See more : ASML Holding N.V. (ASML) Income Statement Analysis – Financial Results

Complete financial analysis of MKS Instruments, Inc. (MKSI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MKS Instruments, Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- Cypherpunk Holdings Inc. (CYFRF) Income Statement Analysis – Financial Results

- Baselode Energy Corp. (BSENF) Income Statement Analysis – Financial Results

- Edoc Acquisition Corp. (ADOCW) Income Statement Analysis – Financial Results

- Zhejiang Shaoxing RuiFeng Rural Commercial Bank Co.,Ltd (601528.SS) Income Statement Analysis – Financial Results

- Cytosorbents Corporation (CTSO) Income Statement Analysis – Financial Results

MKS Instruments, Inc. (MKSI)

About MKS Instruments, Inc.

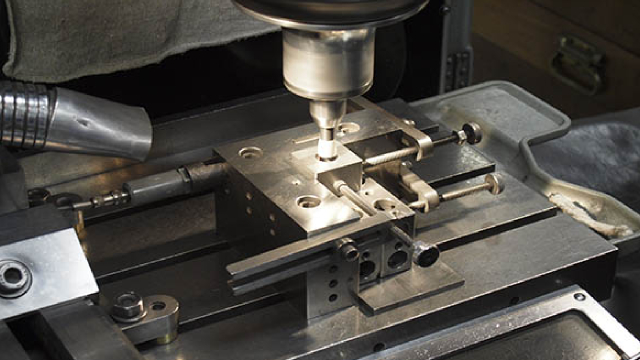

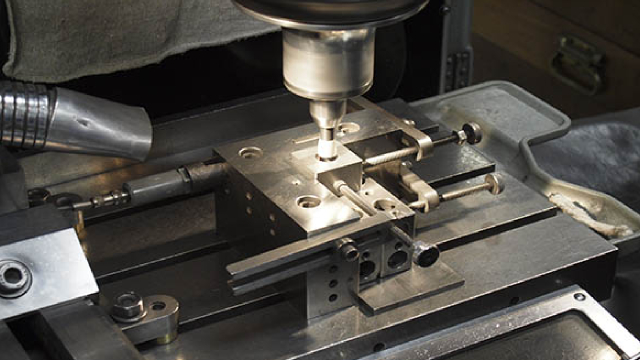

MKS Instruments, Inc. provides instruments, systems, subsystems, and process control solutions that measure, monitor, deliver, analyze, power, and control critical parameters of manufacturing processes worldwide. Its Vacuum & Analysis segment offers pressure and vacuum control solutions, including direct and indirect pressure measurement; materials delivery solutions comprising flow and valve technologies, as well as integrated pressure measurement and control subsystems, which provide customers with precise control capabilities; power solutions products, such as microwave, power delivery systems, radio frequency matching networks, and metrology products used in providing energy to etching, stripping, and deposition processes; and plasma and reactive gas products. Its Light & Motion segment offers laser products, such as continuous wave and pulsed nanosecond, diode and diode-pumped solid-state, and fiber laser technologies; and photonics products comprising motion control, optical tables and vibration isolation systems, photonic instruments, optics and optical assemblies, opto-mechanical components, temperature sensing products for wafer fabrication systems, and laser and LED measurement products, including laser power and energy meters, laser beam profilers, and optical and photonic subsystems. Its Equipment & Solutions segment provides laser-based systems for printed circuit board (PCB) manufacturing, including flexible interconnect PCB processing systems and high-density interconnect solutions for rigid PCB manufacturing and substrate processing, and multi-layer ceramic capacitor test systems. It serves semiconductor, industrial technologies, life and health sciences, research, and defense markets. It sells its products and services through its direct sales organization, independent distributors, and sales representatives, as well as through its websites and product catalogs. The company was incorporated in 1961 and is headquartered in Andover, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.62B | 3.55B | 2.95B | 2.33B | 1.90B | 2.08B | 1.92B | 1.30B | 813.52M | 780.87M | 669.42M | 643.51M | 822.52M | 853.11M | 411.41M | 646.99M | 780.49M | 782.80M | 509.29M | 555.08M | 337.29M | 314.77M | 286.81M | 326.96M | 187.10M | 139.80M |

| Cost of Revenue | 1.98B | 2.00B | 1.57B | 1.28B | 1.07B | 1.10B | 1.02B | 729.72M | 450.65M | 443.10M | 402.85M | 374.03M | 447.53M | 474.48M | 273.32M | 387.05M | 449.00M | 444.68M | 308.86M | 335.71M | 219.18M | 208.98M | 201.23M | 170.04M | 101.00M | 77.60M |

| Gross Profit | 1.64B | 1.55B | 1.38B | 1.05B | 830.40M | 979.48M | 891.45M | 565.62M | 362.87M | 337.77M | 266.57M | 269.48M | 374.99M | 378.64M | 138.09M | 259.94M | 331.49M | 338.12M | 200.43M | 219.37M | 118.11M | 105.80M | 85.58M | 156.91M | 86.10M | 62.20M |

| Gross Profit Ratio | 45.33% | 43.61% | 46.79% | 45.04% | 43.71% | 47.20% | 46.53% | 43.67% | 44.60% | 43.26% | 39.82% | 41.88% | 45.59% | 44.38% | 33.57% | 40.18% | 42.47% | 43.19% | 39.36% | 39.52% | 35.02% | 33.61% | 29.84% | 47.99% | 46.02% | 44.49% |

| Research & Development | 288.00M | 241.00M | 200.00M | 173.10M | 164.10M | 135.72M | 132.56M | 110.58M | 68.31M | 62.89M | 63.57M | 60.12M | 61.03M | 62.69M | 53.54M | 78.54M | 72.17M | 69.70M | 55.92M | 56.97M | 47.65M | 46.00M | 37.96M | 23.01M | 13.20M | 12.10M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 298.12M | 290.55M | 229.17M | 129.09M | 131.83M | 142.01M | 127.19M | 128.02M | 119.84M | 106.33M | 130.80M | 135.25M | 127.70M | 93.02M | 87.28M | 69.89M | 77.83M | 70.19M | 50.89M | 39.00M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 675.00M | 488.00M | 385.10M | 353.10M | 330.30M | 298.12M | 290.55M | 229.17M | 129.09M | 131.83M | 142.01M | 127.19M | 128.02M | 119.84M | 106.33M | 130.80M | 135.25M | 127.70M | 93.02M | 87.28M | 69.89M | 77.83M | 70.19M | 50.89M | 39.00M | 34.70M |

| Other Expenses | 2.23B | 146.00M | 55.30M | 55.20M | 67.40M | -1.94M | -5.90M | -1.24M | 6.76M | 4.95M | 2.14M | 1.04M | 1.02M | 601.00K | 4.41M | 9.00M | 16.18M | 17.38M | 10.86M | 14.76M | 14.69M | 13.90M | 11.03M | 10.52M | 6.20M | 40.90M |

| Operating Expenses | 963.00M | 875.00M | 640.40M | 581.40M | 561.80M | 478.36M | 468.85M | 375.43M | 204.16M | 199.66M | 207.72M | 188.34M | 190.06M | 183.81M | 164.28M | 224.41M | 223.60M | 214.78M | 159.80M | 159.02M | 132.23M | 137.73M | 119.18M | 84.42M | 58.40M | 53.00M |

| Cost & Expenses | 5.18B | 2.88B | 2.21B | 1.86B | 1.63B | 1.57B | 1.49B | 1.11B | 654.81M | 642.76M | 610.57M | 562.37M | 637.59M | 658.29M | 437.60M | 611.46M | 672.60M | 659.46M | 468.66M | 494.73M | 351.42M | 346.70M | 320.40M | 254.47M | 159.40M | 130.60M |

| Interest Income | 17.00M | 4.00M | 600.00K | 1.40M | 5.40M | 5.78M | 3.02M | 2.56M | 3.00M | 1.32M | 999.00K | 1.06M | 1.16M | 1.05M | 1.70M | 7.00M | 15.29M | 9.37M | 7.27M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 356.00M | 177.00M | 25.40M | 29.10M | 44.10M | 16.94M | 30.99M | 30.61M | 143.00K | 72.00K | 85.00K | 146.00K | 32.00K | 135.00K | 62.00K | 577.00K | 806.00K | 974.00K | 810.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 397.00M | 216.00M | 104.10M | 99.20M | 110.03M | 79.85M | 82.56M | 65.93M | 6.76M | 4.95M | 2.14M | 1.04M | 1.02M | 1.28M | 4.41M | 9.00M | 30.64M | 31.35M | 26.22M | 27.84M | 28.20M | 28.73M | 26.71M | 10.52M | 6.20M | 6.20M |

| EBITDA | -1.18B | 888.00M | 795.00M | 551.30M | 338.64M | 578.12M | 505.65M | 272.44M | 180.82M | 158.62M | 82.38M | 89.72M | 199.06M | 210.38M | -220.10M | 65.15M | 151.47M | 163.26M | 74.03M | 95.58M | 14.07M | -3.20M | -6.89M | 102.37M | 33.90M | 15.40M |

| EBITDA Ratio | -32.44% | 24.84% | 28.34% | 24.27% | 19.69% | 28.16% | 26.22% | 17.54% | 20.60% | 18.70% | 9.18% | 13.84% | 22.61% | 22.99% | 46.80% | 6.88% | 18.05% | 19.86% | 12.55% | 14.99% | 4.37% | 2.49% | 3.23% | 25.55% | 17.69% | 10.66% |

| Operating Income | -1.55B | 617.00M | 698.90M | 453.80M | 219.80M | 494.06M | 406.63M | 157.27M | 156.61M | 135.14M | 58.39M | 74.22M | 184.93M | 195.51M | -240.50M | 35.53M | 106.99M | 122.54M | 40.55M | 59.91M | -15.72M | -43.05M | -43.64M | 72.49M | 27.70M | 9.20M |

| Operating Income Ratio | -42.90% | 17.39% | 23.69% | 19.48% | 11.57% | 23.81% | 21.22% | 12.14% | 19.25% | 17.31% | 8.72% | 11.53% | 22.48% | 22.92% | -58.46% | 5.49% | 13.71% | 15.65% | 7.96% | 10.79% | -4.66% | -13.68% | -15.22% | 22.17% | 14.80% | 6.58% |

| Total Other Income/Expenses | -374.00M | -184.00M | -33.40M | -30.80M | -42.00M | -13.15M | 40.99M | -29.29M | 2.86M | 1.25M | 914.00K | 913.00K | 1.13M | 917.00K | -67.20M | 5.52M | 13.03M | 8.40M | 6.46M | 7.32M | 1.98M | 1.53M | -2.42M | 4.58M | 1.50M | -1.10M |

| Income Before Tax | -1.93B | 433.00M | 665.50M | 423.00M | 177.80M | 480.95M | 447.63M | 127.98M | 159.47M | 136.39M | 59.30M | 75.14M | 186.05M | 196.42M | -238.86M | 41.05M | 120.02M | 130.94M | 47.01M | 67.23M | -13.73M | -41.52M | -46.06M | 73.95M | 29.20M | 8.10M |

| Income Before Tax Ratio | -53.23% | 12.21% | 22.56% | 18.15% | 9.36% | 23.18% | 23.36% | 9.88% | 19.60% | 17.47% | 8.86% | 11.68% | 22.62% | 23.02% | -58.06% | 6.35% | 15.38% | 16.73% | 9.23% | 12.11% | -4.07% | -13.19% | -16.06% | 22.62% | 15.61% | 5.79% |

| Income Tax Expense | -87.00M | 100.00M | 114.10M | 72.90M | 37.40M | 88.05M | 108.49M | 23.17M | 37.17M | 20.62M | 23.53M | 27.11M | 56.32M | 63.51M | -26.20M | 10.94M | 33.66M | 36.71M | 12.44M | -2.61M | 2.65M | -1.98M | -15.01M | 27.72M | 5.20M | 3.10M |

| Net Income | -1.84B | 333.00M | 551.00M | 350.00M | 140.40M | 392.90M | 339.13M | 104.81M | 122.30M | 115.78M | 35.78M | 48.03M | 129.73M | 142.59M | -212.66M | 30.12M | 86.36M | 94.24M | 34.57M | 69.84M | -16.39M | -39.54M | -31.04M | 46.23M | 24.00M | 5.00M |

| Net Income Ratio | -50.83% | 9.39% | 18.68% | 15.02% | 7.39% | 18.93% | 17.70% | 8.09% | 15.03% | 14.83% | 5.34% | 7.46% | 15.77% | 16.71% | -51.69% | 4.65% | 11.06% | 12.04% | 6.79% | 12.58% | -4.86% | -12.56% | -10.82% | 14.14% | 12.83% | 3.58% |

| EPS | -27.56 | 5.58 | 9.95 | 6.35 | 2.57 | 7.22 | 6.26 | 1.96 | 2.30 | 2.17 | 0.67 | 0.91 | 2.49 | 2.85 | -4.31 | 0.61 | 1.53 | 1.70 | 0.64 | 1.30 | -0.32 | -0.79 | -0.83 | 1.34 | 1.05 | 0.28 |

| EPS Diluted | -27.56 | 5.56 | 9.90 | 6.33 | 2.55 | 7.14 | 6.16 | 1.94 | 2.28 | 2.16 | 0.67 | 0.90 | 2.45 | 2.80 | -4.31 | 0.59 | 1.51 | 1.68 | 0.63 | 1.28 | -0.32 | -0.79 | -0.83 | 1.28 | 1.00 | 0.27 |

| Weighted Avg Shares Out | 66.80M | 59.70M | 55.40M | 55.10M | 54.71M | 54.40M | 54.14M | 53.47M | 53.28M | 53.23M | 53.06M | 52.69M | 52.17M | 50.08M | 49.32M | 49.72M | 56.35M | 55.40M | 54.07M | 53.52M | 51.58M | 50.00M | 37.49M | 34.60M | 22.78M | 18.05M |

| Weighted Avg Shares Out (Dil) | 66.80M | 59.90M | 55.70M | 55.30M | 55.11M | 55.00M | 55.07M | 54.05M | 53.56M | 53.52M | 53.48M | 53.23M | 52.85M | 50.93M | 49.32M | 50.75M | 57.17M | 55.96M | 54.63M | 54.66M | 51.58M | 50.00M | 37.49M | 36.17M | 23.95M | 18.72M |

MKS Instruments Named One of America's Most Responsible Companies

Why MKS Instruments (MKSI) is a Top Momentum Stock for the Long-Term

Are Investors Undervaluing MKS Instruments (MKSI) Right Now?

MKSI vs. ENTG: Which Stock Is the Better Value Option?

MKS Instruments to Participate at Upcoming Investor Conferences

Why MKS Instruments (MKSI) is a Top Value Stock for the Long-Term

Wall Street Analysts Think MKS Instruments (MKSI) Could Surge 31.17%: Read This Before Placing a Bet

Earnings Estimates Moving Higher for MKS Instruments (MKSI): Time to Buy?

Is MKS Instruments (MKSI) Stock Undervalued Right Now?

Don't Overlook MKS Instruments (MKSI) International Revenue Trends While Assessing the Stock

Source: https://incomestatements.info

Category: Stock Reports