See more : Diffusion Engineers Limited (DIFFNKG.NS) Income Statement Analysis – Financial Results

Complete financial analysis of Medallion Resources Ltd. (MLLOF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Medallion Resources Ltd., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Provident Financial Holdings, Inc. (PROV) Income Statement Analysis – Financial Results

- Guangzhou Tech-Long Packaging Machinery Co.,Ltd. (002209.SZ) Income Statement Analysis – Financial Results

- JUTEC Holdings Corporation (3157.T) Income Statement Analysis – Financial Results

- Jeffersonville Bancorp (JFBC) Income Statement Analysis – Financial Results

- Paramount Resources Ltd. (POU.TO) Income Statement Analysis – Financial Results

Medallion Resources Ltd. (MLLOF)

About Medallion Resources Ltd.

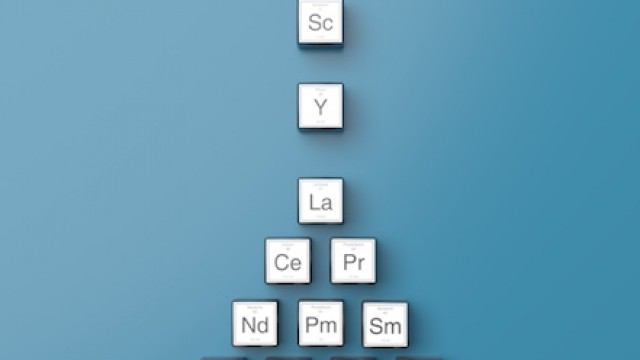

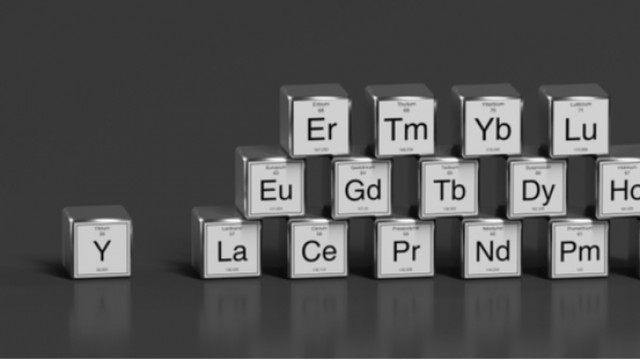

Medallion Resources Ltd. focuses on a rare earth element business. It is involving in processing monazite, a by-product mineral from heavy-mineral-sands mining operations. The company was incorporated in 1989 and is based in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.52K | 3.44K | 841.00 | 842.00 | 397.80K | 51.28K | 0.00 | 5.64K | 76.42K |

| Cost of Revenue | 0.00 | 49.22K | 565.22 | 275.79 | 283.60 | 95.70 | 99.96 | 290.00 | 238.00 | 160.78 | 528.53 | 697.12 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 0.00 | -49.22K | -565.22 | -275.79 | -283.60 | -95.70 | -99.96 | -290.00 | -238.00 | -160.78 | -528.53 | -697.12 | 0.00 | 0.00 | 0.00 | 0.00 | 4.52K | 3.44K | 841.00 | 842.00 | 397.80K | 51.28K | 0.00 | 5.64K | 76.42K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% | 100.00% | 100.00% |

| Research & Development | 79.04K | 320.38K | 535.22K | 275.79K | 283.60K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 697.12K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 298.69K | 1.63M | 842.00K | 1.62M | 993.43K | 600.22K | 725.54K | 481.07K | 701.77K | 1.05M | 1.72M | 980.48K | 1.71M | 1.36M | 711.35K | 489.14K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 106.24K | 148.76K |

| Selling & Marketing | 18.14K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.56K | 7.52K |

| SG&A | 316.82K | 1.63M | 842.00K | 1.62M | 993.43K | 600.22K | 725.54K | 481.07K | 701.77K | 1.05M | 1.72M | 980.48K | 1.71M | 1.36M | 711.35K | 489.14K | 303.90K | 267.28K | 128.18K | 43.75K | 45.14K | 38.36K | 55.07K | 117.80K | 156.28K |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 72.45K | 70.84K | 147.04K | 120.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 51.32K | 0.00 | 0.00 |

| Operating Expenses | 395.86K | 1.95M | 1.41M | 1.89M | 1.19M | 695.91K | 825.51K | 481.36K | 724.08K | 1.05M | 1.72M | 1.68M | 1.71M | 1.36M | -713.29K | 492.02K | 305.54K | 267.28K | 128.18K | 43.75K | 45.14K | 59.23K | 56.90K | 268.18K | 819.03K |

| Cost & Expenses | 395.86K | 2.00M | 1.41M | 1.89M | 1.19M | 695.91K | 825.51K | 481.36K | 724.08K | 1.05M | 1.72M | 1.68M | 1.71M | 1.36M | -713.29K | 492.02K | 305.54K | 267.28K | 128.18K | 43.75K | 45.14K | 59.23K | 56.90K | 268.18K | 819.03K |

| Interest Income | 274.86K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.68K | 12.83K | 33.67K | 14.04K | 141.00 | 2.69K | 4.52K | 0.00 | 841.00 | 842.00 | 451.00 | 0.00 | 259.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 207.08K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 307.00 | 7.90K | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 18.61K | 49.22K | 1.21M | 1.64M | 1.13M | 623.69K | 290.00 | 290.00 | 238.00 | 432.00 | 785.00 | 870.00 | 1.02K | 1.35K | 1.93K | 2.88K | 1.63K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 758.00 | 2.28K | 2.28K |

| EBITDA | -395.86K | -1.68M | 0.00 | 0.00 | 0.00 | 0.00 | -722.18K | -420.69K | -570.28K | -881.18K | -1.50M | -1.36M | -1.09M | -1.32M | 834.23K | 907.68K | -299.39K | -263.84K | -127.34K | -42.91K | 352.66K | -7.95K | 45.62K | -260.26K | -740.32K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,628.01% | -7,672.06% | -15,141.14% | -5,096.08% | 88.65% | -15.50% | 0.00% | -4,618.58% | -968.73% |

| Operating Income | -395.86K | -2.00M | -1.82M | -1.88M | -1.19M | -695.91K | -825.51K | -481.36K | -724.08K | -1.05M | -1.72M | -1.72M | -1.75M | -1.32M | 832.30K | 904.80K | -301.02K | -263.84K | -127.34K | -42.91K | 352.66K | -7.95K | -158.67K | -262.54K | -742.61K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,664.14% | -7,672.06% | -15,141.14% | -5,096.08% | 88.65% | -15.50% | 0.00% | -4,659.11% | -971.72% |

| Total Other Income/Expenses | -1.38M | -416.69K | 745.44K | 18.44K | 223.12K | -72.22K | -103.04K | 0.00 | -3.62K | -15.50K | 105.70K | -268.26K | -469.96K | -6.84K | -1.52M | -2.79M | 0.00 | 263.84K | 127.34K | 42.91K | 397.35K | 7.95K | -50.45K | 0.00 | 0.00 |

| Income Before Tax | -1.77M | -2.09M | -997.26K | -1.90M | -1.19M | -695.91K | -825.51K | -481.36K | -727.71K | -1.06M | -1.62M | -1.98M | -2.22M | -1.33M | -685.12K | -1.89M | 0.00 | 0.00 | 0.00 | 0.00 | 750.01K | 43.15K | -209.12K | 0.00 | 0.00 |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 188.54% | 84.15% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | 207.08K | -411.16K | 7.99K | 81.97K | 3.00K | -103.33 | -60.39 | 3.62K | 15.50K | -105.70K | 305.03K | 585.63K | -126.00K | -103.06K | -112.71K | 0.00 | 263.84K | 127.34K | 43.22K | 405.25K | 61.13K | 101.51K | 0.00 | 0.00 |

| Net Income | -1.31M | -2.09M | -997.26K | -1.90M | -1.19M | -698.91K | -825.51K | -481.36K | -727.71K | -1.06M | -1.62M | -1.98M | -2.22M | -1.20M | -582.06K | -1.77M | -301.02K | -263.84K | -127.34K | -43.22K | 344.76K | -17.97K | -107.09K | -262.54K | -742.61K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,664.14% | -7,672.06% | -15,141.14% | -5,132.66% | 86.67% | -35.05% | 0.00% | -4,659.11% | -971.72% |

| EPS | -0.18 | -0.21 | -0.10 | -0.23 | -0.19 | -0.16 | -0.25 | -0.17 | -0.29 | -0.54 | -0.94 | -1.23 | -0.20 | -0.14 | -0.13 | -0.58 | -0.15 | -0.15 | -0.09 | -0.03 | 0.24 | -0.01 | -0.08 | -0.19 | -0.67 |

| EPS Diluted | -0.18 | -0.21 | -0.10 | -0.23 | -0.19 | -0.16 | -0.25 | -0.17 | -0.29 | -0.54 | -0.94 | -1.23 | -0.20 | -0.14 | -0.13 | -0.58 | -0.15 | -0.15 | -0.09 | -0.03 | 0.24 | -0.01 | -0.08 | -0.19 | -0.67 |

| Weighted Avg Shares Out | 10.03M | 10.03M | 9.95M | 8.17M | 6.14M | 4.42M | 3.35M | 2.87M | 2.47M | 1.98M | 1.73M | 1.62M | 11.18M | 8.67M | 4.43M | 3.05M | 2.06M | 1.73M | 1.41M | 1.37M | 1.37M | 1.37M | 1.37M | 1.36M | 1.11M |

| Weighted Avg Shares Out (Dil) | 10.03M | 10.03M | 9.95M | 8.17M | 6.14M | 4.42M | 3.35M | 2.87M | 2.47M | 1.98M | 1.73M | 1.62M | 11.18M | 8.67M | 4.43M | 3.05M | 2.06M | 1.73M | 1.41M | 1.37M | 1.37M | 1.37M | 1.37M | 1.36M | 1.11M |

Medallion Resources reveals plans for share consolidation to enable dual listing

Medallion Resources strikes three-month exclusivity agreement with private research firm over emerging rare earth technologies

Medallion Resources appoints Dr Kurt Forrester as a director of the company

Medallion Resources making great strides with proprietary process to extract rare earths from mineral sand monazite

Medallion Resources reveals plans for potential up-list to major US stock market amid shift to renewable energy

Medallion Resources scales up rare earth separation research program with Purdue University

Medallion Resources Expands Rare Earth Element Separation Test Work with Purdue University and Provides Corporate Update

Medallion Resources boosts board with two executives who are investors in the rare earth space

Medallion Resources Adds Daniel Mamadou and Gabriel Alonso-Mendoza to Board

Medallion Resources poised to partner with Australian company ACDC to bring its rare earth separation technology to the Murray Basin

Source: https://incomestatements.info

Category: Stock Reports