See more : Fertil-A-Chron, Inc. (FEKR) Income Statement Analysis – Financial Results

Complete financial analysis of Luminar Technologies, Inc. (LAZR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Luminar Technologies, Inc., a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- Postal Savings Bank of China Co., Ltd. (601658.SS) Income Statement Analysis – Financial Results

- Datatec Limited (DTC.JO) Income Statement Analysis – Financial Results

- Young Poong Corporation (000670.KS) Income Statement Analysis – Financial Results

- Silver Crest Acquisition Corporation (SLCR) Income Statement Analysis – Financial Results

- Medalist Diversified REIT, Inc. (MDRR) Income Statement Analysis – Financial Results

Luminar Technologies, Inc. (LAZR)

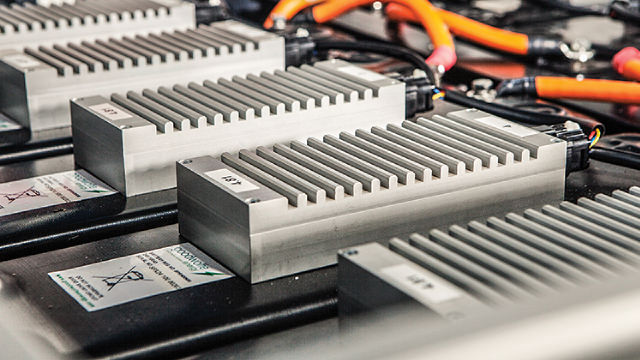

About Luminar Technologies, Inc.

Luminar Technologies, Inc., an automotive technology company, provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East. It operates in two segments, Autonomy Solutions and Components. The Autonomy Solutions segment designs, manufactures, and sells laser imaging, detection, and ranging sensors, as well as related perception and autonomy software solutions primarily for original equipment manufacturers in the automobile, commercial vehicle, robo-taxi, and adjacent industries. The Component segment develops ultra-sensitive pixel-based sensors. This segment also designs, tests, and provides consulting services for non-standard integrated circuits for use in automobile and aeronautics sector, as well as government spending in military and defense activities. The company was founded in 2012 and is headquartered in Orlando, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 69.78M | 40.70M | 31.94M | 13.95M | 12.60M | 11.69M |

| Cost of Revenue | 142.47M | 100.98M | 46.09M | 24.95M | 16.66M | 10.94M |

| Gross Profit | -72.69M | -60.29M | -14.15M | -11.00M | -4.05M | 753.00K |

| Gross Profit Ratio | -104.17% | -148.13% | -44.29% | -78.85% | -32.16% | 6.44% |

| Research & Development | 262.22M | 185.28M | 88.86M | 38.65M | 36.97M | 40.09M |

| General & Administrative | 159.82M | 158.16M | 93.69M | 29.28M | 16.86M | 21.87M |

| Selling & Marketing | 53.10M | 38.67M | 17.86M | 7.95M | 4.73M | 3.03M |

| SG&A | 212.91M | 196.83M | 111.54M | 37.22M | 21.59M | 20.55K |

| Other Expenses | 15.49M | 0.00 | 0.00 | 0.00 | 0.00 | -1.43K |

| Operating Expenses | 490.62M | 382.12M | 200.40M | 75.87M | 58.56M | 21.98K |

| Cost & Expenses | 633.09M | 483.10M | 246.50M | 100.83M | 75.22M | 21.99K |

| Interest Income | 13.11M | 5.02M | 3.46M | 0.00 | 731.00K | 2.64M |

| Interest Expense | 11.05M | 11.10M | 2.03M | 2.89M | 2.24M | 0.00 |

| Depreciation & Amortization | 33.61M | 11.80M | 7.87M | 2.52M | 2.32M | 1.49M |

| EBITDA | -530.40M | -425.58M | -239.85M | -364.90M | -94.86M | -21.99K |

| EBITDA Ratio | -760.11% | -1,045.69% | -647.80% | -606.65% | -472.69% | -0.19% |

| Operating Income | -563.31M | -442.40M | -214.55M | -86.88M | -62.62M | -21.98K |

| Operating Income Ratio | -807.27% | -1,087.04% | -671.65% | -622.72% | -496.87% | -0.19% |

| Total Other Income/Expenses | -6.27M | -2.87M | -24.70M | -275.42M | -32.10M | 0.00 |

| Income Before Tax | -569.57M | -445.27M | -239.25M | -362.30M | -94.72M | -21.99K |

| Income Before Tax Ratio | -816.25% | -1,094.08% | -748.96% | -2,596.93% | -751.61% | -0.19% |

| Income Tax Expense | 1.70M | 672.00K | -1.26M | 2.89M | 2.24M | -1.49M |

| Net Income | -571.27M | -445.94M | -237.99M | -365.18M | -96.96M | -21.99K |

| Net Income Ratio | -818.68% | -1,095.73% | -745.01% | -2,617.61% | -769.38% | -0.19% |

| EPS | -1.47 | -1.25 | -0.69 | -2.52 | -0.30 | 0.00 |

| EPS Diluted | -1.47 | -1.25 | -0.69 | -2.52 | -0.30 | 0.00 |

| Weighted Avg Shares Out | 389.37M | 356.27M | 344.91M | 145.10M | 323.94M | 50.00M |

| Weighted Avg Shares Out (Dil) | 389.37M | 356.27M | 346.30M | 145.10M | 323.94M | 50.00M |

Luminar Technologies, Inc. (LAZR) Advances While Market Declines: Some Information for Investors

Luminar to Provide Q3'24 Business Update November 11th; Reminder for Stockholders Meeting October 30th

Here's Why Luminar Technologies, Inc. (LAZR) Fell More Than Broader Market

Luminar Technologies, Inc. (LAZR) Increases Despite Market Slip: Here's What You Need to Know

These EV Stocks Are Tumbling With No End in Sight

Luminar Media Group/ Fortun Reports 3rd Quarter Results, Surpassing Forecasts and Demonstrating Impressive Growth

Luminar Technologies, Inc. (LAZR) Declines More Than Market: Some Information for Investors

Luminar Technologies Surged Today on Potential Trade Protections

Luminar Technologies reduces workforce by 30% this year

Luminar Technologies, Inc. (LAZR) Stock Slides as Market Rises: Facts to Know Before You Trade

Source: https://incomestatements.info

Category: Stock Reports