See more : PuraPharm Corporation Limited (1498.HK) Income Statement Analysis – Financial Results

Complete financial analysis of MediaCo Holding Inc. (MDIA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MediaCo Holding Inc., a leading company in the Broadcasting industry within the Communication Services sector.

- Larsen & Toubro Limited (LTOD.L) Income Statement Analysis – Financial Results

- South32 Limited (SOUHY) Income Statement Analysis – Financial Results

- FIT Hon Teng Limited (FITGF) Income Statement Analysis – Financial Results

- PT Pelangi Indah Canindo Tbk (PICO.JK) Income Statement Analysis – Financial Results

- Jinneng Holding Shanxi Coal Industry Co.,ltd. (601001.SS) Income Statement Analysis – Financial Results

MediaCo Holding Inc. (MDIA)

About MediaCo Holding Inc.

MediaCo Holding Inc. owns and operates radio stations in the United States. It operates in two segments, Radio and Outdoor Advertising. The Radio segment engages in the operation of WQHT-FM and WBLS-FM radio stations in the New York City area. The Outdoor Advertising segment operates advertising displays, such as bulletins, posters, and digital billboards primarily in Georgia, Alabama, South Carolina, Florida, Kentucky, West Virginia, and Ohio. The company also offers digital advertising and event sponsorship services. As of December 31, 2021, it owned and operated approximately 3,500 outdoor advertising displays. MediaCo Holding Inc. was founded in 2019 and is headquartered in New York, New York. MediaCo Holding Inc. is a subsidiary of Emmis Communications Corporation.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 32.39M | 38.60M | 55.49M | 39.26M | 43.09M | 44.56M |

| Cost of Revenue | 32.63M | 32.85M | 37.72M | 32.34M | 33.83M | 33.09M |

| Gross Profit | -242.00K | 5.75M | 17.77M | 6.92M | 9.26M | 11.46M |

| Gross Profit Ratio | -0.75% | 14.89% | 32.02% | 17.62% | 21.49% | 25.73% |

| Research & Development | 0.00 | 100.00K | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.45M | 6.46M | 8.43M | 4.34M | 31.13M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 5.45M | 6.46M | 8.43M | 4.34M | 31.13M | 0.00 |

| Other Expenses | 0.00 | 666.00K | 3.93M | 4.08M | -29.81M | -15.00K |

| Operating Expenses | 6.45M | 7.13M | 12.36M | 8.42M | 1.32M | 1.12M |

| Cost & Expenses | 38.65M | 39.98M | 50.08M | 40.76M | 35.15M | 34.21M |

| Interest Income | 0.00 | 6.98M | 7.71M | 9.49M | 985.20K | 0.00 |

| Interest Expense | 426.00K | 6.98M | 11.10M | 9.49M | 821.00K | 15.00K |

| Depreciation & Amortization | 568.00K | 2.83M | 2.69M | 7.66M | 1.34M | 1.12M |

| EBITDA | -6.12M | -773.00K | 6.55M | 5.96M | 7.92M | 11.46M |

| EBITDA Ratio | -18.89% | -1.53% | 16.82% | 6.57% | 21.62% | 25.73% |

| Operating Income | -6.26M | -1.38M | 5.46M | -1.50M | 7.89M | 10.35M |

| Operating Income Ratio | -19.33% | -3.58% | 9.83% | -3.83% | 18.30% | 23.22% |

| Total Other Income/Expenses | -852.00K | -8.08M | -7.79M | -9.69M | -2.43M | -2.46M |

| Income Before Tax | -7.11M | -9.46M | -5.72M | -11.19M | 7.89M | 10.33M |

| Income Before Tax Ratio | -21.96% | -24.51% | -10.31% | -28.51% | 18.30% | 23.19% |

| Income Tax Expense | 308.00K | 336.00K | 358.00K | 15.56M | 2.52M | 8.33M |

| Net Income | -7.63M | -9.80M | -6.08M | -26.75M | 5.37M | 2.00M |

| Net Income Ratio | -23.56% | -25.38% | -10.96% | -68.14% | 12.46% | 4.49% |

| EPS | -0.40 | -0.73 | -0.84 | -3.72 | 0.76 | 0.28 |

| EPS Diluted | -0.40 | -0.73 | -0.84 | -3.72 | 0.76 | 0.28 |

| Weighted Avg Shares Out | 24.88M | 13.38M | 7.22M | 7.20M | 7.10M | 7.03M |

| Weighted Avg Shares Out (Dil) | 24.88M | 13.38M | 7.22M | 7.20M | 7.10M | 7.03M |

From Partridge to My Dad Wrote a Porno: 10 of the best comedy podcasts

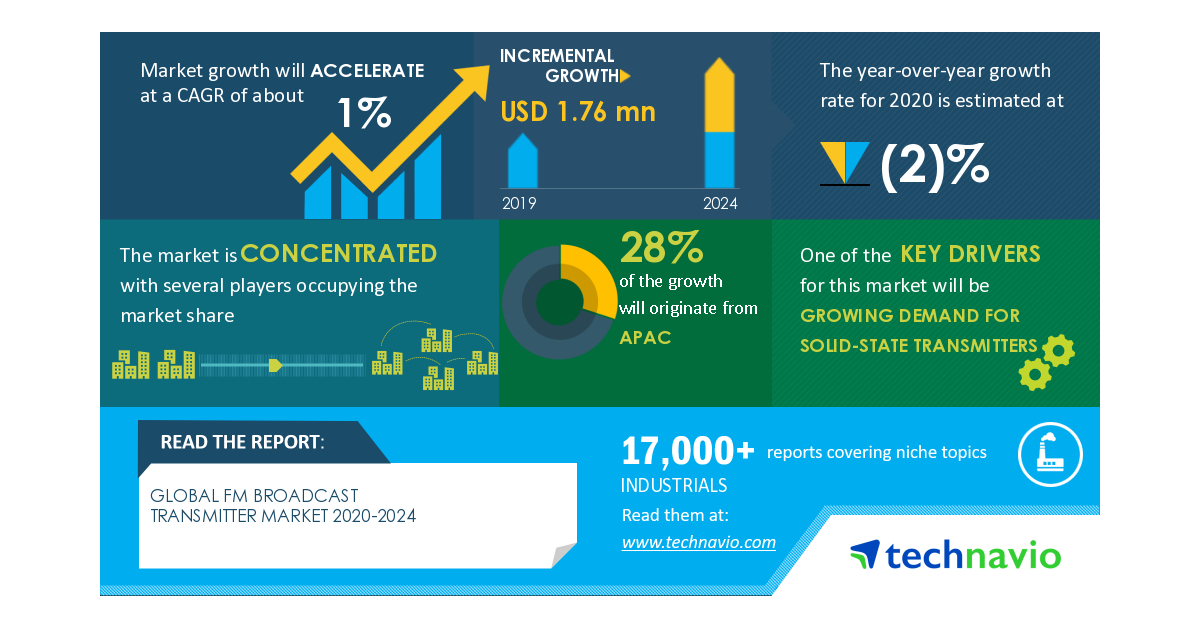

FM Broadcast Transmitter Market | Insights on the Crisis and the Roadmap to Recovery from COVID-19 Pandemic | Technavio

Urban One Inc (NASDAQ:UONE) CEO Buys $554,703.48 in Stock

Coronavirus in Nigeria: 5 tips on what to do - Vanguard News

Insider Selling: Urban One Inc (NASDAQ:UONE) Insider Sells 408,531 Shares of Stock

Insider Selling: Urban One Inc (NASDAQ:UONE) Insider Sells 380,584 Shares of Stock

Urban One Inc (NASDAQ:UONE) CEO Alfred C. Liggins Sells 574,909 Shares

Urban One (NASDAQ:UONE) Shares Gap Down to $12.71

Urban One (NASDAQ:UONEK) Downgraded to Sell at ValuEngine

Stock Traders Purchase High Volume of Call Options on Entravision Communication (NYSE:EVC)

Source: https://incomestatements.info

Category: Stock Reports