See more : Blitz Technologies Ltd (BLTZ.TA) Income Statement Analysis – Financial Results

Complete financial analysis of Office Properties Income Trust (OPINL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Office Properties Income Trust, a leading company in the REIT – Office industry within the Real Estate sector.

- 3M Company (MMM.DE) Income Statement Analysis – Financial Results

- Canyon Resources Limited (CAY.AX) Income Statement Analysis – Financial Results

- Luxe Holdings Limited (LUX.JO) Income Statement Analysis – Financial Results

- Panbela Therapeutics, Inc. (PBLA) Income Statement Analysis – Financial Results

- Nippon Rietec Co.,Ltd. (1938.T) Income Statement Analysis – Financial Results

Office Properties Income Trust (OPINL)

About Office Properties Income Trust

Office Properties Income Trust is a real estate investment trust. It owns, operates, and leases office buildings to single tenants and multi-tenant buildings. The company was founded on February 17, 2009 and is headquartered in Newton, MA.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 533.55M | 554.28M | 576.48M | 587.92M | 678.40M | 426.56M | 316.53M | 258.18M | 248.55M | 251.03M | 226.91M | 227.75M | 178.95M | 116.77M | 78.96M | 75.43M | 73.05M |

| Cost of Revenue | 172.71M | 57.84M | 71.97M | 65.12M | 73.72M | 49.71M | 37.94M | 30.70M | 29.91M | 28.39M | 25.71M | 24.86M | 34.66M | 21.24M | 8.55M | 0.00 | 0.00 |

| Gross Profit | 360.84M | 496.43M | 504.51M | 522.80M | 604.69M | 376.85M | 278.59M | 227.48M | 218.64M | 222.64M | 201.20M | 202.89M | 144.29M | 95.53M | 70.41M | 75.43M | 73.05M |

| Gross Profit Ratio | 67.63% | 89.56% | 87.52% | 88.92% | 89.13% | 88.35% | 88.01% | 88.11% | 87.97% | 88.69% | 88.67% | 89.08% | 80.63% | 81.81% | 89.18% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | -0.01 | 0.01 | 0.05 | -0.06 | -0.03 | 0.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 22.73M | 52.14M | 52.11M | 53.83M | 67.03M | 51.35M | 39.85M | 32.17M | 32.74M | 35.18M | 29.83M | 31.05M | 7.06M | 7.06M | 4.15M | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.84M | 0.00 | 7.36M | 0.00 | 0.00 |

| SG&A | 22.73M | 52.14M | 52.11M | 53.83M | 67.03M | 51.35M | 39.85M | 32.17M | 32.74M | 35.18M | 29.83M | 31.05M | 10.90M | 7.06M | 11.51M | 9.21M | 8.46M |

| Other Expenses | 4.05M | 332.93M | 347.32M | 357.03M | 410.83M | 252.10M | 174.94M | 127.44M | -12.37M | 112.58M | 96.83M | 89.72M | 82.77M | 50.78M | 38.91M | 43.51M | 40.68M |

| Operating Expenses | 26.78M | 385.07M | 399.43M | 410.86M | 477.86M | 303.45M | 214.78M | 159.61M | 151.86M | 147.75M | 126.66M | 128.89M | 82.77M | 50.78M | 38.91M | 43.51M | 40.68M |

| Cost & Expenses | 199.49M | 442.91M | 471.40M | 475.98M | 551.58M | 353.15M | 252.72M | 190.31M | 181.77M | 176.14M | 152.37M | 153.75M | 117.43M | 72.02M | 47.46M | 43.51M | 40.68M |

| Interest Income | 1.04M | 217.00K | 7.00K | 779.00K | 1.05M | 639.00K | 1.96M | 158.00K | 14.00K | 69.00K | 37.00K | 29.00K | 104.00K | 103.00K | 38.00K | 37.00K | 88.00K |

| Interest Expense | 110.65M | 103.48M | 112.39M | 108.30M | 134.88M | 89.87M | 65.41M | 45.06M | 37.01M | 28.05M | 16.83M | 16.95M | 12.06M | 7.35M | 5.56M | 141.00K | 359.00K |

| Depreciation & Amortization | 200.27M | 444.04M | 475.45M | 476.21M | 596.26M | 375.21M | 252.72M | 136.02M | 67.61M | 65.38M | 56.30M | 56.70M | 40.09M | 23.81M | 15.17M | 13.83M | 13.53M |

| EBITDA | 302.34M | 334.14M | 348.45M | 368.12M | 417.76M | 227.13M | 165.37M | 167.05M | 93.35M | 138.93M | 128.40M | 117.62M | 101.85M | 59.55M | 46.67M | 46.09M | 46.20M |

| EBITDA Ratio | 56.67% | 60.28% | 60.12% | 61.96% | 61.58% | 55.45% | 55.42% | 54.72% | 37.56% | 56.39% | 57.68% | 57.54% | 56.92% | 59.17% | 59.11% | 61.11% | 63.25% |

| Operating Income | 334.06M | 111.58M | 105.09M | 112.72M | 127.87M | 73.41M | 54.32M | 66.68M | 65.97M | 71.53M | 72.10M | 73.51M | 61.52M | 37.50M | 31.50M | 31.91M | 32.37M |

| Operating Income Ratio | 62.61% | 20.13% | 18.23% | 19.17% | 18.85% | 17.21% | 17.16% | 25.83% | 26.54% | 28.49% | 31.78% | 32.27% | 34.38% | 32.11% | 39.89% | 42.31% | 44.31% |

| Total Other Income/Expenses | -380.93M | -361.39M | -110.52M | -104.47M | -94.46M | -76.57M | -73.43M | -43.61M | -293.96M | -18.38M | -16.79M | -8.86M | -8.01M | -11.04M | -5.52M | -104.00K | -271.00K |

| Income Before Tax | -46.87M | -2.33M | -5.43M | 8.25M | 32.37M | -25.22M | -9.55M | 22.94M | -227.99M | 42.24M | 55.31M | 56.91M | 46.20M | 27.96M | 25.98M | 0.00 | 0.00 |

| Income Before Tax Ratio | -8.78% | -0.42% | -0.94% | 1.40% | 4.77% | -5.91% | -3.02% | 8.88% | -91.73% | 16.83% | 24.37% | 24.99% | 25.82% | 23.95% | 32.91% | 0.00% | 0.00% |

| Income Tax Expense | 351.00K | 270.00K | 251.00K | 377.00K | 778.00K | 117.00K | 101.00K | 101.00K | 86.00K | 117.00K | 133.00K | 159.00K | 203.00K | 167.00K | 0.00 | 457.00K | 569.00K |

| Net Income | -69.43M | -2.60M | -5.68M | 6.68M | 30.34M | -21.88M | 12.09M | 57.84M | -209.96M | 56.53M | 54.62M | 56.75M | 46.00M | 27.80M | 25.98M | 31.81M | 32.10M |

| Net Income Ratio | -13.01% | -0.47% | -0.99% | 1.14% | 4.47% | -5.13% | 3.82% | 22.40% | -84.47% | 22.52% | 24.07% | 24.92% | 25.70% | 23.80% | 32.91% | 42.17% | 43.94% |

| EPS | -1.44 | -0.05 | -0.12 | 0.14 | 0.63 | -0.88 | 0.56 | 3.24 | -11.88 | 3.68 | 4.00 | 4.16 | 4.24 | 3.24 | 6.88 | 12.79 | 12.92 |

| EPS Diluted | -1.44 | -0.05 | -0.12 | 0.14 | 0.63 | -0.88 | 0.56 | 3.24 | -11.88 | 3.68 | 4.00 | 4.16 | 4.24 | 3.24 | 6.88 | 12.79 | 12.90 |

| Weighted Avg Shares Out | 48.39M | 48.28M | 48.20M | 48.12M | 48.06M | 24.83M | 21.16M | 17.76M | 17.68M | 15.33M | 13.65M | 13.65M | 10.84M | 8.59M | 3.77M | 2.49M | 2.49M |

| Weighted Avg Shares Out (Dil) | 48.39M | 48.28M | 48.20M | 48.12M | 48.06M | 24.83M | 21.16M | 17.77M | 17.68M | 15.35M | 13.67M | 13.65M | 10.84M | 8.59M | 3.77M | 2.49M | 2.49M |

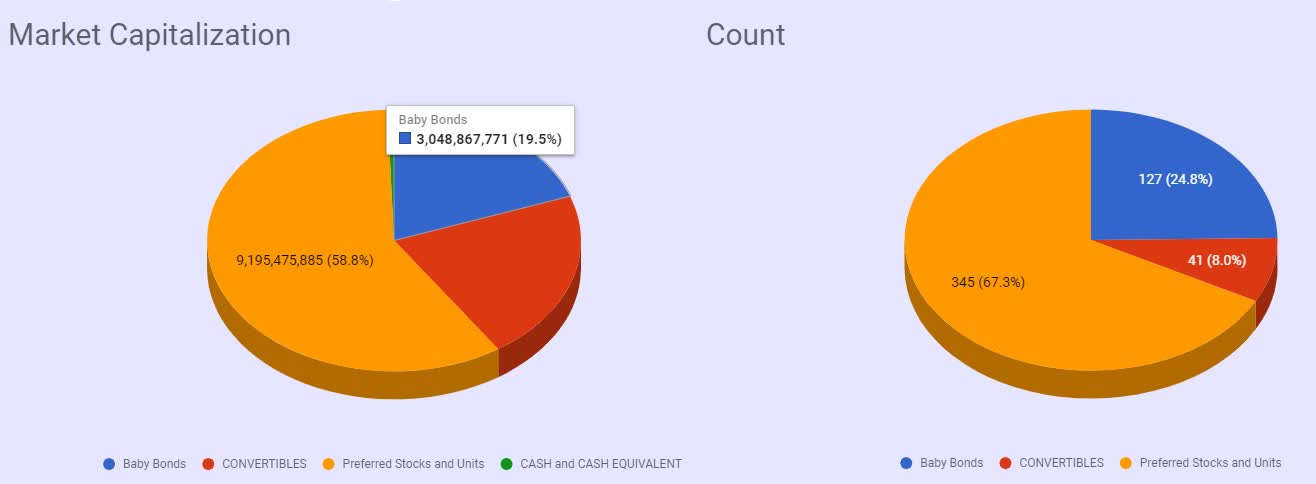

Baby Bonds Complete Review

Source: https://incomestatements.info

Category: Stock Reports