See more : AP Acquisition Corp. (APCA-WT) Income Statement Analysis – Financial Results

Complete financial analysis of Learning Technologies Group plc (LTTHF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Learning Technologies Group plc, a leading company in the Software – Application industry within the Technology sector.

- Murakami Corporation (7292.T) Income Statement Analysis – Financial Results

- Sunray Engineering Group Limited (8616.HK) Income Statement Analysis – Financial Results

- Arista Power, Inc. (ASPW) Income Statement Analysis – Financial Results

- Capital Industrial Financial Services Group Limited (0730.HK) Income Statement Analysis – Financial Results

- Netcompany Group A/S (NTCYF) Income Statement Analysis – Financial Results

Learning Technologies Group plc (LTTHF)

About Learning Technologies Group plc

Learning Technologies Group plc, together with its subsidiaries, provides a range of talent and learning solutions, content, services, and digital platforms to corporate and government clients. It operates through Software & Platforms Division, Content & Services Division, GP Strategies, and Other segments. The company's software and platforms comprise Gomo, a cloud-based responsive HTML5 e-learning authoring, distribution, and video platform; Rustici Software that allow companies to create, distribute, manage, and play e-learning-compliant content; PeopleFluent, an integrated talent management and learning solution; and Affirmity, which offers analysis, consulting, training, and software to optimize affirmative action and diversity, and inclusion programs. Its software and platforms also include Watershed, a SaaS learning analytics platform; VectorVMS that delivers software and services for businesses to optimize their contingent workforce programmes; Breezy HR, a recruiting platform and applicant tracking system; Instilled, a structured corporate learning experience platform; Open LMS that helps organizations and institutions to deliver learning experiences; and Bridge, a learning and performance platform. In addition, the company engages in the mobile e-learning and e-learning interoperability businesses; operation of employee benefit trust; and provision of video distribution software. The company operates in the United Kingdom, the United States, the Asia Pacific, Mainland Europe, Canada, and internationally. Learning Technologies Group plc was founded in 1986 and is based in London, the United Kingdom.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 562.31M | 596.90M | 258.23M | 132.32M | 130.10M | 93.89M | 52.06M | 28.26M | 19.91M | 14.92M | 7.56M | 6.95M | 19.00K | 0.00 |

| Cost of Revenue | 496.40M | 481.31M | 191.84M | 81.83M | 97.71M | 72.07M | 46.44M | 25.12M | 17.97M | 13.28M | 2.98M | 2.87M | 462.00K | 0.00 |

| Gross Profit | 65.91M | 115.59M | 66.38M | 50.50M | 32.39M | 21.82M | 5.62M | 3.14M | 1.93M | 1.64M | 4.58M | 4.08M | -443.00K | 0.00 |

| Gross Profit Ratio | 11.72% | 19.37% | 25.71% | 38.16% | 24.90% | 23.24% | 10.79% | 11.12% | 9.72% | 11.01% | 60.59% | 58.69% | -2,331.58% | 0.00% |

| Research & Development | 19.48M | 13.18M | 11.63M | 10.15M | 12.24M | 11.70M | 510.00K | 405.00K | 5.00K | 139.00K | 75.00K | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.42M | 3.29M | 1.09M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 0.00 | 0.00 | 3.11M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.42M | 3.29M | 1.09M | 0.00 |

| Other Expenses | -14.14M | -1.05M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -102.00K | 0.00 |

| Operating Expenses | 5.35M | 547.78M | 246.69M | 117.47M | 109.95M | 86.17M | 47.61M | 25.19M | 18.08M | 14.43M | 3.42M | 3.29M | 1.18M | 472.00K |

| Cost & Expenses | 503.60M | 547.78M | 246.69M | 117.47M | 109.95M | 86.17M | 47.61M | 25.19M | 18.08M | 14.43M | 6.40M | 6.16M | 1.64M | 472.00K |

| Interest Income | 1.03M | 429.00K | 253.00K | 140.00K | 111.00K | 10.00K | 7.00K | 1.00K | 12.00K | 4.00K | 7.00K | 10.00K | 51.00K | 1.00K |

| Interest Expense | 14.13M | 10.48M | 2.58M | 1.39M | 1.96M | 1.51M | 605.00K | 358.00K | 195.00K | 162.00K | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 46.78M | 49.67M | 35.40M | 28.88M | 26.98M | 17.30M | 8.83M | 3.93M | 1.63M | 830.00K | 154.00K | 103.00K | 95.00K | 94.00K |

| EBITDA | 106.52M | 99.84M | 47.23M | 43.68M | 43.23M | 22.25M | 12.88M | 3.09M | 3.56M | 1.16M | -772.00K | 892.00K | -1.53M | -378.00K |

| EBITDA Ratio | 18.94% | 16.65% | 18.32% | 33.05% | 36.12% | 30.30% | 24.74% | 22.64% | 17.15% | 7.78% | 44.58% | 12.84% | -7,773.68% | 0.00% |

| Operating Income | 58.71M | 50.52M | 11.66M | 14.85M | 16.64M | 3.96M | 2.60M | -142.00K | 1.77M | 327.00K | 1.13M | 772.00K | -1.62M | -472.00K |

| Operating Income Ratio | 10.44% | 8.46% | 4.52% | 11.23% | 12.79% | 4.22% | 4.99% | -0.50% | 8.88% | 2.19% | 14.89% | 11.12% | -8,542.11% | 0.00% |

| Total Other Income/Expenses | -13.10M | -10.05M | -2.33M | -1.39M | -2.09M | -518.00K | -1.91M | -1.05M | -202.00K | -454.00K | -2.05M | 10.00K | 51.00K | 1.00K |

| Income Before Tax | 45.61M | 40.48M | 9.33M | 13.47M | 14.30M | 3.44M | 692.00K | -1.19M | 1.55M | -127.00K | -926.00K | 782.00K | -1.57M | -471.00K |

| Income Before Tax Ratio | 8.11% | 6.78% | 3.61% | 10.18% | 10.99% | 3.66% | 1.33% | -4.22% | 7.78% | -0.85% | -12.25% | 11.26% | -8,273.68% | 0.00% |

| Income Tax Expense | 13.02M | 10.07M | -5.59M | -3.94M | 3.43M | -730.00K | -1.17M | 133.00K | 120.00K | 35.00K | 182.00K | 250.00K | 51.00K | 0.00 |

| Net Income | 29.45M | 30.41M | 14.92M | 17.40M | 10.87M | 4.17M | 2.01M | -1.33M | 1.43M | -162.00K | -1.11M | 532.00K | -1.57M | -471.00K |

| Net Income Ratio | 5.24% | 5.09% | 5.78% | 13.15% | 8.36% | 4.44% | 3.87% | -4.69% | 7.18% | -1.09% | -14.66% | 7.66% | -8,273.68% | 0.00% |

| EPS | 0.04 | 0.04 | 0.02 | 0.02 | 0.02 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -0.08 | -0.71 |

| EPS Diluted | 0.04 | 0.04 | 0.02 | 0.02 | 0.02 | 0.01 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -0.07 | -0.34 |

| Weighted Avg Shares Out | 739.12M | 788.30M | 761.63M | 710.35M | 668.05M | 637.33M | 530.44M | 418.62M | 373.51M | 332.03M | 258.14M | 255.00M | 18.83M | 665.00K |

| Weighted Avg Shares Out (Dil) | 817.87M | 819.61M | 794.43M | 730.62M | 686.28M | 650.59M | 554.55M | 418.62M | 400.28M | 332.03M | 258.14M | 268.77M | 21.25M | 1.37M |

3 Best Generative AI Stocks to Buy as Deep Learning Accelerates

Online Learning Stock With 164% Growth Audits Buy Zone

Disruptive Tech Will Drive Online Learning Growth and This ETF

New Research Suggests Pandemic Learning Loss Recovery Will Require Largest Number of Tutors in U.S. History

Coldwell Banker Commercial Debuts Innovative Learning Platform To Connect Professionals & Inspire Deals Worldwide

COVID-19 Fears Boosting Remote Learning: 4 Stocks to Watch

How You Should Read Research Papers According To Andrew Ng (Stanford Deep Learning Lectures)

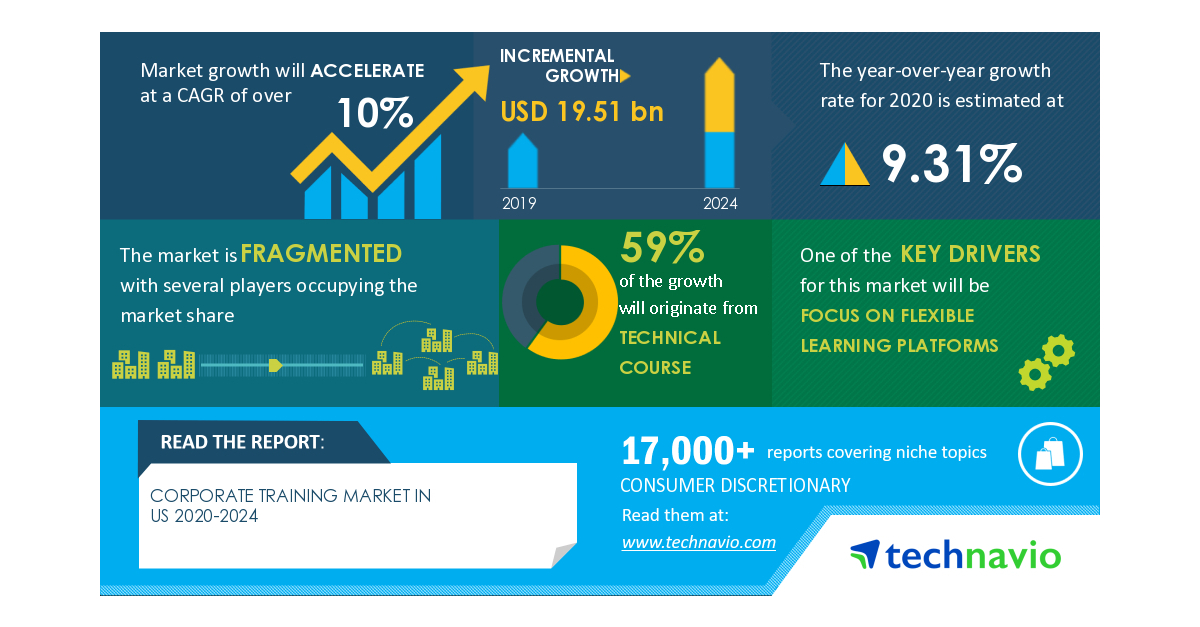

COVID-19 Impact and Recovery Analysis - Corporate Training Market in the US 2020-2024 | Focus on Flexible Learning Platforms to Boost Growth | Technavio

3 Stocks to Gain as Deep Learning Aids in Coronavirus Response

Source: https://incomestatements.info

Category: Stock Reports