See more : Verso Corporation (VRS) Income Statement Analysis – Financial Results

Complete financial analysis of Latch, Inc. (LTCH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Latch, Inc., a leading company in the Software – Application industry within the Technology sector.

- Cobalt Blue Holdings Limited (COB.AX) Income Statement Analysis – Financial Results

- Südzucker AG (SUEZY) Income Statement Analysis – Financial Results

- China Railway Hi-tech Industry Corporation Limited (600528.SS) Income Statement Analysis – Financial Results

- Bolloré SE (BOL.PA) Income Statement Analysis – Financial Results

- YOOZOO Interactive Co., Ltd. (002174.SZ) Income Statement Analysis – Financial Results

Latch, Inc. (LTCH)

About Latch, Inc.

Latch, Inc. operates as an enterprise technology company in the United States and Canada. The company offers LatchOS, an operating system that extends smart access, delivery and guest management, smart home and sensors, connectivity, and personalization and services. Its software products include Latch Resident Mobile Applications, Latch Manager Web, and the Latch Manager Mobile Applications. The company also offers hardware devices that include M, C, and R series door-mounted access control products; Latch Intercom, which integrates into the Latch core access systems and allows audio and video calls for remote unlocking; Latch Camera, a dome camera; Latch Hub, a connectivity solution that enables smart access, smart home, and sensor devices at various buildings; and Latch Leak Detector, a solution to enable leak prevention, detection, and resolution for building owners and residents. In addition, it provides NFC unlock on Android that allows the user to unlock their door without even opening their phone; Latch Visitor Express, a contactless visitor entry system; and LatchID, an identification system. The company is headquartered in New York, New York.

| Metric | 2021 | 2020 | 2019 |

|---|---|---|---|

| Revenue | 41.36M | 18.06M | 14.89M |

| Cost of Revenue | 44.04M | 20.24M | 17.30M |

| Gross Profit | -2.68M | -2.18M | -2.41M |

| Gross Profit Ratio | -6.47% | -12.06% | -16.19% |

| Research & Development | 45.85M | 25.31M | 18.34M |

| General & Administrative | 61.82M | 19.80M | 15.15M |

| Selling & Marketing | 34.99M | 13.13M | 13.08M |

| SG&A | 96.80M | 32.92M | 28.23M |

| Other Expenses | 3.24M | 1.38M | 723.00K |

| Operating Expenses | 145.89M | 59.62M | 47.29M |

| Cost & Expenses | 189.93M | 79.86M | 64.59M |

| Interest Income | 0.00 | 2.26K | 443.00 |

| Interest Expense | 7.78M | 0.00 | 0.00 |

| Depreciation & Amortization | 3.24M | 1.38M | 723.00K |

| EBITDA | -145.33M | -60.17M | -48.98M |

| EBITDA Ratio | -351.38% | -328.63% | -322.86% |

| Operating Income | -141.64M | -61.80M | -49.70M |

| Operating Income Ratio | -342.46% | -342.16% | -333.87% |

| Total Other Income/Expenses | -24.63M | -5.24M | -473.00K |

| Income Before Tax | -166.27M | -65.99M | -50.18M |

| Income Before Tax Ratio | -402.00% | -365.35% | -337.05% |

| Income Tax Expense | 53.00K | 8.00K | 50.00K |

| Net Income | -166.32M | -65.99M | -50.23M |

| Net Income Ratio | -402.13% | -365.40% | -337.38% |

| EPS | -1.92 | -0.47 | -0.36 |

| EPS Diluted | -1.92 | -0.47 | -0.36 |

| Weighted Avg Shares Out | 86.47M | 141.26M | 141.26M |

| Weighted Avg Shares Out (Dil) | 86.47M | 141.26M | 141.26M |

Options Bulls Latch Onto Lyft Stock Ahead of Earnings

Latch to Report First Quarter 2022 Financial Results

Why This Is the Next Potential 10x Software Stock

7 Cheap Stocks Under $10 to Buy for April 2022

This Promising Small-Cap Stock Is Suddenly Fighting an Uphill Battle

3 Under-the-Radar Tech Stocks to Buy in 2022

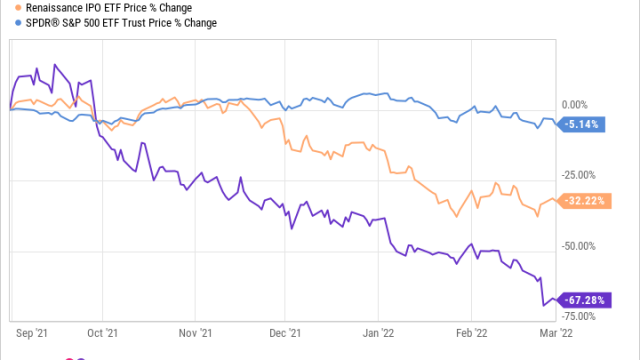

Is This Stock a Buy After Falling 79% From Its All-Time High?

Is Latch the Next Roku?

Latch Stock Is Down 60%: Time to Buy the Dip?

Latch, Inc. (LTCH) CEO Luke Schoenfelder on Q4 2021 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports