See more : LATAM Airlines Group S.A. (LTMAQ) Income Statement Analysis – Financial Results

Complete financial analysis of NextCure, Inc. (NXTC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of NextCure, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- MOGAN ENERJI (MOGAN.IS) Income Statement Analysis – Financial Results

- Element Nutritional Sciences Inc. (ELNSF) Income Statement Analysis – Financial Results

- Faraday Copper Corp. (CPPKF) Income Statement Analysis – Financial Results

- The Bank of Nova Scotia (BNSPF) Income Statement Analysis – Financial Results

- Astellas Pharma Inc. (4503.T) Income Statement Analysis – Financial Results

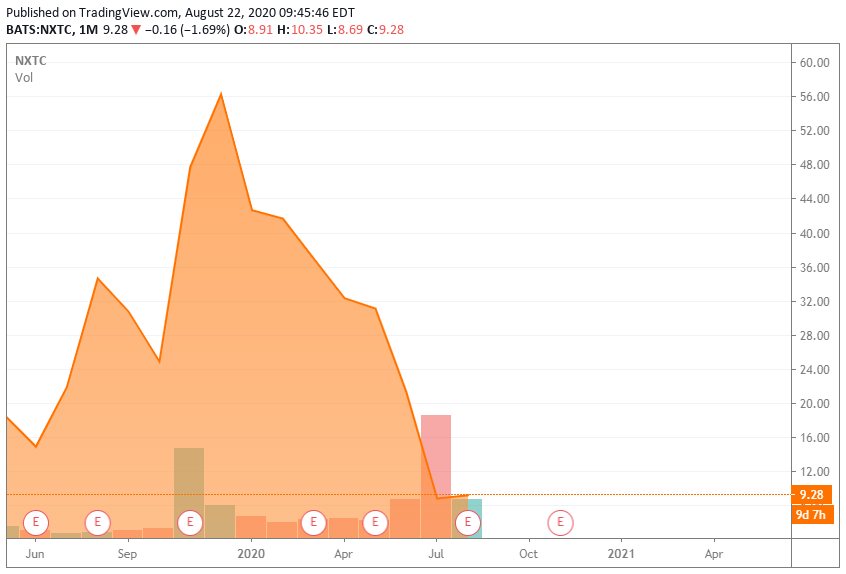

NextCure, Inc. (NXTC)

About NextCure, Inc.

NextCure, Inc., a clinical-stage biopharmaceutical company, engages in discovering and developing novel immunomedicines to treat cancer and other immune-related diseases by restoring normal immune function. Its lead product candidate is NC318, which is in Phase II clinical trials for the treatment of advanced or metastatic solid tumors. The company is also developing NC410, which is in Phase I for novel immunomedicine designed to block immune suppression mediated by an immune modulator called Leukocyte-Associated Immunoglobulin-like Receptor 1; NC762, an immunomedicine targeting a molecule called human B7 homolog 4 protein, or B7-H4; and NC525, a novel LAIR-1 antibody which is in Preclinical trails that targets acute myeloid leukemia, blast cells, and leukemic stem cells. Its discovery and research programs include an antibody in preclinical evaluation of other potential novel immunomodulatory molecules. The company has a license agreement with Yale University. NextCure, Inc. was incorporated in 2015 and is headquartered in Beltsville, Maryland.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 22.38M | 6.35M | 0.00 | 0.00 |

| Cost of Revenue | 3.68M | 4.48M | 4.30M | 46.55K | 34.22K | 1.68M | 582.00K |

| Gross Profit | -3.68M | -4.48M | -4.30M | 22.33M | 6.31M | -1.68M | -582.00K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 99.79% | 99.46% | 0.00% | 0.00% |

| Research & Development | 47.93M | 54.20M | 50.19M | 46.55M | 34.22M | 19.79M | 12.95M |

| General & Administrative | 19.71M | 21.71M | 20.57M | 17.05M | 9.61M | 3.41M | 2.60M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 19.71M | 21.71M | 20.57M | 17.05M | 9.61M | 3.41M | 2.60M |

| Other Expenses | 0.00 | 1.18M | 1.38M | 4.62M | 3.75M | 397.00K | 80.00K |

| Operating Expenses | 67.64M | 75.91M | 70.77M | 63.60M | 43.83M | 23.20M | 15.55M |

| Cost & Expenses | 67.64M | 75.91M | 70.77M | 63.60M | 43.83M | 23.20M | 15.55M |

| Interest Income | 0.00 | 1.17M | 1.32K | 4.55K | 3.75K | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 77.00K | 183.00K | 209.00K | 0.00 | 0.00 |

| Depreciation & Amortization | 3.68M | 4.48M | 4.30M | 3.41M | 2.69M | 1.68M | 582.00K |

| EBITDA | -59.04M | -70.25M | -65.01M | -37.81M | -34.79M | -21.10M | -14.97M |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | -184.22% | -548.20% | 0.00% | 0.00% |

| Operating Income | -67.64M | -75.91M | -70.77M | -41.23M | -37.48M | -23.20M | -15.55M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | -184.22% | -590.55% | 0.00% | 0.00% |

| Total Other Income/Expenses | 4.91M | 1.18M | 1.38M | 4.62M | 3.75M | 397.00K | 80.00K |

| Income Before Tax | -62.72M | -74.73M | -69.39M | -36.60M | -33.74M | -22.80M | -15.47M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | -163.57% | -531.54% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | -5.30M | 6.96M | -3.41M | 2.52M | 397.00K | 0.00 |

| Net Income | -62.72M | -69.43M | -69.39M | -33.19M | -33.74M | -22.80M | -15.47M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | -148.32% | -531.54% | 0.00% | 0.00% |

| EPS | -2.25 | -2.50 | -2.51 | -1.21 | -2.15 | -2.27 | -1.54 |

| EPS Diluted | -2.25 | -2.50 | -2.51 | -1.21 | -2.15 | -2.27 | -1.54 |

| Weighted Avg Shares Out | 27.84M | 27.74M | 27.62M | 27.53M | 15.70M | 10.04M | 10.04M |

| Weighted Avg Shares Out (Dil) | 27.84M | 27.74M | 27.62M | 27.53M | 15.70M | 10.04M | 10.04M |

SHAREHOLDER ALERT: KODK BLNK NXTC: The Law Offices of Vincent Wong Reminds Investors of Important Class Action Deadlines

SHAREHOLDER ALERT: ODT NXTC FLDM: The Law Offices of Vincent Wong Reminds Investors of Important Class Action Deadlines

LAWSUITS FILED AGAINST BLNK, NXTC and TCMD - JAKUBOWITZ LAW PURSUES SHAREHOLDERS CLAIMS

CLASS ACTION UPDATE for BIDU, CLNC and NXTC: Levi & Korsinsky, LLP Reminds Investors of Class Actions on Behalf of Shareholders

Shareholder Alert: Robbins LLP Announces That An Investor of NextCure, Inc. (NXTC ) Filed a Class Action Complaint Against the Company

Scott+Scott Attorneys at Law LLP Files Securities Class Action Against NextCure Inc.

What's Next For NextCure

Vident Investment Advisory LLC Buys 26,730 Shares of NextCure Inc (NASDAQ:NXTC)

NextCure (NASDAQ:NXTC) Shares Gap Down on Analyst Downgrade

Osmotica's FDA Approval, And Other News: The Good, Bad And Ugly Of Biopharma

Source: https://incomestatements.info

Category: Stock Reports