See more : Vertu Capital Limited (VCBC.L) Income Statement Analysis – Financial Results

Complete financial analysis of M-tron Industries, Inc. (MPTI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of M-tron Industries, Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- Goodfellow Inc. (GDL.TO) Income Statement Analysis – Financial Results

- Novo Nordisk A/S (NOVO-B.CO) Income Statement Analysis – Financial Results

- Sumitomo Chemical Company, Limited (SOMMY) Income Statement Analysis – Financial Results

- NPR-Riken Corporation (6209.T) Income Statement Analysis – Financial Results

- Excelsior Biopharma Inc. (6496.TWO) Income Statement Analysis – Financial Results

M-tron Industries, Inc. (MPTI)

About M-tron Industries, Inc.

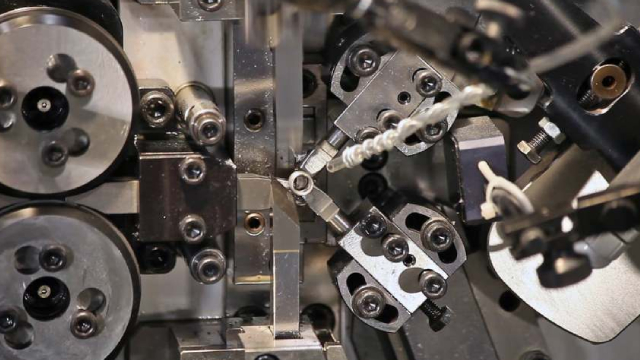

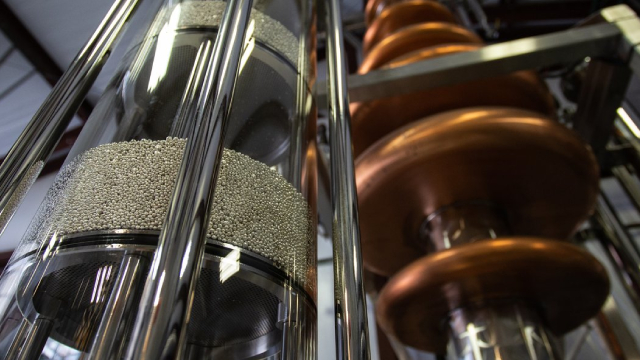

M-tron Industries, Inc. designs, manufactures, and markets frequency and spectrum control products. It operates in two product groups, Frequency Control and Spectrum Control. The Frequency Control product group includes a portfolio of quartz crystal resonators, clock oscillators, VCXO, TCXO OCXO, and DOCXO devices. These products are designed for applications in aerospace and defense, telecommunications infrastructure, and instrumentation markets. The Spectrum Control product group comprises an array of radio frequency (RF), microwave and millimeter wave filters, and diplexers covering a frequency range from 1 MHz to 90 GHz, and solid-state power amplifiers covering a frequency range from 300 MHz to 26 GHz, with power output from 10 Watts to 10 kWatts. The filter devices include crystal, ceramic, LC, tubular, combline, cavity, interdigital and metal insert waveguide, as well as digital, analog, and mechanical tunable filters, switched filter arrays, and RF subsystems. The power amplifiers add active devices comprise GaN, GaAS FET, LDMOS, and chip and wire technologies in narrow or broadband, module, or rack-mounted packages. These products are used in applications in the commercial and military aerospace, defense, space, and other commercial markets. The company was founded in 1965 and is based in Orlando, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 41.17M | 31.85M | 26.69M | 29.98M |

| Cost of Revenue | 24.40M | 20.50M | 17.36M | 19.69M |

| Gross Profit | 16.77M | 11.35M | 9.34M | 10.30M |

| Gross Profit Ratio | 40.73% | 35.63% | 34.97% | 34.34% |

| Research & Development | 2.22M | 2.01M | 2.01M | 2.04M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 10.25M | 8.47M | 7.22M | 7.27M |

| Other Expenses | 0.00 | -269.00K | 11.00K | -51.00K |

| Operating Expenses | 12.47M | 8.47M | 7.22M | 7.27M |

| Cost & Expenses | 36.87M | 28.97M | 24.58M | 26.95M |

| Interest Income | 0.00 | 11.00K | 12.00K | 86.00K |

| Interest Expense | 0.00 | 11.00K | 12.00K | 86.00K |

| Depreciation & Amortization | 850.00K | 725.00K | 542.00K | 489.00K |

| EBITDA | 5.25M | 3.60M | 2.67M | 3.47M |

| EBITDA Ratio | 12.75% | 10.46% | 9.99% | 11.57% |

| Operating Income | 4.30M | 2.88M | 2.11M | 3.03M |

| Operating Income Ratio | 10.44% | 9.03% | 7.92% | 10.11% |

| Total Other Income/Expenses | 101.00K | -280.00K | -1.00K | -137.00K |

| Income Before Tax | 4.40M | 2.60M | 2.11M | 2.89M |

| Income Before Tax Ratio | 10.69% | 8.15% | 7.92% | 9.65% |

| Income Tax Expense | 911.00K | 797.00K | 531.00K | 583.00K |

| Net Income | 3.49M | 1.80M | 1.58M | 2.31M |

| Net Income Ratio | 8.48% | 5.65% | 5.93% | 7.70% |

| EPS | 1.29 | 0.67 | 0.59 | 0.87 |

| EPS Diluted | 1.28 | 0.67 | 0.59 | 0.87 |

| Weighted Avg Shares Out | 2.70M | 2.68M | 2.67M | 2.67M |

| Weighted Avg Shares Out (Dil) | 2.73M | 2.68M | 2.67M | 2.67M |

M-tron Industries, Inc. (MPTI) Ascends While Market Falls: Some Facts to Note

M-tron Industries, Inc. (MPTI) Stock Falls Amid Market Uptick: What Investors Need to Know

M-tron Industries, Inc. (MPTI) Stock Drops Despite Market Gains: Important Facts to Note

M-tron Industries, Inc. Appoints Cameron Pforr as Chief Financial Officer

MPTI Stock Trades Near 52-Week High: Is It Still Worth Buying?

MPTI or ALFVY: Which Is the Better Value Stock Right Now?

M-tron Industries, Inc. (MPTI) Rises As Market Takes a Dip: Key Facts

MPTI vs. HWM: Which Stock Is the Better Value Option?

Should You Buy M-tron Industries, Inc. (MPTI) After Golden Cross?

Earnings Estimates Rising for M-tron Industries, Inc. (MPTI): Will It Gain?

Source: https://incomestatements.info

Category: Stock Reports