See more : Tibet Mineral Development Co., LTD (000762.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of MedMen Enterprises Inc. (MMNFF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MedMen Enterprises Inc., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- Regal Corporation (7938.T) Income Statement Analysis – Financial Results

- Endurance Acquisition Corp. (EDNC) Income Statement Analysis – Financial Results

- GoGreen Investments Corporation (GOGN-UN) Income Statement Analysis – Financial Results

- Relic Technologies Limited (RELICTEC.BO) Income Statement Analysis – Financial Results

- Computer Age Management Services Limited (CAMS.NS) Income Statement Analysis – Financial Results

MedMen Enterprises Inc. (MMNFF)

About MedMen Enterprises Inc.

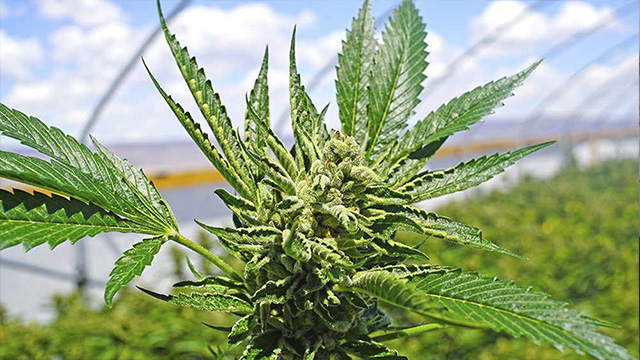

MedMen Enterprises Inc., together with its subsidiaries, operates as a cannabis company in the United States. The company cultivates, produces, distributes, and retails recreational and medicinal cannabis under the MedMen Red and LuxLyte brand names. As of December 25, 2021, it operated 29 stores in California, Florida, Nevada, Illinois, Arizona, Massachusetts, and New York. MedMen Enterprises Inc. is headquartered in Culver City, California.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 140.81M | 145.07M | 157.11M | 129.96M | 39.78M | 2.67M | 20.07K | 26.65K | 20.64K | 24.92K | 19.66K | 27.66K | 18.14K | 33.60K | 36.42K | 22.18K | 20.28K | 19.34K | 30.11K | 0.00 | 305.46K |

| Cost of Revenue | 71.08M | 77.78M | 98.99M | 69.09M | 25.93M | 1.80M | 7.89K | 7.66K | 7.96K | 7.78K | 9.02K | 10.70K | 9.33K | 10.32K | 9.36K | 10.82K | 8.19K | 7.78K | 19.30K | 0.00 | 395.02K |

| Gross Profit | 69.73M | 67.29M | 58.12M | 60.88M | 13.85M | 868.14K | 12.18K | 19.00K | 12.69K | 17.14K | 10.63K | 16.96K | 8.81K | 23.28K | 27.06K | 11.36K | 12.08K | 11.56K | 10.81K | 0.00 | -89.56K |

| Gross Profit Ratio | 49.52% | 46.39% | 36.99% | 46.84% | 34.81% | 32.49% | 60.69% | 71.27% | 61.46% | 68.78% | 54.09% | 61.32% | 48.56% | 69.30% | 74.31% | 51.23% | 59.59% | 59.76% | 35.90% | 0.00% | -29.32% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 6.49 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 108.72M | 124.59M | 200.27M | 234.65M | 98.18M | 14.14M | 136.18K | 240.61K | 133.04K | 236.99K | 53.70K | 28.22K | 41.69K | 41.73K | 11.11K | 8.91K | 9.37K | 19.11K | 45.59K | 0.00 | 0.00 |

| Selling & Marketing | 3.21M | 1.11M | 10.64M | 27.55M | 7.01M | 323.35K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 111.93M | 125.70M | 210.92M | 262.20M | 105.20M | 14.46M | 136.18K | 240.61K | 133.04K | 236.99K | 53.70K | 28.22K | 41.69K | 41.73K | 11.11K | 8.91K | 9.37K | 19.11K | 45.59K | 74.82K | 171.76K |

| Other Expenses | 19.10M | 30.89M | 39.95M | 20.98M | 5.26M | 1.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 216.33K | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 131.03M | 156.59M | 250.87M | 283.17M | 110.45M | 15.66M | 136.18K | 240.61K | 133.04K | 236.99K | 53.70K | 28.22K | 41.69K | 41.73K | 11.11K | 8.91K | 9.37K | 19.11K | 45.59K | 74.82K | 179.99K |

| Cost & Expenses | 202.11M | 234.37M | 349.86M | 352.26M | 136.39M | 17.46M | 144.07K | 248.26K | 140.99K | 244.77K | 62.73K | 38.92K | 51.02K | 52.05K | 20.47K | 19.73K | 17.56K | 26.90K | 64.89K | 74.82K | 575.01K |

| Interest Income | 91.59K | 649.23K | 766.04K | 701.79K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 43.07M | 61.37M | 49.49M | 22.82M | 16.11M | 512.44K | 135.37 | 6.53K | 2.46K | 30.07K | 35.41K | 34.97K | 35.93K | 30.44K | 37.00K | 31.38K | 29.77K | 17.16K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 25.74M | 34.46M | 43.71M | 23.54M | 5.15M | 1.57M | 22.82K | 6.53K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 216.33K | 0.00 | 10.08K | 0.00 | 0.00 |

| EBITDA | -35.56M | -54.84M | -149.04M | -198.75M | -91.45M | -13.22M | -124.01K | -221.61K | -120.35K | -219.85K | -43.07K | -11.26K | -32.88K | -18.45K | 15.95K | 2.45K | 219.04K | -7.55K | -24.71K | -74.82K | -269.55K |

| EBITDA Ratio | -25.26% | -37.81% | -94.86% | -152.93% | -229.87% | -494.85% | -618.00% | -831.49% | -582.98% | -882.08% | -219.12% | -40.73% | -181.26% | -54.90% | 43.80% | 11.04% | 1,080.18% | -39.05% | -82.07% | 0.00% | -88.24% |

| Operating Income | -61.30M | -89.30M | -192.75M | -222.30M | -96.60M | -14.79M | -124.01K | -228.14K | -120.35K | -219.85K | -43.07K | -11.26K | -32.88K | -18.45K | 15.95K | 2.45K | 2.72K | -7.55K | -34.79K | -74.82K | -269.55K |

| Operating Income Ratio | -43.53% | -61.56% | -122.68% | -171.05% | -242.83% | -553.54% | -618.00% | -855.98% | -582.98% | -882.08% | -219.12% | -40.73% | -181.26% | -54.90% | 43.80% | 11.04% | 13.40% | -39.05% | -115.55% | 0.00% | -88.24% |

| Total Other Income/Expenses | -114.15M | -67.40M | -328.92M | -22.30M | -11.01M | -2.91M | -18.81 | 0.00 | -2.46K | -30.07K | -35.41K | -34.97K | -35.93K | -30.44K | -37.00K | -31.38K | 186.55K | -17.16K | 360.22K | 0.00 | -1.00M |

| Income Before Tax | -175.45M | -143.61M | -515.35M | -263.23M | -110.73M | -15.38M | -124.14K | -228.14K | -122.80K | -249.92K | -78.48K | -46.23K | -68.81K | -48.88K | -21.05K | -28.93K | 189.27K | -24.72K | 325.43K | 0.00 | -1.27M |

| Income Before Tax Ratio | -124.60% | -99.00% | -328.01% | -202.54% | -278.32% | -575.46% | -618.67% | -855.98% | -594.87% | -1,002.74% | -399.26% | -167.16% | -379.31% | -145.49% | -57.81% | -130.46% | 933.37% | -127.80% | 1,080.98% | 0.00% | -416.30% |

| Income Tax Expense | -9.90M | 1.83M | -39.60M | 13.81M | 1.54M | 43.17K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 29.77K | 0.00 | 0.00 | 75.18K | 0.00 |

| Net Income | -165.55M | -145.45M | -475.75M | -277.05M | -112.26M | -15.42M | -124.14K | -228.14K | -122.80K | -249.92K | -78.48K | -46.23K | -68.81K | -48.88K | -21.05K | -28.93K | 189.27K | -24.72K | 325.43K | -75.18K | -1.27M |

| Net Income Ratio | -117.57% | -100.26% | -302.81% | -213.17% | -282.19% | -577.07% | -618.67% | -855.98% | -594.87% | -1,002.74% | -399.26% | -167.16% | -379.31% | -145.49% | -57.81% | -130.46% | 933.37% | -127.80% | 1,080.98% | 0.00% | -416.30% |

| EPS | -0.14 | -0.27 | -1.76 | -2.62 | -2.77 | -26.33 | -0.21 | -0.56 | -0.50 | -0.93 | -1.76 | -1.03 | -1.54 | -1.09 | -0.47 | -0.65 | 4.24 | -0.55 | 7.28 | -1.68 | -28.73 |

| EPS Diluted | -0.14 | -0.27 | -1.76 | -2.62 | -2.77 | -26.33 | -0.21 | -0.56 | -0.50 | -0.93 | -1.76 | -1.03 | -1.54 | -1.09 | -0.47 | -0.65 | 4.24 | -0.55 | 7.28 | -1.68 | -28.73 |

| Weighted Avg Shares Out | 1.15B | 530.98M | 270.42M | 105.92M | 40.48M | 585.58K | 585.58K | 410.57K | 245.24K | 268.30K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.26K |

| Weighted Avg Shares Out (Dil) | 1.15B | 530.98M | 270.42M | 105.92M | 40.48M | 585.58K | 585.58K | 410.57K | 245.24K | 268.30K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.67K | 44.26K |

MedMen Refuses To Close $73M Transaction With Ascend Wellness On Heels Of Regulatory Approval

Best Stocks for 2022: Deep Value Tech Stock POSaBIT Is A Can't Miss Cannabis Play

Ascend Wellness Gets Green Light From New York State To Invest $73M In MedMen's Subsidiary

MedMen Opens New Store In Boston's Fenway Park On Heels Of Litigation Hurdles & Management Shakeups

MedMen Opens First Store Since Management Shakeup: Boston's Fenway Park Gets New Cannabis Dispensary

MedMen To Carry Iconic LA Cannabis Brand Jungle Boys

MedMen Launches Medical Cannabis Delivery Across Florida

MedMen's Charitable Cannabis Holiday Shopping Gets Underway Soon In Six States

Cannabis Stocks Are A Coiled Spring - Brady Cobb's Industry Update (Podcast Transcript)

MedMen Bolsters Product Offering By Bringing Coveted Brands To Shelves Just In Time For Holidays

Source: https://incomestatements.info

Category: Stock Reports