See more : Spartan Delta Corp. (SDE.TO) Income Statement Analysis – Financial Results

Complete financial analysis of Kornit Digital Ltd. (KRNT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Kornit Digital Ltd., a leading company in the Industrial – Machinery industry within the Industrials sector.

- Fiesta Restaurant Group, Inc. (FRGI) Income Statement Analysis – Financial Results

- Payoneer Global Inc. (PAYO) Income Statement Analysis – Financial Results

- 3D Pioneer Systems Inc. (DPSM) Income Statement Analysis – Financial Results

- RenuEn Corporation (RENU) Income Statement Analysis – Financial Results

- Gentrack Group Limited (GTK.NZ) Income Statement Analysis – Financial Results

Kornit Digital Ltd. (KRNT)

About Kornit Digital Ltd.

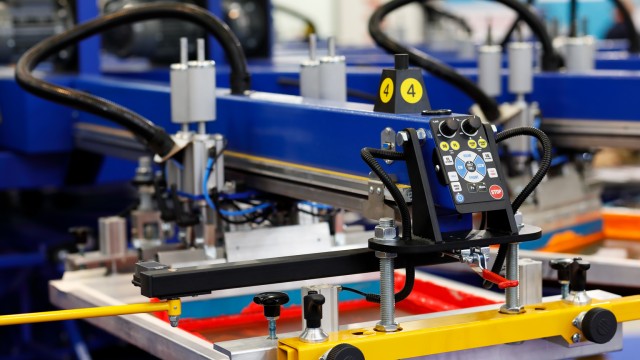

Kornit Digital Ltd. develops, designs, and markets digital printing solutions for the fashion, apparel, and home decor segments of printed textile industry in the United States, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company's solutions include digital printing systems, ink and other consumables, associated software, and value-added services. Its products and services include direct-to-garment printing platform for smaller industrial operators to mass producers; NeoPigment ink and other consumables; QuickP designer software; and maintenance and support, consulting, and professional services. The company serves decorators, online businesses, brand owners, and contract printers. Kornit Digital Ltd. was incorporated in 2002 and is headquartered in Rosh HaAyin, Israel.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 219.79M | 271.52M | 322.01M | 193.33M | 179.87M | 142.37M | 114.09M | 108.69M | 86.41M | 66.36M | 49.40M | 39.17M |

| Cost of Revenue | 152.83M | 175.02M | 170.10M | 105.53M | 97.79M | 72.50M | 59.98M | 59.28M | 45.82M | 37.19M | 27.95M | 22.74M |

| Gross Profit | 66.96M | 96.50M | 151.91M | 87.80M | 82.08M | 69.87M | 54.11M | 49.41M | 40.59M | 29.18M | 21.44M | 16.43M |

| Gross Profit Ratio | 30.46% | 35.54% | 47.18% | 45.41% | 45.63% | 49.07% | 47.43% | 45.46% | 46.97% | 43.97% | 43.41% | 41.94% |

| Research & Development | 50.06M | 56.03M | 43.73M | 31.46M | 22.41M | 21.91M | 20.83M | 17.38M | 11.95M | 9.48M | 7.44M | 4.84M |

| General & Administrative | 37.59M | 39.29M | 36.64M | 26.66M | 18.50M | 16.44M | 13.58M | 12.26M | 9.50M | 5.27M | 3.28M | 3.09M |

| Selling & Marketing | 66.84M | 71.07M | 58.75M | 36.41M | 33.57M | 25.60M | 21.28M | 18.34M | 13.37M | 10.62M | 7.73M | 4.67M |

| SG&A | 104.43M | 110.36M | 95.39M | 63.07M | 52.07M | 42.03M | 34.86M | 30.60M | 22.87M | 15.88M | 11.01M | 7.76M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 503.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 154.49M | 166.38M | 139.12M | 94.53M | 74.48M | 63.94M | 55.69M | 47.98M | 34.82M | 25.36M | 18.46M | 12.60M |

| Cost & Expenses | 307.32M | 341.40M | 309.21M | 200.06M | 172.27M | 136.45M | 115.67M | 107.26M | 80.64M | 62.54M | 46.41M | 35.34M |

| Interest Income | 27.59M | 13.05M | 5.37M | 5.11M | 3.31M | 2.51M | 2.00M | 1.26M | 416.00K | 8.00K | 19.00K | 60.00K |

| Interest Expense | 236.00K | 13.38M | 286.00K | 357.00K | 405.00K | 299.00K | 790.00K | 0.00 | 334.00K | 166.00K | 117.00K | 189.00K |

| Depreciation & Amortization | 14.70M | 13.57M | 7.10M | 4.71M | 4.47M | 4.97M | 4.81M | 2.97M | 1.78M | 1.35M | 1.17M | 786.00K |

| EBITDA | -72.83M | -54.11M | 12.79M | -2.02M | 12.04M | 10.89M | 3.23M | 1.43M | 7.55M | 5.32M | 4.16M | 4.61M |

| EBITDA Ratio | -33.14% | -20.74% | 6.14% | -1.04% | 6.69% | 7.87% | 3.28% | 4.04% | 8.74% | 7.58% | 9.14% | 12.18% |

| Operating Income | -87.53M | -69.88M | 12.79M | -6.73M | 7.60M | 5.60M | -2.08M | 1.43M | 5.77M | 3.82M | 2.99M | 3.83M |

| Operating Income Ratio | -39.83% | -25.74% | 3.97% | -3.48% | 4.22% | 3.94% | -1.83% | 1.32% | 6.68% | 5.76% | 6.05% | 9.77% |

| Total Other Income/Expenses | 24.15M | 13.38M | 2.60M | 3.50M | 3.31M | 1.43M | 452.00K | 46.00K | -334.00K | -15.00K | -460.00K | -285.00K |

| Income Before Tax | -63.38M | -56.50M | 15.39M | -3.23M | 10.91M | 7.04M | -1.63M | 1.48M | 5.43M | 3.81M | 2.53M | 3.54M |

| Income Before Tax Ratio | -28.84% | -20.81% | 4.78% | -1.67% | 6.07% | 4.94% | -1.43% | 1.36% | 6.29% | 5.73% | 5.12% | 9.04% |

| Income Tax Expense | 970.00K | 22.57M | -135.00K | 1.55M | 744.00K | -5.39M | 384.00K | 648.00K | 709.00K | 782.00K | 1.39M | 1.23M |

| Net Income | -64.35M | -79.07M | 15.53M | -4.78M | 10.17M | 12.43M | -2.02M | 828.00K | 4.73M | 3.02M | 1.13M | 2.31M |

| Net Income Ratio | -29.28% | -29.12% | 4.82% | -2.47% | 5.65% | 8.73% | -1.77% | 0.76% | 5.47% | 4.56% | 2.30% | 5.91% |

| EPS | -1.31 | -1.59 | 0.33 | -0.11 | 0.27 | 0.36 | -0.06 | 0.03 | 0.19 | 0.11 | 0.05 | 0.11 |

| EPS Diluted | -1.31 | -1.59 | 0.32 | -0.11 | 0.26 | 0.35 | -0.06 | 0.03 | 0.18 | 0.11 | 0.05 | 0.10 |

| Weighted Avg Shares Out | 49.16M | 49.79M | 47.08M | 42.29M | 38.08M | 34.52M | 33.57M | 30.56M | 24.63M | 28.70M | 21.60M | 21.60M |

| Weighted Avg Shares Out (Dil) | 49.16M | 49.79M | 48.60M | 42.29M | 39.29M | 35.36M | 33.57M | 31.73M | 26.46M | 28.70M | 23.08M | 23.08M |

Kornit Digital: Upgrading On Expected Return To Growth And Profitability Next Year

Kornit Digital (KRNT) Reports Q2 Loss, Lags Revenue Estimates

Kornit Digital Further Demonstrates Commitment to More Sustainable Fashion and Textile Industry with Release of Third-Annual Impact Report

Kornit Digital Reports Second Quarter 2023 Results

Kornit Digital Sets Second Quarter Earnings Release Date and Webcast

Kornit Digital: Inflection Point Likely Still Several Quarters In The Future - Hold

Kornit Digital to Participate in 20th Annual Craig-Hallum Institutional Investor Conference

KORNIT DIGITAL SHAREHOLDER ALERT: CLAIMSFILER REMINDS

7 Value Stocks to Buy for Long-Term Growth

Kornit Digital: No Near-Term Catalysts But Upgrading To 'Hold' On Bargain Valuation

Source: https://incomestatements.info

Category: Stock Reports