See more : Alaska Communications Systems Group, Inc. (ALSK) Income Statement Analysis – Financial Results

Complete financial analysis of One Stop Systems, Inc. (OSS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of One Stop Systems, Inc., a leading company in the Computer Hardware industry within the Technology sector.

- Avantor, Inc. (AVTR-PA) Income Statement Analysis – Financial Results

- Beyond Meat, Inc. (0A20.L) Income Statement Analysis – Financial Results

- Public Policy Holding Company, Inc. (PPHC.L) Income Statement Analysis – Financial Results

- West China Cement Limited (WCHNF) Income Statement Analysis – Financial Results

- North Eastern Carrying Corporation Limited (NECCLTD.NS) Income Statement Analysis – Financial Results

One Stop Systems, Inc. (OSS)

About One Stop Systems, Inc.

One Stop Systems, Inc. designs, manufactures, and markets high-performance computing modules and systems for edge deployments in the United States and internationally. Its systems are built using the graphical processing unit and solid-state flash technologies. The company provides custom servers, data acquisition platforms, compute accelerators, solid-state storage arrays, PCIe expansion products, and system I/O expansion systems, as well as edge optimized industrial and panel PCs. It also offers ruggedized mobile tablets and handhelds that meet the specialized requirement for devices deployed at the edge in a diverse set of environmental conditions. The company sells its products to multinational companies, governmental agencies, military contractors, and technology providers through its website, web store, direct sales team, and original equipment manufacturer focused sales, as well as through a network of resellers and distributors. One Stop Systems, Inc. was founded in 1998 and is headquartered in Escondido, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 60.90M | 72.42M | 61.98M | 51.90M | 58.31M | 37.03M | 27.54M | 18.88M | 14.23M |

| Cost of Revenue | 42.94M | 52.02M | 42.34M | 35.46M | 38.91M | 25.69M | 18.87M | 13.37M | 10.25M |

| Gross Profit | 17.95M | 20.40M | 19.64M | 16.43M | 19.40M | 11.33M | 8.66M | 5.51M | 3.98M |

| Gross Profit Ratio | 29.48% | 28.17% | 31.69% | 31.67% | 33.28% | 30.61% | 31.46% | 29.21% | 28.00% |

| Research & Development | 4.33M | 4.74M | 4.03M | 4.32M | 4.84M | 4.00M | 2.69M | 1.60M | 1.10M |

| General & Administrative | 9.26M | 7.28M | 7.66M | 8.42M | 8.50M | 6.51M | 3.50M | 2.15M | 1.32M |

| Selling & Marketing | 6.65M | 6.81M | 6.20M | 4.12M | 5.14M | 4.00M | 2.92M | 1.99M | 1.37M |

| SG&A | 15.92M | 14.09M | 13.86M | 12.54M | 13.64M | 10.51M | 6.43M | 4.13M | 2.69M |

| Other Expenses | 5.63M | 550.85K | -40.18K | -53.61K | 281.49K | 271.88K | 30.44K | 5.36K | -6.37K |

| Operating Expenses | 25.88M | 18.83M | 17.89M | 16.86M | 18.48M | 14.51M | 9.11M | 5.73M | 3.79M |

| Cost & Expenses | 68.82M | 70.85M | 60.24M | 52.32M | 57.39M | 40.20M | 27.99M | 19.10M | 14.03M |

| Interest Income | 544.96K | 237.75K | 244.38K | 418.38K | 14.45K | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 117.77K | 162.39K | 527.14K | 550.77K | 165.56K | 65.69K | 199.26K | 152.88K | 128.37K |

| Depreciation & Amortization | 1.08M | 1.05M | 1.48M | 1.61M | 1.66M | 1.05M | 837.27K | 437.04K | 156.95K |

| EBITDA | -4.59M | 3.41M | 4.95M | 1.55M | 1.16M | -1.86M | 417.28K | 222.54K | 345.69K |

| EBITDA Ratio | -7.54% | 3.25% | 3.15% | -0.11% | 4.90% | -4.20% | -1.53% | 1.18% | 2.43% |

| Operating Income | -2.29M | 1.57M | 470.63K | -424.28K | 1.20M | -3.18M | -450.44K | -219.86K | 195.11K |

| Operating Income Ratio | -3.76% | 2.17% | 0.76% | -0.82% | 2.06% | -8.58% | -1.64% | -1.16% | 1.37% |

| Total Other Income/Expenses | -3.50M | 626.21K | 1.19M | -186.01K | -1.58M | 206.19K | -168.82K | -147.51K | -134.74K |

| Income Before Tax | -5.79M | 2.19M | 2.94M | -610.29K | -663.09K | -2.97M | -619.26K | -367.37K | 60.38K |

| Income Before Tax Ratio | -9.51% | 3.03% | 4.74% | -1.18% | -1.14% | -8.02% | -2.25% | -1.95% | 0.42% |

| Income Tax Expense | 927.13K | 4.42M | 605.68K | -603.74K | 237.25K | -1.40M | -402.72K | -182.94K | 43.73K |

| Net Income | -6.72M | -2.23M | 2.33M | -6.54K | -900.34K | -1.14M | 96.62K | -184.44K | 16.65K |

| Net Income Ratio | -11.03% | -3.08% | 3.76% | -0.01% | -1.54% | -3.07% | 0.35% | -0.98% | 0.12% |

| EPS | -0.32 | -0.11 | 0.13 | 0.00 | -0.06 | -0.09 | 0.01 | -0.02 | 0.00 |

| EPS Diluted | -0.32 | -0.11 | 0.12 | 0.00 | -0.06 | -0.09 | 0.01 | -0.02 | 0.00 |

| Weighted Avg Shares Out | 20.85M | 19.73M | 18.31M | 16.51M | 15.15M | 12.59M | 11.42M | 8.47M | 7.44M |

| Weighted Avg Shares Out (Dil) | 20.85M | 19.73M | 19.50M | 16.51M | 15.15M | 12.59M | 11.42M | 9.54M | 7.82M |

OSS to Present at LD Micro Main Event, October 3-5, 2023

OSS to Showcase Specialized High-Performance AI Computing Solutions at DSEI on September 12-15, 2023

Top 5 Tech Stocks That Are Set To Fly This Month - Marathon Digital Holdings (NASDAQ:MARA), Indie Semiconductor (NASDAQ:INDI)

One Stop Systems, Inc. (OSS) Q2 2023 Earnings Call Transcript

One Stop Systems, Inc. (OSS) Reports Break-Even Earnings for Q2

One Stop Systems Reports Q2 2023 Results

OSS to Hold Second Quarter 2023 Conference Call on Thursday, August 10, 2023 at 5:00 p.m. ET

One Stop Systems Appoints Industry Veteran, Robert Kalebaugh, as Vice President of Sales

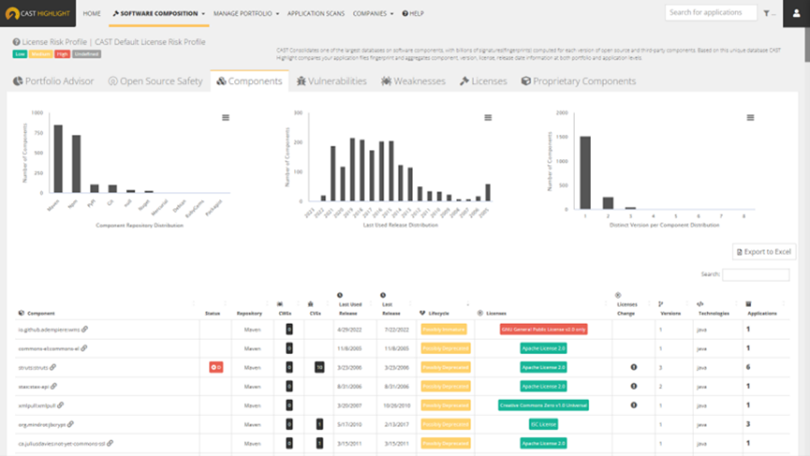

Open-Source Component Lifespan Insights Available in CAST

OSS to Present at LD Micro Conference on June 6, 2023

Source: https://incomestatements.info

Category: Stock Reports