Complete financial analysis of Lowe’s Companies, Inc. (LOW) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lowe’s Companies, Inc., a leading company in the Home Improvement industry within the Consumer Cyclical sector.

- PT Mega Perintis Tbk (ZONE.JK) Income Statement Analysis – Financial Results

- Procter & Gamble Hygiene and Health Care Limited (PGHH.NS) Income Statement Analysis – Financial Results

- Infinity Pharmaceuticals, Inc. (INFI) Income Statement Analysis – Financial Results

- Aston Minerals Limited (ASO.AX) Income Statement Analysis – Financial Results

- Prismo Metals Inc. (PMOMF) Income Statement Analysis – Financial Results

Lowe's Companies, Inc. (LOW)

About Lowe's Companies, Inc.

Lowe's Companies, Inc., together with its subsidiaries, operates as a home improvement retailer in the United States and internationally. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, decor, lighting, and electrical. It also offers installation services through independent contractors in various product categories; extended protection plans; and in-warranty and out-of-warranty repair services. The company sells its national brand-name merchandise and private brand products to homeowners, renters, and professional customers. As of January 28, 2022, it operated 1,971 home improvement and hardware stores. The company also sells its products through websites comprising Lowes.com and Lowesforpros.com; and through mobile applications. Lowe's Companies, Inc. was founded in 1921 and is based in Mooresville, North Carolina.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 86.38B | 97.06B | 96.25B | 89.60B | 72.15B | 71.31B | 68.62B | 65.02B | 59.07B | 56.22B | 53.42B | 50.52B | 50.21B | 48.82B | 47.22B | 48.23B | 48.28B | 46.93B | 43.24B | 36.46B | 30.84B | 26.49B | 22.11B | 18.78B | 15.91B | 12.24B | 10.14B | 8.60B | 7.08B | 6.11B | 4.54B | 3.85B | 3.06B | 2.83B | 2.65B | 2.52B | 2.44B | 2.28B | 2.07B |

| Cost of Revenue | 57.53B | 64.80B | 64.19B | 60.03B | 49.21B | 48.40B | 45.21B | 42.55B | 38.50B | 36.67B | 34.94B | 33.19B | 32.86B | 31.66B | 30.76B | 31.73B | 31.56B | 30.73B | 28.44B | 24.17B | 21.23B | 18.47B | 15.74B | 13.49B | 11.52B | 8.95B | 7.45B | 6.37B | 5.31B | 4.59B | 3.46B | 2.95B | 2.32B | 2.13B | 2.00B | 1.92B | 1.86B | 1.72B | 1.56B |

| Gross Profit | 28.84B | 32.26B | 32.06B | 29.57B | 22.94B | 22.91B | 23.41B | 22.46B | 20.57B | 19.56B | 18.48B | 17.33B | 17.35B | 17.15B | 16.46B | 16.50B | 16.73B | 16.20B | 14.80B | 12.30B | 9.61B | 8.03B | 6.37B | 5.29B | 4.38B | 3.30B | 2.69B | 2.23B | 1.77B | 1.52B | 1.08B | 900.60M | 735.20M | 702.70M | 646.30M | 600.50M | 584.00M | 559.10M | 512.20M |

| Gross Profit Ratio | 33.39% | 33.23% | 33.30% | 33.01% | 31.80% | 32.12% | 34.11% | 34.55% | 34.82% | 34.79% | 34.59% | 34.30% | 34.56% | 35.14% | 34.86% | 34.21% | 34.64% | 34.52% | 34.23% | 33.73% | 31.15% | 30.30% | 28.80% | 28.18% | 27.54% | 26.91% | 26.54% | 25.88% | 24.97% | 24.80% | 23.83% | 23.41% | 24.06% | 24.80% | 24.38% | 23.86% | 23.91% | 24.48% | 24.71% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 14.74B | 19.46B | 17.42B | 17.73B | 14.50B | 16.29B | 14.44B | 14.38B | 14.11B | 13.25B | 12.05B | 12.17B | 12.21B | 11.94B | 11.62B | 11.18B | 10.66B | 9.88B | 9.16B | 7.69B | 5.67B | 0.00 | 4.05B | 3.48B | 2.87B | 2.19B | 1.82B | 1.45B | 1.18B | 1.01B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 831.00M | 869.00M | 877.00M | 798.00M | 871.00M | 1.13B | 932.00M | 754.00M | 10.00M | 28.00M | 811.00M | 77.00M | 388.00M | 71.00M | 114.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 225.00K | -115.00K | -124.00K | -200.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 15.57B | 20.33B | 18.30B | 18.53B | 15.37B | 17.41B | 15.38B | 15.13B | 14.12B | 13.28B | 12.87B | 12.24B | 12.59B | 12.01B | 11.74B | 11.18B | 10.66B | 9.88B | 9.16B | 7.69B | 5.67B | 4.86B | 4.05B | 3.48B | 2.87B | 2.19B | 1.82B | 1.45B | 1.18B | 1.01B | 746.30M | 653.80M | 583.80M | 505.90M | 472.20M | 432.70M | 435.10M | 406.80M | 366.10M |

| Other Expenses | 1.72B | 1.77B | 1.66B | 1.40B | 1.26B | 1.48B | 1.45B | 1.49B | 1.48B | 1.49B | 1.46B | 1.52B | 1.48B | 1.59B | 1.61B | 1.54B | 1.37B | 1.16B | 980.00M | 902.00M | 758.00M | 626.00M | 534.99M | 409.51M | 337.82M | 272.20M | 241.10M | 199.80M | 153.60M | 112.90M | 80.50M | 69.80M | 58.30M | 51.40M | 46.10M | 41.20M | 38.50M | 30.50M | 21.80M |

| Operating Expenses | 17.29B | 22.10B | 19.96B | 19.93B | 16.63B | 18.89B | 16.82B | 16.62B | 15.60B | 14.77B | 14.33B | 13.77B | 14.07B | 13.59B | 13.30B | 12.72B | 12.02B | 11.05B | 10.14B | 8.59B | 6.43B | 5.49B | 4.59B | 3.89B | 3.21B | 2.46B | 2.07B | 1.65B | 1.33B | 1.13B | 826.80M | 723.60M | 642.10M | 557.30M | 518.30M | 473.90M | 473.60M | 437.30M | 387.90M |

| Cost & Expenses | 74.82B | 86.90B | 84.16B | 79.95B | 65.83B | 67.29B | 62.03B | 59.17B | 54.10B | 51.43B | 49.27B | 46.96B | 46.93B | 45.26B | 44.06B | 44.44B | 43.58B | 41.78B | 38.58B | 32.75B | 27.66B | 23.95B | 20.33B | 17.38B | 14.73B | 11.41B | 9.51B | 8.03B | 6.64B | 5.72B | 4.28B | 3.67B | 2.96B | 2.69B | 2.52B | 2.39B | 2.33B | 2.16B | 1.95B |

| Interest Income | 101.00M | 37.00M | 12.00M | 24.00M | 27.00M | 28.00M | 19.00M | 12.00M | 5.00M | 7.00M | 4.00M | 9.00M | 12.00M | 12.00M | 17.00M | 40.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.48B | 1.16B | 897.00M | 848.00M | 691.00M | 624.00M | 633.00M | 645.00M | 552.00M | 516.00M | 476.00M | 423.00M | 377.00M | 332.00M | 287.00M | 320.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.92B | 2.51B | 2.40B | 2.07B | 1.88B | 1.61B | 1.54B | 1.59B | 1.59B | 1.59B | 1.56B | 1.62B | 1.58B | 1.68B | 1.73B | 1.67B | 1.46B | 1.24B | 1.05B | 920.00M | 781.00M | 645.00M | 534.10M | 409.51M | 337.82M | 272.20M | 241.10M | 199.80M | 153.60M | 112.90M | 80.50M | 69.80M | 58.30M | 51.40M | 46.10M | 41.20M | 38.50M | 30.50M | 21.80M |

| EBITDA | 13.57B | 12.69B | 14.47B | 11.24B | 8.22B | 6.58B | 8.13B | 7.48B | 7.12B | 6.42B | 5.71B | 5.22B | 4.87B | 5.25B | 4.87B | 5.49B | 6.17B | 6.39B | 5.72B | 4.63B | 3.96B | 3.19B | 2.31B | 1.81B | 1.51B | 1.11B | 865.20M | 770.70M | 589.90M | 501.10M | 335.00M | 246.80M | 151.40M | 196.80M | 174.10M | 167.80M | 148.90M | 152.30M | 146.10M |

| EBITDA Ratio | 15.71% | 12.51% | 14.52% | 13.73% | 10.71% | 7.89% | 12.52% | 11.44% | 11.10% | 11.34% | 10.69% | 10.26% | 9.67% | 10.74% | 10.36% | 11.31% | 12.78% | 13.61% | 13.22% | 12.70% | 12.84% | 12.03% | 10.47% | 9.65% | 9.65% | 9.03% | 8.54% | 9.76% | 8.99% | 8.20% | 8.22% | 7.34% | 7.29% | 7.92% | 6.50% | 6.60% | 6.10% | 6.67% | 7.05% |

| Operating Income | 11.56B | 10.16B | 12.09B | 9.65B | 6.31B | 4.02B | 6.59B | 5.85B | 4.97B | 4.79B | 4.15B | 3.56B | 3.28B | 3.56B | 3.11B | 3.79B | 4.71B | 5.15B | 4.66B | 3.71B | 3.18B | 2.54B | 1.78B | 1.40B | 1.17B | 833.10M | 624.10M | 570.90M | 436.30M | 388.20M | 254.50M | 177.00M | 93.10M | 145.40M | 128.00M | 126.60M | 110.40M | 121.80M | 124.30M |

| Operating Income Ratio | 13.38% | 10.47% | 12.56% | 10.77% | 8.75% | 5.63% | 9.60% | 8.99% | 8.41% | 8.52% | 7.77% | 7.05% | 6.53% | 7.29% | 6.59% | 7.85% | 9.74% | 10.98% | 10.79% | 10.18% | 10.31% | 9.59% | 8.05% | 7.47% | 7.37% | 6.80% | 6.16% | 6.64% | 6.17% | 6.35% | 5.61% | 4.60% | 3.05% | 5.13% | 4.83% | 5.03% | 4.52% | 5.33% | 6.00% |

| Total Other Income/Expenses | -1.38B | -1.12B | -885.00M | -1.91B | -691.00M | -624.00M | -1.10B | -645.00M | -552.00M | -516.00M | -476.00M | -423.00M | -371.00M | -332.00M | -287.00M | -280.00M | -194.00M | -154.00M | -148.00M | -176.00M | -180.00M | -182.00M | -174.00M | -120.83M | -109.23M | -80.94M | -71.62M | -117.20M | -84.20M | -44.60M | -56.20M | -51.10M | -88.10M | -45.10M | -19.20M | -21.00M | -19.60M | -13.70M | -11.40M |

| Income Before Tax | 10.18B | 9.04B | 11.21B | 7.74B | 5.62B | 3.39B | 5.49B | 5.20B | 4.42B | 4.28B | 3.67B | 3.14B | 2.91B | 3.23B | 2.83B | 3.51B | 4.51B | 5.00B | 4.51B | 3.54B | 3.00B | 2.36B | 1.62B | 1.28B | 1.06B | 758.40M | 558.60M | 453.70M | 352.10M | 343.60M | 198.30M | 125.90M | 5.00M | 100.30M | 108.80M | 105.60M | 90.80M | 108.10M | 112.90M |

| Income Before Tax Ratio | 11.78% | 9.31% | 11.64% | 8.64% | 7.79% | 4.76% | 8.00% | 8.00% | 7.48% | 7.61% | 6.88% | 6.21% | 5.79% | 6.61% | 5.98% | 7.27% | 9.34% | 10.65% | 10.42% | 9.70% | 9.72% | 8.90% | 7.35% | 6.82% | 6.68% | 6.19% | 5.51% | 5.28% | 4.98% | 5.62% | 4.37% | 3.27% | 0.16% | 3.54% | 4.10% | 4.20% | 3.72% | 4.73% | 5.45% |

| Income Tax Expense | 2.45B | 2.60B | 2.77B | 1.90B | 1.34B | 1.08B | 2.04B | 2.11B | 1.87B | 1.58B | 1.39B | 1.18B | 1.07B | 1.22B | 1.04B | 1.31B | 1.70B | 1.89B | 1.74B | 1.36B | 1.14B | 888.00M | 600.99M | 471.57M | 390.32M | 276.00M | 201.10M | 161.50M | 126.10M | 120.00M | 66.50M | 41.20M | -1.50M | 29.20M | 33.90M | 36.40M | 34.80M | 53.00M | 53.20M |

| Net Income | 7.73B | 6.44B | 8.44B | 5.84B | 4.28B | 2.31B | 3.45B | 3.09B | 2.55B | 2.70B | 2.29B | 1.96B | 1.84B | 2.01B | 1.78B | 2.20B | 2.81B | 3.11B | 2.77B | 2.18B | 1.88B | 1.47B | 1.02B | 809.87M | 672.80M | 482.40M | 357.50M | 292.20M | 226.00M | 223.60M | 131.80M | 84.70M | 6.50M | 71.10M | 74.90M | 69.20M | 56.00M | 55.10M | 59.70M |

| Net Income Ratio | 8.94% | 6.63% | 8.77% | 6.51% | 5.93% | 3.25% | 5.02% | 4.75% | 4.31% | 4.80% | 4.28% | 3.88% | 3.66% | 4.12% | 3.78% | 4.55% | 5.82% | 6.62% | 6.41% | 5.97% | 6.09% | 5.55% | 4.63% | 4.31% | 4.23% | 3.94% | 3.53% | 3.40% | 3.19% | 3.66% | 2.90% | 2.20% | 0.21% | 2.51% | 2.83% | 2.75% | 2.29% | 2.41% | 2.88% |

| EPS | 13.24 | 10.20 | 12.08 | 7.77 | 5.49 | 2.85 | 4.09 | 3.48 | 2.73 | 2.71 | 2.14 | 1.69 | 1.43 | 1.43 | 1.21 | 1.50 | 1.90 | 2.02 | 1.78 | 1.39 | 1.16 | 0.95 | 0.67 | 0.53 | 0.44 | 0.34 | 0.26 | 0.22 | 0.18 | 0.18 | 0.11 | 0.07 | 0.01 | 0.06 | 0.07 | 0.06 | 0.05 | 0.05 | 0.05 |

| EPS Diluted | 13.20 | 10.17 | 12.03 | 7.75 | 5.49 | 2.85 | 4.09 | 3.47 | 2.73 | 2.71 | 2.14 | 1.69 | 1.43 | 1.42 | 1.21 | 1.49 | 1.86 | 1.99 | 1.73 | 1.35 | 1.13 | 0.93 | 0.65 | 0.52 | 0.44 | 0.34 | 0.26 | 0.21 | 0.17 | 0.17 | 0.11 | 0.07 | 0.01 | 0.06 | 0.07 | 0.06 | 0.05 | 0.05 | 0.05 |

| Weighted Avg Shares Out | 582.00M | 629.00M | 696.00M | 748.00M | 777.00M | 811.00M | 839.00M | 880.00M | 927.00M | 988.00M | 1.06B | 1.15B | 1.27B | 1.40B | 1.46B | 1.46B | 1.48B | 1.54B | 1.56B | 1.56B | 1.59B | 1.57B | 1.54B | 1.54B | 1.52B | 1.48B | 1.47B | 1.34B | 1.28B | 1.24B | 1.17B | 1.17B | 866.67M | 1.19B | 1.15B | 1.20B | 1.12B | 1.22B | 1.14B |

| Weighted Avg Shares Out (Dil) | 584.00M | 631.00M | 699.00M | 750.00M | 778.00M | 812.00M | 840.00M | 881.00M | 929.00M | 990.00M | 1.06B | 1.15B | 1.27B | 1.40B | 1.46B | 1.47B | 1.51B | 1.57B | 1.61B | 1.61B | 1.63B | 1.60B | 1.59B | 1.56B | 1.54B | 1.50B | 1.47B | 1.37B | 1.33B | 1.29B | 1.17B | 1.17B | 866.67M | 1.19B | 1.15B | 1.20B | 1.12B | 1.22B | 1.14B |

Lowe's Stock Breaks 52-Week Record: Buy, Hold or Take Profits?

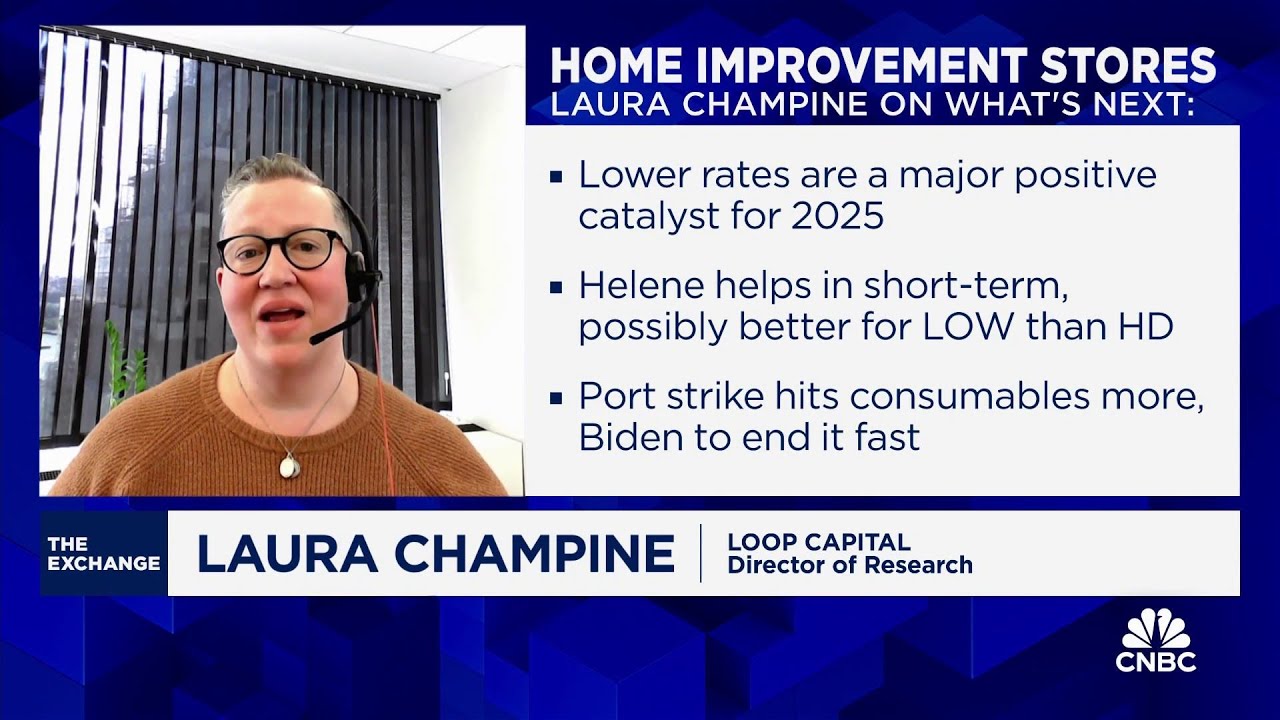

Home improvement stores to continue 'bounce' in the upcoming year, says Loop Capital's Champine

Lowe's Pledges $2 Million to Support Hurricane Helene Relief Efforts

15 Best Dividend Stocks for Lifelong Passive Income

LOWE'S LAUNCHES FIRST-EVER MYLOWE'S REWARDS WEEK WITH UP TO 40% OFF: THE BIGGEST MEMBER DEALS OF THE YEAR

Lowe's (LOW) Declines More Than Market: Some Information for Investors

Lowe's Companies, Inc. (LOW) Is a Trending Stock: Facts to Know Before Betting on It

Lowe's Stock Scores an Upgrade. Home Improvement Demand Will Rebound—Eventually.

Calls of the Day: Starbucks, Uber, Lowe's, Walmart, Casey's General Store, AT&T and Charles Schwab

Lowe's Set For 'Delayed Benefits' From Macro Demand Improvements, Says Optimistic Analyst

Source: https://incomestatements.info

Category: Stock Reports