See more : RAVENO Capital AG (TUF.DE) Income Statement Analysis – Financial Results

Complete financial analysis of 908 Devices Inc. (MASS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of 908 Devices Inc., a leading company in the Medical – Devices industry within the Healthcare sector.

- Hindustan Copper Limited (HINDCOPPER.BO) Income Statement Analysis – Financial Results

- Martin Midstream Partners L.P. (MMLP) Income Statement Analysis – Financial Results

- bioMérieux S.A. (BMXXY) Income Statement Analysis – Financial Results

- GlaxoSmithKline Pharmaceuticals Limited (GLAXO.NS) Income Statement Analysis – Financial Results

- Zumtobel Group AG (ZMTBY) Income Statement Analysis – Financial Results

908 Devices Inc. (MASS)

About 908 Devices Inc.

908 Devices Inc., a commercial-stage technology company, provides various purpose-built handheld and desktop mass spectrometry (Mass Spec) devices to interrogate unknown and invisible materials in life sciences research, bioprocessing, industrial biotech, forensics, and adjacent markets. The company's products include MX908, a handheld, battery-powered, and Mass Spec device that is designed for rapid analysis of gas, liquid, and solid materials of unknown identity; Rebel, a small desktop analyzer that provides real-time information on the extracellular environment in bioprocesses; and ZipChip solution, a plug-and-play, high-resolution separation platform that optimizes Mass Spec sample analysis. It operates in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company was incorporated in 2012 and is headquartered in Boston, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 50.23M | 46.85M | 42.21M | 26.89M | 17.97M | 22.05M |

| Cost of Revenue | 24.91M | 20.83M | 18.97M | 11.97M | 9.83M | 9.66M |

| Gross Profit | 25.32M | 26.02M | 23.23M | 14.92M | 8.14M | 12.39M |

| Gross Profit Ratio | 50.41% | 55.54% | 55.05% | 55.49% | 45.31% | 56.19% |

| Research & Development | 21.90M | 17.53M | 13.07M | 8.24M | 8.99M | 9.53M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 46.18M | 43.88M | 32.24M | 12.50M | 11.29M | 9.30M |

| Other Expenses | 0.00 | 1.82M | 386.00K | -6.03M | 301.00K | 50.00K |

| Operating Expenses | 68.08M | 61.41M | 45.30M | 20.74M | 20.29M | 18.83M |

| Cost & Expenses | 92.99M | 82.23M | 64.28M | 32.71M | 30.12M | 28.49M |

| Interest Income | 6.48M | 2.03M | 500.00K | 100.00K | 200.00K | 0.00 |

| Interest Expense | 201.00K | 129.00K | 486.00K | 976.00K | 1.53M | 1.15M |

| Depreciation & Amortization | 2.38M | 1.61M | 925.00K | 831.00K | 900.00K | 896.00K |

| EBITDA | -34.03M | -31.82M | -20.94M | -11.01M | -10.94M | -5.49M |

| EBITDA Ratio | -67.74% | -75.52% | -51.37% | -44.04% | -60.89% | -24.91% |

| Operating Income | -42.76M | -35.38M | -22.07M | -5.82M | -12.14M | -6.44M |

| Operating Income Ratio | -85.13% | -75.52% | -52.29% | -21.62% | -67.57% | -29.20% |

| Total Other Income/Expenses | 6.15M | 1.82M | -100.00K | -7.00M | -1.23M | -1.10M |

| Income Before Tax | -36.61M | -33.56M | -22.17M | -12.82M | -13.37M | -7.54M |

| Income Before Tax Ratio | -72.89% | -71.64% | -52.53% | -47.66% | -74.41% | -34.17% |

| Income Tax Expense | -211.00K | -1.82M | -53.00K | -5.88M | 1.83M | 50.00K |

| Net Income | -36.40M | -31.74M | -22.12M | -6.94M | -15.20M | -7.54M |

| Net Income Ratio | -72.47% | -67.75% | -52.40% | -25.79% | -84.60% | -34.17% |

| EPS | -1.13 | -1.01 | -0.79 | -0.25 | -0.58 | -0.40 |

| EPS Diluted | -1.13 | -1.01 | -0.79 | -0.25 | -0.58 | -0.40 |

| Weighted Avg Shares Out | 32.21M | 31.49M | 27.96M | 27.27M | 26.20M | 18.98M |

| Weighted Avg Shares Out (Dil) | 32.24M | 31.49M | 27.96M | 27.27M | 26.20M | 18.98M |

5 ‘Strong Buy' Stocks to Buy Under $10, and Cathie Wood's Ark Owns 2 of Them

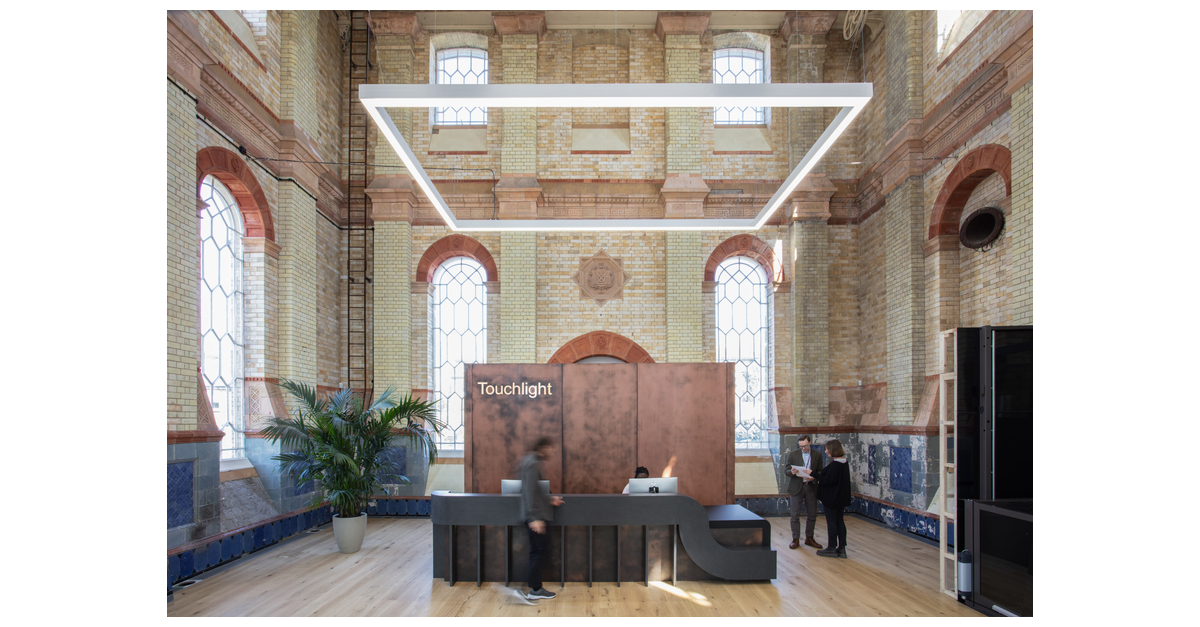

Touchlight Completes Expansion, Creating One of the World’s Largest DNA Manufacturing Facilities in London, UK

Commsignia and Mitsubishi Electric Agree to Partnership for Delivery of Advanced V2X Solutions for Vehicles

Innoviva Specialty Therapeutics Announces FDA Approval for XACDURO® (sulbactam for injection; durlobactam for injection), Co-packaged for Intravenous Use

Veracode voor de tiende keer achtereenvolgend uitgeroepen tot Leader in het Magic Quadrant™ voor het testen van applicatiebeveiliging

VIA Names Tremell Brown Deputy Chief Executive Officer

Watts Water Technologies to Participate in the Stifel 2023 Cross Sector Insight Conference

ReNAgade Therapeutics lanceert met meer dan $300 miljoen in een financiering serie A om het grenzeloze potentieel van RNA-geneeskunde te ontsluiten

E Ink Showcases Latest Color Products, E Ink Spectra™ 6 and E Ink Gallery™ 3 Outdoor, at SID Display Week 2023

908 Devices Inc. (MASS) Reports Q1 Loss, Tops Revenue Estimates

Source: https://incomestatements.info

Category: Stock Reports