See more : FinServ Acquisition Corp. II (FSRXU) Income Statement Analysis – Financial Results

Complete financial analysis of Lincoln Electric Holdings, Inc. (LECO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lincoln Electric Holdings, Inc., a leading company in the Manufacturing – Tools & Accessories industry within the Industrials sector.

- Compugen Ltd. (CGEN.TA) Income Statement Analysis – Financial Results

- CHS Inc. (CHSCL) Income Statement Analysis – Financial Results

- KENKO Mayonnaise Co.,Ltd. (2915.T) Income Statement Analysis – Financial Results

- Inhibrx, Inc. Ex-distribution When-Issued (INBXV) Income Statement Analysis – Financial Results

- Meta Data Limited (ONE) Income Statement Analysis – Financial Results

Lincoln Electric Holdings, Inc. (LECO)

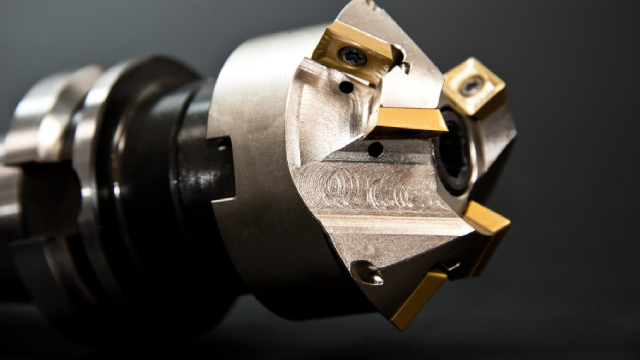

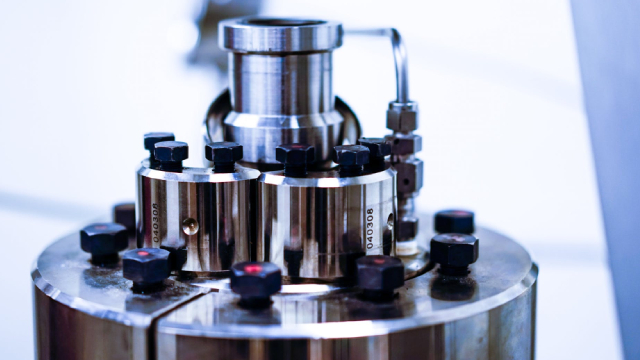

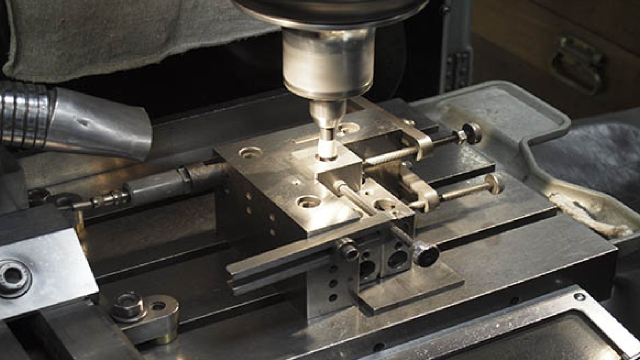

Industry: Manufacturing - Tools & Accessories

Sector: Industrials

Website: https://www.lincolnelectric.com

About Lincoln Electric Holdings, Inc.

Lincoln Electric Holdings, Inc., through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products worldwide. The company operates through three segments: Americas Welding, International Welding, and The Harris Products Group. It offers welding products, including arc welding power sources, plasma cutters, wire feeding systems, robotic welding packages, integrated automation systems, fume extraction equipment, consumable electrodes, fluxes and welding accessories, and specialty welding consumables and fabrication products. The company's product offering also includes computer numeric controlled plasma and oxy-fuel cutting systems, and regulators and torches used in oxy-fuel welding, cutting, and brazing; and consumables used in the brazing and soldering alloys market. In addition, it is involved in the retail business in the United States. Further, the company manufactures copper and aluminum headers, distributor assemblies, and manifolds for the heating, ventilation, and air conditioning sector in the United States and Mexico. The company serves general fabrication, energy and process, automotive and transportation, and construction and infrastructure industries, as well as heavy fabrication, ship building, and maintenance and repair markets. It sells its products directly to users of welding products, as well as through industrial distributors, retailers, and agents. The company was founded in 1895 and is headquartered in Cleveland, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.19B | 3.76B | 3.23B | 2.66B | 3.00B | 3.03B | 2.62B | 2.27B | 2.54B | 2.81B | 2.85B | 2.85B | 2.69B | 2.07B | 1.73B | 2.48B | 2.28B | 1.97B | 1.60B | 1.33B | 1.04B | 994.08M | 978.88M | 1.06B | 1.09B | 1.19B | 1.16B | 1.11B | 1.03B | 906.70M |

| Cost of Revenue | 2.71B | 2.48B | 2.17B | 1.78B | 2.00B | 2.00B | 1.74B | 1.49B | 1.69B | 1.86B | 1.91B | 1.99B | 1.96B | 1.51B | 1.27B | 1.76B | 1.63B | 1.42B | 1.16B | 971.32M | 759.92M | 694.05M | 671.55M | 668.79M | 685.30M | 701.50M | 690.00M | 657.00M | 604.90M | 528.30M |

| Gross Profit | 1.48B | 1.28B | 1.07B | 871.34M | 1.01B | 1.03B | 880.33M | 789.30M | 841.14M | 949.30M | 942.65M | 866.66M | 736.74M | 563.82M | 456.27M | 720.15M | 647.57M | 552.28M | 436.92M | 362.36M | 280.67M | 300.03M | 307.33M | 389.81M | 400.90M | 485.20M | 469.10M | 452.10M | 427.50M | 378.40M |

| Gross Profit Ratio | 35.23% | 34.05% | 33.04% | 32.81% | 33.55% | 33.96% | 33.54% | 34.70% | 33.17% | 33.74% | 33.04% | 30.37% | 27.34% | 27.24% | 26.38% | 29.05% | 28.39% | 28.01% | 27.29% | 27.17% | 26.97% | 30.18% | 31.40% | 36.82% | 36.91% | 40.89% | 40.47% | 40.76% | 41.41% | 41.73% |

| Research & Development | 71.24M | 63.21M | 55.97M | 51.41M | 56.85M | 54.17M | 47.90M | 44.72M | 47.18M | 43.26M | 42.13M | 37.31M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 627.70M | 545.68M | 466.68M | 639.49M | 545.50M | 527.21M | 495.22M | 439.78M | 377.77M | 333.40M | 405.38M | 370.12M | 315.83M | 285.31M | 256.62M | 210.70M | 198.04M | 190.16M | 216.22M | 223.80M | 309.70M | 305.80M | 310.30M | 289.80M | 261.70M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 703.65M | 656.64M | 597.11M | 543.80M | 621.49M | 627.70M | 545.68M | 466.68M | 639.49M | 545.50M | 527.21M | 495.22M | 439.78M | 377.77M | 333.40M | 405.38M | 370.12M | 315.83M | 285.31M | 256.62M | 210.70M | 198.04M | 190.16M | 216.22M | 223.80M | 309.70M | 305.80M | 310.30M | 289.80M | 261.70M |

| Other Expenses | -15.04M | 9.99M | -114.46M | 3.94M | 21.00M | 10.69M | 5.22M | 3.17M | 4.18M | 4.00M | 4.19M | 2.69M | 0.00 | -384.00K | 0.00 | 0.00 | 0.00 | 0.00 | 1.76M | 2.44M | 1.74M | 10.47M | 0.00 | 34.71M | 29.10M | 28.10M | 28.40M | 29.50M | 29.70M | 28.00M |

| Operating Expenses | 758.91M | 656.64M | 597.11M | 543.80M | 621.49M | 627.70M | 545.68M | 466.68M | 639.49M | 545.50M | 527.21M | 495.22M | 440.06M | 377.77M | 333.40M | 424.75M | 370.12M | 315.83M | 287.07M | 259.06M | 212.45M | 208.50M | 190.16M | 250.93M | 252.90M | 337.80M | 334.20M | 339.80M | 319.50M | 289.70M |

| Cost & Expenses | 3.47B | 3.14B | 2.76B | 2.33B | 2.62B | 2.63B | 2.29B | 1.95B | 2.33B | 2.41B | 2.44B | 2.48B | 2.40B | 1.88B | 1.61B | 2.18B | 2.00B | 1.74B | 1.45B | 1.23B | 972.37M | 902.56M | 861.71M | 919.72M | 938.20M | 1.04B | 1.02B | 996.80M | 924.40M | 818.00M |

| Interest Income | 0.00 | 1.61M | 1.57M | 1.99M | 2.53M | 0.00 | 4.79M | 2.09M | 2.71M | 3.09M | 3.32M | 3.99M | 3.12M | 2.38M | 3.46M | 8.85M | 8.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 44.37M | 29.50M | 22.21M | 21.97M | 23.42M | 17.57M | 24.22M | 19.08M | 21.82M | 10.43M | 2.86M | 4.19M | 6.70M | 6.69M | 8.52M | 12.16M | 11.43M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 86.67M | 78.06M | 81.15M | 80.49M | 81.49M | 72.35M | 68.12M | 65.07M | 64.01M | 69.61M | 68.88M | 65.33M | 62.05M | 57.36M | 56.60M | 56.93M | 51.49M | 45.71M | 41.87M | 42.30M | 37.65M | 37.04M | 36.21M | 34.71M | 29.10M | 28.10M | 28.40M | 29.50M | 29.70M | 28.00M |

| EBITDA | 824.67M | 700.14M | 675.23M | 410.35M | 466.89M | 473.29M | 416.69M | 383.95M | 441.64M | 455.85M | 504.29M | 439.10M | 370.09M | 251.16M | 152.75M | 368.89M | 351.20M | 282.16M | 193.47M | 103.30M | 68.22M | 91.52M | 153.37M | 173.59M | 177.10M | 175.50M | 163.30M | 141.80M | 137.70M | 116.70M |

| EBITDA Ratio | 19.67% | 18.93% | 13.55% | 15.51% | 16.27% | 15.98% | 15.83% | 17.40% | 10.87% | 17.27% | 17.41% | 15.72% | 13.63% | 12.03% | 10.29% | 14.81% | 14.29% | 14.39% | 11.79% | 10.83% | 10.05% | 13.76% | 15.33% | 17.40% | 19.03% | 14.34% | 13.52% | 11.59% | 12.96% | 12.08% |

| Operating Income | 717.85M | 612.34M | 357.04M | 282.07M | 370.91M | 375.54M | 377.71M | 288.27M | 181.70M | 373.75M | 406.99M | 362.08M | 296.68M | 186.43M | 92.98M | 295.40M | 277.63M | 232.97M | 149.85M | 103.30M | 68.22M | 91.52M | 117.17M | 138.88M | 148.00M | 147.40M | 134.90M | 112.30M | 108.00M | 88.70M |

| Operating Income Ratio | 17.13% | 16.28% | 11.04% | 10.62% | 12.35% | 12.40% | 14.39% | 12.67% | 7.17% | 13.28% | 14.27% | 12.69% | 11.01% | 9.01% | 5.38% | 11.92% | 12.17% | 11.81% | 9.36% | 7.75% | 6.56% | 9.21% | 11.97% | 13.12% | 13.63% | 12.42% | 11.64% | 10.13% | 10.46% | 9.78% |

| Total Other Income/Expenses | -30.98M | -19.51M | -136.67M | -18.03M | -2.42M | -6.88M | -10.71M | -10.89M | -11.91M | 2.07M | 9.46M | 7.49M | 4.65M | 678.00K | -6.50M | 4.41M | 9.53M | 5.20M | 4.05M | 4.48M | 1.01M | -3.58M | -1.12M | -17.20M | -33.80M | -400.00K | 200.00K | 5.60M | -8.40M | -8.50M |

| Income Before Tax | 686.87M | 592.83M | 325.00M | 264.04M | 368.49M | 368.66M | 366.24M | 277.39M | 169.79M | 375.81M | 416.44M | 369.57M | 301.33M | 187.11M | 86.48M | 299.81M | 287.16M | 238.17M | 153.90M | 107.78M | 69.23M | 87.94M | 116.04M | 121.68M | 114.20M | 147.00M | 135.10M | 117.90M | 99.60M | 80.20M |

| Income Before Tax Ratio | 16.39% | 15.76% | 10.05% | 9.94% | 12.27% | 12.17% | 13.95% | 12.19% | 6.70% | 13.36% | 14.60% | 12.95% | 11.18% | 9.04% | 5.00% | 12.09% | 12.59% | 12.08% | 9.61% | 8.08% | 6.65% | 8.85% | 11.85% | 11.49% | 10.51% | 12.39% | 11.66% | 10.63% | 9.65% | 8.85% |

| Income Tax Expense | 141.62M | 120.60M | 48.42M | 57.90M | 75.41M | 81.67M | 118.76M | 79.02M | 42.38M | 121.93M | 124.75M | 112.35M | 84.32M | 54.90M | 37.91M | 87.52M | 84.42M | 63.16M | 31.59M | 27.18M | 14.69M | 21.06M | 32.45M | 43.59M | 40.30M | 53.30M | 49.70M | 43.60M | 38.10M | 32.20M |

| Net Income | 545.25M | 472.22M | 276.58M | 206.12M | 293.11M | 287.07M | 247.50M | 198.40M | 127.48M | 254.69M | 293.78M | 257.41M | 217.19M | 130.24M | 48.58M | 212.29M | 202.74M | 175.01M | 122.31M | 80.60M | 54.54M | 29.28M | 83.59M | 78.09M | 73.90M | 93.70M | 85.40M | 74.30M | 61.50M | 48.00M |

| Net Income Ratio | 13.01% | 12.56% | 8.55% | 7.76% | 9.76% | 9.48% | 9.43% | 8.72% | 5.03% | 9.05% | 10.30% | 9.02% | 8.06% | 6.29% | 2.81% | 8.56% | 8.89% | 8.88% | 7.64% | 6.04% | 5.24% | 2.94% | 8.54% | 7.38% | 6.80% | 7.90% | 7.37% | 6.70% | 5.96% | 5.29% |

| EPS | 9.51 | 8.14 | 4.66 | 3.46 | 4.73 | 4.42 | 3.76 | 2.94 | 1.72 | 3.22 | 3.58 | 3.10 | 2.60 | 1.54 | 0.57 | 2.49 | 2.37 | 2.06 | 1.47 | 0.98 | 0.66 | 0.35 | 0.99 | 0.92 | 0.82 | 0.96 | 0.87 | 0.75 | 0.66 | 1.10 |

| EPS Diluted | 9.37 | 8.04 | 4.60 | 3.42 | 4.68 | 4.37 | 3.71 | 2.91 | 1.70 | 3.18 | 3.54 | 3.06 | 2.56 | 1.53 | 0.57 | 2.47 | 2.34 | 2.04 | 1.45 | 0.97 | 0.66 | 0.34 | 0.98 | 0.92 | 0.81 | 0.96 | 0.87 | 0.75 | 0.66 | 1.10 |

| Weighted Avg Shares Out | 57.36M | 58.03M | 59.31M | 59.63M | 61.96M | 64.89M | 65.74M | 67.46M | 74.11M | 79.19M | 81.98M | 83.09M | 83.68M | 84.41M | 84.78M | 85.30M | 85.80M | 85.16M | 83.49M | 82.38M | 82.64M | 84.86M | 84.86M | 85.35M | 90.67M | 97.60M | 98.73M | 99.73M | 93.54M | 43.84M |

| Weighted Avg Shares Out (Dil) | 58.22M | 58.75M | 60.06M | 60.25M | 62.66M | 65.68M | 66.64M | 68.16M | 74.85M | 80.10M | 83.04M | 84.18M | 84.71M | 85.22M | 85.27M | 86.11M | 86.78M | 86.00M | 84.35M | 83.29M | 83.27M | 86.10M | 85.29M | 85.35M | 91.23M | 98.12M | 98.73M | 99.73M | 93.54M | 43.84M |

2 Undervalued Industrial Dividend Stocks For August 2024

Why Is Lincoln Electric (LECO) Down 2.8% Since Last Earnings Report?

Lincoln Electric Announces September 2024 Events With the Financial Community

Zacks Industry Outlook Black & Decker and Lincoln Electric Holdings

Lincoln Electric (LECO) Q2 Earnings Beat, Revenues Dip Y/Y

2 Manufacturing Tools Stocks to Watch Despite Industry Headwinds

Lincoln Electric (LECO) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Lincoln Electric Holdings (LECO) Q2 Earnings and Revenues Beat Estimates

Analysts Estimate Lincoln Electric Holdings (LECO) to Report a Decline in Earnings: What to Look Out for

Sila Realty Trust, Inc. to Report Second Quarter Financial Results on Tuesday, August 6

Source: https://incomestatements.info

Category: Stock Reports