See more : Mitsubishi Electric Corporation (MEL.L) Income Statement Analysis – Financial Results

Complete financial analysis of Pasithea Therapeutics Corp. (KTTA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Pasithea Therapeutics Corp., a leading company in the Biotechnology industry within the Healthcare sector.

- Mitsubishi Estate Co., Ltd. (MITEY) Income Statement Analysis – Financial Results

- Media Research Institute,Inc. (9242.T) Income Statement Analysis – Financial Results

- Roboserver Systems Corp. (RBSY) Income Statement Analysis – Financial Results

- ShenZhen WeiYe Decoration Group Co.,LTD (300621.SZ) Income Statement Analysis – Financial Results

- Hycroft Mining Holding Corporation (HYMCL) Income Statement Analysis – Financial Results

Pasithea Therapeutics Corp. (KTTA)

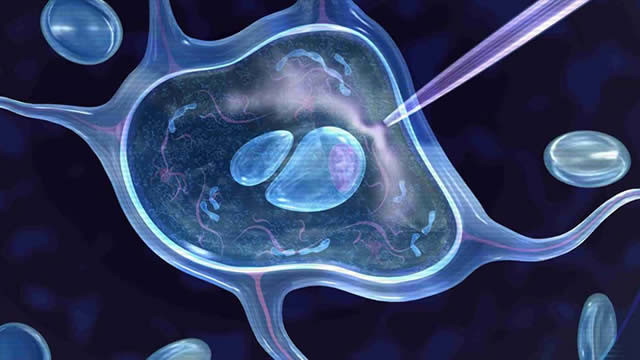

About Pasithea Therapeutics Corp.

Pasithea Therapeutics Corp., a biotechnology company, engages in research and discovery of treatments for psychiatric and neurological disorders. It also intends to operate anti-depression clinics and provide business support services using trained pharmacists to administer intravenous infusions of ketamine. The company was incorporated in 2020 and is headquartered in Miami Beach, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 0.00 | 486.56K | 15.06K | 0.00 |

| Cost of Revenue | 648.45K | 113.20K | 17.28K | 0.00 |

| Gross Profit | -648.45K | 373.36K | -2.21K | 0.00 |

| Gross Profit Ratio | 0.00% | 76.74% | -14.69% | 0.00% |

| Research & Development | 8.10M | 2.67M | 0.00 | 0.00 |

| General & Administrative | 7.88B | 9.92M | 0.00 | 0.00 |

| Selling & Marketing | -7.87B | 2.60M | 0.00 | 0.00 |

| SG&A | 7.88M | 12.52M | 4.51M | 40.98K |

| Other Expenses | 0.00 | 44.72K | 0.00 | 0.00 |

| Operating Expenses | 15.98M | 15.19M | 4.51M | 40.98K |

| Cost & Expenses | 15.98M | 15.30M | 4.52M | 40.98K |

| Interest Income | 0.00 | 102.00 | 508.00 | 0.00 |

| Interest Expense | 0.00 | 102.00 | 508.00 | 0.00 |

| Depreciation & Amortization | 648.45K | 5.09K | 1.38K | 61.48K |

| EBITDA | -15.33M | -12.58M | -4.51M | 0.00 |

| EBITDA Ratio | 0.00% | -3,029.28% | -29,916.57% | 0.00% |

| Operating Income | -15.98M | -14.82M | -4.51M | -40.98K |

| Operating Income Ratio | 0.00% | -3,045.12% | -29,925.73% | 0.00% |

| Total Other Income/Expenses | 471.61K | 861.09K | 2.33M | -4.00 |

| Income Before Tax | -15.51M | -13.94M | -2.17M | -40.98K |

| Income Before Tax Ratio | 0.00% | -2,864.29% | -14,430.49% | 0.00% |

| Income Tax Expense | 0.00 | -879.97K | 508.00 | -61.48K |

| Net Income | -15.96M | -13.06M | -2.17M | -40.98K |

| Net Income Ratio | 0.00% | -2,683.43% | -14,433.87% | 0.00% |

| EPS | -12.65 | -10.34 | -1.89 | -0.06 |

| EPS Diluted | -13.01 | -10.34 | -1.89 | -0.06 |

| Weighted Avg Shares Out | 1.26M | 1.26M | 1.15M | 688.92K |

| Weighted Avg Shares Out (Dil) | 1.23M | 1.26M | 1.15M | 688.92K |

Hot Penny Stocks Today: Why Is KTTA Stock Moving?

Pasithea Therapeutics (KTTA) Stock: Why The Price Surged Today

Pasithea Therapeutics Opens its First Ketamine Therapy Clinic in the United Kingdom

Pasithea Therapeutics: Revenues Just Around the Corner

Biotech Company Pasithea Therapeutics Teams Up With Evotec to Aid Mental Health Drug Discovery

Pasithea, Evotec Ink Drug Development Pact

Source: https://incomestatements.info

Category: Stock Reports