See more : Societal CDMO, Inc. (SCTL) Income Statement Analysis – Financial Results

Complete financial analysis of TRxADE HEALTH, Inc. (MEDS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of TRxADE HEALTH, Inc., a leading company in the Medical – Pharmaceuticals industry within the Healthcare sector.

- Central Development Holdings Limited (0475.HK) Income Statement Analysis – Financial Results

- Empire State Realty OP, L.P. (ESBA) Income Statement Analysis – Financial Results

- Drive Shack Inc. (DS) Income Statement Analysis – Financial Results

- The Toronto-Dominion Bank 5 YR RST PFD 1 (TD-PFA.TO) Income Statement Analysis – Financial Results

- Industrial Securities Co.,Ltd. (601377.SS) Income Statement Analysis – Financial Results

TRxADE HEALTH, Inc. (MEDS)

About TRxADE HEALTH, Inc.

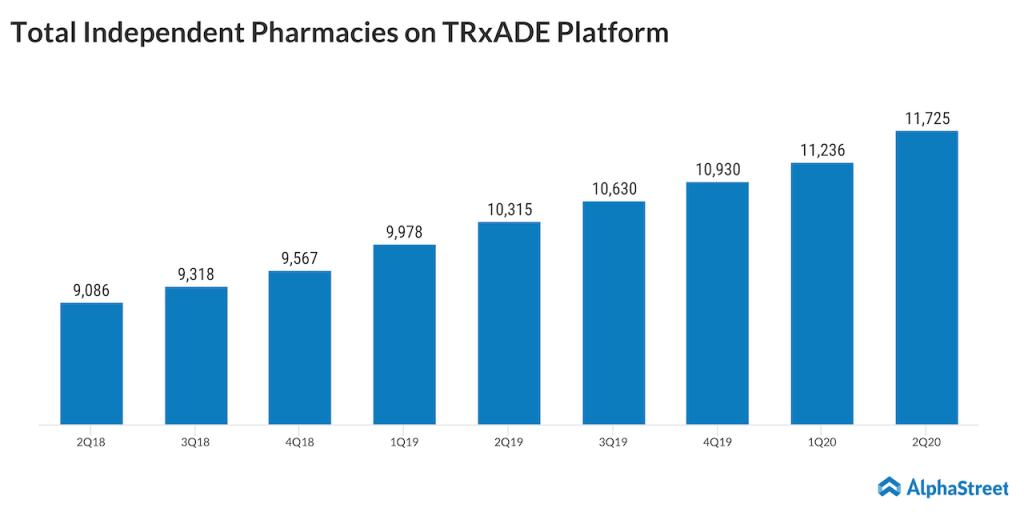

TRxADE HEALTH, Inc. operates as a health services IT company in the United States. The company focuses on digitalizing the retail pharmacy experience by optimizing drug procurement, prescription journey, and patient engagement. It operates the TRxADE drug procurement marketplace, which fosters price transparency and serves approximately 11,800 members; and offers patient centric telehealth services under the Bonum Health brand name. The company was formerly known as Trxade Group, Inc. and changed its name to TRxADE HEALTH, Inc. in June 2021. TRxADE HEALTH, Inc. is based in Land O' Lakes, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 8.27M | 11.45M | 9.89M | 17.12M | 7.44M | 3.83M | 2.93M | 2.48M | 4.99M | 1.50M | 955.88K | 806.05K | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 5.67M | 6.00M | 5.14M | 11.42M | 2.57M | 449.05K | 0.00 | 16.36K | 1.93M | 440.05K | 944.07K | 689.81K | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.60M | 5.45M | 4.75M | 5.71M | 4.87M | 3.38M | 2.93M | 2.47M | 3.06M | 1.06M | 11.81K | 116.24K | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 31.41% | 47.62% | 47.99% | 33.33% | 65.50% | 88.28% | 100.00% | 99.34% | 61.38% | 70.59% | 1.24% | 14.42% | 0.00% | 0.00% | 0.00% |

| Research & Development | 1.38M | 1.16M | 1.37M | 662.73K | 647.14K | 949.95K | 375.17K | 286.76K | 319.44K | 319.44K | 611.71K | 198.41K | 0.00 | 0.00 | 3.57K |

| General & Administrative | 8.48M | 7.05M | 8.81M | 7.49M | 4.38M | 2.35M | 2.27M | 3.30M | 3.70M | 2.11M | 2.10M | 266.95K | 28.50M | 0.00 | 5.16K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 147.63K | 355.12K | 374.62K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 8.48M | 7.05M | 8.81M | 7.49M | 4.38M | 2.35M | 2.27M | 3.45M | 4.05M | 2.49M | 2.10M | 266.95K | 28.50M | 24.77K | 5.16K |

| Other Expenses | 14.54K | 1.60M | -1.23M | 3.25M | 72.08K | 161.64K | 67.50K | 131.27K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.42K | 0.00 |

| Operating Expenses | 9.86M | 8.21M | 8.81M | 7.49M | 4.38M | 3.30M | 2.27M | 3.45M | 4.05M | 2.49M | 2.10M | 266.95K | 28.50M | 28.19K | 8.73K |

| Cost & Expenses | 15.54M | 14.20M | 13.96M | 18.90M | 6.94M | 3.75M | 2.27M | 3.47M | 5.98M | 2.93M | 3.04M | 956.76K | 28.50M | 28.19K | 8.73K |

| Interest Income | 4.20K | 20.99K | 23.59K | 29.39K | 53.23K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.20M | 336.21K | 23.59K | 29.39K | 53.23K | 57.54K | 157.06K | 151.50K | 130.14K | 4.15K | 7.28K | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.05M | 194.70K | 138.91K | 102.52K | 94.73K | 87.62K | -395.10K | 8.67K | 3.80K | 4.80K | 3.99K | 2.63K | 0.00 | 0.00 | 0.00 |

| EBITDA | -13.72M | -1.85M | -5.15M | -2.51M | 660.55K | 96.65K | 288.98K | -984.03K | -133.27K | -2.00M | -2.08M | -148.09K | -28.50M | -28.19K | -8.73K |

| EBITDA Ratio | -74.89% | -22.18% | -52.11% | -9.80% | 8.88% | 6.36% | 24.92% | -39.65% | -19.70% | -95.35% | -217.60% | -18.37% | 0.00% | 0.00% | 0.00% |

| Operating Income | -7.26M | -2.76M | -5.29M | -1.78M | 565.82K | -87.62K | 395.10K | -984.03K | -987.05K | -1.43M | -2.08M | -150.71K | -28.50M | -28.19K | -8.73K |

| Operating Income Ratio | -87.80% | -24.08% | -53.51% | -10.40% | 7.61% | -2.29% | 13.48% | -39.65% | -19.77% | -95.67% | -218.02% | -18.70% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -6.46M | -362.72K | -23.59K | -29.39K | -778.17K | 96.65K | -106.11K | -165.83K | -119.51K | -580.57K | -7.28K | 0.00 | 28.47M | 0.00 | 0.00 |

| Income Before Tax | -13.72M | -3.91M | -5.32M | -2.54M | -284.43K | 9.04K | 288.98K | -1.17M | -1.12M | -2.01M | -2.09M | -150.71K | -28.50K | 0.00 | 0.00 |

| Income Before Tax Ratio | -165.86% | -34.15% | -53.75% | -14.81% | -3.82% | 0.24% | 9.86% | -47.27% | -22.38% | -134.47% | -218.78% | -18.70% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 5.34M | 400.34K | -1.20M | 29.39K | 125.30K | -154.20K | -50.94K | 1.62M | 130.14K | 576.42K | 7.28K | 0.00 | 28.50M | 28.19K | 8.73K |

| Net Income | -17.84M | -4.31M | -4.11M | -2.57M | -409.73K | 9.04K | 288.98K | -2.76M | -1.12M | -2.01M | -2.09M | -150.71K | -28.50M | -28.19K | -8.73K |

| Net Income Ratio | -215.70% | -37.65% | -41.59% | -14.98% | -5.51% | 0.24% | 9.86% | -111.21% | -22.38% | -134.47% | -218.78% | -18.70% | 0.00% | 0.00% | 0.00% |

| EPS | -23.35 | -7.63 | -7.58 | -4.99 | -1.04 | 0.02 | 0.81 | -7.89 | -3.20 | -6.30 | -13.50 | -0.97 | -273.59 | -0.27 | -0.11 |

| EPS Diluted | -7.49 | -7.63 | -7.58 | -4.99 | -1.04 | 0.02 | 0.81 | -7.87 | -3.20 | -6.07 | -13.35 | -0.97 | -269.45 | -0.27 | -0.11 |

| Weighted Avg Shares Out | 764.06K | 564.86K | 542.45K | 513.71K | 395.27K | 388.43K | 355.06K | 349.64K | 349.64K | 319.37K | 154.91K | 154.91K | 104.16K | 105.76K | 81.20K |

| Weighted Avg Shares Out (Dil) | 2.38M | 564.86K | 542.45K | 513.71K | 395.27K | 388.43K | 378.74K | 350.50K | 349.64K | 331.46K | 156.69K | 154.91K | 105.76K | 105.76K | 81.20K |

Trxade Group to Present at March Investor Conferences

TRxADE Group to Present at the Diamond Equity Research Emerging Growth Invitational

Trxade Group's Big New Deal With Amazon

Trxade's stock rockets to pace premarket gainers after Amazon marketing agreement

Trxade Group Inc. (NASDAQ: MEDS) Q3 2020 Research Summary | AlphaStreet

Trxade Group, Inc. -Shareholder Analyst Call

U.S. IPO Week Ahead: The IPO Market Takes A Breather In A 3-IPO Week

Stocks To Watch: Barrick Gold, Hedge Fund Reveals And Election Plays (NASDAQ:ACIA)

Comparing AmerisourceBergen (NYSE:ABC) & MultiCell Technologies (NYSE:MEDS)

Analyzing McKesson (NYSE:MCK) & MultiCell Technologies (NYSE:MEDS)

Source: https://incomestatements.info

Category: Stock Reports