See more : Howmet Aerospace Inc. (48Z.DE) Income Statement Analysis – Financial Results

Complete financial analysis of Lucid Group, Inc. (LCID) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lucid Group, Inc., a leading company in the Auto – Manufacturers industry within the Consumer Cyclical sector.

- General Electric Company (GEC.L) Income Statement Analysis – Financial Results

- Tinkerine Studios Ltd. (TKSTF) Income Statement Analysis – Financial Results

- Sky Metals Limited (SKY.AX) Income Statement Analysis – Financial Results

- Brookfield Asset Management Ltd. (BAM) Income Statement Analysis – Financial Results

- Ellen AB (publ) (ELN.ST) Income Statement Analysis – Financial Results

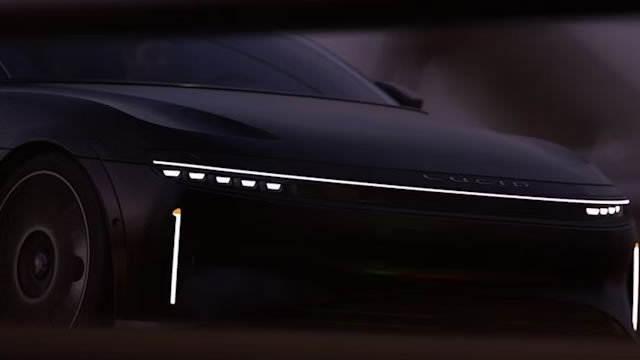

Lucid Group, Inc. (LCID)

About Lucid Group, Inc.

Lucid Group, Inc. a technology and automotive company, develops electric vehicle (EV) technologies. The company designs, engineers, and builds electric vehicles, EV powertrains, and battery systems. As of December 31, 2021, it operates twenty retail studios in the United States. Lucid Group, Inc. was founded in 2007 and is headquartered in Newark, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 595.27M | 608.18M | 27.11M | 3.98M | 4.59M |

| Cost of Revenue | 1.94B | 1.65B | 154.90M | 3.07M | 3.93M |

| Gross Profit | -1.34B | -1.04B | -127.79M | 906.00K | 664.00K |

| Gross Profit Ratio | -225.24% | -170.66% | -471.34% | 22.79% | 14.47% |

| Research & Development | 937.01M | 821.51M | 750.19M | 511.11M | 220.22M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 797.24M | 734.57M | 652.48M | 89.02M | 38.38M |

| Other Expenses | 24.55M | 9.53M | -893.00K | -690.00K | 4.61M |

| Operating Expenses | 1.76B | 1.56B | 1.40B | 600.13M | 258.60M |

| Cost & Expenses | 3.69B | 3.20B | 1.56B | 603.20M | 262.52M |

| Interest Income | 204.27M | 56.76M | 1.37M | 64.00K | 8.55M |

| Interest Expense | 24.92M | 30.60M | 1.37M | 64.00K | 8.55M |

| Depreciation & Amortization | 233.53M | 206.29M | 75.47M | 10.22M | 3.84M |

| EBITDA | -2.57B | -1.07B | -2.50B | -709.29M | -254.09M |

| EBITDA Ratio | -431.56% | -384.94% | -5,426.39% | -14,831.49% | -5,435.42% |

| Operating Income | -3.10B | -2.59B | -1.53B | -599.23M | -257.93M |

| Operating Income Ratio | -520.70% | -426.52% | -5,645.11% | -15,071.10% | -5,619.48% |

| Total Other Income/Expenses | 272.19M | 1.29B | -1.05B | -120.34M | -19.40M |

| Income Before Tax | -2.83B | -1.30B | -2.58B | -719.57M | -277.33M |

| Income Before Tax Ratio | -474.98% | -214.42% | -9,515.37% | -18,097.79% | -6,042.14% |

| Income Tax Expense | 1.03M | 379.00K | 49.00K | -188.00K | 23.00K |

| Net Income | -2.83B | -1.30B | -2.58B | -719.38M | -277.36M |

| Net Income Ratio | -475.15% | -214.49% | -9,515.55% | -18,093.06% | -6,042.64% |

| EPS | -1.36 | -0.78 | -3.48 | -28.98 | -11.17 |

| EPS Diluted | -1.36 | -0.77 | -3.48 | -28.98 | -11.17 |

| Weighted Avg Shares Out | 2.08B | 1.68B | 740.39M | 24.83M | 24.83M |

| Weighted Avg Shares Out (Dil) | 2.08B | 1.69B | 740.39M | 24.83M | 24.83M |

Why Lucid Stock Is Soaring Today

Lucid Motors completes its first Gravity SUV

U.S. Personal Sound Amplification Products Analysis Report 2024-2030 - Prominent Players Include Lucid Hearing, Britzgo, Sound World Solutions, MEDca Hearing, Tweak Hearing, Vivtonehearing & LifeEar

LCID or RIVN: Are Either of These EV Stocks a Smart Buy Now?

Should you hold Lucid (LCID) stock in 2025?

Lucid Diagnostics Completes Convertible Debt Refinancing to Strengthen Balance Sheet and Extend Cash Runway Past Key Near-Term Milestones

Wall St Can't Find a Single Reason the EV Business Will Improve Next Year. Rivian, Tesla, and Lucid Are on Watch (RIVN, TSLA, LCID)

Rivian and Lucid Face Falling Cash and Sales, According to Analysis

Lucid Stock: Buy, Sell, or Hold?

Prediction: Trump's Latest Blow To Lucid (LCID) Pushes Shares Below $2

Source: https://incomestatements.info

Category: Stock Reports