06M | 18.57M | 14.48M |

Kilroy Realty's Q2 Earnings: Strong Results, Low Valuations, And Growth Potential

Cash Cows: 9 High-Yield REITs With Safe Dividends

Kilroy Realty: Why I'm Buying More Of This 6.4% Yield

Kilroy Realty Corporation (KRC) Q2 2024 Earnings Call Transcript

Kilroy Realty (KRC) Surpasses Q2 FFO and Revenue Estimates

Picking A Winner In High-Yield REITs

3 Bargain Stocks to Buy Now: Q3 Edition

REITs Rip As Rates Retreat

Why Opendoor Technologies, Medical Properties Trust, and Kilroy Realty Stocks All Popped on Thursday

Kilroy Realty Passes Through 7% Yield Mark

Source: https://incomestatements.info

Category: Stock Reports