See more : Metalgráfica Iguaçu S.A. (MTIG4.SA) Income Statement Analysis – Financial Results

Complete financial analysis of Metalla Royalty & Streaming Ltd. (MTA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Metalla Royalty & Streaming Ltd., a leading company in the Other Precious Metals industry within the Basic Materials sector.

- Energoinstal S.A. (ENI.WA) Income Statement Analysis – Financial Results

- Redtape Limited (REDTAPE.BO) Income Statement Analysis – Financial Results

- Sichuan Swellfun Co.,Ltd (600779.SS) Income Statement Analysis – Financial Results

- Arax Holdings Corp. (ARAT) Income Statement Analysis – Financial Results

- Diamond Electric Holdings Co., Ltd. (6699.T) Income Statement Analysis – Financial Results

Metalla Royalty & Streaming Ltd. (MTA)

About Metalla Royalty & Streaming Ltd.

Metalla Royalty & Streaming Ltd., a precious metals royalty and streaming company, engages in the acquisition and management of precious metal royalties, streams, and related production-based interests in Canada, Australia, Argentina, Mexico, and the United States. It focuses on gold and silver streams and royalties. The company was formerly known as Excalibur Resources Ltd. and changed its name to Metalla Royalty & Streaming Ltd. in December 2016. Metalla Royalty & Streaming Ltd. was incorporated in 1983 and is headquartered in Vancouver, Canada.

| Metric | 2022 | 2021 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.41M | 2.97M | 2.60M | 5.80M | 5.71M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 1.81M | 2.35M | 1.65M | 4.00M | 5.14M | 0.00 | 506.03 | 481.18 | 111.50K | 112.64K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 605.84K | 622.22K | 950.82K | 1.80M | 578.32K | 0.00 | -506.03 | -481.18 | -111.50K | -112.64K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 25.10% | 20.95% | 36.52% | 31.04% | 10.12% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.77M | 9.57M | 4.55M | 2.87M | 2.01M | 2.27M | 157.59K | 160.89K | 517.65K | 570.73K | 433.09K | 453.28K | 378.10K | 183.47K | 335.31K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.32K | 61.36K | 128.34K | 325.26K | 221.46K | 0.00 | 0.00 | 4.25K | 59.06K |

| SG&A | 6.77M | 9.57M | 4.55M | 2.87M | 2.01M | 2.27M | 161.91K | 222.25K | 645.99K | 895.99K | 654.55K | 453.28K | 378.10K | 187.72K | 394.38K |

| Other Expenses | 52.23K | -14.53K | -8.76K | -34.29K | 0.00 | -2.31K | 5.37K | 0.00 | 65.03K | 0.00 | 62.99K | 0.00 | 83.44K | 654.13 | 637.63 |

| Operating Expenses | 6.77M | 9.57M | 4.55M | 2.87M | 2.01M | 2.27M | 161.91K | 222.25K | 711.02K | 895.99K | 717.54K | 453.28K | 378.10K | 188.37K | 395.02K |

| Cost & Expenses | 8.57M | 11.92M | 6.20M | 6.88M | 7.14M | 2.27M | 162.42K | 222.74K | 822.52K | 1.01M | 717.54K | 453.28K | 378.10K | 188.37K | 395.02K |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 74.23K | 0.00 | 0.00 | 57.45K | 14.78K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.29M | 818.37K | 659.13K | 361.76K | 276.70K | 203.93K | 12.20K | 5.38K | 57.45K | 14.78K | 1.62M | 6.02K | 0.00 | 1.20M | 0.00 |

| Depreciation & Amortization | 1.13M | 2.31M | 673.17K | 1.79M | 2.86M | 91.44K | 506.03 | 481.18 | 111.50K | 112.64K | 62.99K | 0.00 | 5.67K | 654.13 | 637.63 |

| EBITDA | -5.03M | -6.64M | -3.18M | 748.81K | 1.56M | -2.18M | -156.54K | -98.73K | 983.97K | -909.54K | 157.40K | -453.28K | -372.43K | 414.31K | -394.38K |

| EBITDA Ratio | -208.31% | -223.55% | -122.13% | 12.90% | 27.37% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -6.16M | -8.95M | -3.60M | -1.07M | -1.30M | -2.27M | -157.05K | -99.21K | 872.47K | -1.02M | -1.53M | -453.28K | -378.10K | -191.49K | -395.02K |

| Operating Income Ratio | -255.25% | -301.21% | -138.28% | -18.46% | -22.71% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -4.73M | -1.55M | 152.21K | -109.64K | -128.35K | -1.43K | 15.71K | -123.52K | -1.69M | 13.55K | -811.95K | -6.02K | 77.77K | -602.02K | 0.00 |

| Income Before Tax | -10.89M | -10.49M | -4.42M | -1.54M | -1.83M | -2.40M | -158.91K | -350.59K | -2.46M | -980.30K | -1.53M | -459.31K | -300.33K | -790.39K | -395.02K |

| Income Before Tax Ratio | -451.08% | -353.28% | -169.83% | -26.58% | -32.09% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 41.85K | -65.11K | 278.55K | 263.44K | 153.02K | -72.80K | -10.34K | 4.08M | 3.28M | -56.66K | 1.62M | -325.15K | -102.24K | 1.20M | 0.00 |

| Net Income | -10.93M | -10.43M | -4.70M | -1.81M | -1.99M | -2.40M | -158.91K | -4.18M | -2.46M | -980.30K | -1.53M | -134.16K | -198.09K | -790.39K | -395.02K |

| Net Income Ratio | -452.81% | -351.08% | -180.53% | -31.12% | -34.77% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.24 | -0.24 | -0.14 | -0.07 | -0.11 | -0.24 | -0.02 | -0.60 | -0.37 | -0.16 | -0.29 | -0.06 | -0.16 | -1.13 | -0.08 |

| EPS Diluted | -0.24 | -0.24 | -0.14 | -0.07 | -0.11 | -0.24 | -0.02 | -0.60 | -0.37 | -0.16 | -0.29 | -0.06 | -0.16 | -1.13 | -0.08 |

| Weighted Avg Shares Out | 44.80M | 42.57M | 33.89M | 25.70M | 17.82M | 9.84M | 6.97M | 6.91M | 6.59M | 6.00M | 5.35M | 2.44M | 1.21M | 701.18K | 4.71M |

| Weighted Avg Shares Out (Dil) | 44.80M | 42.57M | 33.89M | 25.70M | 17.82M | 9.84M | 6.97M | 6.91M | 6.59M | 6.00M | 5.35M | 2.44M | 1.21M | 701.18K | 4.71M |

Head-To-Head Survey: BRP Group (NYSE:MTA) & McEwen Mining (NYSE:MUX)

Coronavirus stalled MTA’s efforts to prevent OT fraud, agency watchdog says

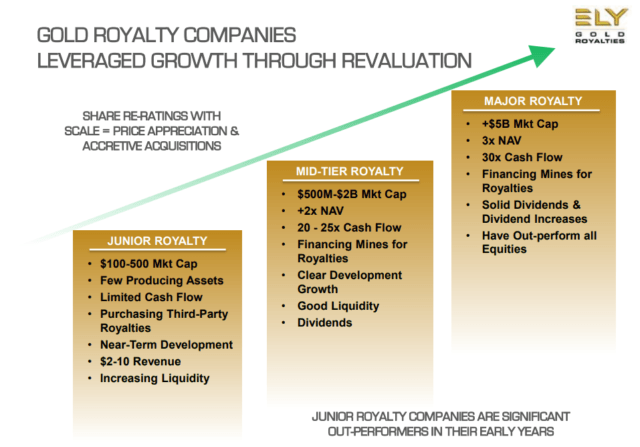

The Challenge And Opportunity In Valuing Precious Metals Royalty Streaming Companies

Contrasting BRP Group (NYSE:MTA) & Newmont Goldcorp (NYSE:NEM)

Comparing Osisko gold royalties (NYSE:OR) & BRP Group (NYSE:MTA)

Metalla Announces 2020 Third Quarter Results

Precious Metals Royalty And Streaming Companies: The March Report

Google Assistant gets NYC subway arrival times ahead of MTA Google Pay support

Source: https://incomestatements.info

Category: Stock Reports