See more : Fusion Acquisition Corp. II (FSNBW) Income Statement Analysis – Financial Results

Complete financial analysis of Merida Merger Corp. I (MCMJ) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Merida Merger Corp. I, a leading company in the Shell Companies industry within the Financial Services sector.

- Thachang Green Energy Public Company Limited (TGE.BK) Income Statement Analysis – Financial Results

- McFarlane Lake Mining Limited (MLM.NE) Income Statement Analysis – Financial Results

- XOMA Corporation (XOMAO) Income Statement Analysis – Financial Results

- FIG (7708.TWO) Income Statement Analysis – Financial Results

- Golden Solar New Energy Technology Holdings Limited (1121.HK) Income Statement Analysis – Financial Results

Merida Merger Corp. I (MCMJ)

About Merida Merger Corp. I

As of February 4, 2022, Merida Merger Corp. I was acquired by Leafly Holdings, Inc., in a reverse merger transaction. Merida Merger Corp. I does not have significant operations. It intends to enter into a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization, or other similar business combination with one or more businesses or entities in the cannabis industry. The company was incorporated in 2019 and is based in New York, New York.

| Metric | 2020 | 2019 |

|---|---|---|

| Revenue | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 |

| Gross Profit | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 |

| Other Expenses | 661.22K | 167.53K |

| Operating Expenses | 661.22K | 167.53K |

| Cost & Expenses | 661.22K | 167.53K |

| Interest Income | 787.35K | 0.00 |

| Interest Expense | 0.00 | 296.02K |

| Depreciation & Amortization | 789.41K | 592.03K |

| EBITDA | 128.19K | 424.50K |

| EBITDA Ratio | 0.00% | 0.00% |

| Operating Income | -661.22K | -167.53K |

| Operating Income Ratio | 0.00% | 0.00% |

| Total Other Income/Expenses | 789.41K | 296.01K |

| Income Before Tax | 128.19K | 128.48K |

| Income Before Tax Ratio | 0.00% | 0.00% |

| Income Tax Expense | 27.11K | 26.98K |

| Net Income | 101.08K | 101.50K |

| Net Income Ratio | 0.00% | 0.00% |

| EPS | 0.01 | 0.01 |

| EPS Diluted | 0.01 | 0.01 |

| Weighted Avg Shares Out | 16.37M | 16.57M |

| Weighted Avg Shares Out (Dil) | 16.37M | 16.57M |

A Week's Worth of Actionable Cannabis Stock News

Cannabis giant Leafly is going public through a SPAC merger

Leafly to go public via SPAC merger that values Seattle cannabis marketplace at $385M

Leafly Cannabis Info Platform Goes Public Via Deal With Merida Merger Corp, The Combined Company Equity Projected At $532M

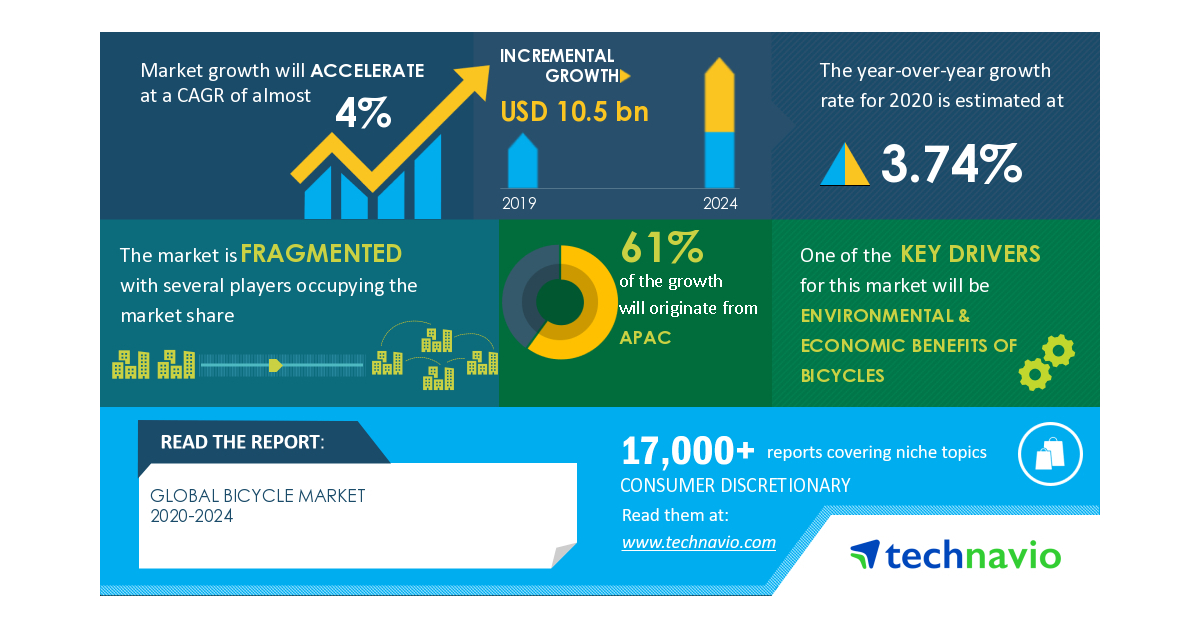

Bicycle Market | Environmental & Economic Benefits of Bicycles to Boost the Market Growth | Technavio

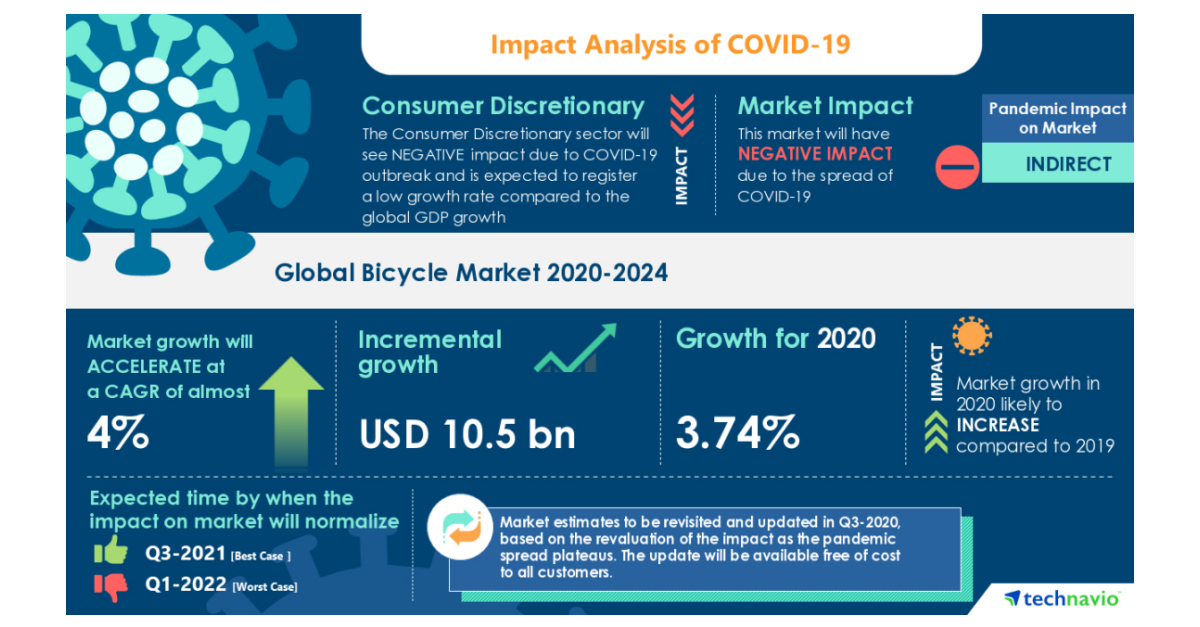

COVID-19 Recovery Analysis: Bicycle Market | Environmental & Economic Benefits Of Bicycles to boost the Market Growth | Technavio

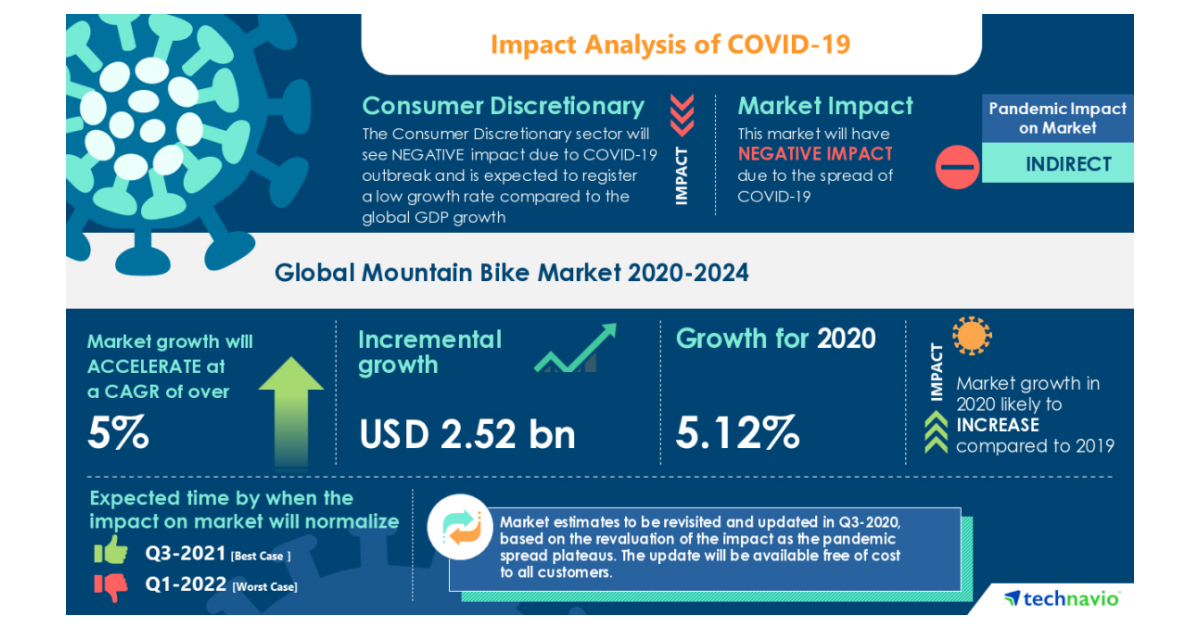

Mountain Bike Market- Roadmap for Recovery from COVID-19 | Rise In Women Mountain Bikers to Boost the Market Growth | Technavio

ASUR Airport Group: June passenger traffic down almost 90%

Source: https://incomestatements.info

Category: Stock Reports