Markets snapshot

- ASX 200: +0.2% to 8,176 points

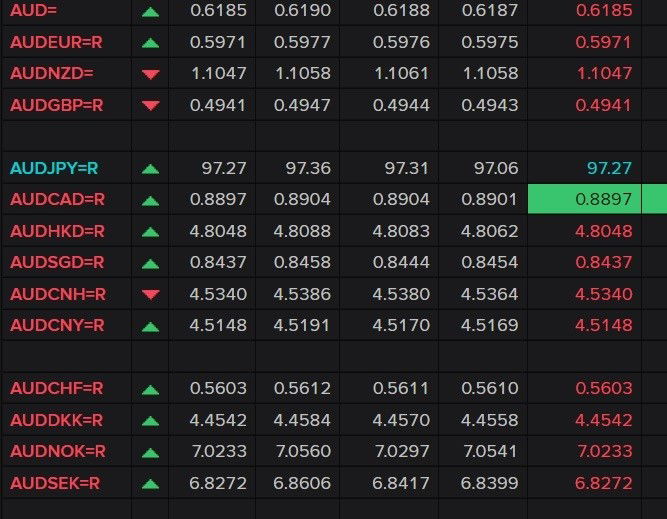

- Australian dollar: Down to 61.89 US cents

- Wall Street: Dow -0.1% S&P 500 -0.4% Nasdaq -0.9%

- Europe: Dax -0.4% FTSE +0.6%

- Spot gold: -0.1% $US2,638.00/ounce

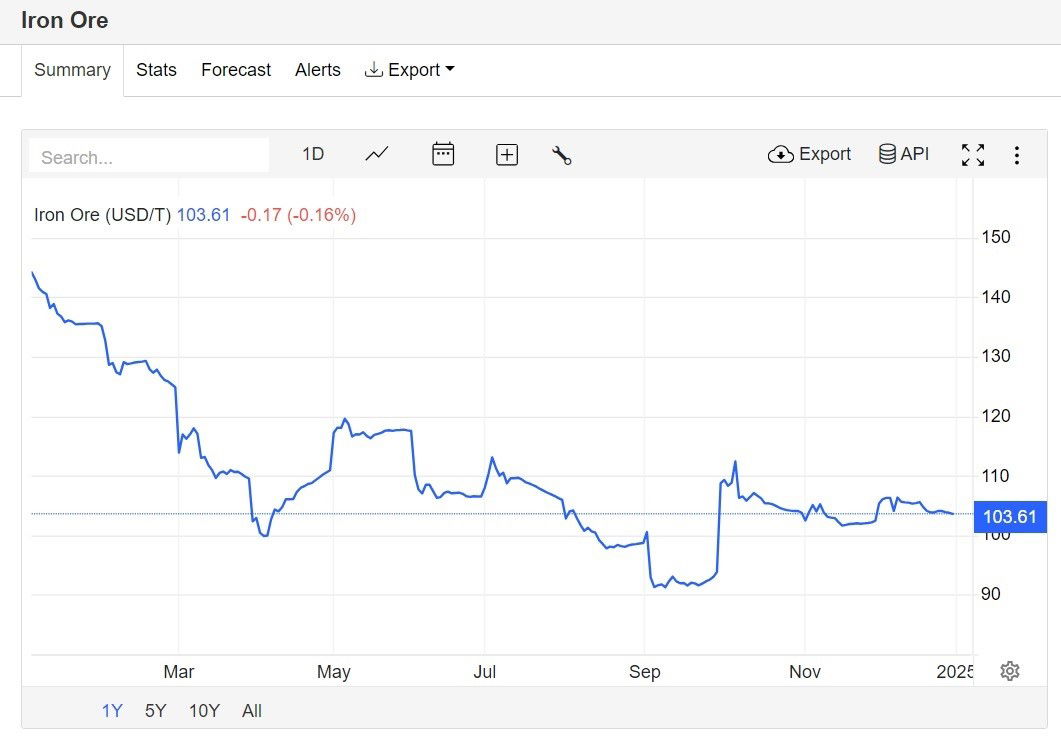

- Iron ore: flat to $100.97 a tonne

- Brent crude: +1.1% to $US74.83/barrel

- Bitcoin: +1% to $US94,505

Price current around 10:45am AEDT

You are watching: Live updates: Aussie dollar slips to new two-year low against the US greenback

Live updates on the major ASX indices:

How the Aussie dollar affects the RBA’s rate cut decision

When the Aussie dollar is weak it usually leads to higher prices because goods and services overseas become more expensive.

Following that line of thinking … it could lead to higher inflation in Australia … which in turn would make the RBA wary of a rate cut.

But AMP economist Shane Oliver says the economic climate of the past few years means that likely won’t happen.

Households, he said, have been struggling for years now to make ends meet, which disincentivises businesses from putting prices up.

Businesses are more likely to absorb higher costs in the hopes it will be short-lived rather than risk turning off customers with higher prices.

And that would stave off a rise inflation, keeping the Reserve Bank board happy.

“I don’t think this changes the RBA’s rate cut forecast at this stage. If the dollar falls below 60c it may, but even then the RBA will look at the circumstances under which that is occurring,” Oliver says.

What does a weak dollar mean for rates?

Happy new year ABC business team! Keep up the great work in 2025. What’s the latest with the Aussie dollar? Cheers ☕️

– Frank

Thanks Frank!

I’ve just spoken with AMP economic analyst Shane Oliver who had some great insights into the fall of the Aussie dollar and what it could mean for rates.

My colleague Dave Chau just spelt out how China and the US are affecting the dollar.

But there’s a big wide world out there and China and the US aren’t the entire picture.

Shane Oliver says that while the Aussie dollar fell about 9% on greenback in 2024, it only fell about 5% against all global currencies.

“The trade weighted index has been around 5% for 4+ years,” he said.

“We’re at the low end of that but in the same range. We have been here before.

“It’s a prefect storm of factors; softer commodity prices in part due to iron ore, concerns about China and fears of a trade war.

“Lately the concern that the US Federal Reserve won’t cut rates makes it less attractive to park money in Australia.

“It’s not great if you’re going on holiday to the US, but I don’t think it’s enough to change the RBA’s thinking at this stage.”

Meaning a rate cut remains on the cards for early this year.

China’s property meltdown is also weighing on the Australian dollar

Now here is ‘part two’ of why the Australian dollar is so weak.

In addition to the strong US dollar (partly driven by Donald Trump’s inflationary policies), China’s sluggish economic recovery is another contributing factor.

Our largest trading partner is experiencing is facing a deflation problem (ie. prices are falling because consumers confidence is so low, and their spending has fallen significantly).

Not only that, property prices in China have been falling for several years (with new home values down 5.7% in the year to October).

This was mainly due to the Chinese government cracking down on rampant borrowing (and a debt addiction) in the nation’s housing sector — which led to the near-collapse of Evergrande, Country Garden and other major property developers.

China’s government has been under immense pressure to introduce even more stimulus to prop up its economy and property sector (with more expected to be unveiled if Trump escalates the US-China trade war by imposing more tariffs, which is likely to happen).

The flow-on effect is the price of iron ore falling sharply to about $US103 per tonne (down from its peak of $US143 at the beginning of last year).

Iron ore is Australia’s major export to China (and a key ingredient for making steel).

So with China’s property sector facing a long-running crisis, it’s unlikely it will need to buy as much iron ore from Australia’s miners.

Weaker demand for iron ore is also contributing to the falling AUD (which is good for Australian businesses exporting goods to foreign countries, but bad for those who are holidaying overseas).

So there you have it! That’s your crash course on what’s happening with the Aussie dollar.

Hopefully this knowledge comes in handy at your next trivia night, or if you want to impress your friends at your next drinks event!

Donald Trump’s policies are dragging the Aussie dollar lower

The Australian dollar dropped as low as 61.84 US cents this morning, its weakest level since April 2020 (the early days of the COVID-19 pandemic).

So what’s going on, you may be wondering?

The short answer is that the world’s most important currency (the US greenback) has been incredibly strong lately!

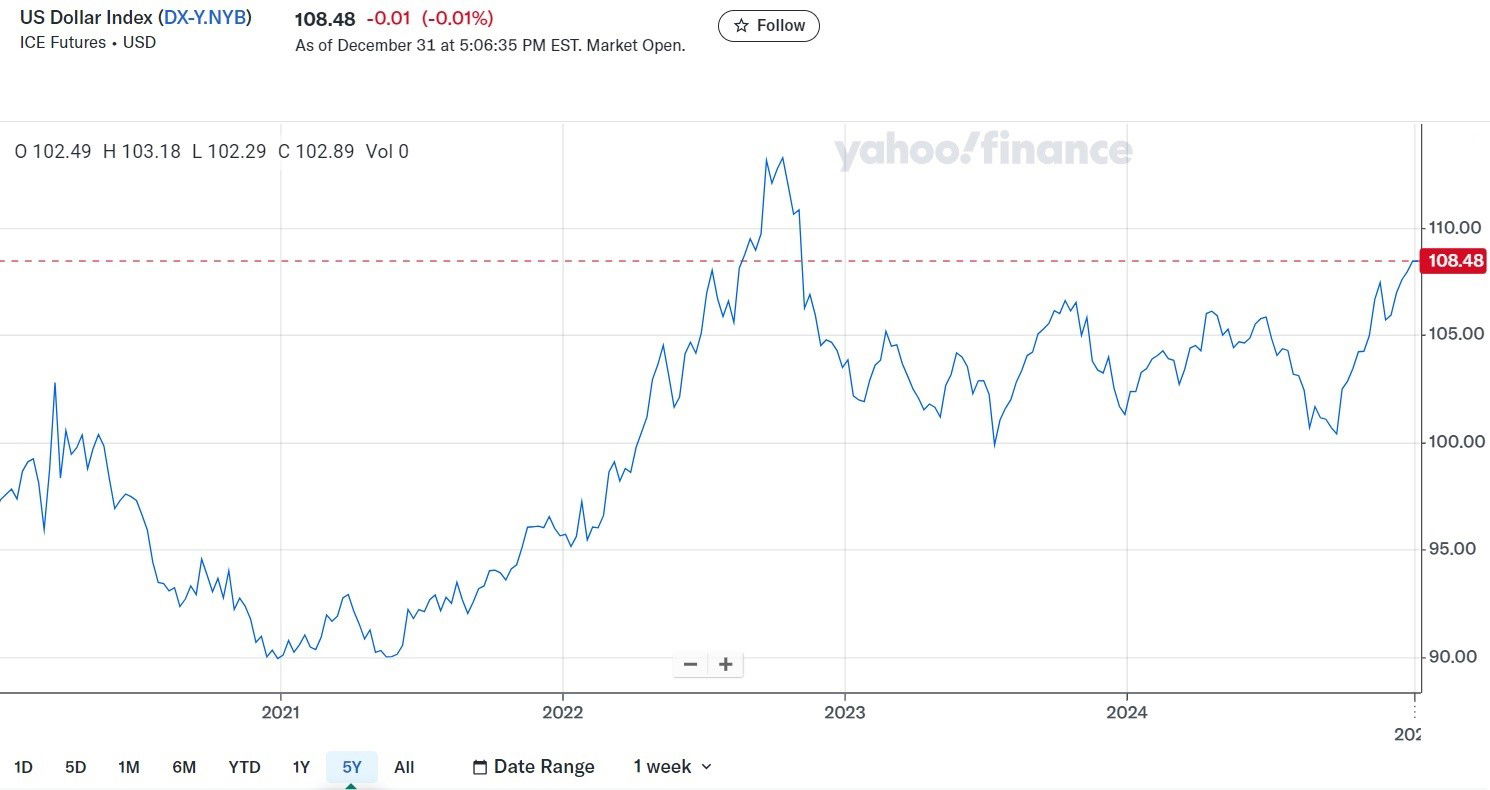

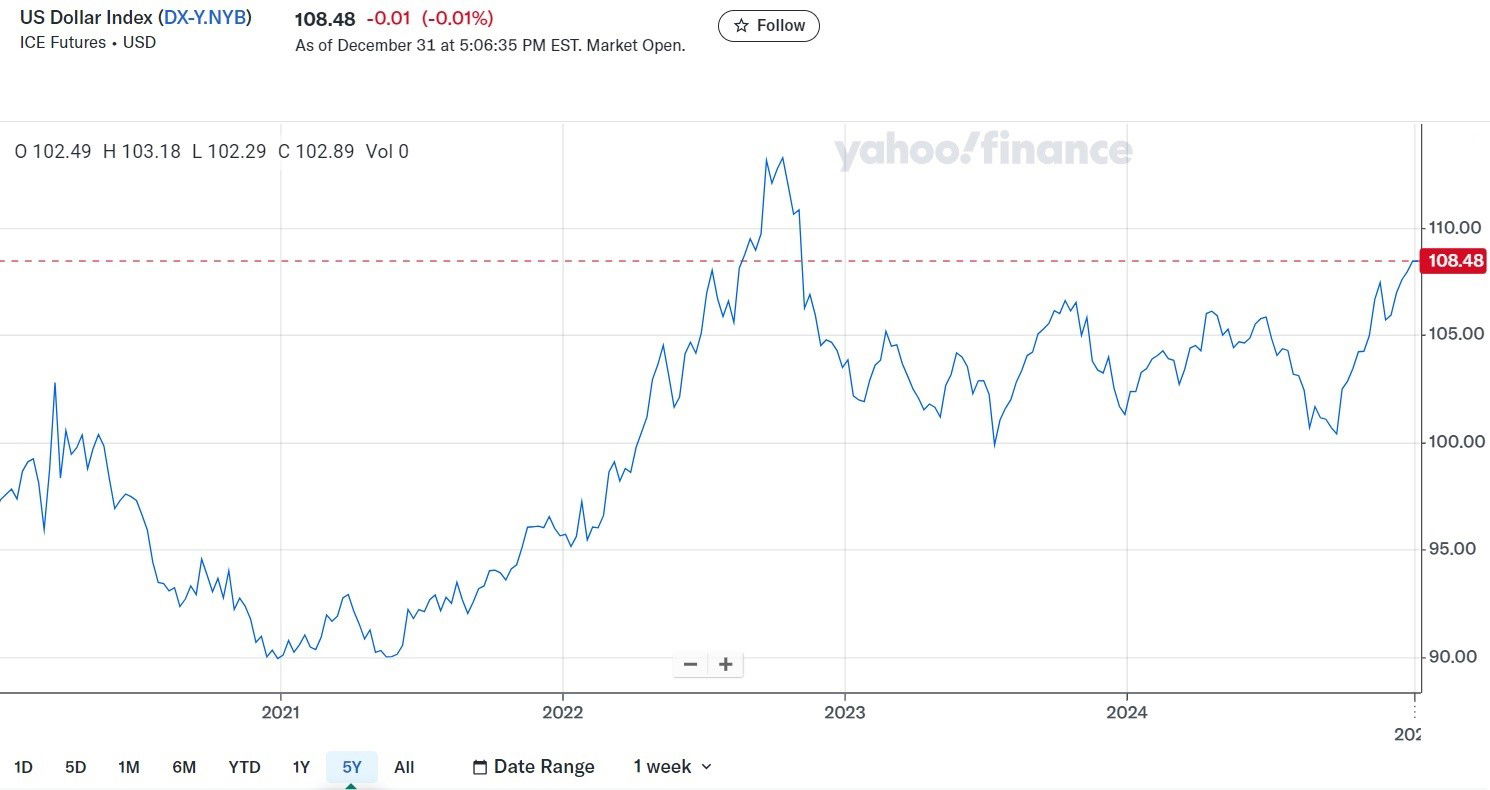

This chart shows the US Dollar Index rising to around 108.5 points, its highest level since November 2022. (In other words, this is the strongest its been in more than three years.)

In case you’re curious, this index tracks how the US dollar is performing against a basket of major currencies (including the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc).

See more : Dow, Nasdaq, S&P 500 rise as Wall Street eyes a new year comeback

You may have noticed the USD rising sharply from September last year, if you look closely at the chart.

Around that time, betting odds were in favour of Donald Trump winning the US Presidential election (and he won by an bigger margin than expected).

Trump has promised to cut corporate tax, impose tariffs on goods imported from other nations (i.e. a trade war), loosen financial regulation, and clamp down on illegal immigration.

All up, Trump’s policies are likely to lift inflation (or prevent it from falling quickly), according to forecasts from well-regarded economists worldwide. It would also likely lead to the US government’s massive debt surging even higher.

Indeed, when the Fed held its mid-December policy meeting (and slashed interest rates again), the US central bank flagged there would be fewer rate cuts than it previously anticipated — because it expected inflation to be higher in 2025.

So that added further fuel to the US Dollar’s ascent!

How an investor sell-off is playing out in Victoria

A property investor sell-off is speeding up in Victoria, with the state’s rental stock falling at an increasingly rapid pace.

The number of active rental bonds (a proxy for the number of rental properties in a market) fell from 677,492 in September 2023 to 652,766 in 2024 — suggesting the state lost 24,726 rentals in the space of a year.

That equated to a 3.6 per cent fall in total Victorian rentals.

The pace of the sell-off also appeared to be increasing, with total rental bonds falling 4,315 in the three months to March 2024, by 7,820 in the three months to June, and 9,498 in the three months to September.

More in this story.

How the US greenback is impacting the AUD

You may be wondering: why the Australian dollar is so weak (and you’re getting a terrible exchange rate overseas).

The short answer is that the world’s most important currency (the US greenback) has been incredibly strong lately!

This chart shows the US Dollar Index rising to about 108.5 points, its highest level since November 2022.

ASX opens slightly higher on first day of trade for 2025

The benchmark index is currently up 0.1%.

We’ll bring you more soon.

How the Chinese currency is impacting the AUD

This from David Taylor’s piece yesterday:

“The problem with the Australian dollar appears to be that there was a real wobble in the Chinese currency into New Year’s Eve,” InTouch Capital Markets senior FX analyst Sean Callow said.

“Particularly the version of the Chinese currency traded outside mainland China.

“It fell sharply and broke a key level and that seems to have spilled over to [weakness in] the Aussie dollar.

“The Yuan is really finishing the year on a very weak note under a lot of pressure.”

Aussie dollar hits almost 5-year low against USD

Just minutes ago the AUD briefly touched 61.85 US cents and is now at 61.88 US cents.

The last time it was this low was on 7 April 2020 when it also hit 61.85 US cents.

That was during the early days of the pandemic, when global markets were in panic mode.

You can read more about the dollar’s woes in this piece by ABC’s David Taylor.

Why Australia’s property market is now losing ground

When Mark and Candace D’Souza put their investment property in Sydney up for sale, they thought they’d get more than $800,000.

“Only one person turned up at the auction, and the property got passed in,” Mark told the ABC.

But they’d just hit a mortgage cliff on the apartment’s repayments, and their investment wasn’t stacking up.

“We finally were able to sell at $790,000 and settled in early December.”

This story highlights why, after years of staggering gains, property prices are now dropping nationally.

You can listen to Mark and Candace’s story here.

Aussie dollar slips to a new two-year low

Good morning Emilia we need to have a conversation about the fall of the Australian Dollar David Taylor did a report on this yesterday and needs to be expanded on Cheers and HNY

– David-W

Thanks for the query, David.

See more : My Top 10 Stock Market Predictions for 2025

We just got this note from Capital:

The AUD/USD has slipped below 62 cents and to a new two-year low, with Chinese President Xi’s New Years address pointed to as the latest catalyst for a weaker Aussie Dollar.

The AUD/USD remains primarily a proxy for China’s economic malaise and the absence of sufficient policy support to jump start economic activity. A firmer US Dollar also remains a significant part of the equation due to the US economy’s world beating performance and the expected impact of Trump tax cuts and tariffs on growth, inflation and monetary policy.

The top 5 stocks on the All Ords in 2024

This reporting from Reuters:

Here are the five best-performing ASX All Ordinaries shares in terms of capital growth for 2024.

1 . Mesoblast Ltd (ASX: MSB)

ASX All Ordinaries biotech share Mesoblast shot the lights out in 2024, rising a staggering 900% to close at $3.10 apiece on December 31.

Mesoblast is a clinical-stage biotech that develops allogeneic cellular medicines for complex diseases.

2. Zip Co Ltd (ASX: ZIP)

Zip was easily one of the greatest comeback stories of the year in 2024. The ASX All Ordinaries financial share soared 352.5% higher to close at $2.96 on Tuesday.

The buy now, pay later company has inspired new confidence among investors after abandoning plans for global expansion to instead focus on profitability.

3. Appen Ltd (ASX: APX)

ASX All Ords tech share Appen ripped 319.1% higher in 2024 to close at $2.64 on Tuesday.

Appen is benefitting from the rising artificial intelligence (AI) investment megatrend.

4. IperionX Ltd (ASX: IPX)

This ASX All Ordinaries materials share soared 295.68% to finish the year at $5.50 per share.

IperionX’s mission is to be a leading developer of sustainable critical mineral and material supply chains in the US to help facilitate the transition to a circular, low-carbon global economy.

5. Nuix Limited (ASX: NXL)

The Nuix share price rocketed 232.63% higher in 2024 to close at $6.32 per share on December 31.

Nuix provides specialised software for analysing large data sets.

Blackwattle Investment Partners rates Nuix shares “the best exposure to the AI thematic on the ASX”.

How the ASX 200 compared to the All Ords in 2024

The All Ords rose by 7.55% in 2024 with a total gross return, including dividends, of 11.44%.

This was a slight outperformance of the overall benchmark index ASX 200, which also registered 7.49% gains in the whole year and the same total gross return.

What will happen to house prices in 2025?

CoreLogic’s data shows Australia’s property market went backwards at a national level in December, recording the first decline in almost two years with a dip of 0.1%.

Separate data from REA Group also shows this decline happens, with its data showing an even bigger dip in December of 0.17%.

“The report found that national home prices were down by 0.17% in December yet remained 4.73% higher year-on-year, as all capital cities except Perth and Hobart recorded a decline,” REA Group’s data noted.

So what will happen to property prices in 2025?

“It really does set the scene for a soft start to 2025,” CoreLogic’s chief economist Tim Lawless said.

“The broad theme of the housing market is values are slowing down.”

You can watch more about property prices in this special edition of ABC’s The Business which delves into the market.

Loading…

Australia’s property market records first drop in almost two years

Australia’s housing market is in a downturn for the first time in almost two years after the average national price of a property sold dipped slightly in December.

The data from CoreLogic shows the median value of property sold in the last month of 2024 was just shy of $815,000 after a price drop of 0.1 per cent.

Yet there’s a lot of divergence between cities and regions. You can read all of the data in this article.

Do you have a story about real estate agents that have sold or rented your property? Or are you a first home buyer that can’t get into the market?

You can confidentially email me on [email protected]

ASX set to open lower on first day of trade in 2025

Good morning!

The Australian share market is set to open lower this morning, after Wall Street did the same. Yet numbers show the US markets made massive gains in 2024, with the S&P 500 rising almost 25% in a year.

We’ll be here with you all day on this first day back for markets in the new year. Any stocks or issues you’d like investigated today? Email me on [email protected]

Source link https://www.abc.net.au/news/2025-01-02/asx-markets-business-live-news-january-2-2025/104778480

Source: https://incomestatements.info

Category: News