See more : Fengxing Co., Ltd. (002760.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Overstock.com, Inc. (OSTK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Overstock.com, Inc., a leading company in the Specialty Retail industry within the Consumer Cyclical sector.

- Venzee Technologies Inc. (VENZ.V) Income Statement Analysis – Financial Results

- Heritage Southeast Bancorporation, Inc. (HSBI) Income Statement Analysis – Financial Results

- Oneflow AB (publ) (ONEF.ST) Income Statement Analysis – Financial Results

- Swift Networks Group Limited (SW1.AX) Income Statement Analysis – Financial Results

- CA Healthcare Acquisition Corp. (CAHC) Income Statement Analysis – Financial Results

Overstock.com, Inc. (OSTK)

About Overstock.com, Inc.

Overstock.com, Inc. operates as an online retailer in the United States. The company offers furniture, décor, area rug, bedding and bath, home improvement, outdoor, and kitchen and dining items. It provides its products and services through its internet websites comprising overstock.com, o.co, overstock.ca, and overstockgovernment.com. The company also offers businesses advertising products or services on its website; Market Partner, a service that allows its partners to sell their products through third party sites; products to international customers using third party logistics providers; and Supplier Oasis, a single integration point through its partners can manage their products, inventory, and sales channels, as well as obtain multi-channel fulfillment services through its distribution network. The company was formerly known as D2-Discounts Direct and changed its name to Overstock.com, Inc. in October 1999. Overstock.com, Inc. was founded in 1997 and is headquartered in Midvale, Utah.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.56B | 1.93B | 2.76B | 2.55B | 1.46B | 1.82B | 1.74B | 1.80B | 1.66B | 1.50B | 1.30B | 1.10B | 1.05B | 1.09B | 876.77M | 834.37M | 760.16M | 788.15M | 803.82M | 494.64M | 238.95M | 91.78M | 40.00M | 25.52M |

| Cost of Revenue | 1.25B | 1.49B | 2.13B | 1.97B | 1.17B | 1.47B | 1.40B | 1.47B | 1.35B | 1.22B | 1.06B | 900.86M | 875.19M | 900.23M | 712.02M | 691.46M | 632.59M | 693.35M | 683.27M | 428.86M | 213.49M | 73.44M | 34.64M | 27.81M |

| Gross Profit | 314.01M | 443.34M | 623.90M | 579.53M | 293.09M | 353.91M | 340.55M | 331.35M | 304.65M | 279.06M | 247.66M | 198.43M | 179.09M | 189.64M | 164.75M | 142.91M | 127.57M | 94.80M | 120.56M | 65.78M | 25.45M | 18.34M | 5.36M | -2.29M |

| Gross Profit Ratio | 20.11% | 22.98% | 22.63% | 22.73% | 20.08% | 19.43% | 19.52% | 18.41% | 18.38% | 18.64% | 18.99% | 18.05% | 16.99% | 17.40% | 18.79% | 17.13% | 16.78% | 12.03% | 15.00% | 13.30% | 10.65% | 19.98% | 13.41% | -8.97% |

| Research & Development | 0.00 | 121.16M | 123.00M | 137.00M | 135.34M | 132.15M | 115.88M | 106.76M | 98.53M | 86.26M | 71.79M | 65.47M | 67.04M | 58.26M | 52.34M | 57.82M | 59.45M | 65.16M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 90.41M | 79.70M | 210.40M | 264.26M | 138.12M | 296.64M | 206.60M | 196.06M | 180.72M | 158.04M | 139.96M | 122.73M | 67.77M | 55.65M | 48.91M | 38.37M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 224.55M | 215.48M | 302.43M | 263.05M | 143.12M | 274.48M | 180.59M | 147.90M | 124.47M | 109.46M | 91.61M | 63.47M | 61.81M | 61.33M | 55.55M | 57.63M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 314.96M | 295.18M | 512.83M | 527.31M | 281.24M | 571.11M | 387.19M | 343.95M | 305.19M | 267.50M | 231.57M | 186.19M | 129.58M | 116.98M | 104.46M | 96.01M | 97.43M | 117.73M | 144.28M | 70.77M | 37.08M | 19.49M | 15.23M | 18.93M |

| Other Expenses | 117.15M | -63.83M | -123.00M | -137.00M | -12.50M | -3.49M | 1.18M | 14.18M | 3.63M | 1.17M | -235.00K | 3.69M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 432.11M | 416.34M | 512.83M | 527.31M | 416.58M | 571.11M | 387.19M | 343.95M | 305.19M | 267.50M | 231.57M | 186.19M | 196.62M | 175.24M | 156.79M | 153.82M | 156.89M | 182.89M | 144.35M | 71.13M | 37.84M | 22.40M | 18.93M | 19.16M |

| Cost & Expenses | 1.68B | 1.90B | 2.65B | 2.50B | 1.58B | 2.04B | 1.79B | 1.81B | 1.66B | 1.49B | 1.29B | 1.09B | 1.07B | 1.08B | 868.81M | 845.28M | 789.48M | 876.24M | 827.62M | 499.99M | 251.33M | 95.84M | 53.57M | 46.97M |

| Interest Income | 0.00 | 2.97M | 556.00K | 1.73M | 1.80M | 2.21M | 659.00K | 326.00K | 155.00K | 152.00K | 127.00K | 116.00K | 161.00K | 157.00K | 170.00K | 3.16M | 0.00 | 3.57M | -270.00K | 0.00 | 461.00K | 0.00 | 0.00 | 241.00K |

| Interest Expense | 12.01M | 2.97M | 556.00K | 1.97M | 342.00K | 1.47M | 2.94M | 877.00K | 140.00K | 39.00K | 113.00K | 809.00K | 2.49M | 2.96M | 3.47M | 3.46M | 0.00 | 4.77M | 5.58M | 0.00 | 76.00K | 0.00 | 0.00 | 73.00K |

| Depreciation & Amortization | 19.45M | 16.71M | 31.06M | 27.72M | 20.33M | 31.70M | 32.85M | 31.29M | 25.10M | 18.06M | 14.52M | 16.01M | 16.35M | 14.58M | 12.88M | 22.67M | 29.84M | 32.74M | 16.31M | 4.44M | 3.17M | 5.39M | 5.81M | 33.00K |

| EBITDA | -118.11M | 43.71M | 142.14M | 79.95M | -103.16M | -186.79M | -11.95M | 33.20M | 28.35M | 30.95M | 30.51M | 32.05M | -1.02M | 29.13M | 21.01M | 13.20M | 12.90M | -49.76M | -12.22M | -858.00K | -9.33M | 1.78M | -7.79M | -21.41M |

| EBITDA Ratio | -7.57% | 2.27% | 5.16% | 3.14% | -7.07% | -10.25% | -0.68% | 1.84% | 1.71% | 2.07% | 2.34% | 2.92% | -0.10% | 2.67% | 2.40% | 1.58% | 1.70% | -6.31% | -1.52% | -0.17% | -3.91% | 1.94% | -19.47% | -83.90% |

| Operating Income | -118.11M | 27.01M | 111.07M | 52.23M | -123.49M | -217.21M | -46.63M | 6.92M | -534.00K | 11.92M | 16.57M | 12.16M | -17.53M | 14.97M | 8.03M | -10.91M | -41.60M | -93.77M | -23.79M | -5.35M | -12.39M | -4.05M | -13.57M | -21.45M |

| Operating Income Ratio | -7.57% | 1.40% | 4.03% | 2.05% | -8.46% | -11.92% | -2.67% | 0.38% | -0.03% | 0.80% | 1.27% | 1.11% | -1.66% | 1.37% | 0.92% | -1.31% | -5.47% | -11.90% | -2.96% | -1.08% | -5.18% | -4.42% | -33.91% | -84.03% |

| Total Other Income/Expenses | -148.02M | -60.86M | 11.94M | -5.07M | -11.05M | -2.75M | -1.10M | 13.63M | 3.65M | 1.28M | -221.00K | 2.99M | -2.05M | -717.00K | -23.00K | -1.75M | -3.92M | -1.12M | 4.67M | -49.00K | 115.00K | -444.00K | 29.00K | -33.00K |

| Income Before Tax | -266.12M | -33.85M | 123.02M | 47.16M | -134.54M | -219.95M | -47.73M | 20.55M | 3.12M | 13.21M | 16.34M | 15.15M | -19.58M | 14.25M | 8.00M | -12.36M | -53.97M | -99.36M | -19.07M | -5.40M | -12.27M | -4.50M | -13.54M | -21.48M |

| Income Before Tax Ratio | -17.05% | -1.75% | 4.46% | 1.85% | -9.22% | -12.07% | -2.74% | 1.14% | 0.19% | 0.88% | 1.25% | 1.38% | -1.86% | 1.31% | 0.91% | -1.48% | -7.10% | -12.61% | -2.37% | -1.09% | -5.14% | -4.90% | -33.84% | -84.16% |

| Income Tax Expense | 41.72M | 1.38M | -48.78M | 989.00K | 185.00K | -2.38M | 64.19M | 9.30M | 1.90M | 4.40M | -72.17M | 485.00K | -142.00K | 359.00K | 257.00K | 1.75M | 15.70M | 13.61M | 1.12M | -349.00K | -500.00K | 506.00K | 239.00K | -168.00K |

| Net Income | -307.84M | -35.24M | 171.79M | 56.00M | -134.72M | -206.07M | -109.88M | 12.52M | 2.45M | 8.85M | 88.51M | 14.67M | -19.44M | 13.89M | 7.75M | -12.66M | -45.02M | -101.71M | -24.92M | -5.00M | -11.89M | -4.56M | -13.81M | -21.31M |

| Net Income Ratio | -19.72% | -1.83% | 6.23% | 2.20% | -9.23% | -11.31% | -6.30% | 0.70% | 0.15% | 0.59% | 6.79% | 1.33% | -1.84% | 1.27% | 0.88% | -1.52% | -5.92% | -12.90% | -3.10% | -1.01% | -4.97% | -4.97% | -34.51% | -83.50% |

| EPS | -6.81 | -0.79 | 4.00 | 1.25 | -3.86 | -6.87 | -4.39 | 0.49 | 0.10 | 0.37 | 3.55 | 0.63 | -0.83 | 0.60 | 0.34 | -0.55 | -1.89 | -4.99 | -1.28 | -0.28 | -0.73 | -0.35 | -1.25 | -3.59 |

| EPS Diluted | -6.81 | -0.79 | 3.96 | 1.24 | -3.86 | -6.87 | -4.39 | 0.49 | 0.10 | 0.36 | 3.46 | 0.62 | -0.83 | 0.59 | 0.33 | -0.55 | -1.89 | -4.99 | -1.28 | -0.28 | -0.73 | -0.35 | -1.25 | -3.59 |

| Weighted Avg Shares Out | 45.21M | 44.32M | 42.98M | 41.22M | 34.87M | 29.98M | 25.03M | 25.34M | 24.61M | 24.00M | 23.77M | 23.44M | 23.31M | 23.07M | 22.88M | 22.96M | 23.76M | 20.38M | 19.48M | 17.89M | 16.24M | 13.14M | 11.02M | 5.94M |

| Weighted Avg Shares Out (Dil) | 45.21M | 44.32M | 43.33M | 41.61M | 34.87M | 29.98M | 25.04M | 25.43M | 24.70M | 24.32M | 24.35M | 23.73M | 23.31M | 23.42M | 23.12M | 22.96M | 23.76M | 20.38M | 19.48M | 17.89M | 16.24M | 13.14M | 11.02M | 5.94M |

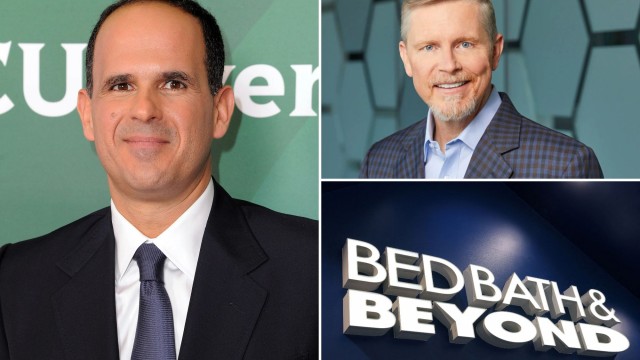

Beyond recruits Conn's Inc. exec to lead Bed, Bath & Beyond and promotes Overstock executive

Bed Bath & Beyond Relaunches Its Market-Leading Gift Registry

Allison Abraham Retires as Co-Chair and Member of the Beyond, Inc. Board of Directors

Beyond Announces Participation in Fireside Chat Hosted by Needham & Company

Beyond Sets New Cyber 5 Sales Record, Revenue Grew 24% YoY

Beyond Board of Directors Unanimously Votes to Enhance Governance and Accountability through Declassification

Allison Abraham and Marcus Lemonis to Serve as Co-Chairs of Beyond, Inc. Board of Directors

Bed Bath & Beyond CEO Departs Amid Investor Pressure

Bed Bath & Beyond just removed the CEO who led its transition from Overstock.com

Activist investor forces out CEO of rebranded Bed Bath & Beyond

Source: https://incomestatements.info

Category: Stock Reports