See more : Tara Chand Infra Soln Ltd (TARACHAND.NS) Income Statement Analysis – Financial Results

Complete financial analysis of Maverix Metals Inc. (MMX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Maverix Metals Inc., a leading company in the Other Precious Metals industry within the Basic Materials sector.

- Top Union Electronics Corp. (6266.TWO) Income Statement Analysis – Financial Results

- US Foods Holding Corp. (USFD) Income Statement Analysis – Financial Results

- Oaktree Capital Group, LLC (OAK-PB) Income Statement Analysis – Financial Results

- VWF Bancorp, Inc. (VWFB) Income Statement Analysis – Financial Results

- Zensho Holdings Co., Ltd. (7550.T) Income Statement Analysis – Financial Results

Maverix Metals Inc. (MMX)

About Maverix Metals Inc.

Maverix Metals Inc., together with its subsidiaries, operates as a precious metals royalty and streaming company in Canada. The company explores for gold, silver, lead, zinc, copper, nickel, and other metals. It has a portfolio of over 100 royalties and streams in the Americas and Australia. The company was incorporated in 2016 and is headquartered in Vancouver, Canada.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 57.53M | 51.68M | 34.24M | 25.00M | 15.53M | 1.75M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 26.74M | 23.02M | 17.38M | 15.30M | 8.38M | 1.21M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 30.80M | 28.66M | 16.87M | 9.70M | 7.15M | 534.19K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 53.53% | 55.46% | 49.25% | 38.79% | 46.02% | 30.57% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.44M | 4.78M | 6.69M | 4.16M | 3.83M | 1.48M | 116.62K | 105.36K | 218.13K | 565.84K | 311.75K | 282.52K | 421.19K | 968.26K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 5.44M | 4.78M | 6.69M | 4.16M | 3.83M | 1.48M | 116.62K | 105.36K | 218.13K | 565.84K | 311.75K | 282.52K | 421.19K | 968.26K |

| Other Expenses | 4.01M | 3.50M | 123.25K | 44.05K | 0.00 | 0.00 | 96.50K | -55.61K | 83.57K | 689.47K | -10.38K | 1.57K | -13.98K | -13.90K |

| Operating Expenses | 9.45M | 8.29M | 6.81M | 4.20M | 3.83M | 1.48M | 213.12K | 49.74K | 301.69K | 1.26M | 301.37K | 284.09K | 407.21K | 954.37K |

| Cost & Expenses | 36.18M | 31.31M | 24.19M | 19.50M | 12.21M | 2.70M | 213.12K | 49.74K | 301.69K | 1.26M | 301.37K | 284.09K | 407.21K | 954.37K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 50.89K | 13.39K | 0.00 | 0.00 | 0.00 | 0.00 | 1.19K | 0.00 | 4.92K | 111.87K |

| Interest Expense | 1.15M | 2.46M | 1.84M | 2.03M | 512.92K | 13.39K | 0.00 | 0.00 | 0.00 | 0.00 | 1.19K | 0.00 | 4.92K | 111.87K |

| Depreciation & Amortization | 17.81M | 18.15M | 13.51M | 12.86M | 6.80M | 828.06K | 1.16K | 1.23K | -557.40 | -11.30K | 129.36K | -510.40K | -2.97M | -7.48M |

| EBITDA | 53.53M | 50.38M | 8.76M | 17.85M | 10.08M | -5.30M | -211.96K | -48.52K | -302.25K | -1.27M | -172.01K | -794.49K | -1.52M | -3.59M |

| EBITDA Ratio | 93.05% | 97.48% | 25.59% | 71.41% | 64.94% | -303.11% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | 35.72M | 20.38M | -4.41M | 5.50M | 2.94M | -949.33K | -213.12K | -49.74K | -301.69K | -1.26M | -301.37K | -284.09K | 1.45M | 3.89M |

| Operating Income Ratio | 62.09% | 39.43% | -12.89% | 21.99% | 18.97% | -54.32% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -1.15M | 9.40M | -2.17M | -2.54M | -178.93K | -5.19M | 1.16K | 1.23K | -557.40 | -11.30K | 126.98K | -510.40K | -2.98M | -7.59M |

| Income Before Tax | 34.57M | 29.78M | -6.59M | 2.96M | 2.77M | -6.14M | -211.96K | -48.52K | -302.25K | -1.27M | -174.39K | -794.49K | -1.53M | -3.70M |

| Income Before Tax Ratio | 60.08% | 57.62% | -19.24% | 11.83% | 17.81% | -351.26% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 10.50M | 6.06M | 1.20M | 966.20K | 632.21K | 53.57K | -6.70K | -24.19K | 0.00 | 0.00 | -1.19K | 0.00 | 0.00 | 206.88K |

| Net Income | 24.07M | 23.72M | -7.79M | 1.99M | 2.13M | -6.19M | -205.26K | -24.33K | -302.25K | -1.27M | -173.20K | -794.49K | -1.53M | -3.91M |

| Net Income Ratio | 41.84% | 45.90% | -22.75% | 7.96% | 13.74% | -354.32% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | 0.16 | 0.17 | -0.07 | 0.02 | 0.03 | -0.30 | -0.14 | -0.02 | -0.21 | -1.02 | -0.16 | -1.02 | -1.97 | -3.49 |

| EPS Diluted | 0.16 | 0.17 | -0.07 | 0.02 | 0.03 | -0.30 | -0.14 | -0.02 | -0.21 | -1.02 | -0.16 | -1.02 | -1.97 | -3.49 |

| Weighted Avg Shares Out | 149.42M | 135.98M | 108.36M | 97.99M | 73.15M | 20.88M | 1.49M | 1.49M | 1.45M | 1.24M | 1.05M | 776.44K | 775.68K | 1.12M |

| Weighted Avg Shares Out (Dil) | 149.42M | 135.98M | 108.36M | 97.99M | 75.91M | 20.88M | 1.49M | 1.49M | 1.45M | 1.24M | 1.05M | 776.44K | 775.68K | 1.12M |

Why Maverix Metals (MMX) Could Beat Earnings Estimates Again

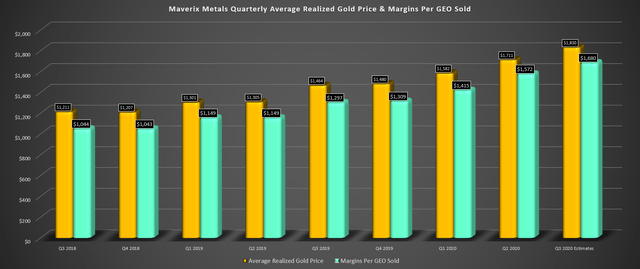

Maverix Metals is a rapidly growing, cashed up royalty company exposed to a rising gold price

Maverix Metals exceeds 2020 guidance with record 4Q gold equivalent ounces sold

Maverix Metals Inc exceeds 2020 guidance with record 4Q gold equivalent ounces sold

Canaccord Genuity initiates Buy rating on Maverix Metals with C$8 price target

Maverix Metals is a rapidly growing royalty company exposed to a rising gold price

NA Proactive news snapshot: Bragg Gaming, Maverix Metals, Alpine 4 Technologies, Silvercorp Metals, Real Luck Group UPDATE.

10 Strong Momentum Patterns In Junior Gold/Silver Mining

Precious Metals Royalty And Streaming Companies: The August Report

Maverix Metals: A Decent Start To FY2020

Source: https://incomestatements.info

Category: Stock Reports