See more : Dunedin Enterprise Investment Trust PLC (DNE.L) Income Statement Analysis – Financial Results

Complete financial analysis of Las Vegas Sands Corp. (LVS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Las Vegas Sands Corp., a leading company in the Gambling, Resorts & Casinos industry within the Consumer Cyclical sector.

- Kelly Services, Inc. (KELYB) Income Statement Analysis – Financial Results

- Toppan Inc. (TOPPY) Income Statement Analysis – Financial Results

- Star Navigation Systems Group Ltd. (SNAVF) Income Statement Analysis – Financial Results

- Gores Technology Partners, Inc. (GTPA) Income Statement Analysis – Financial Results

- Centrica plc (CPYYY) Income Statement Analysis – Financial Results

Las Vegas Sands Corp. (LVS)

About Las Vegas Sands Corp.

Las Vegas Sands Corp., together with its subsidiaries, develops, owns, and operates integrated resorts in Asia and the United States. It owns and operates The Venetian Macao Resort Hotel, the Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, Cotai Strip, and the Sands Macao in Macao, the People's Republic of China; and Marina Bay Sands in Singapore. The company also owns and operates The Venetian Resort Hotel Casino on the Las Vegas Strip; and the Sands Expo and Convention Center in Las Vegas, Nevada. Its integrated resorts feature accommodations, gaming, entertainment and retail malls, convention and exhibition facilities, celebrity chef restaurants, and other amenities. Las Vegas Sands Corp. was founded in 1988 and is based in Las Vegas, Nevada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 10.37B | 4.11B | 4.23B | 2.94B | 12.13B | 13.73B | 12.73B | 11.27B | 11.69B | 14.58B | 13.77B | 11.13B | 9.41B | 6.85B | 4.56B | 4.39B | 2.95B | 2.24B | 1.74B | 1.20B | 691.75M | 623.34M | 586.97M | 641.20M |

| Cost of Revenue | 5.21B | 1.53B | 1.41B | 1.31B | 2.17B | 2.88B | 6.33B | 5.69B | 6.12B | 7.75B | 7.52B | 6.07B | 4.92B | 3.88B | 2.88B | 2.77B | 1.75B | 1.16B | 873.45M | 541.72M | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 5.17B | 2.59B | 2.83B | 1.63B | 9.96B | 10.85B | 6.40B | 5.59B | 5.57B | 6.84B | 6.25B | 5.06B | 4.49B | 2.98B | 1.69B | 1.62B | 1.20B | 1.07B | 867.46M | 655.34M | 691.75M | 623.34M | 586.97M | 641.20M |

| Gross Profit Ratio | 49.82% | 62.90% | 66.79% | 55.54% | 82.11% | 78.99% | 50.27% | 49.55% | 47.66% | 46.89% | 45.41% | 45.47% | 47.69% | 43.45% | 36.95% | 36.93% | 40.83% | 47.96% | 49.83% | 54.75% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 205.00M | 143.00M | 109.00M | 18.00M | 24.00M | 12.00M | 13.00M | 9.00M | 10.00M | 14.00M | 15.81M | 19.96M | 11.31M | 1.78M | 533.00K | 12.79M | 9.73M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.11B | 1.17B | 1.04B | 966.00M | 1.43B | 1.69B | 1.42B | 1.29B | 1.27B | 1.26B | 1.33B | 1.06B | 836.92M | 683.30M | 845.93M | 850.75M | 319.36M | 230.36M | 192.81M | 173.09M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 143.00M | 109.00M | 18.00M | 24.00M | 12.00M | 13.00M | 130.00M | 134.00M | 14.00M | 15.81M | 117.76M | 0.00 | 0.00 | 0.00 | 0.00 | 341.95M | 154.90M | 88.47M | 180.27M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.11B | 1.40B | 1.23B | 1.14B | 1.56B | 1.74B | 1.42B | 1.29B | 1.27B | 1.26B | 1.33B | 1.06B | 836.92M | 683.30M | 845.93M | 850.75M | 661.31M | 385.26M | 281.27M | 353.36M | 126.13M | 112.91M | 0.00 | 0.00 |

| Other Expenses | 1.54B | -9.00M | -31.00M | 19.00M | 56.00M | 26.00M | -94.00M | 31.00M | 31.00M | 2.00M | 4.32M | 5.74M | -3.96M | -8.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 2.85B | 3.39B | 3.69B | 3.01B | 5.98B | 7.13B | 2.92B | 3.00B | 2.70B | 2.73B | 2.83B | 2.60B | 2.09B | 1.74B | 1.55B | 1.42B | 874.71M | 498.65M | 378.01M | 36.87M | 505.63M | 463.40M | 456.77M | 490.24M |

| Cost & Expenses | 8.06B | 4.91B | 5.09B | 4.31B | 8.15B | 10.02B | 9.24B | 8.69B | 8.81B | 10.48B | 10.35B | 8.67B | 7.01B | 5.62B | 4.42B | 4.19B | 2.62B | 1.66B | 1.25B | 578.59M | 505.63M | 463.40M | 456.77M | 490.24M |

| Interest Income | 288.00M | 116.00M | 4.00M | 21.00M | 74.00M | 59.00M | 16.00M | 10.00M | 15.00M | 26.00M | 16.34M | 23.25M | 14.39M | 8.95M | 11.12M | 19.79M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 818.00M | 702.00M | 621.00M | 536.00M | 555.00M | 446.00M | 327.00M | 274.00M | 265.00M | 274.00M | 271.21M | 258.56M | 282.95M | 306.81M | 321.87M | 421.83M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.33B | 1.04B | 1.04B | 997.00M | 1.17B | 1.11B | 1.17B | 1.11B | 1.04B | 1.07B | 1.05B | 932.21M | 837.77M | 736.27M | 586.04M | 533.15M | 252.78M | 119.98M | 99.80M | 76.32M | 53.86M | 46.66M | 1.94M | 0.00 |

| EBITDA | 3.92B | 351.00M | 188.00M | -356.00M | 5.52B | 4.89B | 4.55B | 3.64B | 3.91B | 5.18B | 4.51B | 3.25B | 3.17B | 1.86B | 535.28M | 726.95M | 582.79M | 694.07M | 589.25M | 694.79M | 239.99M | 206.60M | 130.20M | 150.96M |

| EBITDA Ratio | 37.79% | 6.16% | 8.95% | -10.99% | 36.83% | 36.76% | 36.25% | 33.46% | 33.88% | 35.70% | 32.59% | 30.71% | 34.52% | 28.78% | 16.17% | 17.18% | 20.45% | 31.15% | 41.88% | 26.36% | 34.57% | 32.98% | 22.51% | 23.54% |

| Operating Income | 2.31B | -783.00M | -662.00M | -1.32B | 3.45B | 3.90B | 3.46B | 2.50B | 2.84B | 4.10B | 3.41B | 2.31B | 2.39B | 1.18B | -28.74M | 163.66M | 330.01M | 574.10M | 489.45M | 618.47M | 186.13M | 159.94M | 130.20M | 150.96M |

| Operating Income Ratio | 22.30% | -19.05% | -15.64% | -44.90% | 28.42% | 28.41% | 27.22% | 22.20% | 24.31% | 28.11% | 24.75% | 20.77% | 25.40% | 17.23% | -0.63% | 3.73% | 11.18% | 25.67% | 28.11% | 51.67% | 26.91% | 25.66% | 22.18% | 23.54% |

| Total Other Income/Expenses | -538.00M | -595.00M | -785.00M | -483.00M | 235.00M | -425.00M | -410.00M | -238.00M | -219.00M | -266.00M | -264.73M | -248.81M | -295.06M | -324.68M | -343.89M | -391.69M | -191.73M | -69.85M | -201.52M | -137.02M | -119.49M | 1.05M | -122.33M | -134.10M |

| Income Before Tax | 1.78B | -1.39B | -1.47B | -1.88B | 3.60B | 3.33B | 3.05B | 2.26B | 2.62B | 3.83B | 3.14B | 2.06B | 2.09B | 855.91M | -372.63M | -228.03M | 138.28M | 504.25M | 287.94M | 481.45M | 66.63M | 160.98M | 7.87M | 16.86M |

| Income Before Tax Ratio | 17.11% | -33.75% | -34.81% | -63.81% | 29.69% | 24.23% | 23.99% | 20.09% | 22.43% | 26.28% | 22.83% | 18.53% | 22.26% | 12.49% | -8.17% | -5.19% | 4.69% | 22.54% | 16.54% | 40.22% | 9.63% | 25.83% | 1.34% | 2.63% |

| Income Tax Expense | 344.00M | 154.00M | 5.00M | 24.00M | 432.00M | 375.00M | -209.00M | 239.00M | 236.00M | 245.00M | 188.84M | 180.76M | 211.70M | 74.30M | -3.88M | -59.70M | 21.59M | 62.24M | 4.25M | -13.74M | 119.49M | 171.78M | 120.39M | 0.00 |

| Net Income | 1.22B | -1.07B | -1.15B | -1.44B | 2.70B | 2.41B | 2.81B | 1.68B | 1.97B | 2.84B | 2.31B | 1.52B | 1.56B | 599.39M | -354.48M | -163.56M | 116.69M | 442.00M | 283.69M | 495.18M | 66.63M | -11.84M | 7.87M | 16.86M |

| Net Income Ratio | 11.77% | -25.94% | -27.26% | -49.05% | 22.25% | 17.58% | 22.06% | 14.90% | 16.82% | 19.48% | 16.75% | 13.69% | 16.58% | 8.75% | -7.77% | -3.73% | 3.95% | 19.76% | 16.30% | 41.37% | 9.63% | -1.90% | 1.34% | 2.63% |

| EPS | 1.60 | -1.40 | -1.51 | -1.89 | 3.50 | 3.07 | 3.54 | 2.10 | 2.47 | 3.52 | 2.80 | 1.89 | 1.74 | 0.61 | -0.54 | -0.42 | 0.33 | 1.25 | 0.80 | 1.52 | 0.21 | -9.71 | 0.02 | 0.05 |

| EPS Diluted | 1.60 | -1.40 | -1.51 | -1.89 | 3.50 | 3.07 | 3.54 | 2.10 | 2.47 | 3.52 | 2.79 | 1.85 | 1.56 | 0.51 | -0.54 | -0.42 | 0.33 | 1.24 | 0.80 | 1.52 | 0.20 | -9.71 | 0.02 | 0.05 |

| Weighted Avg Shares Out | 763.00M | 764.00M | 764.00M | 764.00M | 771.00M | 786.00M | 792.00M | 794.63M | 796.79M | 806.13M | 822.28M | 806.40M | 728.34M | 667.46M | 656.84M | 392.13M | 354.81M | 354.28M | 354.16M | 326.49M | 324.66M | 1.22M | 393.70M | 337.24M |

| Weighted Avg Shares Out (Dil) | 765.00M | 764.00M | 764.00M | 764.00M | 771.00M | 786.00M | 792.00M | 795.21M | 797.60M | 808.02M | 826.32M | 824.56M | 811.82M | 791.76M | 656.84M | 392.13M | 355.79M | 355.26M | 354.53M | 326.85M | 325.19M | 1.22M | 393.70M | 337.24M |

Eaton Introduces Higher Power Fuses for Electrified Commercial Vehicles

The 3 Best Casino Stocks With Dividends to Bet On in May 2024

Why Is Las Vegas Sands (LVS) Up 1.6% Since Last Earnings Report?

Sands Macao Celebrates 20th Anniversary

Revive Your Portfolio: 3 Undervalued Stocks Poised for Growth

Is Trending Stock Las Vegas Sands Corp. (LVS) a Buy Now?

Las Vegas Sands' Loss Could Be MGM and Wynn's Gain

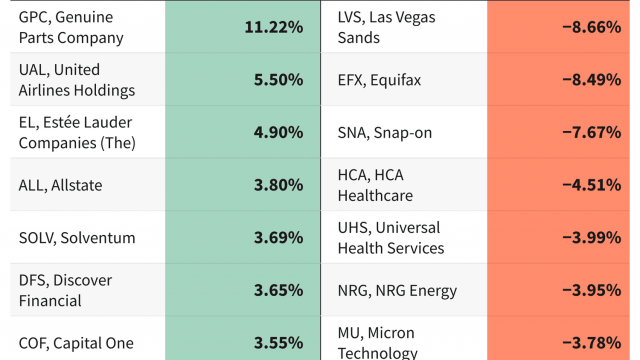

S&P 500 Gains and Losses Today: Las Vegas Sands Stock Drops Amid Macau Renovations

2 Stocks Sliding Despite Upbeat Earnings

Las Vegas Sands (LVS) Q1 Earnings & Revenues Beat, Rise Y/Y

Source: https://incomestatements.info

Category: Stock Reports