Complete financial analysis of Pulmonx Corporation (LUNG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Pulmonx Corporation, a leading company in the Medical – Devices industry within the Healthcare sector.

- Smith-Midland Corporation (SMID) Income Statement Analysis – Financial Results

- Avantium N.V. (AVTX.AS) Income Statement Analysis – Financial Results

- Elis SA (ELSSF) Income Statement Analysis – Financial Results

- Kamux Oyj (KAMUX.HE) Income Statement Analysis – Financial Results

- Sensyne Health plc (SENS.L) Income Statement Analysis – Financial Results

Pulmonx Corporation (LUNG)

About Pulmonx Corporation

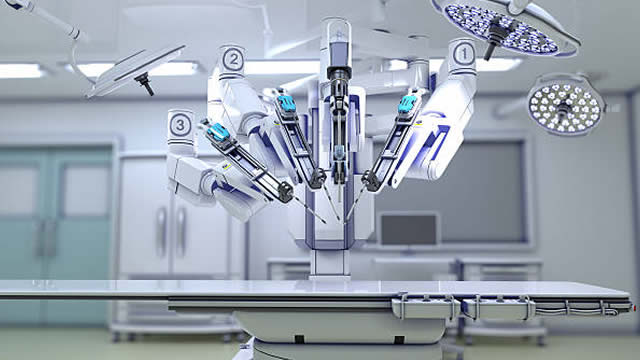

Pulmonx Corporation, a medical technology company, provides minimally invasive devices for the treatment of chronic obstructive pulmonary diseases. It offers Zephyr Endobronchial Valve, a solution for the treatment of bronchoscopic in adult patients with hyperinflation associated with severe emphysema; and Chartis Pulmonary Assessment System, a balloon catheter and console system with flow and pressure sensors that are used to assess the presence of collateral ventilation. The company also provides StratX Lung Analysis Platform, a cloud-based quantitative computed tomography analysis service that offers information on emphysema destruction, fissure completeness, and lobar volume to help identify target lobes for the treatment with Zephyr Valves. It serves emphysema patients in the United States, Europe, the Middle East, Africa, the Asia-Pacific, and internationally. The company was formerly known as Pulmonx and changed its name to Pulmonx Corporation in December 2013. Pulmonx Corporation was incorporated in 1995 and is headquartered in Redwood City, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 68.68M | 53.66M | 48.42M | 32.73M | 32.60M | 20.00M |

| Cost of Revenue | 17.92M | 13.80M | 12.79M | 11.53M | 10.18M | 7.72M |

| Gross Profit | 50.75M | 39.87M | 35.63M | 21.20M | 22.41M | 12.29M |

| Gross Profit Ratio | 73.90% | 74.29% | 73.59% | 64.77% | 68.77% | 61.42% |

| Research & Development | 18.08M | 15.40M | 13.06M | 7.46M | 6.05M | 6.99M |

| General & Administrative | 89.81M | 77.01M | 64.77M | 44.57M | 34.20M | 20.35M |

| Selling & Marketing | 4.80M | 6.10M | 5.10M | 1.50M | 600.00K | 100.00K |

| SG&A | 94.61M | 83.11M | 69.87M | 46.07M | 34.20M | 20.35M |

| Other Expenses | 0.00 | -396.00K | -585.00K | 3.28M | -617.00K | -916.00K |

| Operating Expenses | 112.69M | 98.50M | 82.93M | 53.53M | 40.25M | 27.34M |

| Cost & Expenses | 130.61M | 112.30M | 95.72M | 65.07M | 50.43M | 35.06M |

| Interest Income | 5.57M | 1.53M | 400.00K | 213.00K | 432.00K | 21.00K |

| Interest Expense | 3.23M | 1.07M | 829.00K | 3.18M | 2.32M | 2.52M |

| Depreciation & Amortization | 1.95M | 4.00M | 3.16M | 400.00K | 1.20M | 270.00K |

| EBITDA | -55.09M | -55.99M | -46.62M | -28.44M | -16.82M | -15.68M |

| EBITDA Ratio | -80.22% | -107.16% | -98.09% | -88.10% | -54.17% | -78.37% |

| Operating Income | -61.94M | -58.64M | -47.30M | -32.33M | -17.84M | -15.05M |

| Operating Income Ratio | -90.19% | -109.27% | -97.70% | -98.77% | -54.73% | -75.24% |

| Total Other Income/Expenses | 1.66M | 67.00K | -1.01M | 314.00K | -2.50M | -3.42M |

| Income Before Tax | -60.27M | -58.57M | -48.32M | -32.02M | -20.34M | -18.47M |

| Income Before Tax Ratio | -87.76% | -109.15% | -99.80% | -97.82% | -62.40% | -92.32% |

| Income Tax Expense | 571.00K | 353.00K | 343.00K | 213.00K | 363.00K | 12.00K |

| Net Income | -60.84M | -58.92M | -48.66M | -32.23M | -20.70M | -18.48M |

| Net Income Ratio | -88.60% | -109.80% | -100.51% | -98.47% | -63.52% | -92.38% |

| EPS | -1.60 | -1.59 | -1.35 | -0.90 | -0.58 | -0.89 |

| EPS Diluted | -1.60 | -1.59 | -1.35 | -0.90 | -0.58 | -0.89 |

| Weighted Avg Shares Out | 37.97M | 37.10M | 36.13M | 35.69M | 35.43M | 20.71M |

| Weighted Avg Shares Out (Dil) | 37.97M | 37.10M | 36.13M | 35.69M | 35.43M | 20.71M |

Does Pulmonx (LUNG) Have the Potential to Rally 117.74% as Wall Street Analysts Expect?

Pulmonx to Present at the Piper Sandler 36th Annual Healthcare Conference

Pulmonx Partners with American Lung Association to Launch New Educational Initiatives for COPD Patients and Providers

Pulmonx to Present at the Stifel 2024 Healthcare Conference

Wall Street Analysts Predict an 89.61% Upside in Pulmonx (LUNG): Here's What You Should Know

Pulmonx Corporation (LUNG) Reports Q3 Loss, Misses Revenue Estimates

Pulmonx to Report Third Quarter 2024 Financial Results on October 30, 2024

Pulmonx Announces Presentation of Clinical Data from the AeriSeal® CONVERT Trial and 5-Year Follow-up Data from the LIBERATE Study at the European Respiratory Society Congress 2024

AMGEN PRESENTS NEW DATA FOR FIRST-IN-CLASS IMDELLTRA™ (TARLATAMAB-DLLE) IN SMALL CELL LUNG CANCER AT WCLC 2024

Pulmonx to Participate in the Lake Street 8th Annual Best Ideas Growth Conference

Source: https://incomestatements.info

Category: Stock Reports