See more : Rapicut Carbides Limited (RAPICUT.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Affiliated Managers Group, Inc. (MGR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Affiliated Managers Group, Inc., a leading company in the Investment – Banking & Investment Services industry within the Financial Services sector.

- Sunshine Biopharma, Inc. (SBFMW) Income Statement Analysis – Financial Results

- Odysight.ai Inc. (ODYS) Income Statement Analysis – Financial Results

- Kinnevik AB (KINV-B.ST) Income Statement Analysis – Financial Results

- CITIC Telecom International Holdings Limited (1883.HK) Income Statement Analysis – Financial Results

- Solnaberg Property AB (publ) (SOLNA.ST) Income Statement Analysis – Financial Results

Affiliated Managers Group, Inc. (MGR)

Industry: Investment - Banking & Investment Services

Sector: Financial Services

About Affiliated Managers Group, Inc.

Affiliated Managers Group, Inc. engages in the provision of investment management services. It offers strategies across a range of return-oriented asset classes and product structures. The company was founded by William J. Nutt in December 1993 and is headquartered in West Palm Beach, FL.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.06B | 2.33B | 2.41B | 2.03B | 2.24B | 2.38B | 2.31B | 2.19B | 2.48B | 2.51B | 2.19B | 1.81B | 1.70B | 1.36B | 841.84M | 1.16B | 1.37B | 1.17B | 916.49M | 660.00M | 495.03M | 482.54M | 408.21M | 458.71M | 518.73M | 238.49M | 95.30M | 50.40M |

| Cost of Revenue | 907.50M | 1.07B | 1.05B | 883.70M | 943.00M | 987.20M | 979.00M | 932.40M | 1.03B | 1.03B | 947.50M | 784.70M | 718.80M | 594.49M | 402.58M | 516.90M | 579.37M | 472.40M | 21.50M | 16.71M | 16.06M | 15.97M | 11.14M | 10.33M | 8.91M | 6.28M | 45.20M | 2.30M |

| Gross Profit | 1.15B | 1.26B | 1.37B | 1.14B | 1.30B | 1.39B | 1.33B | 1.26B | 1.46B | 1.48B | 1.24B | 1.02B | 986.00M | 763.76M | 439.26M | 641.32M | 790.50M | 697.95M | 895.00M | 643.29M | 478.97M | 466.57M | 397.07M | 448.38M | 509.82M | 232.22M | 50.10M | 48.10M |

| Gross Profit Ratio | 55.90% | 54.00% | 56.60% | 56.41% | 57.89% | 58.49% | 57.53% | 57.51% | 58.64% | 58.96% | 56.71% | 56.54% | 57.84% | 56.23% | 52.18% | 55.37% | 57.71% | 59.64% | 97.65% | 97.47% | 96.76% | 96.69% | 97.27% | 97.75% | 98.28% | 97.37% | 52.57% | 95.44% |

| Research & Development | 0.00 | 0.74 | 0.47 | 0.25 | 0.14 | 0.30 | 0.46 | 0.44 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 376.80M | 417.70M | 373.10M | 398.10M | 443.80M | 485.50M | 427.20M | 366.90M | 350.80M | 284.60M | 131.54M | 226.58M | 216.79M | 207.90M | 528.04M | 350.70M | 259.05M | 250.36M | 208.68M | 242.93M | 271.03M | 119.31M | 18.90M | 32.00M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 358.20M | 385.50M | 347.10M | 321.40M | 376.80M | 417.70M | 373.10M | 398.10M | 443.80M | 485.50M | 427.20M | 366.90M | 350.80M | 284.60M | 131.54M | 226.58M | 216.79M | 207.90M | 528.04M | 350.70M | 259.05M | 250.36M | 208.68M | 242.93M | 271.03M | 119.31M | 18.90M | 32.00M |

| Other Expenses | 0.00 | 67.40M | 52.30M | 212.40M | 222.80M | 206.50M | 147.20M | 158.80M | 178.00M | 179.70M | 180.00M | 253.50M | 149.10M | 105.13M | 72.63M | 46.62M | 238.66M | 36.14M | 31.90M | 24.71M | 22.41M | 20.38M | 34.10M | 31.02M | 26.13M | 20.12M | 8.60M | 9.00M |

| Operating Expenses | 358.20M | 452.90M | 399.40M | 533.80M | 599.60M | 624.20M | 520.30M | 556.90M | 621.80M | 665.20M | 607.20M | 620.40M | 499.90M | 389.72M | 204.17M | 273.20M | 455.45M | 244.04M | 559.94M | 375.41M | 281.46M | 270.74M | 242.78M | 273.95M | 297.16M | 139.44M | 27.50M | 41.00M |

| Cost & Expenses | 1.27B | 1.52B | 1.45B | 1.42B | 1.54B | 1.61B | 1.50B | 1.49B | 1.65B | 1.70B | 1.55B | 1.41B | 1.22B | 984.21M | 606.75M | 790.10M | 1.03B | 716.44M | 581.44M | 392.12M | 297.51M | 286.71M | 253.92M | 284.27M | 306.07M | 145.71M | 72.70M | 43.30M |

| Interest Income | 0.00 | 4.10M | 6.20M | 58.20M | 51.00M | 0.00 | 0.00 | 0.00 | 40.30M | 0.00 | 0.00 | 26.10M | 0.00 | 22.91M | 24.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 123.80M | 114.40M | 111.40M | 92.30M | 76.20M | 80.60M | 100.80M | 93.30M | 88.90M | 106.70M | 119.00M | 83.00M | 101.10M | 91.14M | 78.13M | 73.89M | 76.92M | 58.80M | 37.43M | 31.73M | 22.98M | 25.22M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 61.30M | 1.50B | 1.52B | 1.41B | 1.53B | 1.69B | 1.60B | 1.58B | 134.20M | 139.10M | 142.20M | 214.10M | 112.70M | 74.14M | 45.68M | 51.35M | 45.35M | 39.00M | 34.92M | 28.35M | 25.69M | 23.96M | 38.46M | 31.02M | 26.13M | 20.12M | 8.60M | 9.00M |

| EBITDA | 1.23B | 1.82B | 1.19B | 726.20M | 524.80M | 903.80M | 1.21B | 820.80M | 969.20M | 954.30M | 776.30M | 592.30M | 497.70M | 357.04M | 202.64M | 340.85M | 380.40M | 492.92M | 369.98M | 296.23M | 223.21M | 219.79M | 192.75M | 205.46M | 238.70M | 112.90M | 31.20M | 16.10M |

| EBITDA Ratio | 59.69% | 78.03% | 49.21% | 35.82% | 23.43% | 37.99% | 52.69% | 53.03% | 52.26% | 49.23% | 49.53% | 42.66% | 39.10% | 38.37% | 36.61% | 37.92% | 23.68% | 41.83% | 36.41% | 43.60% | 43.42% | 44.83% | 45.97% | 44.30% | 43.29% | 46.40% | 31.48% | 31.35% |

| Operating Income | 792.10M | 1.75B | 1.13B | 566.60M | 359.00M | 767.00M | 1.11B | 705.30M | 835.00M | 815.20M | 634.10M | 400.40M | 486.10M | 374.03M | 235.09M | 368.12M | 335.06M | 453.91M | 335.06M | 267.88M | 197.52M | 195.83M | 154.29M | 174.44M | 212.66M | 92.78M | 22.60M | 7.10M |

| Operating Income Ratio | 38.49% | 75.14% | 47.04% | 27.95% | 16.03% | 32.25% | 48.07% | 32.14% | 33.61% | 32.47% | 28.97% | 22.18% | 28.51% | 27.54% | 27.93% | 31.78% | 24.46% | 38.78% | 36.56% | 40.59% | 39.90% | 40.58% | 37.80% | 38.03% | 41.00% | 38.90% | 23.71% | 14.09% |

| Total Other Income/Expenses | 299.30M | 873.80M | 122.90M | -104.40M | -446.00M | -53.40M | -40.80M | 269.30M | -33.30M | 198.30M | 229.60M | 94.80M | -33.40M | 4.82M | 5.83M | -215.08M | -46.23M | -216.03M | -145.40M | -138.79M | -95.68M | -102.59M | -70.97M | -78.83M | -83.70M | -50.20M | -19.60M | -8.30M |

| Income Before Tax | 1.09B | 1.75B | 1.14B | 508.40M | 308.00M | 713.60M | 1.07B | 974.60M | 1.09B | 1.01B | 863.70M | 495.20M | 452.70M | 378.85M | 240.92M | 44.11M | 288.83M | 237.89M | 189.65M | 129.09M | 101.83M | 93.24M | 83.31M | 95.61M | 128.91M | 42.59M | 3.00M | -1.20M |

| Income Before Tax Ratio | 53.04% | 74.97% | 47.30% | 25.08% | 13.75% | 30.00% | 46.30% | 44.41% | 43.90% | 40.36% | 39.46% | 27.43% | 26.55% | 27.89% | 28.62% | 3.81% | 21.08% | 20.33% | 20.69% | 19.56% | 20.57% | 19.32% | 20.41% | 20.84% | 24.85% | 17.86% | 3.15% | -2.38% |

| Income Tax Expense | 185.30M | 358.30M | 251.00M | 81.40M | 2.90M | 181.30M | 58.40M | 235.60M | 256.90M | 227.90M | 194.10M | 83.80M | 93.10M | 91.52M | 28.00M | 20.94M | 106.87M | 86.61M | 70.58M | 51.95M | 41.30M | 37.30M | 33.33M | 38.95M | 56.72M | 17.03M | 1.40M | 200.00K |

| Net Income | 672.90M | 1.15B | 890.10M | 427.00M | 305.10M | 243.60M | 689.50M | 472.80M | 516.00M | 452.10M | 360.50M | 174.00M | 164.90M | 138.63M | 59.47M | 23.17M | 181.96M | 151.28M | 119.07M | 77.15M | 60.53M | 55.94M | 49.99M | 56.66M | 72.19M | 25.55M | -8.40M | -2.40M |

| Net Income Ratio | 32.70% | 49.19% | 36.90% | 21.06% | 13.62% | 10.24% | 29.91% | 21.54% | 20.77% | 18.01% | 16.47% | 9.64% | 9.67% | 10.21% | 7.06% | 2.00% | 13.28% | 12.93% | 12.99% | 11.69% | 12.23% | 11.59% | 12.25% | 12.35% | 13.92% | 10.71% | -8.81% | -4.76% |

| EPS | 20.95 | 29.76 | 21.45 | 9.18 | 6.04 | 4.54 | 12.30 | 8.73 | 9.49 | 8.22 | 6.79 | 3.36 | 3.18 | 2.92 | 1.44 | -0.03 | 6.18 | 4.83 | 3.54 | 2.57 | 1.27 | 1.69 | 1.51 | 1.69 | 2.17 | 0.97 | -0.60 | -0.16 |

| EPS Diluted | 17.42 | 25.36 | 19.87 | 9.14 | 6.03 | 4.53 | 12.03 | 8.57 | 9.28 | 8.01 | 6.55 | 3.28 | 3.11 | 2.81 | 1.38 | -0.03 | 4.55 | 3.74 | 2.81 | 2.02 | 1.05 | 1.65 | 1.47 | 1.66 | 2.12 | 0.89 | -0.60 | -0.16 |

| Weighted Avg Shares Out | 35.10M | 38.50M | 41.50M | 46.50M | 50.50M | 53.60M | 56.00M | 54.20M | 54.30M | 55.00M | 53.10M | 51.70M | 51.80M | 47.40M | 41.39M | 38.21M | 29.46M | 31.29M | 33.67M | 29.99M | 47.80M | 33.03M | 33.20M | 33.46M | 33.27M | 26.37M | 14.06M | 14.99M |

| Weighted Avg Shares Out (Dil) | 42.20M | 49.00M | 44.80M | 46.70M | 50.60M | 53.80M | 58.60M | 57.00M | 57.20M | 58.40M | 56.70M | 53.00M | 53.00M | 49.40M | 43.33M | 38.21M | 42.40M | 45.16M | 44.69M | 39.64M | 60.17M | 33.87M | 34.10M | 34.12M | 34.04M | 28.83M | 14.06M | 14.99M |

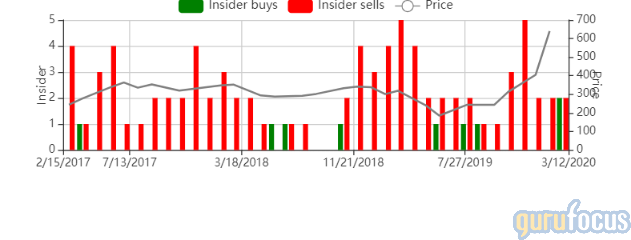

Affiliated Managers Group, Inc. (NYSE:AMG) Shares Sold by Bruni J V & Co. Co.

Is Affiliated Managers Group (AMG) a Great Value Stock Right Now?

Weekly CEO Buys Highlight

Affiliated Managers Group, Inc. (NYSE:AMG) Director Dwight D. Churchill Buys 2,500 Shares

Ceredex Value Advisors LLC Has $60.19 Million Stock Position in Affiliated Managers Group, Inc. (NYSE:AMG)

Federated Investors (NYSE:FII) vs. Affiliated Managers Group (NYSE:AMG) Critical Contrast

Rhumbline Advisers Buys 38,307 Shares of Affiliated Managers Group, Inc. (NYSE:AMG)

Affiliated Managers Group, Inc. (NYSE:AMG) CEO Jay C. Horgen Buys 10,000 Shares

Sepio Capital LLC Has $340,000 Stake in Affiliated Managers Group, Inc. (NYSE:AMG)

Davy Global Fund Management Ltd Sells 560 Shares of Affiliated Managers Group, Inc. (NYSE:AMG)

Source: https://incomestatements.info

Category: Stock Reports