See more : Castro Model Ltd. (CAST.TA) Income Statement Analysis – Financial Results

Complete financial analysis of FireFly Metals Ltd (MNXMF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of FireFly Metals Ltd, a leading company in the Industrial Materials industry within the Basic Materials sector.

- Faraday Technology Corporation (3035.TW) Income Statement Analysis – Financial Results

- Renco Holdings Group Limited (2323.HK) Income Statement Analysis – Financial Results

- Butler National Corporation (BUKS) Income Statement Analysis – Financial Results

- WalkMe Ltd. (WKME) Income Statement Analysis – Financial Results

- EGF Theramed Health Corp. (EVAHF) Income Statement Analysis – Financial Results

FireFly Metals Ltd (MNXMF)

About FireFly Metals Ltd

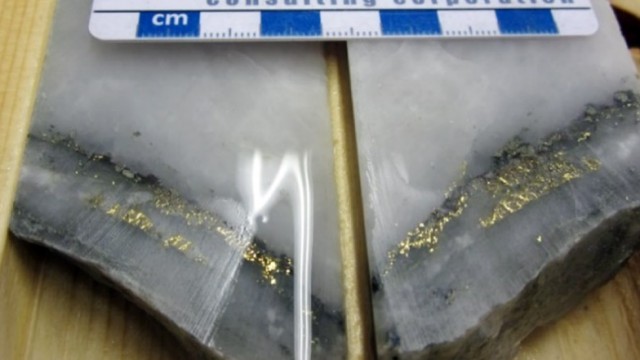

FireFly Metals Ltd engages in the exploration of mineral deposits in Australia and Canada. It primarily explores for gold and copper deposits. The company holds interest in the Green Bay copper-gold project in Newfoundland, Canada; and a 70% interest in the Pickle Crow gold project in Ontario. The company also holds a 90% interest in the Limestone Well vanadium-titanium project in Western Australia. The company was formerly known as Auteco Minerals Limited and changed its name to FireFly Metals Ltd in November 2023. FireFly Metals Ltd was incorporated in 2004 and is based in West Perth, Australia.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 44.00 | 41.38K | 152.34K | 92.01K | 378.76K | 133.50K | 63.80K | 132.86K | 0.00 | 88.74K | 5.00 | 300.00 |

| Cost of Revenue | 3.02M | 554.20K | 99.31K | 55.81K | 611.00 | 1.76K | 2.41K | 2.97K | 6.05K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -3.02M | -554.20K | -99.31K | -55.81K | -611.00 | -1.76K | -2.41K | -2.92K | 35.33K | 152.34K | 92.01K | 378.76K | 133.50K | 63.80K | 132.86K | 0.00 | 88.74K | 5.00 | 300.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,645.45% | 85.38% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 1.79M | 2.17M | 1.93M | 6.62M | 656.36K | 262.85K | 719.02K | 192.55K | 287.67K | 316.46K | 302.09K | 410.79K | 460.03K | 1.31M | 994.14K | 1.09M | 1.16M | 582.10K |

| Selling & Marketing | 0.00 | 536.30 | 371.84 | 283.42 | 25.57 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 21.56M | 3.33M | 2.17M | 1.93M | 6.62M | 656.36K | 262.85K | 719.02K | 192.55K | 287.67K | 316.46K | 302.09K | 410.79K | 460.03K | 1.31M | 994.14K | 1.09M | 1.16M | 582.10K |

| Other Expenses | -27.00K | 260.36K | 302.10K | 145.98K | -146.00 | 6.99K | 17.36K | -88.14K | 41.38K | -8.63K | -79.26K | 448.03K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 17.22K | 0.00 |

| Operating Expenses | 21.53M | 3.07M | 3.48M | 3.57M | 7.66M | 876.30K | 526.39K | 721.99K | 485.88K | 7.14M | 6.94M | 780.35K | 1.88M | 905.21K | 4.27M | 1.50M | 1.81M | 1.27M | 648.58K |

| Cost & Expenses | 24.56M | 3.63M | 3.48M | 3.57M | 7.66M | 876.30K | 526.39K | 721.99K | 485.88K | 7.14M | 6.94M | 780.35K | 1.88M | 905.21K | 4.27M | 1.50M | 1.81M | 1.27M | 648.58K |

| Interest Income | 786.00K | 146.20K | 16.46K | 61.58K | 7.04K | 0.00 | 6.38K | 15.44K | 7.75K | 48.08K | 32.59K | 92.37K | 171.34K | 260.46K | 705.64K | 665.57K | 750.08K | 133.62K | 223.14K |

| Interest Expense | 221.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 307.00 | 71.00 |

| Depreciation & Amortization | 3.02M | 554.20K | 99.31K | 55.81K | 611.00 | 1.76K | 2.41K | 2.97K | 6.05K | 19.76K | 21.52K | 9.67K | 8.80K | 15.22K | 46.50K | 88.77K | 34.05K | 19.83K | 9.01K |

| EBITDA | -21.53M | -3.07M | -3.45M | -3.13M | -7.66M | -810.90K | 365.71K | 46.11K | -269.35K | -6.96M | -6.83M | -391.92K | -1.74M | -826.19K | -4.09M | -1.40M | -1.69M | -1.10M | -416.13K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 104,786.36% | -650.94% | -4,465.68% | -7,420.61% | -103.47% | -1,301.67% | -1,294.97% | -3,079.88% | 0.00% | -1,902.58% | -22,071,180.00% | -138,710.67% |

| Operating Income | -24.56M | -3.63M | -3.48M | -3.57M | -7.66M | -812.66K | 363.31K | 43.14K | -275.41K | -6.82M | -6.85M | -401.59K | -1.75M | -841.41K | -4.14M | -1.49M | -1.72M | -1.12M | -425.14K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 98,040.91% | -665.57% | -4,478.65% | -7,444.00% | -106.03% | -1,308.26% | -1,318.82% | -3,114.88% | 0.00% | -1,940.95% | -22,467,820.00% | -141,714.00% |

| Total Other Income/Expenses | 695.00K | -22.40K | 180.62K | 3.37K | -83.52K | -48.61K | -13.94K | -122.52K | 0.00 | -169.72K | -79.26K | 487.35K | -1.26M | 280.82K | 705.64K | 639.24K | 750.08K | 150.54K | 223.07K |

| Income Before Tax | -23.86M | -3.48M | -3.16M | -3.37M | -7.65M | -932.94K | -1.39M | -1.56M | -605.84K | -7.11M | -6.90M | 85.77K | -3.01M | -560.59K | -3.43M | -847.67K | -972.38K | -1.12M | -425.21K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -3,538,109.09% | -1,464.12% | -4,664.25% | -7,494.73% | 22.64% | -2,251.49% | -878.66% | -2,583.77% | 0.00% | -1,095.72% | -22,473,960.00% | -141,737.67% |

| Income Tax Expense | -1.41M | 1.21K | -16.46K | -61.58K | -7.04K | 63.63K | 12.22K | 22.78K | 18.37K | 30.96K | 16.24K | -92.37K | -171.34K | -442.94K | 115.08K | -302.54K | 51.42K | 41.66K | 141.52K |

| Net Income | -22.45M | -3.48M | -3.16M | -3.37M | -7.65M | -932.94K | -1.40M | -1.58M | -624.21K | -7.14M | -6.91M | 85.77K | -3.01M | -117.65K | -3.19M | -393.27K | -1.01M | -1.17M | -566.73K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -3,589,875.00% | -1,508.52% | -4,684.57% | -7,512.37% | 22.64% | -2,251.49% | -184.40% | -2,399.66% | 0.00% | -1,140.48% | -23,307,180.00% | -188,909.67% |

| EPS | -0.07 | -0.02 | -0.03 | -0.03 | -0.11 | -0.02 | -0.04 | -0.05 | -0.04 | -0.51 | -0.67 | 0.01 | -0.28 | -0.01 | -0.38 | -0.07 | -0.23 | -0.28 | -0.17 |

| EPS Diluted | -0.07 | -0.02 | -0.03 | -0.03 | -0.11 | -0.02 | -0.04 | -0.05 | -0.04 | -0.51 | -0.67 | 0.01 | -0.28 | -0.01 | -0.38 | -0.07 | -0.23 | -0.28 | -0.17 |

| Weighted Avg Shares Out | 326.68M | 143.94M | 120.09M | 104.52M | 72.83M | 56.70M | 38.80M | 29.92M | 16.44M | 14.03M | 10.26M | 10.75M | 10.74M | 10.69M | 8.39M | 5.32M | 4.40M | 4.22M | 3.28M |

| Weighted Avg Shares Out (Dil) | 326.68M | 143.93M | 120.09M | 104.52M | 72.82M | 56.70M | 38.86M | 29.94M | 16.44M | 14.03M | 10.26M | 10.75M | 10.74M | 10.69M | 8.39M | 5.32M | 4.40M | 4.22M | 3.28M |

Auteco Minerals lifts Pickle Crow gold resource by 71% to 1.7 million ounces

Auteco's Carey discovery has “potential for high-grade open pit” according to Canaccord Genuity

Auteco Minerals makes new gold discovery at Pickle Crow Project

Auteco Minerals successful March quarter exploration expected to underpin Pickle Crow gold resource update in July

Auteco Minerals secures price target of $0.25 from Canaccord Genuity off the back of strong drilling results at Pickle Crow

Auteco Minerals discovery of more high-grade gold provides momentum to upcoming resource increase

Auteco Minerals lifts stake in Pickle Crow Gold Project to 51%

Auteco Minerals Pickle Crow Project in Canada “about to take flight”, according to Canaccord Genuity

Source: https://incomestatements.info

Category: Stock Reports