See more : Mezzion Pharma Co.,Ltd. (140410.KQ) Income Statement Analysis – Financial Results

Complete financial analysis of Legacy Housing Corporation (LEGH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Legacy Housing Corporation, a leading company in the Residential Construction industry within the Consumer Cyclical sector.

- Tufin Software Technologies Ltd. (TUFN) Income Statement Analysis – Financial Results

- Gujarat State Financial Corporation (GUJSTATFIN.BO) Income Statement Analysis – Financial Results

- Appili Therapeutics Inc. (APLIF) Income Statement Analysis – Financial Results

- Red Oak Hereford Farms, Inc. (HERF) Income Statement Analysis – Financial Results

- Steadfast Group Limited (SDF.AX) Income Statement Analysis – Financial Results

Legacy Housing Corporation (LEGH)

Industry: Residential Construction

Sector: Consumer Cyclical

Website: https://www.legacyhousingcorp.com

About Legacy Housing Corporation

Legacy Housing Corporation builds, sells, and finances manufactured homes and tiny houses primarily in the southern United States. The company manufactures and provides for the transport of mobile homes; and offers wholesale financing to dealers and mobile home parks, as well as a range of homes, including 1 to 5 bedrooms with 1 to 3 1/2 bathrooms. It also provides floor plan financing for independent retailers; consumer financing for its products; and financing to manufactured housing community owners that buy its products for use in their rental housing communities. In addition, it involved in financing and developing new manufactured home communities; and retail financing to consumers. The company markets its homes under the Legacy brand through a network of 176 independent and 13 company-owned retail locations, as well as direct sales to owners of manufactured home communities in 15 states in the United States. Legacy Housing Corporation was founded in 2005 and is headquartered in Bedford, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 189.14M | 257.02M | 197.51M | 176.72M | 168.96M | 161.88M | 128.74M | 110.55M |

| Cost of Revenue | 99.69M | 150.11M | 114.05M | 109.72M | 104.90M | 107.23M | 82.50M | 77.33M |

| Gross Profit | 89.45M | 106.90M | 83.46M | 67.00M | 64.05M | 54.65M | 46.24M | 33.22M |

| Gross Profit Ratio | 47.29% | 41.59% | 42.26% | 37.91% | 37.91% | 33.76% | 35.92% | 30.05% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 24.28M | 27.57M | 23.31M | 19.07M | 25.48M | 21.02M | 17.11M | 13.58M |

| Selling & Marketing | 586.00K | 1.32M | 1.24M | 336.00K | 731.00K | 829.00K | 1.04M | 1.21M |

| SG&A | 24.87M | 28.88M | 24.54M | 19.40M | 26.21M | 21.85M | 18.14M | 14.79M |

| Other Expenses | 0.00 | 1.56M | 503.00K | 1.36M | 152.00K | 162.00K | 149.00K | 102.00K |

| Operating Expenses | 24.87M | 28.88M | 24.54M | 19.40M | 26.21M | 21.85M | 18.14M | 14.79M |

| Cost & Expenses | 124.56M | 179.00M | 138.59M | 129.13M | 131.12M | 129.08M | 100.64M | 92.12M |

| Interest Income | 3.02M | 2.94M | 2.10M | 915.00K | 300.00K | 190.00K | 272.00K | 214.00K |

| Interest Expense | 930.00K | 375.00K | 887.00K | 1.05M | 702.00K | 2.51M | 2.04M | 1.24M |

| Depreciation & Amortization | 1.73M | 1.78M | 1.59M | 1.21M | 1.01M | 838.00K | 652.00K | 576.00K |

| EBITDA | 71.39M | 84.30M | 63.10M | 51.09M | 39.31M | 33.99M | 29.17M | 19.32M |

| EBITDA Ratio | 37.74% | 32.89% | 31.95% | 28.91% | 23.26% | 21.00% | 22.66% | 17.47% |

| Operating Income | 64.59M | 78.02M | 58.92M | 47.60M | 37.84M | 32.80M | 28.10M | 18.43M |

| Operating Income Ratio | 34.15% | 30.36% | 29.83% | 26.93% | 22.40% | 20.26% | 21.82% | 16.67% |

| Total Other Income/Expenses | 4.15M | 4.13M | 1.71M | 1.23M | -250.00K | -2.16M | -1.62M | -928.00K |

| Income Before Tax | 68.74M | 82.15M | 60.63M | 48.82M | 37.59M | 30.65M | 26.47M | 17.50M |

| Income Before Tax Ratio | 36.34% | 31.96% | 30.70% | 27.63% | 22.25% | 18.93% | 20.56% | 15.83% |

| Income Tax Expense | 14.28M | 14.38M | 10.76M | 10.83M | 8.75M | 9.13M | 124.00K | 158.00K |

| Net Income | 54.46M | 67.77M | 49.87M | 38.00M | 28.84M | 21.51M | 26.35M | 17.34M |

| Net Income Ratio | 28.79% | 26.37% | 25.25% | 21.50% | 17.07% | 13.29% | 20.47% | 15.69% |

| EPS | 2.23 | 2.78 | 2.06 | 1.57 | 1.18 | 1.07 | 1.10 | 0.56 |

| EPS Diluted | 2.17 | 2.74 | 2.05 | 1.57 | 1.18 | 1.07 | 1.10 | 0.56 |

| Weighted Avg Shares Out | 24.39M | 24.36M | 24.20M | 24.23M | 24.38M | 20.20M | 24.00M | 20.00M |

| Weighted Avg Shares Out (Dil) | 25.07M | 24.74M | 24.28M | 24.24M | 24.44M | 20.20M | 24.00M | 20.00M |

Legacy Housing (LEGH) Hits 52-Week High, Can the Run Continue?

Sell Homebuilders And Buy Manufactured Housing

Legacy Housing Corporation Reports Fourth Quarter 2020 Financial Results

Legacy Housing: Underappreciated Value

Legacy Housing (LEGH) Tops Q3 Earnings and Revenue Estimates

Legacy Housing Corporation Reports 2020 Third Quarter Results

Legacy Housing Corporation Reports Amended 2020 Second Quarter Results

Legacy Housing: Building A Legacy In Housing

Legacy Housing Corp (NASDAQ:LEGH) Chairman Curtis Drew Hodgson Sells 10,000 Shares

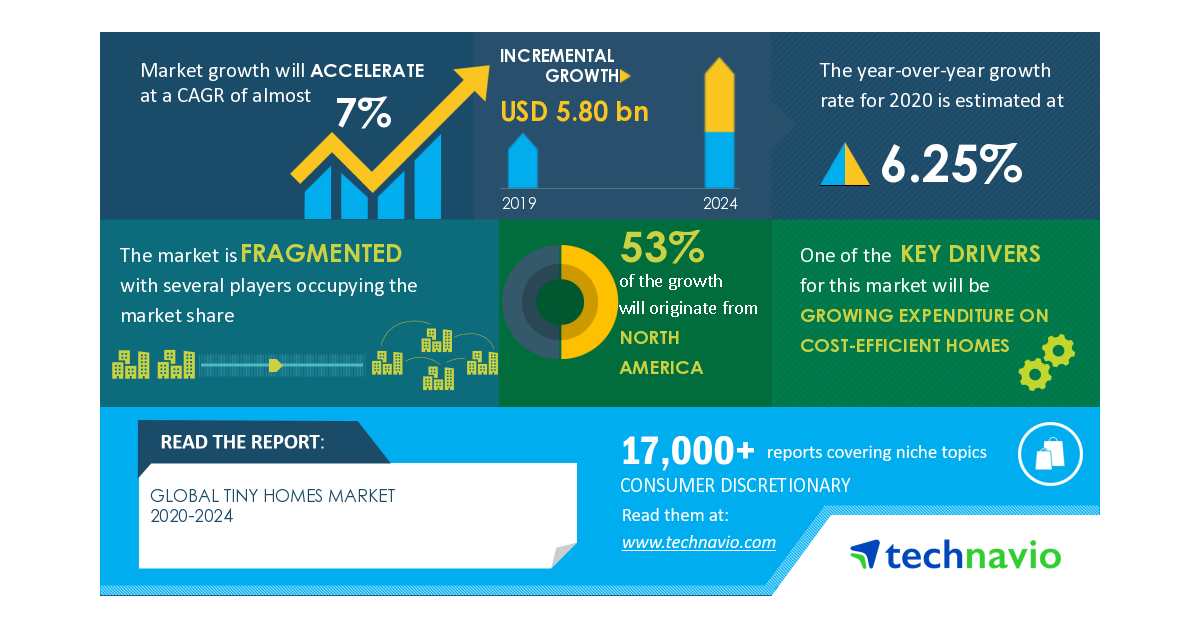

Global Tiny Homes Market - Actionable Research on COVID-19 | Growing Expenditure on Cost-efficient Homes to Boost the Market Growth | Technavio

Source: https://incomestatements.info

Category: Stock Reports