Complete financial analysis of Liberty Global plc (LBTYB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Liberty Global plc, a leading company in the Telecommunications Services industry within the Communication Services sector.

- Clearside Biomedical, Inc. (CLSD) Income Statement Analysis – Financial Results

- Matchaah Holdings, Inc. (MCHA) Income Statement Analysis – Financial Results

- Orosur Mining Inc. (OMI.L) Income Statement Analysis – Financial Results

- United Malt Group Limited (UMLGF) Income Statement Analysis – Financial Results

- Grupo Mateus S.A. (GMAT3.SA) Income Statement Analysis – Financial Results

Liberty Global plc (LBTYB)

Industry: Telecommunications Services

Sector: Communication Services

Website: https://www.libertyglobal.com

About Liberty Global plc

Liberty Global plc, together with its subsidiaries, provides broadband internet, video, fixed-line telephony, and mobile communications services to residential and business customers. It offers value-added broadband services, such as intelligent WiFi features; security; smart home, online storage solutions, and Web spaces; Connect Box, a set-top or Horizon box that delivers in-home Wi-Fi service; community Wi-Fi via routers in home, which provides access to the internet; and public Wi-Fi access points in train stations, hotels, bars, restaurants, and other public places. The company also provides various tiers of digital video programming and audio services, as well as digital video recorders and multimedia home gateway systems; and channels, including general entertainment, sports, movies, series, documentaries, lifestyles, news, adult, children, and ethnic and foreign channels. In addition, it offers postpaid and prepaid mobile services; circuit-switched telephony services; and personal call manager, unified messaging, and a second or third phone line at an incremental cost. Further, the company offers business services comprising voice, advanced data, video, wireless, cloud-based services, and mobile and converged fixed-mobile services to small or home office, small business, and medium and large enterprises, as well as on a wholesale basis to other operators. It operates in the United Kingdom, Belgium, Switzerland, Ireland, Poland, Slovakia, and internationally. Liberty Global plc was founded in 2004 and is based in London, the United Kingdom.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7.49B | 7.20B | 10.31B | 11.98B | 11.54B | 11.96B | 15.05B | 17.29B | 17.06B | 18.25B | 14.47B | 10.31B | 9.51B | 9.02B | 130.70B | 1.02B | 9.00B | 6.49B | 5.15B | 2.64B | 2.36B | 100.30M | 139.54M | 125.25M |

| Cost of Revenue | 2.38B | 2.09B | 3.02B | 3.44B | 3.24B | 3.25B | 3.45B | 3.93B | 6.23B | 6.81B | 5.42B | 3.62B | 3.38B | 3.35B | 103.05B | 589.30M | 3.74B | 2.78B | 2.19B | 1.07B | 1.63B | 0.00 | 58.10M | 0.00 |

| Gross Profit | 5.11B | 5.11B | 7.29B | 8.54B | 8.30B | 8.71B | 11.60B | 13.36B | 10.83B | 11.44B | 9.06B | 6.69B | 6.13B | 5.67B | 27.65B | 429.50M | 5.26B | 3.71B | 2.97B | 1.58B | 721.38M | 100.30M | 81.44M | 125.25M |

| Gross Profit Ratio | 68.17% | 71.01% | 70.74% | 71.31% | 71.94% | 72.85% | 77.08% | 77.27% | 63.50% | 62.68% | 62.57% | 64.92% | 64.47% | 62.88% | 21.16% | 42.16% | 58.45% | 57.12% | 57.57% | 59.60% | 30.62% | 100.00% | 58.36% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.43B | 1.30B | 1.75B | 1.80B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.94B | 0.00 | 0.00 | 8.39B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 343.60M | 328.40M | 416.10M | 424.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.96B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -88.70M | 0.00 |

| SG&A | 1.76B | 1.62B | 2.17B | 2.23B | 2.11B | 2.05B | 2.48B | 3.03B | 2.97B | 3.17B | 2.62B | 1.94B | 1.78B | 1.68B | 10.35B | 190.80M | 1.89B | 1.44B | 1.25B | 830.61M | 42.11M | 0.00 | -88.70M | 0.00 |

| Other Expenses | 3.59B | 3.25B | 3.82B | 4.10B | 5.29B | 43.40M | 28.80M | -2.40M | -58.00M | -42.40M | -5.60M | -4.50M | 2.46B | 2.37B | -5.25B | 2.86B | 2.71B | 1.90B | 1.46B | 1.03B | 2.02B | -139.40M | 262.16M | 121.42M |

| Operating Expenses | 5.35B | 4.88B | 5.99B | 6.33B | 7.40B | 7.62B | 9.54B | 10.68B | 14.81B | 15.48B | 12.16B | 8.24B | 4.24B | 4.05B | 15.19B | 190.80M | 4.60B | 3.34B | 2.72B | 1.86B | 2.06B | -139.40M | 262.16M | 121.42M |

| Cost & Expenses | 7.74B | 6.96B | 9.01B | 9.76B | 10.64B | 10.87B | 12.99B | 14.61B | 14.81B | 15.48B | 12.16B | 8.24B | 7.62B | 7.40B | 118.24B | 780.10M | 8.34B | 6.12B | 4.90B | 2.93B | 3.69B | -139.40M | 262.16M | 121.42M |

| Interest Income | 212.70M | 76.60M | 13.90M | 57.10M | 77.80M | 0.00 | 0.00 | 0.00 | 33.50M | 31.70M | 113.10M | 42.30M | 73.20M | 38.90M | 1.64B | 91.80M | 115.30M | 85.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 907.90M | 589.30M | 882.10M | 1.19B | 1.39B | 1.48B | 1.89B | 2.32B | 2.28B | 2.54B | 2.29B | 1.68B | 1.46B | 1.34B | 2.74B | 191.30M | 982.10M | 673.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.32B | 2.19B | 2.44B | 2.34B | 3.75B | 3.86B | 3.79B | 5.21B | 5.61B | 5.50B | 4.28B | 2.69B | 2.46B | 2.37B | 2.53B | 2.86B | 2.57B | 1.97B | 1.56B | 982.62M | 1.06B | 139.40M | 0.00 | 0.00 |

| EBITDA | -420.50M | 4.20B | 3.66B | 1.73B | 3.98B | 4.88B | 3.10B | 8.19B | 7.88B | 6.99B | 6.04B | 3.89B | 3.34B | 2.38B | 10.03B | 3.84B | 3.52B | 2.39B | 1.62B | 574.50M | -283.09M | 100.30M | -122.62M | 3.83M |

| EBITDA Ratio | -5.61% | 17.65% | 141.84% | 36.55% | 38.73% | 41.65% | 45.52% | 48.65% | 45.95% | 45.23% | 46.24% | 46.50% | 46.52% | 44.64% | 7.67% | 23.44% | 35.91% | 35.60% | 31.73% | 19.93% | -27.42% | 100.00% | -87.88% | 3.06% |

| Operating Income | -244.50M | -901.50M | 12.27B | 2.12B | 745.50M | 839.10M | 1.95B | 2.48B | 2.10B | 2.23B | 2.01B | 1.98B | 1.82B | 1.50B | 12.47B | 238.70M | 666.80M | 352.30M | 251.18M | -313.87M | -1.34B | -39.10M | -122.62M | 3.83M |

| Operating Income Ratio | -3.26% | -12.53% | 119.02% | 17.68% | 6.46% | 7.02% | 12.94% | 14.36% | 12.31% | 12.21% | 13.90% | 19.23% | 19.12% | 16.58% | 9.54% | 23.43% | 7.41% | 5.43% | 4.88% | -11.87% | -56.80% | -38.98% | -87.88% | 3.06% |

| Total Other Income/Expenses | -3.48B | 1.28B | 12.68B | -3.83B | -1.82B | -677.30M | -2.90B | -1.33B | -2.88B | -3.28B | -2.54B | -2.57B | -2.38B | -2.54B | -1.23B | -423.90M | -617.10M | -522.50M | -199.31M | 139.40M | 1.10B | 39.10M | 122.62M | -3.83M |

| Income Before Tax | -3.72B | 1.42B | 14.00B | -1.72B | -1.16B | 161.80M | -1.56B | 647.50M | -776.90M | -1.06B | -526.50M | -483.30M | -575.80M | -1.10B | 12.02B | 47.10M | 49.70M | -170.20M | 50.79M | -228.88M | -240.41M | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | -49.71% | 19.79% | 135.78% | -14.39% | -10.02% | 1.35% | -10.34% | 3.75% | -4.55% | -5.79% | -3.64% | -4.69% | -6.05% | -12.21% | 9.20% | 4.62% | 0.55% | -2.62% | 0.99% | -8.66% | -10.21% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 149.60M | 318.90M | 473.30M | -256.90M | 253.00M | 1.57B | 309.50M | -1.35B | 324.30M | -75.00M | 355.50M | 89.00M | 231.70M | -224.90M | 3.57B | 62.30M | 233.10M | -7.90M | 29.85M | -17.45M | 101.73M | 0.00 | 820.36M | 129.69M |

| Net Income | -4.05B | 1.11B | 13.43B | -1.47B | -1.41B | 725.30M | -2.78B | 1.96B | -1.20B | -695.00M | -963.90M | 322.80M | -772.70M | 388.20M | 8.45B | -15.20M | -422.60M | 706.20M | -80.10M | -31.76M | -928.47M | 0.00 | -820.36M | -129.69M |

| Net Income Ratio | -54.08% | 15.36% | 130.21% | -12.24% | -12.21% | 6.07% | -18.46% | 11.34% | -7.01% | -3.81% | -6.66% | 3.13% | -8.12% | 4.31% | 6.47% | -1.49% | -4.69% | 10.89% | -1.55% | -1.20% | -39.41% | 0.00% | -587.92% | -103.55% |

| EPS | -9.52 | 2.26 | 24.16 | -2.44 | -2.00 | 0.93 | -3.28 | 2.20 | -1.38 | -0.77 | -1.54 | 0.53 | -2.60 | 1.37 | 19.22 | -0.04 | -0.99 | 1.43 | -0.17 | -0.09 | -2.66 | 0.00 | -2.39 | -0.38 |

| EPS Diluted | -9.52 | 2.22 | 23.59 | -2.44 | -2.00 | 0.93 | -3.28 | 2.18 | -1.38 | -0.77 | -1.54 | 0.53 | -2.60 | 1.37 | 19.22 | -0.04 | -0.99 | 1.43 | -0.17 | -0.09 | -2.66 | 0.00 | -2.39 | -0.38 |

| Weighted Avg Shares Out | 425.68M | 489.56M | 555.70M | 602.08M | 705.79M | 778.68M | 847.89M | 889.79M | 864.72M | 898.54M | 625.62M | 601.35M | 296.65M | 284.22M | 304.16M | 364.37M | 427.66M | 492.80M | 467.09M | 365.51M | 348.70M | 164.18M | 343.37M | 343.37M |

| Weighted Avg Shares Out (Dil) | 425.68M | 496.99M | 569.11M | 602.08M | 705.79M | 778.68M | 847.89M | 899.97M | 864.72M | 898.54M | 625.62M | 601.35M | 296.65M | 284.22M | 304.16M | 364.37M | 427.66M | 492.80M | 467.09M | 365.75M | 348.70M | 164.18M | 343.37M | 343.37M |

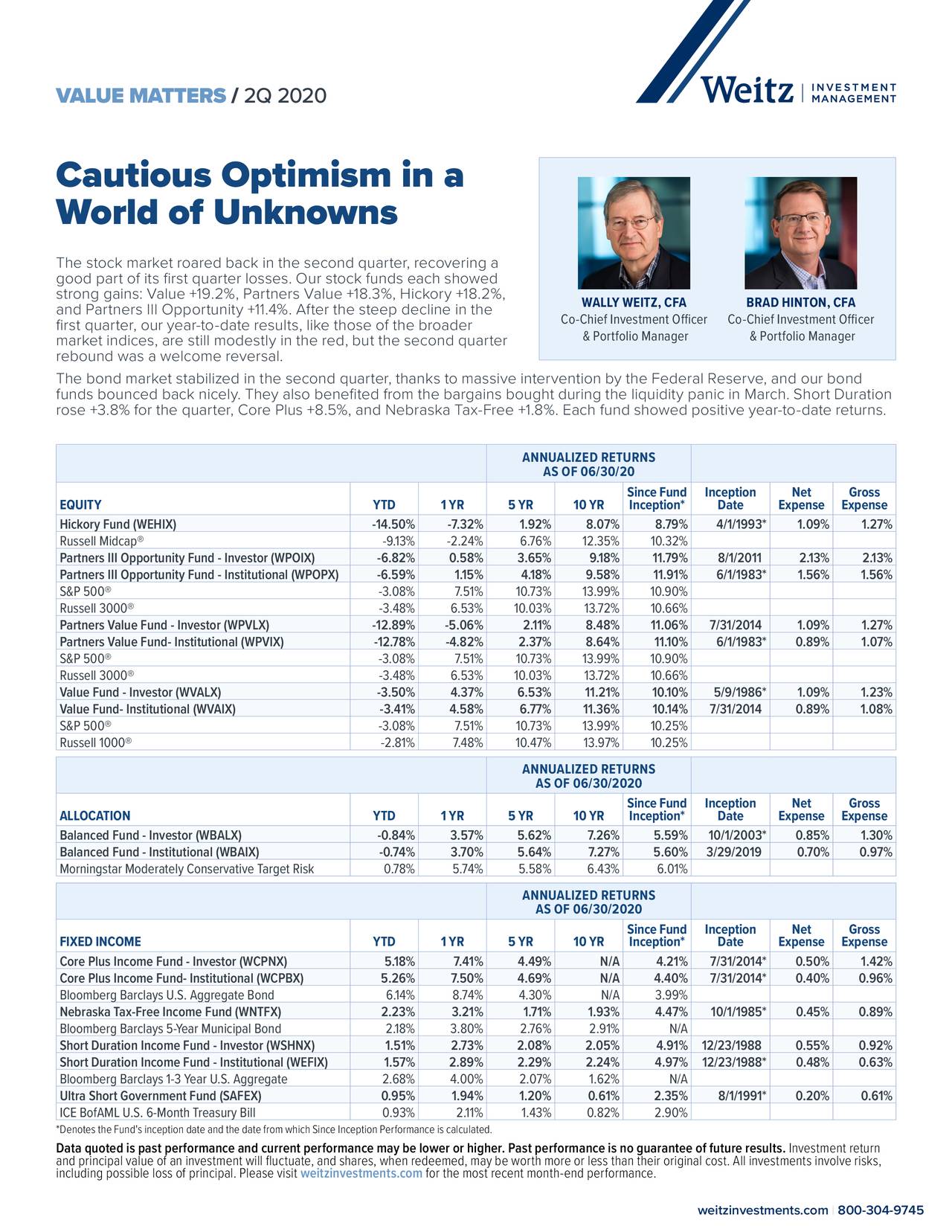

Tracking Wallace Weitz's Weitz Investment Management Portfolio - Q2 2020 Update

Top Buys From The Best Money Managers (Q2 2020)

Tracking Seth Klarman's Baupost Group Holdings - Q2 2020 Update

Baupost Q2 2020 Investor Letter

Weitz Investment Management Q2 2020 Commentary

Telefnica, Liberty Global discuss merger of UK operations - Bloomberg

Liberty Global: A Cash Flow Producing Marvel

Liberty Global Announces Creation of $4 Million COVID-19 Employee Assistance Fund

Liberty Global (NASDAQ:LBTYB) Rating Increased to Buy at ValuEngine

UK’s Virgin Media, Owned by Liberty Global, Reports Database Breach

Source: https://incomestatements.info

Category: Stock Reports