See more : InVision Aktiengesellschaft (IVX.DE) Income Statement Analysis – Financial Results

Complete financial analysis of Marine Products Corporation (MPX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Marine Products Corporation, a leading company in the Auto – Recreational Vehicles industry within the Consumer Cyclical sector.

- Ningbo Donly Co.,Ltd (002164.SZ) Income Statement Analysis – Financial Results

- Treace Medical Concepts, Inc. (TMCI) Income Statement Analysis – Financial Results

- Zenith Exports Limited (ZENITHEXPO.BO) Income Statement Analysis – Financial Results

- ESGold Corp. (SEKZF) Income Statement Analysis – Financial Results

- Yurtec Corporation (1934.T) Income Statement Analysis – Financial Results

Marine Products Corporation (MPX)

Industry: Auto - Recreational Vehicles

Sector: Consumer Cyclical

Website: https://www.marineproductscorp.com

About Marine Products Corporation

Marine Products Corporation designs, manufactures, and sells recreational fiberglass powerboats for the sportboat, sport fishing, and jet boat markets worldwide. The company offers Chaparral sterndrive pleasure boats, including SSi Sport Boats, SSX Sport Boats, and the Surf Series; Chaparral outboard pleasure boats, which include OSX Luxury Sportboats, and SSi and SSX outboard models; and Robalo outboard sport fishing boats. It also provides center and dual consoles, and Cayman Bay Boats under the Robalo brand name. The company sells its products to a network of 206 domestic and 92 international independent authorized dealers. Marine Products Corporation was founded in 1965 and is based in Atlanta, Georgia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 383.73M | 381.00M | 298.01M | 239.83M | 292.14M | 298.62M | 267.32M | 241.33M | 207.06M | 171.05M | 168.04M | 148.95M | 106.44M | 101.01M | 48.47M | 175.62M | 244.27M | 261.38M | 272.06M | 252.42M | 193.98M | 162.68M | 134.69M | 148.28M | 122.88M | 103.50M |

| Cost of Revenue | 293.35M | 287.28M | 229.74M | 186.22M | 226.74M | 232.29M | 208.30M | 190.86M | 163.26M | 138.38M | 137.68M | 121.75M | 86.93M | 83.30M | 46.00M | 143.68M | 191.81M | 201.97M | 202.94M | 186.83M | 143.66M | 125.28M | 105.34M | 114.08M | 93.25M | 77.78M |

| Gross Profit | 90.38M | 93.72M | 68.27M | 53.61M | 65.39M | 66.32M | 59.02M | 50.47M | 43.80M | 32.67M | 30.37M | 27.20M | 19.51M | 17.71M | 2.48M | 31.95M | 52.46M | 59.41M | 69.12M | 65.59M | 50.32M | 37.40M | 29.35M | 34.20M | 29.63M | 25.72M |

| Gross Profit Ratio | 23.55% | 24.60% | 22.91% | 22.35% | 22.38% | 22.21% | 22.08% | 20.91% | 21.15% | 19.10% | 18.07% | 18.26% | 18.33% | 17.54% | 5.11% | 18.19% | 21.48% | 22.73% | 25.41% | 25.98% | 25.94% | 22.99% | 21.79% | 23.07% | 24.11% | 24.85% |

| Research & Development | 757.00K | 437.00K | 776.00K | 751.00K | 730.00K | 822.00K | 960.00K | 858.00K | 663.00K | 743.00K | 1.07M | 768.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 43.13M | 41.84M | 30.24M | 27.23M | 28.72M | 28.47M | 26.96M | 24.87M | 20.77M | 18.37M | 18.24M | 16.44M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 16.22M | 16.95M | 0.00 | 0.00 |

| Selling & Marketing | -1.54M | 76.80K | 1.65M | 2.01M | 2.54M | 2.47M | 2.31M | 2.55M | 2.48M | 2.29M | 2.11M | 2.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 41.59M | 41.92M | 31.88M | 29.24M | 31.26M | 30.94M | 29.26M | 27.42M | 23.25M | 20.67M | 20.36M | 18.44M | 14.13M | 13.99M | 21.64M | 23.15M | 30.23M | 32.47M | 33.56M | 29.81M | 23.02M | 18.02M | 16.22M | 16.95M | 15.15M | 13.58M |

| Other Expenses | -1.17M | 0.00 | 0.00 | 0.00 | 0.00 | -4.18M | 29.26M | 27.42M | 23.25M | 20.67M | 20.31M | 18.44M | 14.13M | 13.99M | 12.61M | 23.15M | 30.23M | 32.47M | 33.56M | 29.81M | 23.02M | 18.02M | 0.00 | 1.80M | 15.15M | 13.58M |

| Operating Expenses | 41.18M | 41.92M | 31.88M | 29.24M | 31.26M | 30.94M | 29.26M | 27.42M | 23.25M | 20.67M | 20.36M | 18.44M | 14.13M | 13.99M | 21.64M | 23.15M | 30.23M | 32.47M | 33.56M | 29.81M | 23.02M | 18.02M | 16.22M | 18.75M | 15.15M | 13.58M |

| Cost & Expenses | 334.53M | 329.20M | 261.62M | 215.46M | 258.00M | 263.23M | 237.56M | 218.28M | 186.51M | 159.04M | 158.03M | 140.19M | 101.06M | 97.29M | 67.63M | 166.82M | 222.04M | 234.45M | 236.49M | 216.64M | 166.68M | 143.30M | 121.57M | 132.82M | 108.39M | 91.35M |

| Interest Income | 2.86M | 338.00K | 16.00K | 95.00K | 323.00K | 268.00K | 229.00K | 355.00K | 420.00K | 521.00K | 524.00K | 960.00K | 997.00K | 1.17M | 1.66M | 2.59M | 2.59M | 1.33M | 1.33M | 590.00K | 0.00 | 600.00K | 689.00K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 338.00K | 338.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.42M | 1.91M | 1.82M | 1.95M | 2.09M | 1.82M | 1.53M | 1.38M | 1.01M | 712.00K | 726.00K | 768.00K | 889.00K | 1.08M | 1.35M | 1.69M | 1.95M | 2.13M | 3.02M | 2.53M | 2.31M | 2.08M | 2.27M | 1.80M | 1.55M | 0.00 |

| EBITDA | 49.58M | 53.70M | 38.21M | 26.32M | 34.14M | 37.21M | 31.29M | 24.43M | 21.56M | 12.72M | 10.23M | 9.53M | 6.27M | 4.80M | -17.81M | 10.49M | 24.19M | 29.06M | 38.58M | 38.31M | 29.61M | 19.38M | 13.12M | 17.26M | 16.03M | 12.14M |

| EBITDA Ratio | 12.92% | 13.59% | 12.21% | 10.16% | 11.68% | 11.85% | 11.13% | 9.55% | 9.93% | 7.02% | 5.96% | 5.88% | 3.15% | 3.68% | -39.53% | 5.97% | 9.90% | 11.12% | 14.18% | 15.18% | 15.26% | 13.19% | 11.43% | 7.04% | 13.04% | 11.73% |

| Operating Income | 49.20M | 51.80M | 36.39M | 24.36M | 34.14M | 35.39M | 29.76M | 23.05M | 20.55M | 12.01M | 10.01M | 8.76M | 5.38M | 3.72M | -19.16M | 8.80M | 22.24M | 26.93M | 35.56M | 35.78M | 27.30M | 19.38M | 13.12M | 15.46M | 14.48M | 12.14M |

| Operating Income Ratio | 12.82% | 13.59% | 12.21% | 10.16% | 11.68% | 11.85% | 11.13% | 9.55% | 9.93% | 7.02% | 5.96% | 5.88% | 5.05% | 3.68% | -39.53% | 5.01% | 9.10% | 10.30% | 13.07% | 14.17% | 14.07% | 11.91% | 9.74% | 10.42% | 11.79% | 11.73% |

| Total Other Income/Expenses | 2.86M | 338.00K | 16.00K | 95.00K | 323.00K | 268.00K | 229.00K | 355.00K | 420.00K | 521.00K | 524.00K | 960.00K | 3.02M | 1.17M | 1.66M | 2.42M | 2.59M | 2.50M | 1.33M | 590.00K | 501.00K | 600.00K | 689.00K | 7.10M | 233.00K | 240.00K |

| Income Before Tax | 52.06M | 52.13M | 36.41M | 24.46M | 34.46M | 35.66M | 29.99M | 23.41M | 20.97M | 12.53M | 10.53M | 9.72M | 8.40M | 4.89M | -17.50M | 11.22M | 24.83M | 29.44M | 36.89M | 36.37M | 27.80M | 19.98M | 138.11M | 22.55M | 14.72M | 12.38M |

| Income Before Tax Ratio | 13.57% | 13.68% | 12.22% | 10.20% | 11.80% | 11.94% | 11.22% | 9.70% | 10.13% | 7.32% | 6.27% | 6.53% | 7.89% | 4.84% | -36.10% | 6.39% | 10.16% | 11.26% | 13.56% | 14.41% | 14.33% | 12.28% | 102.54% | 15.21% | 11.98% | 11.96% |

| Income Tax Expense | 10.37M | 11.79M | 7.38M | 5.01M | 6.22M | 7.17M | 10.69M | 6.66M | 6.67M | 3.61M | 2.74M | 2.74M | 1.67M | 1.04M | -6.81M | 3.63M | 8.40M | 9.12M | 10.67M | 12.62M | 9.73M | 7.59M | 5.25M | 8.59M | 5.60M | 4.71M |

| Net Income | 41.70M | 40.35M | 29.03M | 19.44M | 28.24M | 28.49M | 19.30M | 16.75M | 14.31M | 8.91M | 7.79M | 6.98M | 6.73M | 3.85M | -10.69M | 7.59M | 16.42M | 20.31M | 26.22M | 23.74M | 18.07M | 12.39M | 8.56M | 13.96M | 9.12M | 7.67M |

| Net Income Ratio | 10.87% | 10.59% | 9.74% | 8.11% | 9.67% | 9.54% | 7.22% | 6.94% | 6.91% | 5.21% | 4.64% | 4.69% | 6.32% | 3.81% | -22.06% | 4.32% | 6.72% | 7.77% | 9.64% | 9.41% | 9.32% | 7.62% | 6.36% | 9.42% | 7.42% | 7.41% |

| EPS | 1.21 | 1.18 | 0.85 | 0.56 | 0.81 | 0.83 | 0.55 | 0.44 | 0.39 | 0.24 | 0.21 | 0.19 | 0.19 | 0.11 | -0.30 | 0.21 | 0.44 | 0.54 | 0.69 | 0.41 | 0.32 | 0.22 | 0.23 | 0.36 | 0.24 | 0.20 |

| EPS Diluted | 1.21 | 1.18 | 0.85 | 0.56 | 0.81 | 0.83 | 0.55 | 0.44 | 0.39 | 0.24 | 0.21 | 0.19 | 0.18 | 0.11 | -0.30 | 0.21 | 0.43 | 0.52 | 0.65 | 0.39 | 0.32 | 0.22 | 0.22 | 0.36 | 0.24 | 0.20 |

| Weighted Avg Shares Out | 33.61M | 33.44M | 33.31M | 33.93M | 34.06M | 34.53M | 33.75M | 36.63M | 36.96M | 36.94M | 36.82M | 36.66M | 36.37M | 36.18M | 35.96M | 35.17M | 37.33M | 37.62M | 38.00M | 38.43M | 38.04M | 38.12M | 37.78M | 38.31M | 37.99M | 38.31M |

| Weighted Avg Shares Out (Dil) | 33.61M | 33.44M | 33.31M | 33.93M | 34.06M | 34.53M | 34.84M | 37.86M | 37.15M | 37.23M | 37.14M | 36.80M | 36.74M | 36.67M | 35.96M | 35.17M | 38.19M | 39.07M | 40.34M | 40.75M | 40.18M | 40.30M | 39.32M | 38.31M | 37.99M | 38.31M |

'A great step forward': end of messy overhaul heralds new era for Australian cycling | Kieran Pender

SEC halts trading for blockchain company run by former Ron Paul staffer

Morning mail: 200,000 US Covid deaths, NBN upgrades, 'Jesus' cult leader held

Ford Endeavour Sport launched in India, price starts at Rs 35.10 lakh

Covid spike leads government to pause return of fans to sports stadiums

Ford Endeavour Sport spotted; launch on September 22

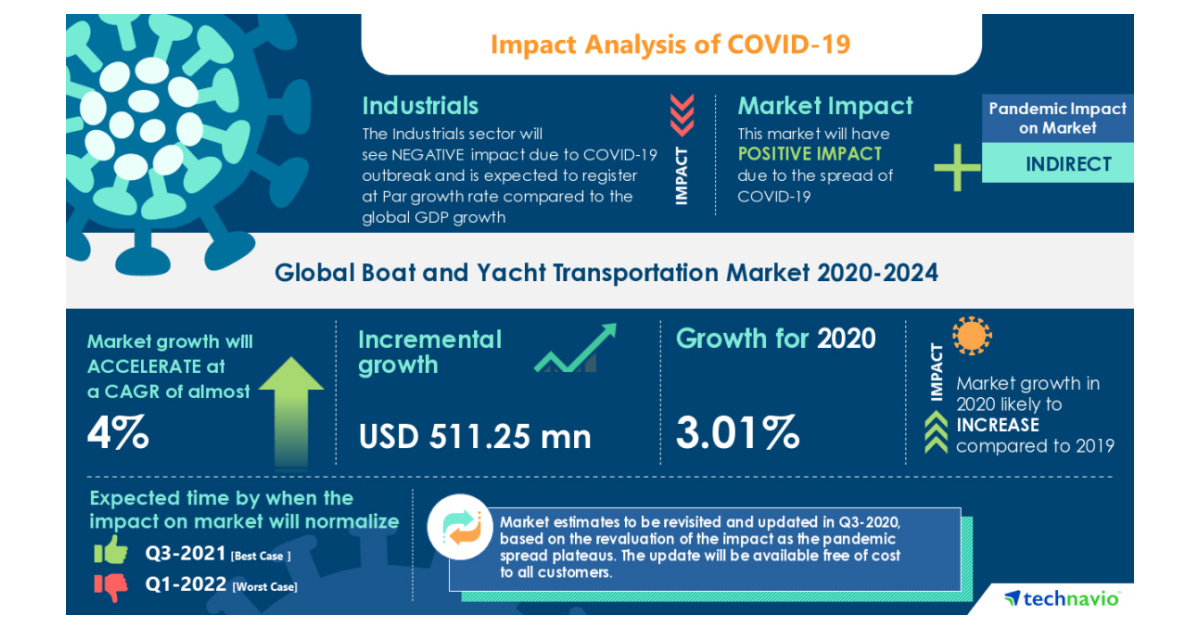

Boat And Yacht Transportation Market- Roadmap for Recovery from COVID-19 | Rising Demand For Recreational Boating to boost the Market Growth | Technavio

Head to Head Contrast: Chaparral Energy (CHAPQ) versus Its Competitors

Morning mail: environment laws farce, Palaszczuk under fire, Israel deals signed

Jet Black Social Club Launches Digital Membership

Source: https://incomestatements.info

Category: Stock Reports