See more : PT Intraco Penta Tbk (INTA.JK) Income Statement Analysis – Financial Results

Complete financial analysis of MICT, Inc. (MICT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MICT, Inc., a leading company in the Computer Hardware industry within the Technology sector.

- 1st Capital Bancorp (FISB) Income Statement Analysis – Financial Results

- Epsilon Healthcare Limited (EPN.AX) Income Statement Analysis – Financial Results

- ntc industries limited (NTCIND.BO) Income Statement Analysis – Financial Results

- St. Joseph, Inc. (STJO) Income Statement Analysis – Financial Results

- enherent Corp. (ENHT) Income Statement Analysis – Financial Results

MICT, Inc. (MICT)

About MICT, Inc.

MICT, Inc., through its subsidiaries, engages in the financial technology and insurance business in China, Singapore, and Hong Kong. It primarily develops platforms for insurance products, and financial products and services. The company also deals in securities, futures, and options; and provides securities advisory and asset management services, as well as the Magpie Invest app that allows to trade in securities on various stock exchanges. In addition, it conducts insurance brokerage and agency businesses; and offers a range of insurance products, including automobile, property and liability, life, and health insurance products. The company was formerly known as Micronet Enertec Technologies, Inc. and changed its name to MICT, Inc. in July 2018. MICT, Inc. was incorporated in 2002 and is based in Montvale, New Jersey.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 146.04M | 55.68M | 1.17M | 477.00K | 14.16M | 18.37M | 22.75M | 23.59M | 34.24M | 35.57M | 17.79M | 10.15M | 11.11M | 9.09M | 10.46M | 9.64M | 7.84M | 7.27M | 6.18M |

| Cost of Revenue | 81.24M | 46.46M | 1.23M | 846.00K | 10.65M | 14.09M | 18.60M | 16.28M | 24.18M | 22.30M | 13.79M | 6.30M | 6.18M | 6.85M | 7.55M | 7.10M | 5.68M | 5.26M | 4.13M |

| Gross Profit | 64.79M | 9.22M | -58.00K | -369.00K | 3.51M | 4.27M | 4.15M | 7.30M | 10.06M | 13.27M | 4.00M | 3.85M | 4.93M | 2.24M | 2.91M | 2.54M | 2.16M | 2.01M | 2.05M |

| Gross Profit Ratio | 44.37% | 16.56% | -4.94% | -77.36% | 24.78% | 23.26% | 18.24% | 30.96% | 29.38% | 37.31% | 22.48% | 37.94% | 44.35% | 24.66% | 27.83% | 26.32% | 27.59% | 27.62% | 33.13% |

| Research & Development | 1.69M | 889.00K | 484.00K | 255.00K | 1.91M | 1.96M | 2.32M | 2.45M | 2.81M | 2.68M | 777.00K | 240.00K | 250.00K | 251.00K | 143.00K | 244.00K | 399.00K | 379.00K | 0.00 |

| General & Administrative | 58.17M | 36.49M | 14.23M | 3.03M | 6.35M | 4.12M | 5.93M | 4.72M | 6.29M | 4.18M | 2.24M | 1.37M | 1.54M | 1.55M | 1.84M | 1.35M | 1.23M | 0.00 | 0.00 |

| Selling & Marketing | 11.14M | 6.81M | -38.00K | 198.00K | 1.58M | 1.88M | 1.94M | 1.53M | 1.95M | 1.17M | 752.00K | 350.00K | 307.00K | 150.00K | 194.00K | 193.00K | 110.00K | 0.00 | 0.00 |

| SG&A | 69.31M | 43.30M | 14.19M | 3.23M | 7.93M | 6.00M | 7.87M | 6.25M | 8.24M | 5.35M | 3.00M | 1.72M | 1.84M | 1.70M | 2.04M | 1.54M | 1.34M | 1.39M | 1.22M |

| Other Expenses | 5.59M | 2.93M | 1.85M | 20.00K | 1.30M | 978.00K | 926.00K | 1.12M | 850.00K | 657.00K | 551.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 76.58M | 47.12M | 16.52M | 3.50M | 11.13M | 8.94M | 11.12M | 9.82M | 11.89M | 8.68M | 4.32M | 1.96M | 2.09M | 1.95M | 2.18M | 1.78M | 1.74M | 1.77M | 1.22M |

| Cost & Expenses | 157.83M | 93.57M | 17.75M | 4.35M | 21.78M | 23.04M | 29.72M | 26.11M | 36.07M | 30.98M | 18.11M | 8.25M | 8.28M | 8.80M | 9.73M | 8.89M | 7.41M | 7.03M | 5.35M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 84.68M | 395.00K | -7.46M | -388.00K | -1.27M | -401.00K | -672.00K | -610.00K | -296.00K | -2.29M | 89.00K | 596.00K | -300.00K | 355.00K | 493.00K | -419.00K | -378.00K | 0.00 | 0.00 |

| Depreciation & Amortization | -86.09M | 3.09M | 1.78M | 88.00K | 1.42M | 1.32M | 1.37M | 1.60M | 1.38M | 984.00K | 779.00K | 66.00K | 23.00K | 65.00K | 111.00K | 144.00K | 84.00K | 148.00K | 146.00K |

| EBITDA | -11.79M | -34.74M | -29.00M | -4.50M | -1.85M | -7.25M | -5.24M | -1.56M | -816.00K | -1.31M | 6.15M | 1.94M | 1.45M | 304.00K | 792.00K | 475.00K | 103.00K | 103.00K | 550.00K |

| EBITDA Ratio | -8.07% | -62.39% | -2,472.29% | -943.40% | -13.08% | -39.45% | -23.03% | -6.61% | -2.38% | -3.68% | 34.57% | 19.16% | 13.03% | 3.34% | 7.57% | 4.93% | 1.31% | 1.42% | 8.91% |

| Operating Income | 74.29M | -37.82M | -16.58M | -3.87M | -9.09M | -4.67M | -6.97M | -2.52M | -1.84M | 4.59M | -325.00K | 1.89M | 2.83M | 292.00K | 732.00K | 756.00K | 428.00K | 238.00K | 825.00K |

| Operating Income Ratio | 50.87% | -67.94% | -1,413.38% | -811.11% | -64.16% | -25.42% | -30.64% | -10.69% | -5.36% | 12.91% | -1.83% | 18.66% | 25.49% | 3.21% | 7.00% | 7.84% | 5.46% | 3.27% | 13.36% |

| Total Other Income/Expenses | -84.68M | -1.13M | -7.38M | -884.00K | -1.27M | -401.00K | -672.00K | -610.00K | -296.00K | -2.30M | 4.72M | -611.00K | -305.00K | -404.00K | -493.00K | -419.00K | -372.00K | -269.00K | -230.00K |

| Income Before Tax | -10.39M | -38.95M | -23.96M | -4.75M | -10.35M | -5.07M | -7.64M | -3.13M | -2.13M | 2.30M | 4.39M | 1.28M | 2.53M | -112.00K | 239.00K | 337.00K | 56.00K | -31.00K | 595.00K |

| Income Before Tax Ratio | -7.12% | -69.96% | -2,042.80% | -996.44% | -73.11% | -27.61% | -33.59% | -13.27% | -6.23% | 6.46% | 24.69% | 12.64% | 22.74% | -1.23% | 2.28% | 3.50% | 0.71% | -0.43% | 9.63% |

| Income Tax Expense | -47.87M | -1.79M | -326.00K | 17.00K | 606.00K | -10.00K | -129.00K | -81.00K | 242.00K | 496.00K | -136.00K | -77.00K | 105.00K | 4.00K | 17.00K | 234.00K | 134.00K | 3.00K | 61.00K |

| Net Income | 37.47M | -37.16M | -22.99M | -4.22M | -2.61M | -8.16M | -5.81M | -2.47M | -2.14M | -495.00K | 5.42M | 1.36M | 1.62M | -120.00K | 171.00K | 97.00K | -115.00K | -48.00K | 343.00K |

| Net Income Ratio | 25.66% | -66.74% | -1,960.10% | -884.07% | -18.43% | -44.41% | -25.53% | -10.46% | -6.25% | -1.39% | 30.45% | 13.39% | 14.58% | -1.32% | 1.63% | 1.01% | -1.47% | -0.66% | 5.55% |

| EPS | 0.29 | -0.33 | -0.83 | -0.39 | -0.28 | -1.14 | -0.97 | -0.42 | -0.37 | -0.10 | 3.34 | 0.42 | 0.50 | -0.04 | 0.05 | 0.03 | -0.04 | -0.02 | 0.13 |

| EPS Diluted | 0.29 | -0.33 | -0.83 | -0.39 | -0.28 | -1.14 | -0.97 | -0.42 | -0.37 | -0.10 | 3.01 | 0.42 | 0.50 | -0.04 | 0.05 | 0.03 | -0.04 | -0.02 | 0.13 |

| Weighted Avg Shares Out | 129.35M | 112.56M | 27.62M | 10.70M | 9.17M | 7.13M | 5.97M | 5.86M | 5.83M | 5.09M | 1.62M | 3.24M | 3.24M | 3.24M | 3.24M | 3.24M | 3.24M | 2.95M | 2.74M |

| Weighted Avg Shares Out (Dil) | 129.35M | 112.56M | 27.62M | 10.70M | 9.17M | 7.13M | 5.97M | 5.86M | 5.83M | 5.09M | 1.80M | 3.24M | 3.24M | 3.24M | 3.24M | 3.24M | 3.24M | 2.95M | 2.74M |

MICT Closes Acquisition of GFH with $15 Million in Committed Funding | Finance Magnates

InspireMD (NYSEAMERICAN:NSPR) Downgraded to “Hold” at Zacks Investment Research

MICT, Inc. (MICT) Management on Q1 2020 Results - Earnings Call Transcript

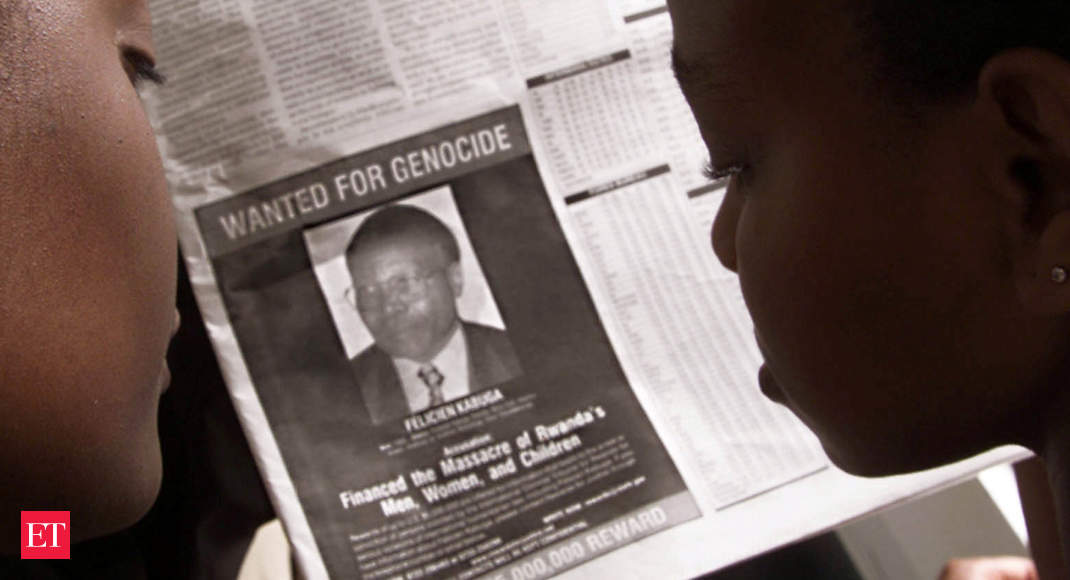

Alleged Rwandan genocide bankroller to be tried in Arusha: judge

France arrests fugitive 'financier' of Rwanda genocide

France arrests fugitive 'financier' of Rwanda genocide

ICT tenders: SITA steams ahead

ICT tenders: Something for everyone

BTE, BRSS, WVE and FLXN among notable midday movers

VisTracks Teams With Micronet to Deliver DOT-Compliant Solutions

Source: https://incomestatements.info

Category: Stock Reports