See more : Magnate Technology Co., Ltd. (4541.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Nuveen New York Select Tax-Free Income Portfolio (NXN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Nuveen New York Select Tax-Free Income Portfolio, a leading company in the Asset Management – Income industry within the Financial Services sector.

- Safari Industries (India) Limited (SAFARIND.BO) Income Statement Analysis – Financial Results

- Hanil Holdings Co., Ltd. (003300.KS) Income Statement Analysis – Financial Results

- Iberdrola, S.A. (IBE1.DE) Income Statement Analysis – Financial Results

- 360 Ludashi Holdings Limited (3601.HK) Income Statement Analysis – Financial Results

- Revolution Healthcare Acquisition Corp. (REVH) Income Statement Analysis – Financial Results

Nuveen New York Select Tax-Free Income Portfolio (NXN)

Industry: Asset Management - Income

Sector: Financial Services

Website: https://www.nuveen.com/CEF/Product/Overview.aspx?FundCode=NXN

About Nuveen New York Select Tax-Free Income Portfolio

Nuveen New York Select Tax-Free Income Portfolio is a closed-ended fixed income mutual fund launched by Nuveen Investments Inc. The fund is co-managed by Nuveen Fund Advisors LLC and Nuveen Asset Management, LLC. It invests in the fixed income markets of New York. The fund invests in the securities of companies that operate across diversified sectors. It primarily invests in municipal bonds with an average credit quality of Baa/BBB or better. The fund employs fundamental analysis to create its portfolio. It benchmarks the performance of its portfolio against Barclays Capital New York Municipal Bond Index and S&P New York Municipal Bond Index. Nuveen New York Select Tax-Free Income Portfolio was formed on June 19, 1992 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.66M | -3.82M | 1.66M | 3.33M | 1.57M | 2.64M | 1.75M | 2.41M | 2.48M | 2.44M | 2.60M | 2.71M | 0.00 |

| Cost of Revenue | 2.96M | 159.03K | 172.54K | 177.59K | 176.90K | 173.11K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -1.30M | -3.97M | 1.49M | 3.15M | 1.39M | 2.46M | 1.75M | 2.41M | 2.48M | 2.44M | 2.60M | 2.71M | 0.00 |

| Gross Profit Ratio | -78.23% | 104.17% | 89.60% | 94.67% | 88.72% | 93.44% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 76.09K | 79.35K | 226.56K | 78.86K | 83.35K | 75.85K | 81.14K | 237.19K | 233.46K | 235.99K | 228.28K | 222.62K | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 76.09K | 79.35K | 226.56K | 78.86K | 83.35K | 75.85K | 81.14K | 237.19K | 233.46K | 235.99K | 228.28K | 222.62K | 0.00 |

| Other Expenses | 2.99M | 2.14K | -1.80M | 2.22K | 2.34K | 2.55K | 2.92K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 3.06M | 81.49K | 2.16M | 81.07K | 85.69K | 78.40K | 84.05K | 2.16M | 260.84K | 2.05M | 3.07M | 486.00K | 0.00 |

| Cost & Expenses | 3.06M | 81.49K | 1.97M | 81.07K | 85.69K | 78.40K | 84.05K | 2.16M | 260.84K | 2.05M | 3.07M | 486.00K | 0.00 |

| Interest Income | 2.14M | 473.00 | 71.00 | 93.00 | 8.59K | 8.62K | 0.00 | 11.64K | 5.45K | 5.46K | 3.63K | 4.46K | 0.00 |

| Interest Expense | 1.56K | 473.00 | 70.91 | 93.00 | 8.59K | 8.62K | 12.57K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.35M | -1.75M | -1.62M | -1.82M | -1.91M | -1.96M | -2.04M | -2.18M | -2.24M | -2.21M | -2.38M | -2.49M | 0.00 |

| EBITDA | 2.99M | -3.90M | -315.16K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 179.96% | 102.12% | -18.99% | 97.57% | 94.54% | 97.35% | 95.91% | -80.16% | -1.33% | 93.28% | -109.09% | 25.95% | 0.00% |

| Operating Income | -4.36M | -3.90M | -315.16K | 3.25M | 1.48M | 2.57M | 1.68M | 2.18M | 2.24M | 2.21M | 2.38M | 2.49M | 0.00 |

| Operating Income Ratio | -262.80% | 102.12% | -18.99% | 97.57% | 94.54% | 97.35% | 95.91% | 90.18% | 90.57% | 90.35% | 91.24% | 91.79% | 0.00% |

| Total Other Income/Expenses | 7.35M | 159.03K | -1.93M | 0.00 | -430.14K | 603.32K | -371.07K | -1.94M | -32.83K | 2.28M | -2.84M | 704.15K | 0.00 |

| Income Before Tax | 2.99M | -3.90M | -315.22K | 3.25M | 1.48M | 2.56M | 1.67M | 241.84K | 2.21M | 4.49M | -465.14K | 3.19M | 0.00 |

| Income Before Tax Ratio | 179.87% | 102.14% | -18.99% | 97.57% | 94.54% | 97.03% | 95.19% | 10.02% | 89.24% | 183.63% | -17.86% | 117.75% | 0.00% |

| Income Tax Expense | 0.00 | 1.75M | 1.62M | 1.82M | 1.90M | 1.96M | 2.04M | -1.94M | -32.83K | 2.28M | -2.84M | 704.15K | 0.00 |

| Net Income | 2.99M | -3.90M | -315.22K | 3.25M | 1.48M | 2.56M | 1.67M | 241.84K | 2.21M | 4.49M | -465.14K | 3.19M | 0.00 |

| Net Income Ratio | 179.87% | 102.14% | -18.99% | 97.57% | 94.54% | 97.03% | 95.19% | 10.02% | 89.24% | 183.63% | -17.86% | 117.75% | 0.00% |

| EPS | 0.76 | -0.99 | -0.08 | 0.83 | 0.38 | 0.65 | 0.43 | 0.06 | 0.56 | 1.14 | -0.12 | 0.81 | 0.00 |

| EPS Diluted | 0.76 | -0.99 | -0.08 | 0.83 | 0.38 | 0.65 | 0.43 | 0.06 | 0.56 | 1.14 | -0.12 | 0.81 | 0.00 |

| Weighted Avg Shares Out | 3.92M | 3.92M | 3.92M | 3.92M | 3.92M | 3.92M | 3.87M | 3.92M | 3.92M | 3.92M | 3.92M | 3.92M | 3.92M |

| Weighted Avg Shares Out (Dil) | 3.92M | 3.92M | 3.92M | 3.92M | 3.92M | 3.94M | 3.87M | 3.92M | 3.92M | 3.92M | 3.92M | 3.92M | 3.92M |

Nuveen Closed-End Funds Declare Distributions and Updates to Distribution Policies

Weekly Closed-End Fund Roundup: Special Distributions Coming Up (December 4, 2022)

Large-Scale COVID-19 Antibody Testing of Frontline Health Care Workers Reveals Prevalence

NY Senate passes bill that provides 90-day grace period to redeem credit card rewards

Northwell Health Creates Program of Home Care for People With Moderate to Severe COVID-19

‘Pause’: Freezing the Action, From Tape Decks to Lockdowns

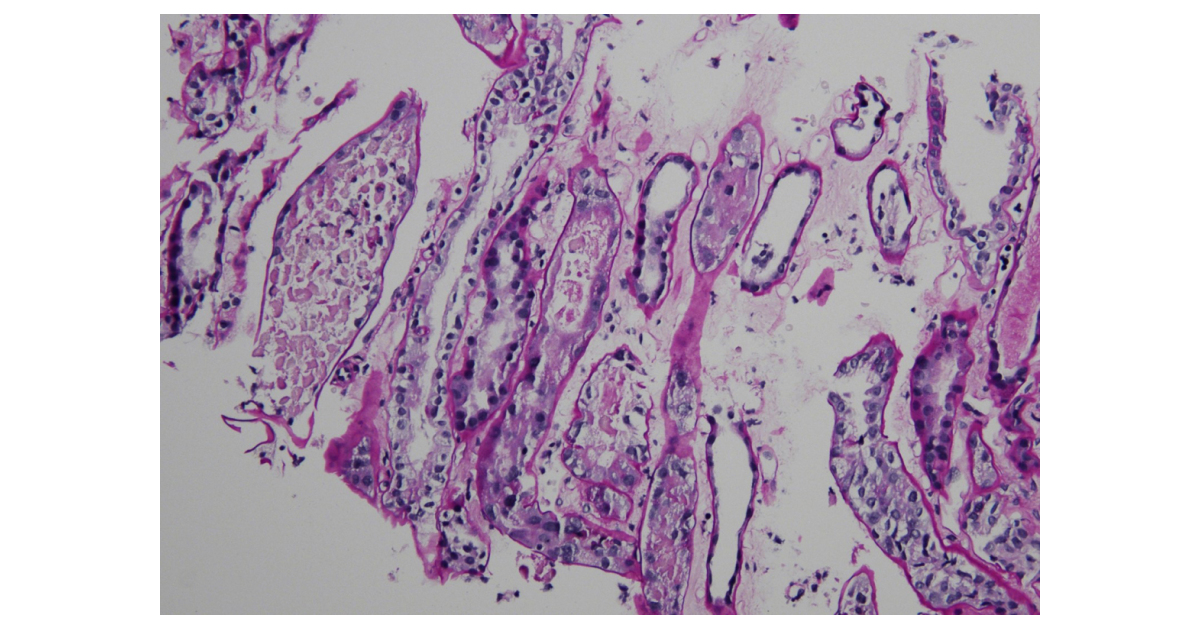

COVID-19 Kidney Biopsy Research Shows Mostly Tubular Damage With No Presence of Virus in the Tissue

The Reopening Killed The V-Shaped Recovery

Source: https://incomestatements.info

Category: Stock Reports