See more : News World Wu Company (2245.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Mobileye Global Inc. (MBLY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Mobileye Global Inc., a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- DMK Pharmaceuticals Corporation (DMKPQ) Income Statement Analysis – Financial Results

- Jaiprakash Associates Limited (JPASSOCIAT.BO) Income Statement Analysis – Financial Results

- China Literature Limited (0772.HK) Income Statement Analysis – Financial Results

- First High-School Education Group Co., Ltd. (FHSEY) Income Statement Analysis – Financial Results

- Hong Kong Shanghai Alliance Holdings Limited (1001.HK) Income Statement Analysis – Financial Results

Mobileye Global Inc. (MBLY)

About Mobileye Global Inc.

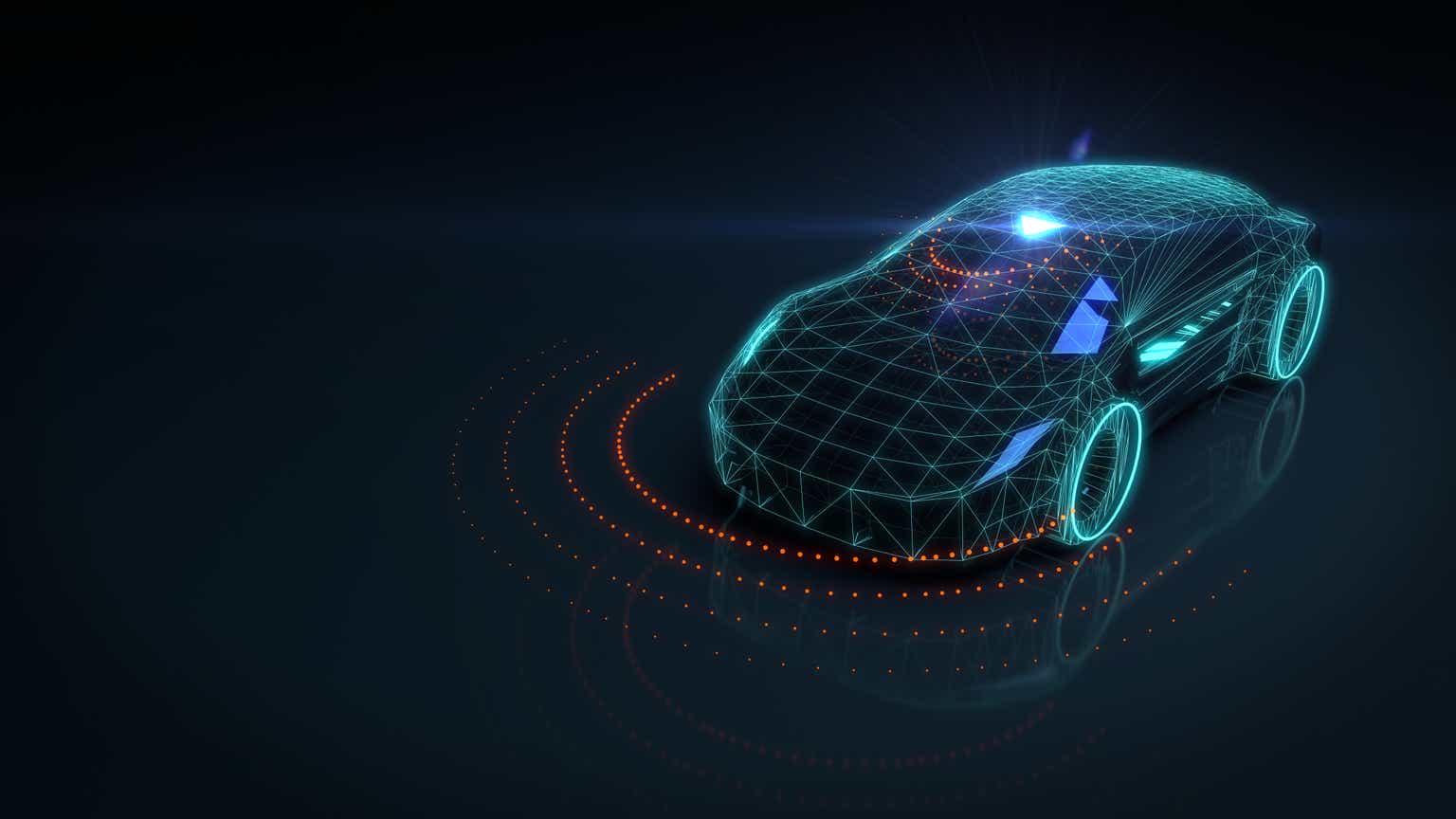

Mobileye Global Inc. engages in the development and deployment of advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide. The company offers Driver Assist, which comprise ADAS and autonomous vehicle solutions that covers safety features, such as real-time detection of road users, geometry, semantics, and markings to provide safety alerts and emergency interventions; Cloud-Enhanced Driver Assist, a solution for drivers with interpretations of a scene in real-time; Mobileye SuperVision Lite, a driver assist solution; and Mobileye SuperVision, an operational point-to-point assisted driving navigation solution on various road types and includes cloud-based enhancements, such as road experience management and supports over-the-air updates. It also provides Mobileye Chauffeur, a generation solution; and Mobileye Drive, a Level 4 solution, which comprise a set of autonomous driving technology solutions, such as Self-Driving System & Vehicles and Autonomous Mobility as a Service. The company was founded in 1999 and is headquartered in Jerusalem, Israel. Mobileye Global Inc. operates as a subsidiary of Intel Overseas Funding Corporation.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 2.08B | 1.87B | 1.39B | 967.00M | 879.00M |

| Cost of Revenue | 1.03B | 947.00M | 731.00M | 591.00M | 456.00M |

| Gross Profit | 1.05B | 922.00M | 655.00M | 376.00M | 423.00M |

| Gross Profit Ratio | 50.36% | 49.33% | 47.26% | 38.88% | 48.12% |

| Research & Development | 889.00M | 789.00M | 544.00M | 440.00M | 384.00M |

| General & Administrative | 73.00M | 50.00M | 34.00M | 33.00M | 25.00M |

| Selling & Marketing | 118.00M | 120.00M | 134.00M | 116.00M | 100.00M |

| SG&A | 191.00M | 170.00M | 168.00M | 149.00M | 125.00M |

| Other Expenses | 0.00 | 11.00M | -3.00M | -5.00M | -4.00M |

| Operating Expenses | 1.08B | 959.00M | 712.00M | 589.00M | 509.00M |

| Cost & Expenses | 2.11B | 1.91B | 1.44B | 1.18B | 965.00M |

| Interest Income | 0.00 | 18.00M | 3.00M | 6.00M | 235.00M |

| Interest Expense | 0.00 | 24.00M | 0.00 | 0.00 | 235.00M |

| Depreciation & Amortization | 513.00M | 567.00M | 526.00M | 463.00M | 338.00M |

| EBITDA | 529.00M | 559.00M | 469.00M | 251.00M | 252.00M |

| EBITDA Ratio | 25.44% | 29.91% | 33.84% | 25.96% | 28.67% |

| Operating Income | -33.00M | -8.00M | -57.00M | -212.00M | -86.00M |

| Operating Income Ratio | -1.59% | -0.43% | -4.11% | -21.92% | -9.78% |

| Total Other Income/Expenses | 49.00M | 5.00M | 0.00 | 1.00M | -239.00M |

| Income Before Tax | 16.00M | -32.00M | -57.00M | -212.00M | -325.00M |

| Income Before Tax Ratio | 0.77% | -1.71% | -4.11% | -21.92% | -36.97% |

| Income Tax Expense | 43.00M | 50.00M | 18.00M | -16.00M | 3.00M |

| Net Income | -27.00M | -82.00M | -75.00M | -196.00M | -328.00M |

| Net Income Ratio | -1.30% | -4.39% | -5.41% | -20.27% | -37.32% |

| EPS | -0.03 | -0.10 | -0.09 | -0.25 | -0.41 |

| EPS Diluted | -0.03 | -0.10 | -0.09 | -0.25 | -0.41 |

| Weighted Avg Shares Out | 806.15M | 801.91M | 796.26M | 796.26M | 796.26M |

| Weighted Avg Shares Out (Dil) | 805.00M | 801.91M | 796.26M | 796.26M | 796.26M |

Prediction: 3 Unstoppable Stocks That Can Rocket Higher if Kamala Harris Wins in November

Overlooked Stock: MBLY

Self-Driving Mobileye Falls. More Bad News Is Coming.

Mobileye: Underappreciated Data Acquisition Capabilities

VLEEY vs. MBLY: Which Stock Is the Better Value Option?

Why Auto Stocks Surged This Week

Crude Oil Gains Over 1%; Mobileye Global Shares Jump

Intel (INTC) the "Catalyst to Spark Flame" for Mobileye (MBLY)

Why Intel, Alphabet, and Mobileye Stocks All Popped Today

Mobileye Stock Pops After Intel Reassurance

Source: https://incomestatements.info

Category: Stock Reports