See more : DTE Energy Company JR SUB DB 2017 E (DTW) Income Statement Analysis – Financial Results

Complete financial analysis of Mesa Laboratories, Inc. (MLAB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Mesa Laboratories, Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- Liaoning Port Co., Ltd. (601880.SS) Income Statement Analysis – Financial Results

- Usha Martin Limited (USHAMART.BO) Income Statement Analysis – Financial Results

- J. B. Chemicals & Pharmaceuticals Limited (JBCHEPHARM.BO) Income Statement Analysis – Financial Results

- Abdullah Saad Mohammed Abo Moati for Bookstores Company (4191.SR) Income Statement Analysis – Financial Results

- People Co., Ltd. (7865.T) Income Statement Analysis – Financial Results

Mesa Laboratories, Inc. (MLAB)

About Mesa Laboratories, Inc.

Mesa Laboratories, Inc. develops, manufactures, and sells life sciences tools and quality control products and services in the United States, Europe, the Asia Pacific, and internationally. The company's Sterilization and Disinfection Control segment manufactures and sells biological, cleaning, and chemical indicators that are used to assess the effectiveness of sterilization and disinfection processes in the hospital, dental, medical device, and pharmaceutical industries. This segment also provides testing and laboratory services primarily to the dental industry. Its Biopharmaceutical Development segment develops, manufactures, and sells automated systems for protein analysis (immunoassays) and peptide synthesis solutions. This segment's solutions include protein analysis comprising analysis equipment, CDs, kits, and buffers; and peptide synthesizers that enables to automate chemically synthesized peptides that are used in the creation of peptide therapies, biomaterials, cosmetics, and general research. The company's Calibration Solutions segment designs, manufactures, and markets quality control and calibration products to measure or calibrate temperature, pressure, pH, humidity, and other such parameters used for health and safety purposes in the hospital, medical device manufacturing, pharmaceutical manufacturing, and various laboratory and healthcare environments. This segment's products include continuous monitoring systems, dialysate meters and consumables, data loggers, gas flow calibration and air sampling equipment, and torque testing systems. Its Clinical Genomics segment develops, manufactures, and sells genetic analysis tools that include MassARRAY system and consumables, including chips, panels, and chemical reagent solutions used by clinical labs to perform genomic clinical testing in several therapeutic areas, such as newborn screenings, pharmacogenetics, and oncology. The company was incorporated in 1982 and is headquartered in Lakewood, Colorado.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 216.19M | 219.08M | 184.34M | 133.94M | 117.69M | 103.14M | 96.18M | 93.67M | 84.66M | 71.33M | 52.72M | 46.44M | 39.62M | 32.83M | 21.93M | 21.54M | 19.56M | 17.24M | 11.58M | 10.04M | 9.13M | 9.08M | 9.04M | 9.10M | 8.66M | 8.10M | 7.90M | 7.80M | 8.10M | 6.60M | 6.20M | 4.40M | 3.80M | 3.50M | 2.80M | 1.10M | 1.00M |

| Cost of Revenue | 82.94M | 85.39M | 75.25M | 46.92M | 52.75M | 42.22M | 41.56M | 40.43M | 33.25M | 27.94M | 21.04M | 17.57M | 16.11M | 13.26M | 8.74M | 7.72M | 6.70M | 6.35M | 4.15M | 3.72M | 3.43M | 3.40M | 3.65M | 3.07M | 2.80M | 2.40M | 2.50M | 2.70M | 2.80M | 2.20M | 2.10M | 1.40M | 1.20M | 1.20M | 1.20M | 400.00K | 400.00K |

| Gross Profit | 133.25M | 133.69M | 109.09M | 87.01M | 64.93M | 60.92M | 54.62M | 53.24M | 51.41M | 43.39M | 31.69M | 28.86M | 23.51M | 19.57M | 13.19M | 13.82M | 12.86M | 10.90M | 7.44M | 6.32M | 5.70M | 5.68M | 5.39M | 6.03M | 5.85M | 5.70M | 5.40M | 5.10M | 5.30M | 4.40M | 4.10M | 3.00M | 2.60M | 2.30M | 1.60M | 700.00K | 600.00K |

| Gross Profit Ratio | 61.64% | 61.02% | 59.18% | 64.97% | 55.17% | 59.06% | 56.79% | 56.84% | 60.73% | 60.83% | 60.10% | 62.16% | 59.35% | 59.61% | 60.17% | 64.16% | 65.74% | 63.19% | 64.21% | 62.94% | 62.44% | 62.59% | 59.61% | 66.30% | 67.62% | 70.37% | 68.35% | 65.38% | 65.43% | 66.67% | 66.13% | 68.18% | 68.42% | 65.71% | 57.14% | 63.64% | 60.00% |

| Research & Development | 19.30M | 20.49M | 15.77M | 10.39M | 6.36M | 3.51M | 3.54M | 4.16M | 3.97M | 3.29M | 2.32M | 2.01M | 1.36M | 1.44M | 669.00K | 636.00K | 532.00K | 392.00K | 358.00K | 358.00K | 332.00K | 259.97K | 289.94K | 308.17K | 281.65K | 200.00K | 300.00K | 300.00K | 300.00K | 400.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 72.87M | 72.44M | 60.31M | 45.70M | 37.83M | 31.30M | 26.26M | 22.81M | 23.62M | 17.06M | 11.46M | 9.12M | 5.42M | 4.58M | 2.54M | 2.52M | 5.27M | 4.84M | 2.97M | 2.49M | 2.12M | 2.24M | 2.16M | 2.40M | 2.39M | 2.20M | 2.10M | 2.10M | 2.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 38.63M | 37.44M | 28.31M | 18.48M | 12.91M | 8.26M | 8.82M | 9.96M | 7.50M | 7.18M | 6.12M | 4.63M | 3.91M | 3.69M | 2.62M | 3.05M | 2.85B | 2.77B | 1.88B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 111.49M | 109.88M | 88.62M | 64.18M | 50.74M | 39.56M | 35.08M | 32.77M | 31.12M | 24.23M | 17.58M | 13.75M | 9.33M | 8.26M | 5.16M | 5.57M | 5.27M | 4.84M | 2.97M | 2.49M | 2.12M | 2.24M | 2.16M | 2.40M | 2.39M | 2.20M | 2.10M | 2.10M | 2.30M | 1.80M | 2.30M | 1.60M | 1.30M | 1.20M | 1.00M | 600.00K | 600.00K |

| Other Expenses | 274.53M | -3.71M | -1.13M | 91.00K | 50.00K | -1.16M | -1.88M | -2.02M | -768.00K | -517.00K | 1.32M | -126.00K | 350.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 332.59K | 200.00K | 200.00K | 200.00K | 300.00K | 300.00K | 200.00K | 100.00K | 100.00K | 200.00K | 100.00K | 0.00 | 0.00 |

| Operating Expenses | 406.55M | 130.37M | 104.39M | 74.66M | 57.14M | 43.06M | 38.62M | 36.93M | 35.09M | 27.53M | 19.90M | 15.76M | 10.68M | 9.70M | 5.83M | 6.21M | 5.80M | 5.24M | 3.33M | 2.85M | 2.45M | 2.50M | 2.45M | 2.71M | 3.01M | 2.60M | 2.60M | 2.60M | 2.90M | 2.50M | 2.50M | 1.70M | 1.40M | 1.40M | 1.10M | 600.00K | 600.00K |

| Cost & Expenses | 488.26M | 215.76M | 179.63M | 121.58M | 109.90M | 85.28M | 80.18M | 77.35M | 68.34M | 55.47M | 40.94M | 33.33M | 26.79M | 22.96M | 14.56M | 13.93M | 12.50M | 11.58M | 7.47M | 6.57M | 5.88M | 5.90M | 6.10M | 5.77M | 5.81M | 5.00M | 5.10M | 5.30M | 5.70M | 4.70M | 4.60M | 3.10M | 2.60M | 2.60M | 2.30M | 1.00M | 1.00M |

| Interest Income | 0.00 | 4.77M | 3.89M | 107.00K | 960.00K | 1.72M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 86.00K | 195.00M | 130.00M | 193.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 5.70M | 3.71M | 3.89M | 8.02M | 5.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 31.57M | 33.13M | 25.07M | 17.47M | 12.87M | 9.47M | 9.47M | 8.74M | 7.17M | 5.66M | 3.84M | 3.43M | 2.22M | 1.84M | 786.00K | 788.00K | 742.00K | 669.00K | 93.00K | 90.00K | 97.00K | 115.35K | 115.09K | 521.69K | 332.59K | 200.00K | 200.00K | 200.00K | 300.00K | 300.00K | 200.00K | 100.00K | 100.00K | 200.00K | 100.00K | 0.00 | 0.00 |

| EBITDA | -238.38M | 36.45M | 29.77M | 12.36M | 8.09M | 18.09M | 9.77M | 25.05M | 23.50M | 21.52M | 15.63M | 16.54M | 14.55M | 11.71M | 8.15M | 8.40M | 7.80M | 6.33M | 4.20M | 3.57M | 3.35M | 3.30M | 3.06M | 3.85M | 3.18M | 3.30M | 3.20M | 2.70M | 2.70M | 2.20M | 1.80M | 1.40M | 1.30M | 1.10M | 600.00K | 100.00K | 0.00 |

| EBITDA Ratio | -110.26% | 1.52% | 2.55% | 9.23% | 6.87% | 34.28% | 31.01% | 17.42% | 19.28% | 22.24% | 22.35% | 28.22% | 39.22% | 36.01% | 33.76% | 38.99% | 39.90% | 36.70% | 36.29% | 35.50% | 36.66% | 36.36% | 33.80% | 43.13% | 36.72% | 37.04% | 35.44% | 33.33% | 32.10% | 33.33% | 29.03% | 29.55% | 31.58% | 31.43% | 21.43% | 9.09% | 0.00% |

| Operating Income | -272.08M | -30.50M | -20.37M | -5.30M | -4.90M | 9.78M | 2.18M | 16.31M | 16.32M | 15.86M | 11.79M | 13.10M | 12.48M | 9.86M | 7.37M | 7.61M | 7.06M | 5.66M | 4.11M | 3.48M | 3.25M | 3.19M | 2.94M | 2.81M | 2.85M | 3.10M | 2.80M | 2.50M | 2.40M | 1.90M | 1.60M | 1.30M | 1.20M | 900.00K | 500.00K | 100.00K | 0.00 |

| Operating Income Ratio | -125.85% | -13.92% | -11.05% | -3.96% | -4.16% | 9.48% | 2.27% | 17.42% | 19.28% | 22.24% | 22.35% | 28.22% | 31.49% | 30.05% | 33.60% | 35.33% | 36.10% | 32.82% | 35.48% | 34.61% | 35.60% | 35.09% | 32.53% | 30.84% | 32.87% | 38.27% | 35.44% | 32.05% | 29.63% | 28.79% | 25.81% | 29.55% | 31.58% | 25.71% | 17.86% | 9.09% | 0.00% |

| Total Other Income/Expenses | -3.57M | -3.71M | -1.13M | -10.06M | -4.06M | -1.16M | -1.88M | -2.02M | -768.00K | -517.00K | 1.32M | -126.00K | -146.00K | -113.00K | 36.00K | 86.00K | 195.00K | 130.00K | 193.00K | 98.00K | 50.00K | 55.16K | 78.51K | 70.96K | 243.83K | 100.00K | 400.00K | 100.00K | 0.00 | -100.00K | -100.00K | 0.00 | 100.00K | 100.00K | 0.00 | 100.00K | 0.00 |

| Income Before Tax | -275.65M | -389.00K | 3.57M | 2.30M | 3.43M | 8.62M | 301.00K | 14.30M | 15.56M | 15.35M | 13.10M | 12.98M | 12.33M | 9.75M | 7.40M | 7.69M | 7.26M | 5.79M | 4.30M | 3.57M | 3.30M | 3.24M | 3.02M | 2.88M | 3.09M | 3.20M | 3.20M | 2.60M | 2.40M | 1.80M | 1.50M | 1.30M | 1.30M | 1.00M | 0.00 | 200.00K | 0.00 |

| Income Before Tax Ratio | -127.50% | -0.18% | 1.94% | 1.72% | 2.92% | 8.36% | 0.31% | 15.26% | 18.37% | 21.52% | 24.85% | 27.95% | 31.13% | 29.71% | 33.76% | 35.73% | 37.10% | 33.57% | 37.15% | 35.58% | 36.15% | 35.69% | 33.40% | 31.62% | 35.69% | 39.51% | 40.51% | 33.33% | 29.63% | 27.27% | 24.19% | 29.55% | 34.21% | 28.57% | 0.00% | 18.18% | 0.00% |

| Income Tax Expense | -21.40M | -1.32M | 1.70M | -971.00K | 2.08M | 1.14M | 3.26M | 3.11M | 4.39M | 5.76M | 4.10M | 4.53M | 4.41M | 3.57M | 2.64M | 2.90M | 2.65M | 1.83M | 1.50M | 1.26M | 1.17M | 1.11M | 989.66K | 1.05M | 982.46K | 1.10M | 1.10M | 900.00K | 800.00K | 600.00K | 500.00K | 400.00K | 400.00K | 100.00K | 100.00K | 100.00K | 0.00 |

| Net Income | -254.25M | 930.00K | 1.87M | 3.27M | 1.35M | 7.48M | -2.96M | 11.18M | 11.17M | 9.58M | 9.00M | 8.45M | 7.92M | 6.18M | 4.77M | 4.79M | 4.61M | 3.96M | 2.81M | 2.31M | 2.13M | 2.13M | 2.03M | 1.83M | 2.11M | 2.10M | 2.10M | 1.70M | 1.60M | 1.20M | 1.00M | 900.00K | 900.00K | 900.00K | 400.00K | 100.00K | 0.00 |

| Net Income Ratio | -117.60% | 0.42% | 1.01% | 2.44% | 1.15% | 7.26% | -3.08% | 11.94% | 13.19% | 13.43% | 17.07% | 18.20% | 19.99% | 18.84% | 21.75% | 22.24% | 23.57% | 22.96% | 24.22% | 23.03% | 23.34% | 23.42% | 22.46% | 20.13% | 24.34% | 25.93% | 26.58% | 21.79% | 19.75% | 18.18% | 16.13% | 20.45% | 23.68% | 25.71% | 14.29% | 9.09% | 0.00% |

| EPS | -47.20 | 0.17 | 0.36 | 0.66 | 0.32 | 1.95 | -0.79 | 3.04 | 3.10 | 2.72 | 2.61 | 2.52 | 2.41 | 1.91 | 1.49 | 1.51 | 1.46 | 1.25 | 0.94 | 0.76 | 0.70 | 0.66 | 0.60 | 0.59 | 0.55 | 0.51 | 0.48 | 0.39 | 0.29 | 0.29 | 0.23 | 0.21 | 0.21 | 0.20 | 0.10 | 0.04 | 0.01 |

| EPS Diluted | -47.20 | 0.17 | 0.35 | 0.64 | 0.31 | 1.86 | -0.79 | 2.91 | 2.97 | 2.63 | 2.49 | 2.35 | 2.29 | 1.86 | 1.45 | 1.48 | 1.41 | 1.22 | 0.92 | 0.74 | 0.68 | 0.64 | 0.59 | 0.59 | 0.55 | 0.50 | 0.47 | 0.39 | 0.29 | 0.29 | 0.23 | 0.21 | 0.21 | 0.20 | 0.10 | 0.04 | 0.01 |

| Weighted Avg Shares Out | 5.39M | 5.32M | 5.21M | 4.98M | 4.20M | 3.84M | 3.75M | 3.68M | 3.61M | 3.52M | 3.45M | 3.36M | 3.29M | 3.23M | 3.19M | 3.18M | 3.17M | 3.16M | 2.99M | 3.06M | 3.05M | 3.23M | 3.41M | 3.69M | 3.82M | 4.14M | 4.30M | 4.47M | 4.33M | 4.14M | 4.35M | 4.29M | 4.29M | 4.50M | 4.00M | 2.50M | 3.48M |

| Weighted Avg Shares Out (Dil) | 5.39M | 5.36M | 5.34M | 5.12M | 4.37M | 4.03M | 3.77M | 3.84M | 3.76M | 3.65M | 3.61M | 3.59M | 3.46M | 3.33M | 3.29M | 3.24M | 3.28M | 3.23M | 3.05M | 3.14M | 3.14M | 3.30M | 3.45M | 3.72M | 3.84M | 4.17M | 4.40M | 4.47M | 4.33M | 4.14M | 4.35M | 4.29M | 4.29M | 4.50M | 4.00M | 2.50M | 3.48M |

Infection Control Market overview 2020, In-depth analysis with Impact of COVID-19, Types, Opportunities, Revenue and Forecast 2026

Infection Control Market Research Report with Detailed Analysis 2020 & Forecast to 2026

Mesa Laboratories, Inc. (NASDAQ:MLAB) Given Average Rating of “Hold” by Brokerages

Parametric Portfolio Associates LLC Boosts Holdings in Mesa Laboratories, Inc. (NASDAQ:MLAB)

Mesa Laboratories, Inc. (NASDAQ:MLAB) Shares Sold by Balyasny Asset Management LLC

Mackenzie Financial Corp Sells 750 Shares of Mesa Laboratories, Inc. (NASDAQ:MLAB)

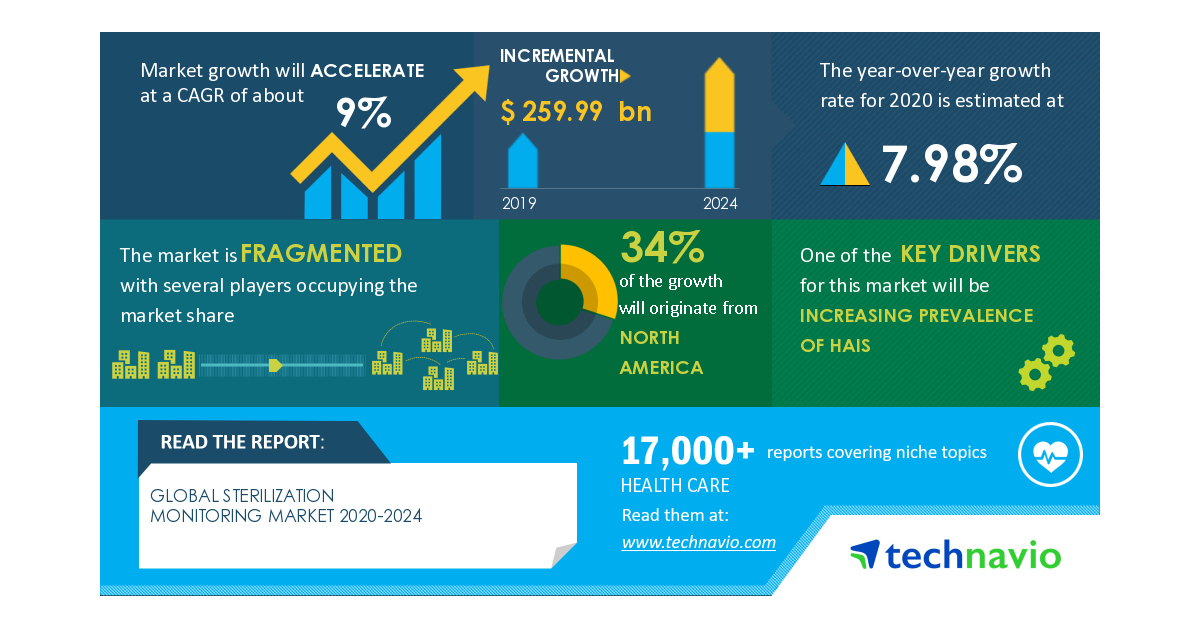

COVID-19 Impact and Recovery Analysis- Sterilization Monitoring Market 2020-2024 | Increasing Prevalence of HAIs to Boost Growth | Technavio

Mesa Laboratories, Inc. (NASDAQ:MLAB) Announces Quarterly Dividend of $0.16

Mesa Laboratories, Inc. (NASDAQ:MLAB) Receives Average Recommendation of "Buy" from Brokerages

Mesa Laboratories (NASDAQ:MLAB) Stock Rating Lowered by ValuEngine

Source: https://incomestatements.info

Category: Stock Reports