See more : Shandong Humon Smelting Co., Ltd. (002237.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Mobile TeleSystems Public Joint Stock Company (MBT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Mobile TeleSystems Public Joint Stock Company, a leading company in the Telecommunications Services industry within the Communication Services sector.

- Rederiaktiebolaget Gotland (publ) (GOTL-A.ST) Income Statement Analysis – Financial Results

- ECARX Holdings, Inc. (ECX) Income Statement Analysis – Financial Results

- Wajax Corporation (WJX.TO) Income Statement Analysis – Financial Results

- TC Biopharm (Holdings) Plc (TCBPW) Income Statement Analysis – Financial Results

- HAEMATO AG (HAEK.DE) Income Statement Analysis – Financial Results

Mobile TeleSystems Public Joint Stock Company (MBT)

About Mobile TeleSystems Public Joint Stock Company

Mobile TeleSystems Public Joint Stock Company provides telecommunication services primarily in Russia. It offers voice and data transmission, internet access, broadband, pay TV, and various value added services through wireless and fixed lines; financial services; and integration services, as well as sells equipment, accessories, and software. The company also provides cloud computing services, data analysis tools, cybersecurity systems, and intelligent IoT solutions for B2B clients; provides My MTS self care app, mobile music, mobile TV, and video-on demand; and owns eSport clubs and MTS online shop. In addition, it offers banking and e-commerce services. The company was founded in 1993 and is headquartered in Moscow, Russia. Mobile TeleSystems Public Joint Stock Company is a subsidiary of Sistema Public Joint-Stock Financial Corporation.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 569.53B | 420.49B | 253.88B | 248.13B | 233.31B | 181.35B | 187.74B | 189.73B | 123.12B | 104.57B | 377.75B | 394.06B | 345.46B | 296.02B | 302.74B | 202.74B | 168.03B | 144.01B | 107.67B | 74.89B | 43.48B | 27.22B | 15.31B | 9.78B |

| Cost of Revenue | 268.90B | 219.18B | 166.72B | 136.24B | 124.10B | 101.73B | 88.20B | 82.90B | 67.52B | 68.02B | 147.37B | 113.12B | 91.42B | 70.94B | 71.44B | 46.33B | 37.72B | 28.38B | 19.38B | 13.95B | 16.47B | 9.69B | 6.64B | 2.49B |

| Gross Profit | 300.63B | 201.31B | 87.16B | 111.88B | 109.22B | 79.62B | 99.55B | 106.83B | 55.61B | 36.54B | 230.38B | 280.94B | 254.04B | 225.09B | 231.30B | 156.41B | 130.32B | 115.63B | 88.29B | 60.94B | 27.01B | 17.52B | 8.66B | 7.30B |

| Gross Profit Ratio | 52.79% | 47.88% | 34.33% | 45.09% | 46.81% | 43.90% | 53.02% | 56.31% | 45.17% | 34.95% | 60.99% | 71.29% | 73.54% | 76.04% | 76.40% | 77.15% | 77.55% | 80.29% | 82.00% | 81.38% | 62.13% | 64.39% | 56.59% | 74.58% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 66.20B | 16.48B | 14.27B | 14.02B | 13.60B | 12.18B | 9.22B | 8.38B | 22.82B | 77.93B | 69.58B | 59.31B | 44.09B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 17.68B | 36.22B | 33.50B | 24.34B | 19.77B | 17.75B | 12.96B | 8.38B | 21.62B | 28.09B | 26.02B | 22.78B | 26.08B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 42.46B | 27.89B | 24.10B | 52.70B | 47.77B | 38.36B | 33.37B | 29.94B | 22.18B | 16.76B | 44.44B | 106.03B | 95.60B | 82.09B | 70.17B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 0.00 | 119.70B | 103.84B | 94.51B | 111.45B | 94.92B | 94.26B | 96.17B | 93.64B | 81.95B | 105.28B | 84.46B | 70.88B | 63.97B | 66.47B | 89.24B | 74.16B | 68.73B | 47.75B | 33.81B | 12.19B | 7.34B | 4.69B | 4.14B |

| Operating Expenses | 67.68B | 37.59B | 56.94B | 47.73B | 76.67B | 41.49B | 20.73B | 56.34B | 69.46B | 25.38B | 149.72B | 190.48B | 166.48B | 146.06B | 136.64B | 89.24B | 74.16B | 68.73B | 47.75B | 33.81B | 12.19B | 7.34B | 4.69B | 4.14B |

| Cost & Expenses | 336.58B | 256.77B | 223.66B | 183.97B | 200.77B | 143.22B | 108.93B | 139.24B | 136.98B | 93.40B | 297.09B | 303.60B | 257.90B | 216.99B | 208.08B | 135.58B | 111.87B | 97.11B | 67.13B | 47.75B | 28.65B | 17.03B | 11.33B | 6.63B |

| Interest Income | 649.00M | 2.52B | 2.30B | 3.41B | 5.54B | 5.15B | 4.79B | 7.92B | 4.52B | 2.79B | 2.56B | 2.00B | 2.58B | 3.27B | 980.02M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 41.35B | 40.16B | 43.08B | 39.29B | 22.87B | 23.54B | 25.29B | 16.45B | 15.50B | 17.26B | 21.01B | 23.78B | 17.23B | 4.53B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 374.69M | 111.09B | 100.21B | 106.95B | 104.59B | 79.91B | 83.26B | 9.13B | 8.01B | 7.79B | 69.10B | 74.70B | 61.20B | 55.43B | 57.27B | 35.29B | 28.07B | 24.80B | 17.42B | 11.37B | 5.90B | 4.39B | 2.51B | 1.45B |

| EBITDA | 266.13B | 190.49B | 82.81B | 75.43B | 75.49B | 51.41B | 72.98B | 83.38B | 37.89B | 24.03B | 134.62B | 158.91B | 143.03B | 118.12B | 137.48B | 104.32B | 71.55B | 68.97B | 54.61B | 33.71B | 18.28B | 14.17B | 6.54B | 4.31B |

| EBITDA Ratio | 46.73% | 45.30% | 32.62% | 30.40% | 32.36% | 28.35% | 38.87% | 43.95% | 30.77% | 22.98% | 35.64% | 40.33% | 41.40% | 39.90% | 45.41% | 51.46% | 42.58% | 47.89% | 50.72% | 45.02% | 42.03% | 52.06% | 42.73% | 44.03% |

| Operating Income | 237.78B | 164.59B | 57.81B | 52.26B | 54.58B | 36.60B | 62.21B | 74.25B | 29.88B | 16.23B | 60.63B | 90.46B | 87.56B | 79.03B | 94.66B | 67.16B | 56.16B | 46.90B | 40.54B | 27.14B | 14.83B | 10.19B | 3.97B | 3.16B |

| Operating Income Ratio | 41.75% | 39.14% | 22.77% | 21.06% | 23.39% | 20.18% | 33.14% | 39.13% | 24.26% | 15.52% | 16.05% | 22.96% | 25.35% | 26.70% | 31.27% | 33.13% | 33.42% | 32.57% | 37.65% | 36.23% | 34.10% | 37.42% | 25.96% | 32.26% |

| Total Other Income/Expenses | -5.48B | -4.54B | -31.14B | 8.92B | -26.47B | -2.56B | 12.72B | -28.02B | -45.31B | -6.19B | -11.43B | -23.31B | -24.37B | -33.99B | -18.70B | 2.34B | -12.31B | -1.96B | -2.51B | -4.79B | -2.45B | -417.68M | 61.57M | -303.63M |

| Income Before Tax | 232.30B | 160.06B | 26.67B | 61.18B | 28.11B | 34.04B | 74.93B | 46.22B | -15.43B | 10.04B | 49.20B | 67.16B | 63.19B | 45.04B | 75.96B | 69.50B | 43.85B | 44.94B | 38.03B | 22.34B | 12.37B | 9.77B | 4.03B | 2.85B |

| Income Before Tax Ratio | 40.79% | 38.06% | 10.51% | 24.66% | 12.05% | 18.77% | 39.91% | 24.36% | -12.53% | 9.60% | 13.03% | 17.04% | 18.29% | 15.22% | 25.09% | 34.28% | 26.09% | 31.21% | 35.32% | 29.84% | 28.46% | 35.89% | 26.36% | 29.16% |

| Income Tax Expense | 47.58B | 30.38B | 9.75B | 11.78B | 5.98B | 8.71B | 15.04B | 9.79B | 2.03B | 1.74B | 17.66B | 17.01B | 15.82B | 15.19B | 18.63B | 18.14B | 15.16B | 11.80B | 9.82B | 7.13B | 3.53B | 2.97B | 1.46B | 514.03M |

| Net Income | 184.66B | 129.70B | 16.93B | 49.35B | 22.07B | 25.33B | 59.88B | 36.44B | -13.64B | 7.39B | 30.60B | 46.19B | 42.23B | 30.27B | 57.04B | 50.89B | 28.31B | 32.37B | 27.37B | 15.21B | 8.85B | 6.81B | 2.57B | 2.34B |

| Net Income Ratio | 32.42% | 30.84% | 6.67% | 19.89% | 9.46% | 13.97% | 31.90% | 19.21% | -11.08% | 7.06% | 8.10% | 11.72% | 12.23% | 10.23% | 18.84% | 25.10% | 16.85% | 22.48% | 25.41% | 20.31% | 20.35% | 25.02% | 16.81% | 23.91% |

| EPS | 1.43K | 1.00K | 130.75 | 381.07 | 170.42 | 195.62 | 462.42 | 281.41 | -105.34 | 57.70 | 30.77 | 46.87 | 44.07 | 32.11 | 59.36 | 51.58 | 28.49 | 32.59 | 27.58 | 15.34 | 8.92 | 6.87 | 2.85 | 2.86 |

| EPS Diluted | 1.43K | 1.00K | 130.75 | 381.07 | 170.42 | 195.62 | 462.42 | 281.41 | -105.34 | 57.70 | 30.77 | 46.87 | 44.07 | 32.11 | 59.36 | 51.56 | 28.49 | 32.59 | 27.58 | 15.34 | 8.92 | 6.83 | 2.85 | 2.86 |

| Weighted Avg Shares Out | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 128.03M | 994.46M | 985.48M | 958.43M | 942.53M | 960.97M | 986.68M | 993.81M | 993.41M | 992.25M | 991.69M | 991.68M | 991.68M | 903.48M | 817.26M |

| Weighted Avg Shares Out (Dil) | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 129.50M | 128.03M | 994.46M | 985.48M | 958.43M | 942.53M | 960.97M | 987.04M | 993.81M | 993.41M | 992.25M | 991.70M | 991.70M | 996.66M | 903.48M | 817.26M |

Porsche's virtual race series starts tomorrow with pro drivers at the wheel

Can HeadHunter Group Extend Local Success Globally?

Can HeadHunter Group Extend Local Success Globally?

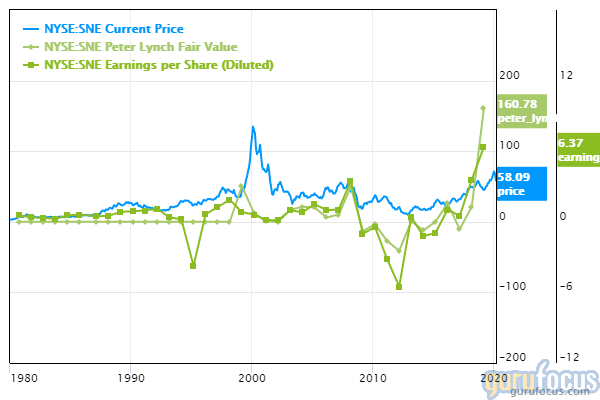

5 Undervalued Stocks Trading Below Peter Lynch Value

Aircraft Lubricants Market Size to Reach US$ 1.48 Billion in 2025, Says Stratview Research

3 Ultra-High-Yield Dividend Stocks That Can Make You Rich

NASCAR Texas Motor Speedway FREE LIVE STREAM (3/29/20): Watch eNASCAR iRacing Pro invitational Series online | Time, TV, channel

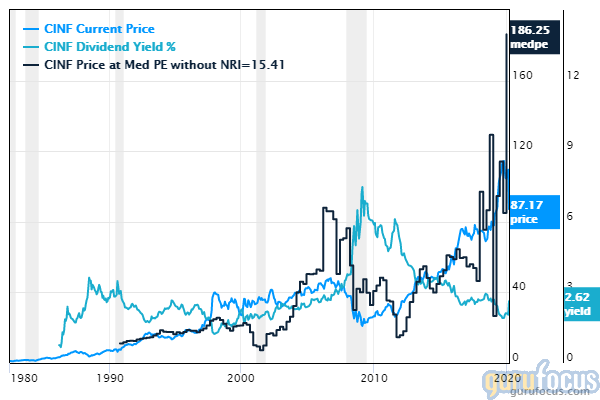

5 High-Yielding Stocks Trading With Low Price-Earnings Ratios

Coronavirus Income Stocks: 7 High-Yield Dividend Stocks to Buy Right Now

Source: https://incomestatements.info

Category: Stock Reports