See more : PT United Tractors Tbk (PUTKF) Income Statement Analysis – Financial Results

Complete financial analysis of Leju Holdings Limited (LEJU) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Leju Holdings Limited, a leading company in the Real Estate – Services industry within the Real Estate sector.

- Radient Technologies Inc. (RTI.V) Income Statement Analysis – Financial Results

- Pathfinder Bancorp, Inc. (PBHC) Income Statement Analysis – Financial Results

- Merchants Bancorp (MBINM) Income Statement Analysis – Financial Results

- Sangam (India) Limited (SANGAMIND.BO) Income Statement Analysis – Financial Results

- MAYO Human Capital Inc. (6738.TWO) Income Statement Analysis – Financial Results

Leju Holdings Limited (LEJU)

About Leju Holdings Limited

Leju Holdings Limited, through its subsidiaries, provides online to offline (O2O) real estate services in the People's Republic of China. It offers real estate e-commerce, online advertising, and online listing services through its online platform, which comprises websites covering 401 cities and various mobile applications. The company also operates various real estate and home furnishing Websites of SINA Corporation (SINA). Its O2O services for new residential properties include selling discount coupons; and facilitating online property viewing, physical property visits, marketing events, and pre-sale customer support, as well as home furnishing business transactions on its platform. In addition, the company sells advertising primarily on the SINA new residential properties and home furnishing websites; and acts as an advertising agent for the SINA home page and non-real estate Websites with respect to advertising sold to real estate developers and home furnishing suppliers. Further, it offers fee-based online property listing services to real estate agents; and services to individual property sellers. The company was incorporated in 2013 and is headquartered in Beijing, the People's Republic of China.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 534.12M | 534.12M | 719.53M | 692.60M | 462.03M | 362.53M | 559.51M | 575.80M | 496.02M | 335.42M | 171.30M | 137.09M |

| Cost of Revenue | 55.80M | 55.80M | 73.76M | 68.30M | 72.91M | 74.05M | 57.49M | 60.31M | 51.13M | 63.99M | 54.12M | 37.58M |

| Gross Profit | 478.32M | 478.32M | 645.76M | 624.31M | 389.12M | 288.48M | 502.02M | 515.49M | 444.89M | 271.43M | 117.18M | 99.51M |

| Gross Profit Ratio | 89.55% | 89.55% | 89.75% | 90.14% | 84.22% | 79.57% | 89.72% | 89.53% | 89.69% | 80.92% | 68.41% | 72.59% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 202.65M | 98.71M | 120.05M | 402.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 442.98M | 523.32M | 487.11M | 54.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | -645.62M | 645.62M | 622.03M | 607.16M | 402.26M | 434.28M | 521.80M | 475.45M | 366.34M | 226.14M | 163.53M | 121.61M |

| Other Expenses | 1.50M | -560.00K | -381.00K | -597.85K | -4.22M | 480.00K | 620.00K | 290.00K | 36.00K | -1.19M | -1.88M | -1.03M |

| Operating Expenses | -645.62M | 645.06M | 621.65M | 606.57M | 400.10M | 431.20M | 517.21M | 471.88M | 363.82M | 225.54M | 163.38M | 121.60M |

| Cost & Expenses | -589.82M | 700.86M | 695.41M | 674.86M | 473.01M | 505.26M | 574.70M | 532.19M | 414.95M | 289.53M | 217.50M | 159.18M |

| Interest Income | 2.34M | 3.13M | 7.27M | 151.93K | 1.09M | 1.31M | 1.31M | 1.17M | 1.32M | 1.08M | 257.20K | 675.76K |

| Interest Expense | 163.97M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 12.58M | 13.37M | 14.34M | 13.43M | 15.71M | 16.54M | 15.01M | 29.28M | 26.12M | 38.34M | 39.79M | 29.18M |

| EBITDA | 298.00K | 560.00K | 24.12M | 31.17M | 4.73M | 3.07M | -183.89K | 72.89M | 107.25M | 84.23M | -6.32M | 424.91M |

| EBITDA Ratio | 0.10% | -31.22% | 3.35% | 4.50% | -2.38% | -28.00% | -2.68% | 7.53% | 16.35% | 25.11% | -3.69% | 309.95% |

| Operating Income | -12.02M | -166.75M | 9.78M | 17.74M | -10.97M | -183.95M | -15.19M | 43.61M | 81.08M | 45.89M | -46.20M | -439.91M |

| Operating Income Ratio | -2.25% | -31.22% | 1.36% | 2.56% | -2.38% | -50.74% | -2.72% | 7.57% | 16.35% | 13.68% | -26.97% | -320.89% |

| Total Other Income/Expenses | 3.83M | 3.34M | 7.57M | 2.13M | -3.13M | -39.43M | 1.75M | 1.72M | 1.13M | -172.03K | -1.72M | -350.04K |

| Income Before Tax | -163.41M | -163.41M | 31.69M | 19.87M | -14.11M | -182.16M | -13.44M | 45.34M | 82.43M | 45.78M | -47.93M | -440.26M |

| Income Before Tax Ratio | -30.59% | -30.59% | 4.40% | 2.87% | -3.05% | -50.25% | -2.40% | 7.87% | 16.62% | 13.65% | -27.98% | -321.15% |

| Income Tax Expense | -13.48M | -13.50M | 10.67M | 8.99M | -1.33M | -20.33M | -2.07M | 10.31M | 15.55M | 3.07M | -4.08M | -2.01M |

| Net Income | -149.92M | -149.91M | 19.30M | 11.52M | -13.48M | -160.90M | -9.79M | 35.33M | 66.52M | 42.52M | -44.76M | -438.83M |

| Net Income Ratio | -28.07% | -28.07% | 2.68% | 1.66% | -2.92% | -44.38% | -1.75% | 6.14% | 13.41% | 12.68% | -26.13% | -320.10% |

| EPS | -10.94 | -10.97 | 1.42 | 0.85 | -1.00 | -11.86 | -0.72 | 2.60 | 5.10 | 3.54 | -3.39 | -33.24 |

| EPS Diluted | -10.94 | -10.97 | 1.40 | 0.85 | -0.99 | -11.86 | -0.72 | 2.60 | 5.00 | 3.54 | -3.39 | -33.24 |

| Weighted Avg Shares Out | 13.70M | 13.67M | 13.61M | 13.58M | 13.48M | 13.52M | 13.52M | 13.45M | 12.93M | 12.00M | 13.20M | 13.20M |

| Weighted Avg Shares Out (Dil) | 13.70M | 13.67M | 13.76M | 13.58M | 13.58M | 13.57M | 13.52M | 13.62M | 13.25M | 12.00M | 13.20M | 13.20M |

Leju to Report Fourth Quarter and Full Year 2020 Financial Results on March 26, 2021

Leju Holdings Limited (LEJU) CEO Geoffrey He on Q3 2020 Results - Earnings Call Transcript

Leju Reports Third Quarter 2020 Results and Issues Notice of Annual General Meeting

Leju to Report Third Quarter 2020 Financial Results on November 23, 2020

Merger Arbitrage Analysis And Spread Performance - October 4, 2020

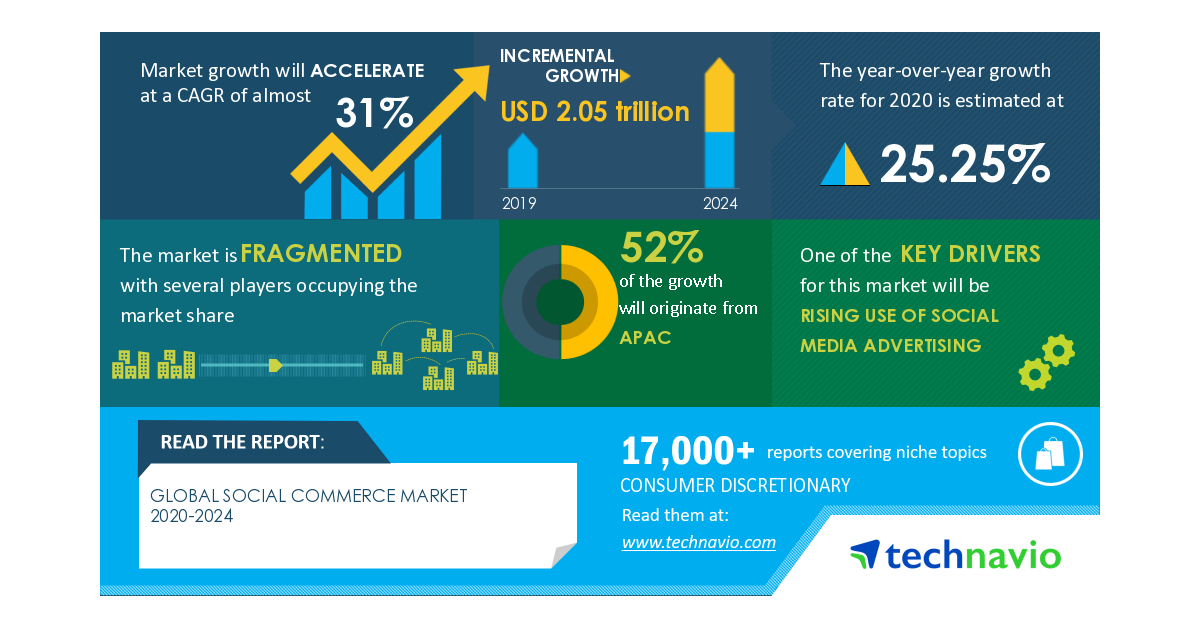

Social Commerce Market - Actionable Research on COVID-19 | Rising Use of Social Media Advertising to Boost the Market Growth | Technavio

What to watch today: Wall Street set to pick up where Friday's rally left off

Stocks making the biggest moves premarket: Spotify, Caesars, Virgin Galactic & more

Leju Holdings Limited (LEJU) CEO Geoffrey He on Q2 2020 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports