See more : Bravo Multinational Incorporated (BRVO) Income Statement Analysis – Financial Results

Complete financial analysis of NewtekOne, Inc. 8.00% Fixed Rate Senior Notes due 2028 (NEWTI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of NewtekOne, Inc. 8.00% Fixed Rate Senior Notes due 2028, a leading company in the Financial – Credit Services industry within the Financial Services sector.

- Jyske Bank A/S (JYSKY) Income Statement Analysis – Financial Results

- PT Ciputra Development Tbk (CTRA.JK) Income Statement Analysis – Financial Results

- Eldeco Housing and Industries Limited (ELDEHSG.BO) Income Statement Analysis – Financial Results

- Piramal Enterprises Limited (PEL.BO) Income Statement Analysis – Financial Results

- De La Rue plc (DELRF) Income Statement Analysis – Financial Results

NewtekOne, Inc. 8.00% Fixed Rate Senior Notes due 2028 (NEWTI)

About NewtekOne, Inc. 8.00% Fixed Rate Senior Notes due 2028

NewtekOne, Inc. is a financial holding company, which engages in the provision of business and financial solutions. Its brands include Newtek Bank, Newtek Lending, Newtek Payments, Newtek Insurance, Newtek Payroll, and Newtek Technology. The company was founded by Barry Sloane in 1998 and is headquartered in Boca Raton, FL.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 271.15M | 158.00M | 160.93M | 103.57M | 109.70M | 92.69M | 78.33M | 62.59M | 59.93M | 130.11M | 142.25M | 129.60M |

| Cost of Revenue | 44.30M | 30.99M | 29.81M | 18.69M | 19.66M | 8.85M | 6.27M | 296.00K | 326.00K | 66.96M | 77.08M | 72.99M |

| Gross Profit | 226.84M | 127.01M | 131.12M | 84.88M | 90.04M | 83.84M | 72.06M | 62.29M | 59.60M | 63.15M | 65.17M | 56.60M |

| Gross Profit Ratio | 83.66% | 80.39% | 81.48% | 81.96% | 82.08% | 90.46% | 91.99% | 99.53% | 99.46% | 48.54% | 45.81% | 43.68% |

| Research & Development | 0.00 | 0.25 | 0.52 | 0.32 | 0.37 | 0.38 | 0.50 | 0.44 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 32.31M | 13.81M | 12.17M | 26.83M | 28.45M | 17.13M | 15.07M | 14.49M | 11.83M | 20.77M | 20.73M | 17.73M |

| Selling & Marketing | 68.83M | 21.19M | 18.76M | 15.05M | 15.25M | 22.32M | 20.39M | 17.00M | 13.62M | 24.83M | 24.36M | 22.31M |

| SG&A | 101.14M | 34.99M | 30.93M | 41.88M | 43.70M | 0.38 | 0.50 | 0.44 | 25.45M | 45.60M | 45.09M | 40.05M |

| Other Expenses | 0.00 | -26.74M | -22.07M | -17.93M | -20.72M | -17.07M | -10.94M | -9.04M | -17.39M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 101.14M | 66.40M | 62.29M | 40.71M | 2.26M | 2.23M | 11.46M | 4.78M | 17.39M | 47.25M | 48.24M | 42.67M |

| Cost & Expenses | 145.45M | 92.48M | 54.72M | 52.02M | 68.27M | 2.23M | 11.46M | 4.78M | 24.19M | 114.20M | 125.32M | 115.66M |

| Interest Income | 0.00 | 26.33M | 20.52M | 17.88M | 20.42M | 16.07M | 11.40M | 8.44M | 6.48M | 7.89M | 5.86M | 4.50M |

| Interest Expense | 67.74M | 26.33M | 20.52M | 17.88M | 20.42M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.88M | 239.00K | 304.00K | 402.00K | 501.00K | 39.94M | 39.81M | 34.68M | 326.00K | 3.18M | 3.28M | 3.04M |

| EBITDA | 125.70M | 96.50M | 106.51M | 51.95M | 15.60M | 53.24M | 38.92M | 28.21M | 620.00K | 17.59M | 20.22M | 17.08M |

| EBITDA Ratio | 46.36% | 41.62% | 66.19% | 50.16% | 56.84% | 10.86% | 4.42% | -0.84% | 70.99% | 13.52% | 14.21% | 13.18% |

| Operating Income | 125.70M | 65.52M | 106.21M | 51.55M | 61.85M | 484.00K | 402.00K | 296.00K | 42.22M | 14.41M | 16.93M | 14.05M |

| Operating Income Ratio | 46.36% | 41.47% | 66.00% | 49.77% | 56.38% | 0.52% | 0.51% | 0.47% | 70.44% | 11.08% | 11.90% | 10.84% |

| Total Other Income/Expenses | -80.33M | -26.74M | -22.07M | -17.93M | -293.00K | 43.17M | 46.86M | 37.17M | 35.12M | -9.53M | -9.01M | -4.61M |

| Income Before Tax | 45.37M | 38.78M | 84.14M | 33.62M | 41.14M | 53.24M | 50.32M | 36.65M | 35.74M | 8.02M | 11.07M | 9.44M |

| Income Before Tax Ratio | 16.73% | 24.54% | 52.28% | 32.46% | 37.50% | 57.43% | 64.24% | 58.55% | 59.63% | 6.16% | 7.78% | 7.28% |

| Income Tax Expense | -1.96M | 6.46M | 1.33M | 51.55M | 61.85M | 52.75M | 49.92M | 36.35M | 0.00 | 4.13M | 3.92M | 3.88M |

| Net Income | 47.33M | 32.31M | 84.14M | 33.62M | 41.14M | 35.68M | 38.98M | 27.31M | 35.74M | 3.97M | 7.53M | 5.64M |

| Net Income Ratio | 17.46% | 20.45% | 52.28% | 32.46% | 37.50% | 38.49% | 49.76% | 43.63% | 59.63% | 3.05% | 5.29% | 4.35% |

| EPS | 1.89 | 1.34 | 3.69 | 1.59 | 2.13 | 18.71M | 17.32M | 14.52M | 3.32 | 0.54 | 0.99 | 0.77 |

| EPS Diluted | 1.88 | 1.34 | 3.69 | 1.59 | 2.13 | 1.91 | 17.32M | 14.52M | 3.32 | 0.54 | 0.99 | 0.77 |

| Weighted Avg Shares Out | 24.26M | 24.20M | 22.80M | 21.15M | 19.33M | 1.91 | 2.25 | 1.88 | 10.77M | 7.36M | 7.60M | 7.33M |

| Weighted Avg Shares Out (Dil) | 24.35M | 24.20M | 22.80M | 21.15M | 19.33M | 18.71M | 2.25 | 1.88 | 10.77M | 7.36M | 7.58M | 7.35M |

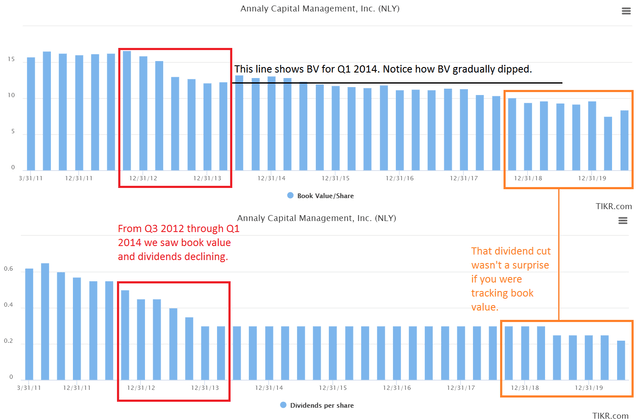

An Introduction To Annaly

Full Analysis Of Main Street Capital's Q4 2019 Results (Includes Updated Investment Ratings Analysis And Price Target)

Source: https://incomestatements.info

Category: Stock Reports