See more : St.Cousair Co., Ltd. (2937.T) Income Statement Analysis – Financial Results

Complete financial analysis of L&F Acquisition Corp. (LNFA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of L&F Acquisition Corp., a leading company in the Shell Companies industry within the Financial Services sector.

- RESGEN LIMITED (RESGEN.BO) Income Statement Analysis – Financial Results

- Royal Bank of Canada (RY-PT) Income Statement Analysis – Financial Results

- ironSource Ltd. (IS) Income Statement Analysis – Financial Results

- Videocon Industries Limited (VIDEOIND.NS) Income Statement Analysis – Financial Results

- PT Duta Pertiwi Nusantara Tbk (DPNS.JK) Income Statement Analysis – Financial Results

L&F Acquisition Corp. (LNFA)

About L&F Acquisition Corp.

L&F Acquisition Corp. does not have significant operations. It intends to effect a merger, share exchange, asset acquisition, share purchase, reorganization, or similar business combination with one or more businesses in the governance, risk, and compliance and legal technology and software sectors. L&F Acquisition Corp. was incorporated in 2020 and is based in Chicago, Illinois.

| Metric | 2021 | 2020 |

|---|---|---|

| Revenue | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 |

| Gross Profit | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 |

| General & Administrative | 3.85M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 |

| SG&A | 3.85M | 0.00 |

| Other Expenses | 0.00 | -162.16K |

| Operating Expenses | 3.85M | -162.16K |

| Cost & Expenses | 3.85M | -162.16K |

| Interest Income | 20.50K | 0.00 |

| Interest Expense | 20.50K | 0.00 |

| Depreciation & Amortization | 9.47M | 206.30K |

| EBITDA | 5.62M | -162.16K |

| EBITDA Ratio | 0.00% | 0.00% |

| Operating Income | -3.85M | -162.16K |

| Operating Income Ratio | 0.00% | 0.00% |

| Total Other Income/Expenses | 9.45M | 0.00 |

| Income Before Tax | 5.60M | -162.16K |

| Income Before Tax Ratio | 0.00% | 0.00% |

| Income Tax Expense | -9.47M | 0.00 |

| Net Income | 15.06M | -162.16K |

| Net Income Ratio | 0.00% | 0.00% |

| EPS | 0.70 | -0.01 |

| EPS Diluted | 0.70 | -0.01 |

| Weighted Avg Shares Out | 21.56M | 21.56M |

| Weighted Avg Shares Out (Dil) | 21.56M | 21.56M |

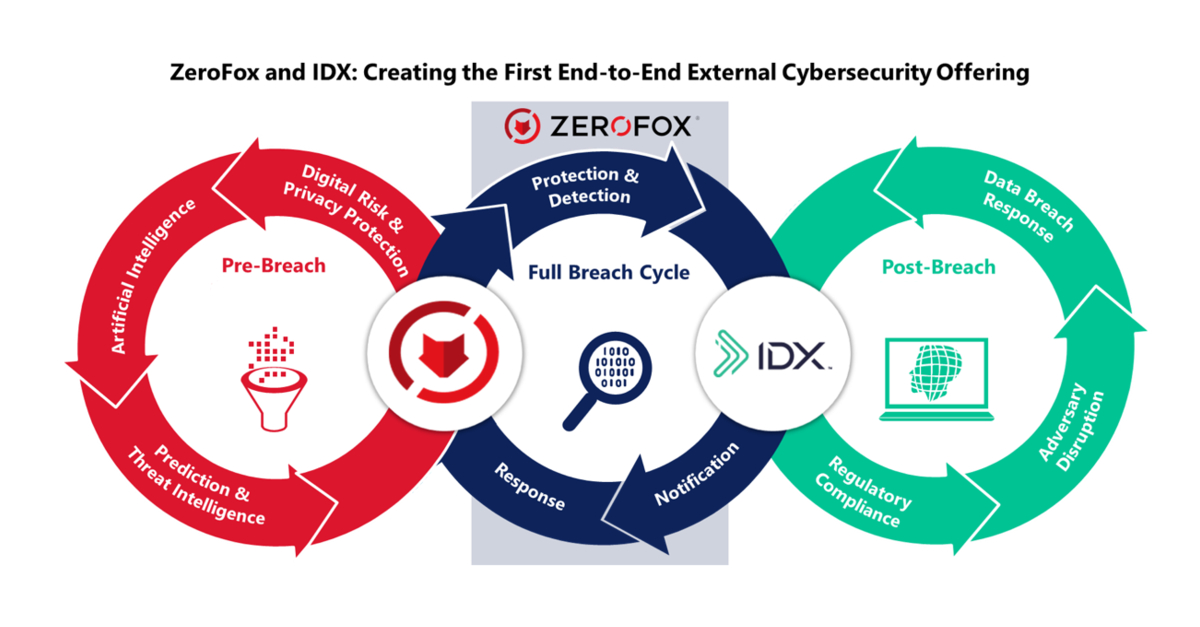

L&F Acquisition Corp. and ZeroFox, Inc. Announce Effectiveness of Registration Statement and August 2, 2022 Extraordinary General Meeting to Approve Business Combination

L&F Acquisition Corp. Transfers Listing to NYSE American LLC

ZeroFox, Leading External Cybersecurity SaaS Provider, Announces Plan to Acquire IDX and Become Publicly Traded Company via Merger with L&F Acquisition Corp.

L&F Acquisition Corp. Announces the Separate Trading of its Class A Ordinary Shares and Warrants Commencing January 7, 2021

L&F Acquisition Corp. Announces Pricing of $150 Million Initial Public Offering

Source: https://incomestatements.info

Category: Stock Reports