Complete financial analysis of Nkarta, Inc. (NKTX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Nkarta, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Canyon Resources Limited (CAY.AX) Income Statement Analysis – Financial Results

- JPP Holding Company Limited (5284.TW) Income Statement Analysis – Financial Results

- Galactico Corporate Services L (GALACTICO.BO) Income Statement Analysis – Financial Results

- Kennametal Inc. (KMT) Income Statement Analysis – Financial Results

- Ashiana Ispat Limited (ASHIS.BO) Income Statement Analysis – Financial Results

Nkarta, Inc. (NKTX)

About Nkarta, Inc.

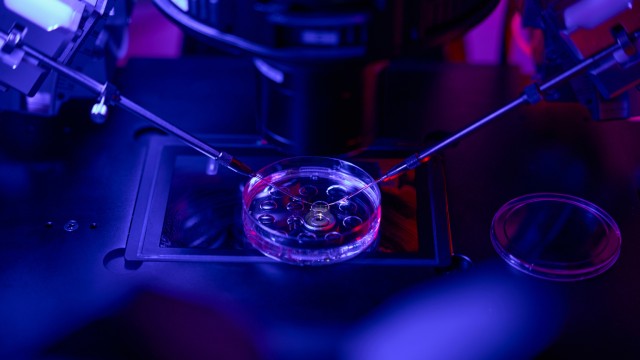

Nkarta, Inc., a a clinical-stage biopharmaceutical company, develops and commercializes cell therapies for cancer treatment. The company's approach for cellular immunotherapy involves chimeric antigen receptors on the surface of a natural killer (NK) cell that enable the cell to recognize specific proteins or antigens that are present on the surface of tumor cells. Its two co-lead product candidates are NKX101, which is in Phase I clinical trials for the treatment of relapsed/refractory acute myeloid leukemia or higher risk myelodysplastic syndromes; and NKX019, a pre-clinical product, which is based on the ability to treat various B cell malignancies by targeting the CD19 antigen found on these types of cancerous cells. The company has a research collaboration agreement with CRISPR Therapeutics AG. Nkarta, Inc. was incorporated in 2015 and is based in South San Francisco, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 115.39K | 6.55M |

| Cost of Revenue | 5.87M | 6.57M | 2.12M | 1.05M | 17.22K | 4.25M |

| Gross Profit | -5.87M | -6.57M | -2.12M | -1.05M | 98.17K | 2.30M |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 85.08% | 35.08% |

| Research & Development | 96.77M | 90.90M | 63.41M | 36.22M | 17.22M | 4.25M |

| General & Administrative | 34.88M | 28.06M | 23.02M | 15.29M | 5.25M | 2.65M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 34.88M | 28.06M | 23.02M | 15.29M | 5.25M | 2.65M |

| Other Expenses | 0.00 | -470.00K | -16.00K | -40.17M | 1.34M | 0.00 |

| Operating Expenses | 131.65M | 118.96M | 86.43M | 51.51M | 22.46M | 6.91M |

| Cost & Expenses | 131.65M | 118.96M | 86.43M | 51.51M | 22.46M | 6.91M |

| Interest Income | 14.11M | 5.59M | 370.00K | 313.00K | 304.11K | 81.95K |

| Interest Expense | 0.00 | 5.59M | 0.00 | 0.00 | 472.82K | 0.00 |

| Depreciation & Amortization | 5.87M | 6.57M | 2.12M | 1.05M | 553.28K | 183.21K |

| EBITDA | -120.48M | -107.27M | -83.95M | -90.31M | -20.05M | -91.29K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -17,600.68% | -1.39% |

| Operating Income | -131.65M | -118.96M | -86.43M | -51.51M | -22.35M | -356.45K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -19,368.66% | -5.44% |

| Total Other Income/Expenses | 14.15M | 5.12M | 354.00K | -39.85M | 1.27M | 81.95K |

| Income Before Tax | -117.50M | -113.84M | -86.08M | -91.36M | -21.08M | -274.50K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -18,265.66% | -4.19% |

| Income Tax Expense | 0.00 | 5.59M | -2.13M | -40.95M | 1.81M | 81.95K |

| Net Income | -117.50M | -119.43M | -83.95M | -50.41M | -22.88M | -274.50K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | -19,832.65% | -4.19% |

| EPS | -2.40 | -2.74 | -2.55 | -1.59 | -2.55 | 0.00 |

| EPS Diluted | -2.40 | -2.74 | -2.55 | -1.59 | -2.55 | 0.00 |

| Weighted Avg Shares Out | 49.01M | 43.63M | 32.86M | 31.80M | 8.98M | 5.03B |

| Weighted Avg Shares Out (Dil) | 49.01M | 43.63M | 32.86M | 31.80M | 8.98M | 5.03B |

Last Call! 7 Small-Cap Stocks Ready to Explode in Value

3 Under-the-Radar Stocks Set to Soar 300% by 2026

3 Sleeper Stocks With Serious Potential to Make You a Millionaire

3 Once-in-a-Lifetime Biotech Stocks With Unprecedented Surge Potential

Unseen Giants: 3 Stocks Quietly Preparing for a 10X Surge

Nkarta: Possible Upside From H1 Update, If Positive

Penny Stocks To Buy Now? 4 To Watch Before 2024

Nkarta Presents NKX101 Clinical Data at the 2023 American Society of Hematology Annual Meeting & Exposition

All You Need to Know About Nkarta, Inc. (NKTX) Rating Upgrade to Buy

Nkarta Reports Third Quarter 2023 Financial Results and Corporate Highlights

Source: https://incomestatements.info

Category: Stock Reports