See more : Pineapple Financial Inc. (PAPL) Income Statement Analysis – Financial Results

Complete financial analysis of Marker Therapeutics, Inc. (MRKR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Marker Therapeutics, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Ind-Swift Laboratories Limited (INDSWFTLAB.NS) Income Statement Analysis – Financial Results

- Spartacus Acquisition Corporation (TMTSU) Income Statement Analysis – Financial Results

- Yuan Jen Enterprises Co.,Ltd. (1725.TW) Income Statement Analysis – Financial Results

- WinPro Industries Limited (JUMPNET.NS) Income Statement Analysis – Financial Results

- Canadian Imperial Bank of Commerce (CM) Income Statement Analysis – Financial Results

Marker Therapeutics, Inc. (MRKR)

About Marker Therapeutics, Inc.

Marker Therapeutics, Inc., a clinical-stage immuno-oncology company, engages in the development and commercialization of various T cell-based immunotherapies and peptide-based vaccines for the treatment of hematological malignancies and solid tumor indications in the United States. Its MultiTAA-specific T cell technology is based on the manufacture of non-engineered tumor-specific T cells that recognize multiple tumor-associated antigens and kill tumor cells expressing tumor-associated antigens. The company's MultiTAA-specific T cell therapies include autologous T cells for the treatment of lymphoma, and various solid tumors; allogeneic T cells for the treatment of acute myeloid leukemia and acute lymphoblastic leukemia; and off-the-shelf products in various indications. It is also developing TPIV100/110, a peptide-based immunotherapeutic vaccines for the treatment of breast and ovarian cancer cells; and TPIV200, which is in Phase 2 clinical trial for the treatment of breast and ovarian cancers. The company was founded in 1999 and is headquartered in Houston, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.31M | 9.00M | 1.24M | 466.79K | 213.19K | 205.99K | 183.06K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 25.05K | 120.72K |

| Cost of Revenue | 10.42M | 3.68M | 3.16M | 18.88M | 12.76M | 124.00M | 5.25M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.63K | 38.60K |

| Gross Profit | -7.11M | 5.32M | -1.92M | -18.41M | -12.55M | -123.79M | -5.07M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 22.42K | 82.12K |

| Gross Profit Ratio | -214.60% | 59.13% | -154.70% | -3,944.85% | -5,887.41% | -60,094.84% | -2,768.39% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 89.50% | 68.03% |

| Research & Development | 10.42M | 26.14M | 27.79M | 18.88M | 12.76M | 124.00M | 5.25M | 3.80M | 1.71M | 189.00K | 661.63K | 1.06M | 203.73K | 290.05K | 93.04K | 182.34K | 425.57K | 173.17K | 248.36K | 1.04M | 1.73M | 833.59K | 0.00 | 341.19K | 294.92K |

| General & Administrative | 7.48M | 12.82M | 12.92M | 10.47M | 9.98M | 24.38M | 6.41M | 4.69M | 4.45M | 3.18M | 2.00M | 4.42M | 2.43M | 3.65M | 4.10M | 1.31M | 2.08M | 708.71K | 593.67K | 1.61M | 4.01M | 1.41M | 379.86K | 1.13M | 834.02K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 7.48M | 12.82M | 12.92M | 10.47M | 9.98M | 24.38M | 6.41M | 4.69M | 4.45M | 3.18M | 2.00M | 4.42M | 2.43M | 3.65M | 4.10M | 1.31M | 2.08M | 708.71K | 593.67K | 1.61M | 4.01M | 1.41M | 379.86K | 1.13M | 834.02K |

| Other Expenses | 0.00 | -232.97K | -2.41M | 0.00 | 0.00 | 116.05M | -183.06K | 1.83K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.74K | 7.48K | 5.97K | 6.37K | 147.53K | 37.45K | 42.37K | 40.77K | 0.00 | 20.64K | 17.71K |

| Operating Expenses | 17.89M | 38.96M | 40.72M | 29.35M | 22.74M | 148.38M | 11.48M | 8.26M | 6.16M | 3.37M | 2.66M | 5.48M | 2.64M | 3.94M | 4.19M | 1.50M | 2.51M | 888.25K | 989.56K | 2.68M | 5.78M | 2.28M | 379.86K | 1.49M | 1.15M |

| Cost & Expenses | 17.89M | 38.96M | 40.72M | 29.35M | 22.74M | 148.38M | 11.48M | 8.26M | 6.16M | 3.37M | 2.66M | 5.48M | 2.64M | 3.94M | 4.19M | 1.50M | 2.51M | 888.25K | 989.56K | 2.68M | 5.78M | 2.28M | 379.86K | 1.49M | 1.19M |

| Interest Income | 539.16K | 248.06K | 5.70K | 148.74K | 1.08M | 253.72K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.81K | 0.00 | 0.00 | 0.00 | 3.96K | 0.00 | 0.00 | 125.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 10.93K | 575.54K | 1.76M | 745.07K | 679.33K | 1.24M | 1.19M | 778.18K | 1.38M | 446.60K | 116.82K | 0.00 | -5.78M | -2.28M | -379.86K | 0.00 | 0.00 |

| Depreciation & Amortization | 2.79M | 3.68M | 3.16M | 1.08M | 286.58K | 148.17M | 11.48M | 8.49M | -27.90M | -26.94M | -466.28K | 1.11M | 1.29M | 93.84K | 3.74K | 7.48K | 5.97K | 6.37K | 71.51K | 37.45K | 42.37K | 40.89K | -4.68K | 20.64K | 17.71K |

| EBITDA | -11.79M | -19.79M | -36.32M | -27.63M | -22.03M | -147.97M | -11.30M | 6.04M | -34.06M | -30.31M | -3.78M | -5.58M | 0.00 | -3.85M | -3.27M | -1.41M | -2.51M | -851.42K | -838.07K | -2.65M | -5.74M | -2.24M | -379.86K | -457.20K | -1.05M |

| EBITDA Ratio | -356.14% | -291.69% | -2,924.62% | -5,964.44% | -10,441.30% | -71,910.65% | -6,543.02% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,476.07% | -815.17% |

| Operating Income | -14.58M | -29.95M | -39.48M | -28.89M | -22.53M | -148.17M | -11.66M | -8.49M | -6.16M | -3.37M | -3.31M | -6.22M | -2.64M | -3.94M | -5.38M | -2.28M | -2.51M | -888.25K | -989.56K | -2.68M | -5.78M | -2.28M | -379.86K | -1.47M | -1.06M |

| Operating Income Ratio | -440.37% | -332.56% | -3,179.32% | -6,188.25% | -10,567.28% | -71,930.07% | -6,371.05% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -5,857.63% | -881.85% |

| Total Other Income/Expenses | 539.16K | 15.09K | -2.40M | 179.74K | 1.10M | 213.72K | 497.87K | 6.04M | -27.91M | -27.51M | -2.87M | -373.57K | 607.92K | -1.15M | -268.53K | -695.52K | -1.38M | -416.14K | 29.69K | 0.00 | 0.00 | 0.00 | -4.68K | 460.51K | -62.80K |

| Income Before Tax | -14.04M | -29.93M | -41.88M | -28.71M | -21.43M | -147.96M | -10.98M | -2.46M | -34.07M | -30.88M | -5.53M | -5.86M | -2.03M | -5.09M | -4.46M | -2.20M | -3.89M | -1.30M | -989.56K | -2.68M | -5.78M | -2.28M | -384.54K | -1.29M | -1.13M |

| Income Before Tax Ratio | -424.09% | -332.40% | -3,372.68% | -6,149.74% | -10,050.92% | -71,826.32% | -5,999.09% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -5,156.80% | -933.87% |

| Income Tax Expense | 3.68K | -15.09K | -5.70K | -179.74K | -1.10M | -213.72K | -680.93K | -6.04M | 27.90M | 26.94M | 466.28K | -1.11M | -1.29M | -93.84K | 4.46M | 2.20M | 3.89M | 1.30M | 989.56K | 2.68M | 5.78M | 2.28M | 384.54K | 1.29M | 1.13M |

| Net Income | -14.05M | -29.92M | -41.87M | -28.53M | -20.33M | -147.96M | -10.98M | -2.46M | -34.07M | -30.88M | -5.53M | -5.86M | -2.03M | -5.09M | -4.46M | -2.20M | -3.89M | -1.30M | -989.56K | -2.68M | -5.78M | -2.28M | -384.54K | -1.29M | -1.13M |

| Net Income Ratio | -424.20% | -332.23% | -3,372.22% | -6,111.23% | -9,534.57% | -71,826.32% | -5,999.09% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -5,156.80% | -933.87% |

| EPS | -1.93 | -3.58 | -5.47 | -6.06 | -4.46 | -77.50 | -11.62 | -3.56 | -93.02 | -239.63 | -584.40 | -1.07K | -529.47 | -1.54K | -1.40K | -1.12K | -2.24K | -1.30M | -989.56K | -2.68M | -5.78M | -2.28M | -384.54K | -1.29M | -1.13M |

| EPS Diluted | -1.93 | -3.58 | -5.47 | -6.06 | -4.46 | -77.50 | -11.62 | -3.31 | -93.02 | -239.63 | -584.40 | -1.07K | -529.47 | -1.54K | -1.40K | -1.12K | -2.24K | -1.30M | -989.56K | -2.68M | -5.78M | -2.28M | -384.54K | -1.29M | -1.13M |

| Weighted Avg Shares Out | 8.81M | 8.35M | 7.65M | 4.70M | 4.56M | 1.91M | 945.35K | 688.99K | 366.23K | 128.88K | 9.47K | 5.46K | 3.83K | 3.32K | 3.20K | 1.95K | 1.73K | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Weighted Avg Shares Out (Dil) | 8.81M | 8.35M | 7.65M | 4.70M | 4.56M | 1.91M | 945.35K | 742.10K | 366.23K | 128.88K | 9.47K | 5.46K | 3.83K | 3.32K | 3.20K | 1.95K | 1.73K | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

The candidates to replace Rebecca Long-Bailey, and what it means for Labour's education policy

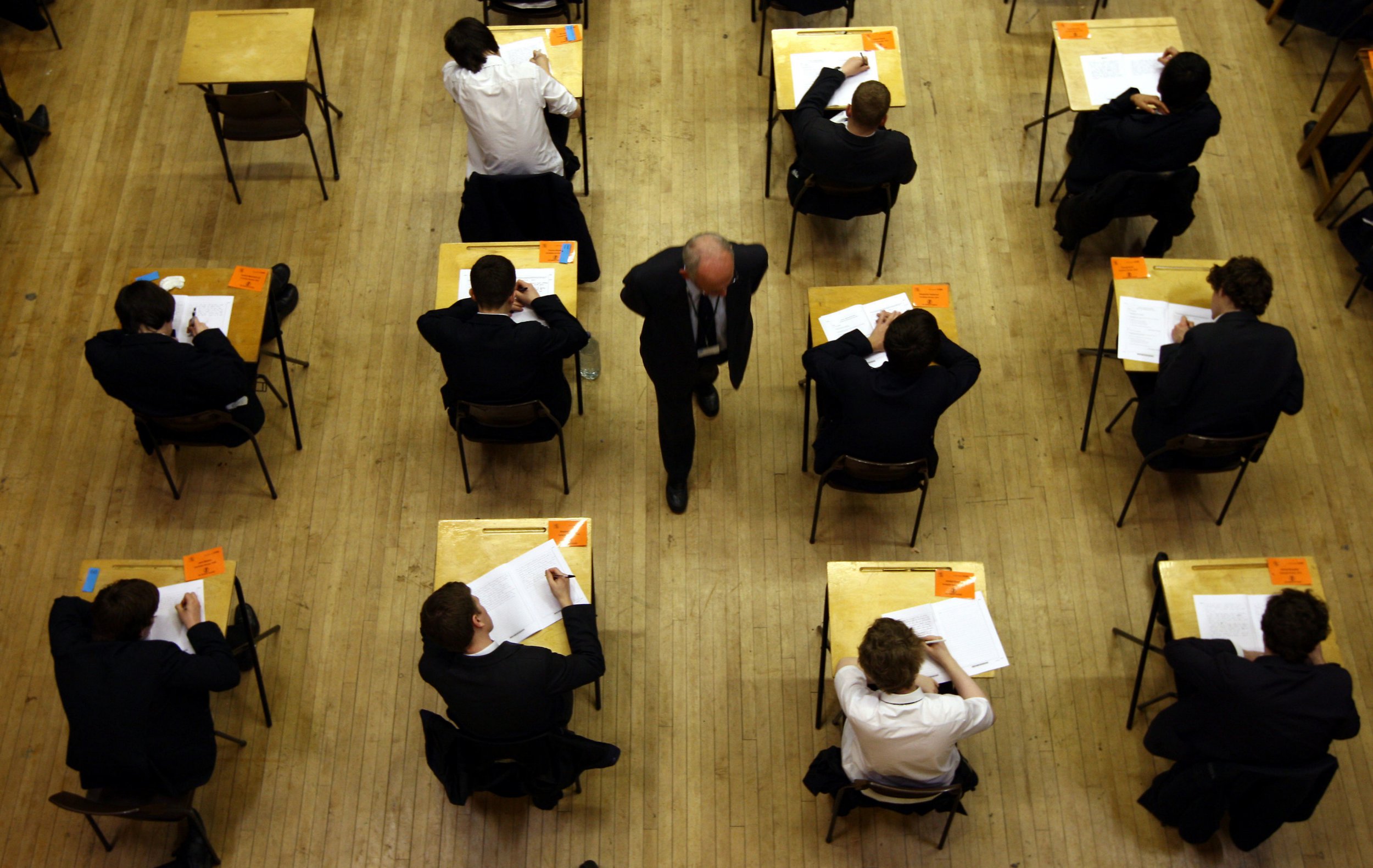

England class sizes largest in nearly 20 years

Teaching unions say fourth week of school was never agreed

Schools reopening UK: Boris Johnson's hopes 'pure fantasy' – teachers union bashes plans

A renewed back-door attempt to privatise education?

Labour SLAMMED over school closures during COVID-19 pandemic

Children desperate to return to school as ministers announce £1bn catch up plan

The National Education Union dealing with 'enormous' structural transphobia

Source: https://incomestatements.info

Category: Stock Reports