See more : Hemp Naturals, Inc. (HPMM) Income Statement Analysis – Financial Results

Complete financial analysis of MicroVision, Inc. (MVIS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MicroVision, Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- Jinneng Science&Techology Co.,Ltd (603113.SS) Income Statement Analysis – Financial Results

- Transcorp International Limited (TRANSCOR.BO) Income Statement Analysis – Financial Results

- RaQualia Pharma Inc. (4579.T) Income Statement Analysis – Financial Results

- DSR Wire Corp (069730.KS) Income Statement Analysis – Financial Results

- Welspun Enterprises Limited (WELENT.BO) Income Statement Analysis – Financial Results

MicroVision, Inc. (MVIS)

About MicroVision, Inc.

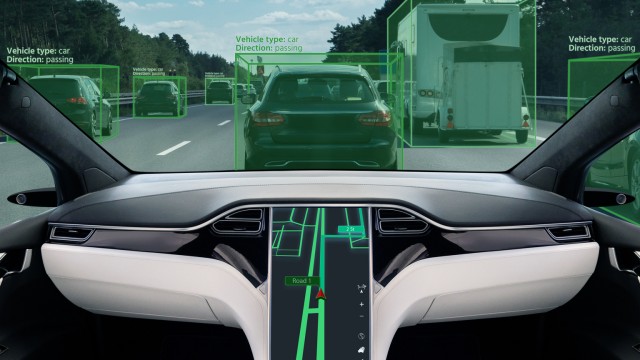

MicroVision, Inc. develops lidar sensors used in automotive safety and autonomous driving applications. Its laser beam scanning technology is based on micro-electrical mechanical systems, laser diodes, opto-mechanics, electronics, algorithms, and software. The company also develops micro-display concepts and designs for head-mounted augmented reality (AR) headsets, as well as 1440i MEMS module that can support AR headsets; Interactive Display modules used in smart speakers and other devices; and Consumer Lidar used in smart home systems. In addition, it provides PicoP, a scanning technology that creates full color, high-contrast, and uniform image over the entire field-of-view from a small and thin module. Further, the company develops 1st generation long range lidar. The company sells its products primarily to original equipment manufacturers and original design manufacturers. MicroVision, Inc. was founded in 1993 and is headquartered in Redmond, Washington.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7.26M | 664.00K | 2.50M | 3.09M | 8.89M | 17.61M | 10.89M | 14.76M | 9.19M | 3.49M | 5.85M | 8.37M | 5.62M | 4.74M | 3.83M | 6.61M | 10.48M | 7.04M | 14.75M | 11.42M | 14.65M | 15.92M | 10.76M | 8.12M | 6.90M | 7.10M | 1.70M | 100.00K |

| Cost of Revenue | 2.77M | 100.00K | 2.00K | 1.40M | 8.56M | 10.64M | 9.88M | 10.37M | 7.18M | 1.04M | 1.80M | 6.92M | 13.07M | 16.22M | 3.89M | 3.85M | 6.61M | 8.17M | 15.09M | 9.41M | 7.05M | 7.00M | 6.11M | 4.83M | 4.27M | 5.90M | 0.00 | 0.00 |

| Gross Profit | 4.49M | 564.00K | 2.50M | 1.69M | 322.00K | 6.97M | 1.02M | 4.39M | 2.01M | 2.44M | 4.05M | 1.44M | -7.45M | -11.48M | -61.00K | 2.76M | 3.88M | -1.12M | -346.00K | 2.01M | 7.61M | 8.92M | 4.65M | 3.29M | 2.63M | 1.20M | 1.70M | 100.00K |

| Gross Profit Ratio | 61.81% | 84.94% | 99.92% | 54.76% | 3.62% | 39.58% | 9.32% | 29.72% | 21.85% | 70.04% | 69.22% | 17.23% | -132.60% | -242.24% | -1.59% | 41.75% | 36.99% | -15.94% | -2.35% | 17.61% | 51.91% | 56.04% | 43.24% | 40.54% | 38.17% | 16.90% | 100.00% | 100.00% |

| Research & Development | 56.71M | 30.41M | 24.11M | 9.84M | 18.66M | 24.67M | 15.10M | 12.13M | 8.68M | 9.07M | 10.27M | 13.14M | 15.28M | 21.60M | 24.58M | 22.58M | 14.94M | 10.72M | 6.59M | 14.71M | 23.32M | 25.52M | 31.90M | 19.52M | 10.23M | 3.30M | 4.40M | 1.80M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 9.52M | 10.16M | 8.74M | 7.88M | 7.01M | 8.79M | 11.25M | 13.31M | 15.25M | 14.54M | 15.73M | 15.78M | 17.36M | 20.35M | 21.35M | 17.98M | 18.78M | 16.89M | 12.07M | 7.44M | 4.90M | 3.10M | 1.80M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 36.69M | 24.04M | 22.26M | 5.92M | 8.13M | 9.52M | 10.16M | 8.74M | 7.88M | 7.01M | 8.79M | 11.25M | 13.31M | 15.25M | 14.54M | 15.73M | 15.78M | 17.36M | 20.35M | 21.35M | 17.98M | 18.78M | 16.89M | 12.07M | 7.44M | 4.90M | 3.10M | 1.80M |

| Other Expenses | -34.00K | 799.00K | -23.00K | -19.00K | -11.00K | -30.00K | -6.00K | -14.00K | 8.00K | 15.00K | 115.00K | 174.00K | -11.00K | 0.00 | 0.00 | -5.00K | -117.00K | -198.00K | 0.00 | 1.00K | 0.00 | 0.00 | 0.00 | 1.25M | 675.60K | 500.00K | 0.00 | 0.00 |

| Operating Expenses | 93.36M | 54.45M | 46.37M | 15.76M | 26.79M | 34.19M | 25.25M | 20.85M | 16.56M | 15.61M | 18.90M | 24.39M | 28.58M | 36.85M | 39.12M | 38.30M | 30.61M | 27.88M | 26.94M | 36.06M | 41.30M | 44.30M | 48.79M | 32.83M | 18.34M | 8.70M | 7.50M | 3.60M |

| Cost & Expenses | 96.17M | 54.55M | 46.37M | 17.16M | 35.36M | 44.83M | 35.13M | 31.22M | 23.74M | 16.65M | 20.70M | 31.31M | 41.65M | 53.07M | 43.01M | 42.15M | 37.21M | 36.05M | 42.03M | 45.46M | 48.35M | 51.30M | 54.90M | 37.66M | 22.61M | 14.60M | 7.50M | 3.60M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 47.00K | 112.00K | 212.00K | 1.13M | 655.00M | 719.00K | 263.00K | 0.00 | 381.00K | 0.00 | 0.00 | 3.11M | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 46.00K | 62.00K | 68.00K | 48.00K | 0.00 | 5.75M | 3.25M | 0.00 | 51.00K | 0.00 | 0.00 | 163.60K | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.86M | 2.25M | 1.46M | 963.00K | 1.21M | 1.84M | 1.26M | 1.25M | 557.00K | 546.00K | 1.08M | 1.63M | 2.59M | 1.76M | 1.14M | 989.00K | 953.00K | 1.22M | 1.60M | 2.41M | 3.11M | 2.94M | 2.38M | 1.25M | 675.60K | 500.00K | -800.00K | -300.00K |

| EBITDA | -81.05M | -50.85M | -42.41M | -13.10M | -25.28M | -25.38M | -24.22M | -15.21M | -13.99M | -12.62M | -14.01M | -20.82M | -33.45M | -46.57M | -38.04M | -34.55M | -18.32M | -17.01M | -19.63M | -33.08M | -30.58M | -32.44M | -41.75M | -28.30M | -15.03M | -7.03M | -6.60M | -3.80M |

| EBITDA Ratio | -1,116.48% | -7,777.71% | -1,782.44% | -469.74% | -297.91% | -154.60% | -222.54% | -111.50% | -158.36% | -235.32% | -261.96% | -275.25% | -645.38% | -999.89% | -1,009.21% | -550.51% | -242.10% | -420.08% | -210.34% | -277.09% | -209.25% | -200.43% | -390.91% | -348.44% | -217.79% | -102.82% | -388.24% | -3,800.00% |

| Operating Income | -88.88M | -53.89M | -43.87M | -14.07M | -26.47M | -27.22M | -24.24M | -16.46M | -14.55M | -13.17M | -15.09M | -22.87M | -36.03M | -48.33M | -39.18M | -35.54M | -26.73M | -29.00M | -27.29M | -34.05M | -33.69M | -35.38M | -44.14M | -29.54M | -15.71M | -7.50M | -5.80M | -3.50M |

| Operating Income Ratio | -1,224.34% | -8,115.96% | -1,754.76% | -455.18% | -297.91% | -154.60% | -222.54% | -111.50% | -158.36% | -377.85% | -257.93% | -273.37% | -641.45% | -1,019.70% | -1,022.12% | -537.59% | -254.94% | -411.78% | -185.03% | -298.17% | -229.95% | -222.28% | -410.10% | -363.80% | -227.58% | -105.63% | -341.18% | -3,500.00% |

| Total Other Income/Expenses | 7.18M | 799.00K | 669.00K | -19.00K | -11.00K | -30.00K | -6.00K | -14.00K | 8.00K | -4.95M | 1.92M | 174.00K | 222.00K | 874.00K | -351.00K | 2.92M | 7.06M | 5.02M | -898.00K | -1.59M | 75.00K | -536.00K | 9.34M | 2.94B | 0.00 | 325.90K | 800.00K | 300.00K |

| Income Before Tax | -81.70M | -53.09M | -43.20M | -13.63M | -26.48M | -27.25M | -24.24M | -16.47M | -14.54M | -18.12M | -13.18M | -22.69M | -35.81M | -47.51M | -39.67M | -33.70M | -20.52M | -10.45B | -10.45B | -8.92B | -33.62M | -35.92M | -34.79M | -26.60B | 0.00 | -7.20M | -5.00M | -3.20M |

| Income Before Tax Ratio | -1,125.44% | -7,995.63% | -1,728.00% | -441.23% | -298.03% | -154.77% | -222.60% | -111.59% | -158.27% | -519.94% | -225.19% | -271.29% | -637.49% | -1,002.32% | -1,035.04% | -509.71% | -195.68% | -148,416.87% | -70,887.02% | -78,148.54% | -229.44% | -225.65% | -323.30% | -327,575.55% | 0.00% | -101.41% | -294.12% | -3,200.00% |

| Income Tax Expense | 1.15M | -799.00K | -2.16M | -1.41M | -1.65M | -30.00K | -1.26M | -1.25M | -557.00K | 4.42M | -1.56M | -1.71M | -2.81M | -874.00K | -787.00K | -2.92M | -335.00K | 3.43M | -2.34M | -2.56M | -7.53M | -8.21M | -9.34M | 2.94B | -991.00K | -200.00K | -100.00K | 300.00K |

| Net Income | -82.84M | -52.29M | -41.04M | -12.22M | -24.83M | -27.25M | -24.24M | -16.47M | -14.54M | -18.12M | -13.18M | -22.69M | -35.81M | -47.46M | -39.53M | -32.62M | -19.79M | -23.98M | -28.18M | -33.20M | -26.16M | -27.18M | -34.79M | -26.60M | -14.72M | -7.30M | -4.90M | -3.50M |

| Net Income Ratio | -1,141.23% | -7,875.30% | -1,641.76% | -395.50% | -279.47% | -154.77% | -222.60% | -111.59% | -158.27% | -519.94% | -225.19% | -271.29% | -637.49% | -1,001.27% | -1,031.28% | -493.42% | -188.74% | -340.54% | -191.12% | -290.74% | -178.56% | -170.74% | -323.30% | -327.58% | -213.22% | -102.82% | -288.24% | -3,500.00% |

| EPS | -0.45 | -0.32 | -0.26 | -0.09 | -0.22 | -0.31 | -0.33 | -0.32 | -0.31 | -0.44 | -0.47 | -1.05 | -2.57 | -4.17 | -4.29 | -4.23 | -3.17 | -5.72 | -10.02 | -12.36 | -11.66 | -15.46 | -22.82 | -18.63 | -14.41 | -9.74 | -6.80 | -5.47 |

| EPS Diluted | -0.45 | -0.32 | -0.26 | -0.09 | -0.22 | -0.31 | -0.33 | -0.32 | -0.31 | -0.44 | -0.47 | -1.05 | -2.57 | -4.17 | -4.29 | -4.23 | -3.17 | -5.72 | -10.02 | -12.36 | -11.66 | -15.46 | -22.82 | -18.63 | -14.41 | -9.74 | -6.80 | -5.47 |

| Weighted Avg Shares Out | 182.80M | 165.96M | 160.66M | 139.83M | 111.30M | 86.98M | 72.79M | 51.96M | 46.54M | 41.60M | 28.03M | 21.60M | 13.92M | 11.38M | 9.22M | 7.71M | 6.25M | 4.20M | 2.81M | 2.69M | 2.24M | 1.76M | 1.53M | 1.43M | 1.02M | 749.19K | 720.59K | 639.54K |

| Weighted Avg Shares Out (Dil) | 182.80M | 165.96M | 160.66M | 139.83M | 111.30M | 86.98M | 72.79M | 51.96M | 46.54M | 41.60M | 28.03M | 21.60M | 13.92M | 11.38M | 9.22M | 7.71M | 6.25M | 4.20M | 2.81M | 2.69M | 2.24M | 1.76M | 1.53M | 1.43M | 1.02M | 749.19K | 720.59K | 639.54K |

Investing In Lidar, Mid-Year 2023 Update

MicroVision, Inc. (MVIS) Q2 2023 Earnings Call Transcript

MicroVision Announces Second Quarter 2023 Results

7 AI Stocks With High Short Interest

MicroVision to Announce Second Quarter 2023 Results on August 8, 2023

3 Artificial Intelligence Stocks That AI Predicts Will Deliver Triple-Digit Returns in 2023

Why MicroVision Stock Surged 17% Higher on Friday

MicroVision Announces Completion of At-the-Market Equity Facility

Look Out Below! MVIS Stock Looks Ready to Crash.

Why MicroVision Stock Is Skyrocketing Today

Source: https://incomestatements.info

Category: Stock Reports