See more : Vanquis Banking Group plc (FPLPF) Income Statement Analysis – Financial Results

Complete financial analysis of Oxford Lane Capital Corp. (OXLCM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Oxford Lane Capital Corp., a leading company in the Asset Management industry within the Financial Services sector.

- Fuji Electric Co., Ltd. (FELTY) Income Statement Analysis – Financial Results

- Power Grid Corporation of India Limited (POWERGRID.BO) Income Statement Analysis – Financial Results

- Formosa International Hotels Corporation (2707.TW) Income Statement Analysis – Financial Results

- AIREA plc (AIEA.L) Income Statement Analysis – Financial Results

- Sichuan Expressway Company Limited (0107.HK) Income Statement Analysis – Financial Results

Oxford Lane Capital Corp. (OXLCM)

About Oxford Lane Capital Corp.

Oxford Lane Capital Corp. is a close ended fund launched and managed by Oxford Lane Management LLC. It invests in fixed income securities. The fund primarily invests in securitization vehicles which in turn invest in senior secured loans made to companies whose debt is rated below investment grade or is unrated. Oxford Lane Capital Corp was formed on June 9, 2010 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 290.64M | -158.43M | 130.15M | 293.35M | -288.16M | -18.57M | 40.42M | 107.41M | -83.46M | 5.95M | 25.25M | 11.60M | 5.01M | 520.00K |

| Cost of Revenue | 77.49M | 65.59M | 54.45M | 32.12M | 31.63M | 23.62M | 19.38M | 14.59M | 15.10M | 0.00 | 0.00 | 3.87M | 1.21M | 140.00K |

| Gross Profit | 213.15M | -224.02M | 75.69M | 261.23M | -319.79M | -42.20M | 21.04M | 92.82M | -98.56M | 5.95M | 25.25M | 7.73M | 3.80M | 380.00K |

| Gross Profit Ratio | 73.34% | 141.40% | 58.16% | 89.05% | 110.98% | 227.20% | 52.05% | 86.42% | 118.09% | 100.00% | 100.00% | 66.64% | 75.85% | 73.08% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.33M | 4.45M | 3.91M | 3.22M | 2.80M | 2.27M | 2.28M | 2.10M | 2.23M | 2.51M | 2.52M | 1.80M | 1.17M | 260.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 5.33M | 4.45M | 3.91M | 3.22M | 2.80M | 2.27M | 2.28M | 2.10M | 2.23M | 2.51M | 2.52M | 1.80M | 1.17M | 260.00K |

| Other Expenses | 0.00 | -315.74M | 361.97K | 201.41K | 176.24K | 140.67K | 136.90K | 108.62K | 83.59K | 109.11K | 69.76K | 0.00 | 0.00 | -10.00K |

| Operating Expenses | 11.55M | 12.86M | 4.27M | 3.42M | 2.97M | 2.41M | 2.42M | 2.21M | 2.32M | 2.62M | 2.59M | 1.80M | 1.17M | 250.00K |

| Cost & Expenses | 22.68M | 12.86M | 4.27M | 3.42M | 2.97M | 2.41M | 2.42M | 2.21M | 2.32M | 2.62M | 2.59M | 5.67M | 2.38M | 390.00K |

| Interest Income | 15.31M | 7.25M | 3.95M | 6.12M | 3.74M | 1.40M | 1.60M | 1.05M | 1.04M | 1.45M | 23.01M | 0.00 | 0.00 | 0.00 |

| Interest Expense | 32.86M | 31.81M | 22.08M | 16.28M | 15.48M | 15.05M | 13.40M | 11.71M | 14.81M | 10.66M | 4.50M | 18.39M | 1.79M | 0.00 |

| Depreciation & Amortization | 1.00 | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 52.52K | 22.82K | 14.81M | 10.66M | 4.50M | 36.78M | 3.58M | -80.00K |

| EBITDA | 267.96M | -171.29M | 147.96M | 306.21M | -275.65M | 0.00 | 39.72M | 116.91M | -70.97M | 13.99M | 27.16M | 42.70M | 6.21M | 40.00K |

| EBITDA Ratio | 92.20% | 108.11% | 113.68% | 104.38% | 95.66% | 31.93% | 127.17% | 108.85% | 85.03% | 235.18% | 107.55% | 368.10% | 123.95% | 7.69% |

| Operating Income | 267.96M | -171.29M | 147.96M | 306.21M | -275.65M | -5.93M | 51.41M | 116.91M | -85.78M | 3.33M | 22.66M | 5.92M | 2.63M | 120.00K |

| Operating Income Ratio | 92.20% | 108.11% | 113.68% | 104.38% | 95.66% | 31.93% | 127.17% | 108.85% | 102.77% | 56.00% | 89.73% | 51.03% | 52.50% | 23.08% |

| Total Other Income/Expenses | -32.86M | -31.81M | -22.08M | -16.28M | -15.48M | 0.00 | -1.71M | 14.59M | 0.00 | 0.00 | 0.00 | 18.39M | 1.79M | -40.00K |

| Income Before Tax | 235.11M | -171.29M | 125.88M | 289.93M | -291.13M | -20.98M | 38.01M | 105.20M | -85.78M | 3.33M | 22.66M | 24.31M | 4.42M | 80.00K |

| Income Before Tax Ratio | 80.89% | 108.11% | 96.72% | 98.83% | 101.03% | 112.97% | 94.02% | 97.94% | 102.77% | 56.00% | 89.73% | 209.57% | 88.22% | 15.38% |

| Income Tax Expense | 0.00 | -32.03M | -236.56K | -206.30K | -171.86K | -161.14K | -52.52K | -22.82K | -14.81M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 235.11M | -171.29M | 125.88M | 289.93M | -291.13M | -20.98M | 38.01M | 105.20M | -85.78M | 3.33M | 22.66M | 24.31M | 4.42M | 80.00K |

| Net Income Ratio | 80.89% | 108.11% | 96.72% | 98.83% | 101.03% | 112.97% | 94.02% | 97.94% | 102.77% | 56.00% | 89.73% | 209.57% | 88.22% | 15.38% |

| EPS | 1.12 | -1.14 | 1.20 | 3.14 | -4.14 | -0.51 | 1.49 | 5.41 | -4.64 | 0.23 | 1.49 | 1.55 | 0.28 | 0.01 |

| EPS Diluted | 1.12 | -1.14 | 1.20 | 3.14 | -4.14 | -0.51 | 1.49 | 5.41 | -4.64 | 0.23 | 1.49 | 1.55 | 0.28 | 0.01 |

| Weighted Avg Shares Out | 209.92M | 150.25M | 104.90M | 92.34M | 70.32M | 41.14M | 25.51M | 19.45M | 18.49M | 14.48M | 15.24M | 15.70M | 15.70M | 15.70M |

| Weighted Avg Shares Out (Dil) | 209.92M | 150.25M | 104.90M | 92.34M | 70.32M | 41.14M | 25.51M | 19.45M | 18.49M | 14.48M | 15.24M | 15.70M | 15.70M | 15.70M |

Oxford Lane Capital 2020 Q2 - Results - Earnings Call Presentation

Building Resilient CEF Portfolios

The Retiree's Dividend Portfolio - Jane's June Update: Record Dividends During COVID-19

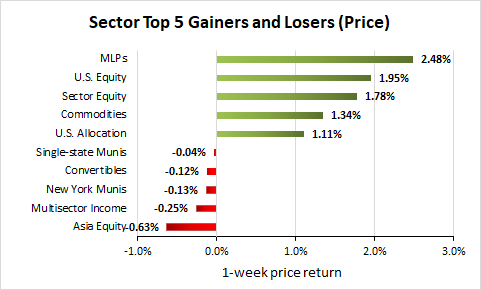

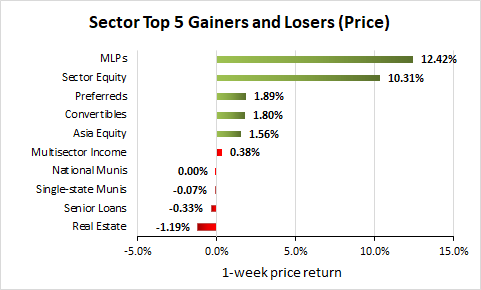

Weekly Closed-End Fund Roundup: July 19, 2020

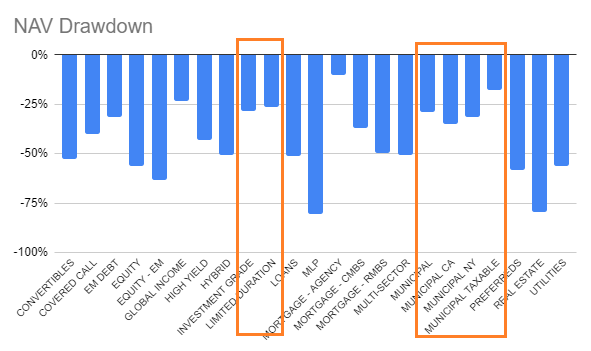

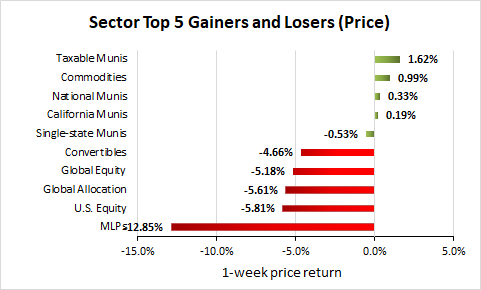

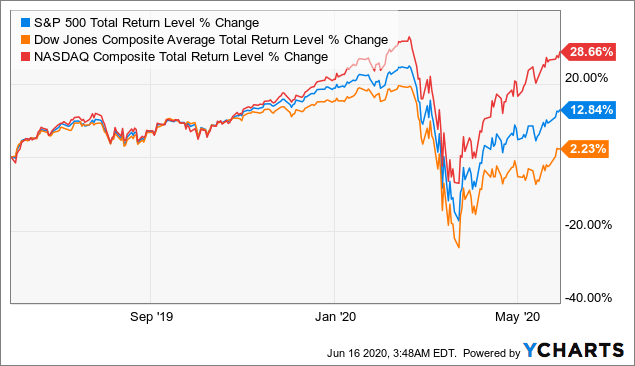

Income Lab Ideas: H1 2020 Closed-End Fund Sector Performance

Weekly Closed-End Fund Roundup: TYG/NTG Reinstates Distributions (July 12, 2020)

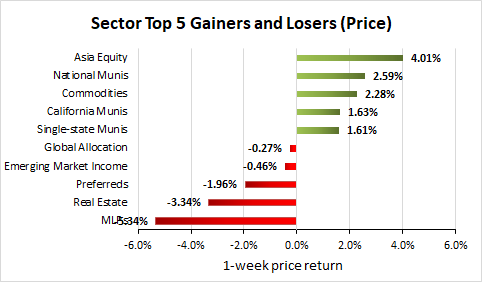

Weekly Closed-End Fund Roundup: June 21, 2020

The Chemist's Closed-End Fund Report, June 2020: Valuations And Sentiment Improving

Weekly Closed-End Fund Roundup: June 14, 2020

The Retiree's Dividend Portfolio - Jane's May Update: Following The Gameplan

Source: https://incomestatements.info

Category: Stock Reports