See more : ABIONYX Pharma SA (ABNX.PA) Income Statement Analysis – Financial Results

Complete financial analysis of Lotus Ventures Inc. (LTTSF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lotus Ventures Inc., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- Newmont Corporation (NMM.DE) Income Statement Analysis – Financial Results

- Blackhawk Growth Corp. (BLR.CN) Income Statement Analysis – Financial Results

- Masterkool International Public Company Limited (KOOL.BK) Income Statement Analysis – Financial Results

- Bank of America Corporation (BAC.SW) Income Statement Analysis – Financial Results

- Pigeon Corporation (PIGEF) Income Statement Analysis – Financial Results

Lotus Ventures Inc. (LTTSF)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://www.lotuscannabis.ca

About Lotus Ventures Inc.

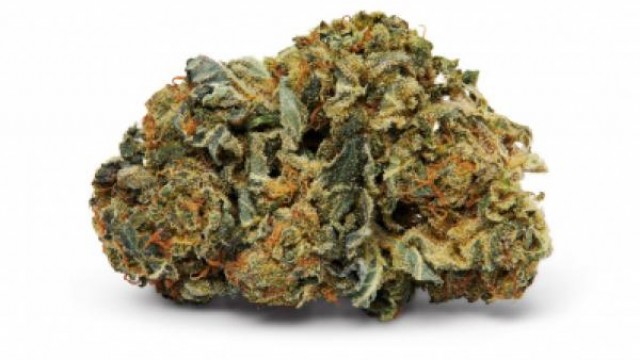

Lotus Ventures Inc. engages in the production, cultivation, and sale of cannabis products for medical purpose in Canada. The company sells its products under the Lotus Cannabis Co. brand name. Lotus Ventures Inc. was incorporated in 2007 and is based in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.00M | 1.69M | 5.48M | 4.63M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 2.14M | 4.93M | 2.71M | 917.87K | 392.71K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -137.15K | -3.24M | 2.77M | 3.71M | -392.71K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | -6.86% | -191.76% | 50.61% | 80.17% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 648.00 | 11.24K | 0.00 | 0.00 | 20.40K | 0.00 |

| General & Administrative | 566.83K | 580.58K | 1.45M | 954.75K | 2.52M | 2.41M | 681.74K | 797.29K | 526.37K | 28.36K | 94.02K | 72.08K | 116.66K |

| Selling & Marketing | 100.19K | 201.82K | 234.09K | 274.36K | 242.97K | 83.16K | 31.75K | 3.57K | 3.45K | 1.19K | 1.76K | 0.00 | 0.00 |

| SG&A | 667.03K | 782.40K | 1.69M | 1.23M | 2.77M | 2.49M | 713.49K | 800.86K | 529.82K | 29.55K | 95.78K | 72.08K | 116.66K |

| Other Expenses | 0.00 | 572.93K | 801.36K | 909.87K | 392.71K | 10.98K | 9.40K | 6.49K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.50M | 1.36M | 2.49M | 2.14M | 3.16M | 2.50M | 722.89K | 808.00K | 541.06K | 29.55K | 95.78K | 92.48K | 116.66K |

| Cost & Expenses | 3.63M | 6.29M | 5.19M | 3.06M | 3.16M | 2.50M | 722.89K | 808.00K | 541.06K | 29.55K | 95.78K | 92.48K | 116.66K |

| Interest Income | 0.00 | 52.40K | 38.48K | 60.96K | 2.44K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 526.00 | 2.28K | 1.42K |

| Interest Expense | 257.85K | 175.10K | 46.00K | 78.89K | 3.92K | 1.40K | 860.00 | 0.00 | 0.00 | 141.00 | 275.00 | 127.00 | 114.00 |

| Depreciation & Amortization | 624.26K | 1.02M | 710.18K | 739.11K | 392.71K | 10.98K | 9.40K | 6.49K | 1.09K | 0.00 | 526.00 | 2.41K | 114.00 |

| EBITDA | -969.44K | -4.10M | 997.27K | 2.35M | -3.02M | -2.49M | -713.03K | -801.61K | -541.06K | -29.55K | -95.26K | -90.20K | -116.66K |

| EBITDA Ratio | -48.51% | -232.58% | 18.19% | 49.94% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -1.59M | -4.95M | 287.09K | 1.57M | -3.41M | -2.50M | -724.20K | -809.24K | -542.14K | -29.55K | -95.78K | -92.61K | -116.77K |

| Operating Income Ratio | -79.56% | -292.98% | 5.24% | 33.97% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -282.77K | -35.20K | -64.73K | -78.89K | 246.60K | -1.40K | -1.31K | -1.24K | -78.37K | 4.86K | -60.16K | 2.28K | 0.00 |

| Income Before Tax | -1.87M | -4.79M | 241.10K | 1.49M | -2.91M | -2.50M | -724.20K | -809.24K | -542.14K | -24.69K | -155.94K | -90.33K | 0.00 |

| Income Before Tax Ratio | -93.71% | -283.63% | 4.40% | 32.27% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | 22.03K | 46.00K | 78.89K | -246.60K | 1.40K | 908.00 | 2.49K | 1.09K | -5.00K | 59.88K | -2.41K | -1.54K |

| Net Income | -1.87M | -4.81M | 241.10K | 1.49M | -2.67M | -2.50M | -724.20K | -809.24K | -542.14K | -24.69K | -155.94K | -90.33K | -115.35K |

| Net Income Ratio | -93.71% | -284.94% | 4.40% | 32.27% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.02 | -0.05 | 0.00 | 0.02 | -0.04 | -0.05 | -0.02 | -0.03 | -0.03 | -0.01 | -0.03 | -0.02 | -0.03 |

| EPS Diluted | -0.02 | -0.05 | 0.00 | 0.02 | -0.04 | -0.05 | -0.02 | -0.03 | -0.03 | -0.01 | -0.03 | -0.02 | -0.03 |

| Weighted Avg Shares Out | 89.97M | 89.97M | 89.74M | 84.96M | 75.29M | 52.11M | 35.45M | 30.31M | 21.39M | 4.00M | 4.71M | 5.00M | 4.22M |

| Weighted Avg Shares Out (Dil) | 89.97M | 89.97M | 89.74M | 84.96M | 75.29M | 52.11M | 35.45M | 30.31M | 21.39M | 4.00M | 4.71M | 5.00M | 4.22M |

CSE Bulletin: Delist - Lotus Ventures Inc. (J)

Lotus Venture: Update on Proposal Transaction

Lotus Launches Joker Juice Cannabis Strain in BC and Reduces Debt with Shares

Lotus Receives Notice of Claim

Lotus Announces Third Quarter Financial Results

Lotus Ventures Receives License To Produce, Sell, Distribute Cannabis To Provincial Canadian Distributors

Lotus Ventures Inc. Accelerates Path to Retail Market Sales Upon Receipt of Standard Processing License from Health Canada

Lotus Reports Third Fiscal Quarter of 2021

Lotus Cannabis Finding Success Growing Premium Dried Flower

Source: https://incomestatements.info

Category: Stock Reports