See more : Establishment Labs Holdings Inc. (ESTA) Income Statement Analysis – Financial Results

Complete financial analysis of Pacific Basin Shipping Limited (PCFBF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Pacific Basin Shipping Limited, a leading company in the Marine Shipping industry within the Industrials sector.

- Fureasu Co.,Ltd. (7062.T) Income Statement Analysis – Financial Results

- Time Finance plc (TIME.L) Income Statement Analysis – Financial Results

- Varun Beverages Limited (VBL.BO) Income Statement Analysis – Financial Results

- Exail Technologies (EXA.PA) Income Statement Analysis – Financial Results

- Gongniu Group Co., Ltd. (603195.SS) Income Statement Analysis – Financial Results

Pacific Basin Shipping Limited (PCFBF)

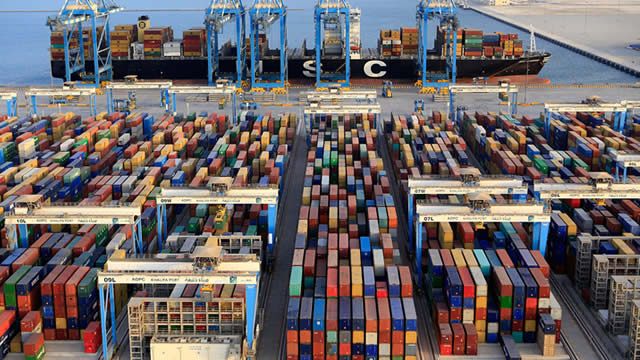

About Pacific Basin Shipping Limited

Pacific Basin Shipping Limited, an investment holding company, provides dry bulk shipping services worldwide. It also offers shipping consulting, ocean shipping, crewing, secretarial, and agency and ship management services; and engages in the vessel owning and chartering, and convertible bonds issuing activities. As of February 28, 2022, the company had a fleet of 130 Handysize vessels, and 124 Supramax vessels. Pacific Basin Shipping Limited was founded in 1987 and is headquartered in Wong Chuk Hang, Hong Kong.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.30B | 3.28B | 2.97B | 1.47B | 1.59B | 1.59B | 1.49B | 1.09B | 1.26B | 1.72B | 1.71B | 1.44B | 1.34B | 1.27B | 950.48M | 1.69B | 1.18B | 620.44M | 433.70M | 188.88M | 54.19M |

| Cost of Revenue | 2.17B | 2.55B | 2.23B | 1.43B | 1.51B | 1.51B | 1.46B | 1.14B | 1.26B | 1.76B | 1.65B | 1.36B | 1.23B | 1.11B | 797.68M | 544.60M | 315.95M | 215.81M | 114.75M | 70.72M | 26.21M |

| Gross Profit | 130.95M | 732.08M | 739.34M | 36.87M | 72.47M | 83.86M | 24.71M | -54.33M | -4.11M | -39.62M | 55.10M | 81.87M | 107.65M | 159.33M | 152.80M | 1.15B | 861.34M | 404.64M | 318.95M | 118.17M | 27.97M |

| Gross Profit Ratio | 5.70% | 22.31% | 24.87% | 2.51% | 4.57% | 5.27% | 1.66% | -5.00% | -0.33% | -2.31% | 3.22% | 5.67% | 8.02% | 12.56% | 16.08% | 67.79% | 73.16% | 65.22% | 73.54% | 62.56% | 51.62% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.75M | 8.13M | 8.46M | 6.11M | 6.04M | 6.00M | 5.31M | 5.75M | 5.95M | 9.35M | 17.56M | 10.84M | 10.75M | 12.95M | 12.29M | 18.01M | 17.80M | 12.29M | 11.81M | 6.88M | 469.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.75M | 8.13M | 8.46M | 6.11M | 6.04M | 6.00M | 5.31M | 5.75M | 5.95M | 9.35M | 17.56M | 10.84M | 10.75M | 12.95M | 12.29M | 18.01M | 17.80M | 12.29M | 11.81M | 6.88M | 469.00K |

| Other Expenses | 0.00 | -15.82M | 0.00 | 0.00 | -19.00K | -2.42M | -4.23M | -9.04M | -3.72M | -32.00M | -4.38M | -4.10M | -11.07M | 0.00 | -116.28M | 84.44M | -15.82M | -23.81M | -14.45M | -7.72M | -4.82M |

| Operating Expenses | 130.95M | 14.69M | 12.74M | 4.71M | 5.69M | -22.84M | -14.96M | -21.92M | -15.37M | 8.69M | 17.56M | 10.84M | 34.65M | 24.96M | -96.64M | 18.01M | 372.50M | 18.93M | 156.58M | 6.45M | 467.00K |

| Cost & Expenses | 2.18B | 2.56B | 2.25B | 1.44B | 1.52B | 1.48B | 1.45B | 1.12B | 1.25B | 1.77B | 1.67B | 1.37B | 1.27B | 1.13B | 701.04M | 562.61M | 688.45M | 234.74M | 271.33M | 77.17M | 26.68M |

| Interest Income | 14.19M | 8.66M | 722.00K | 2.98M | 5.72M | 3.51M | 3.65M | 2.75M | 4.47M | 10.79M | 14.68M | 17.48M | 12.85M | 0.00 | 11.43M | 26.02M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 25.94M | 23.61M | 28.20M | 35.57M | 42.43M | 35.03M | 34.55M | 30.02M | 33.08M | 35.57M | 32.40M | 30.84M | 31.33M | 31.19M | 37.19M | 22.13M | 17.85M | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 215.52M | 199.03M | 151.69M | 160.12M | 166.83M | 116.46M | 108.94M | 98.89M | 100.09M | 102.58M | 82.79M | 72.44M | 73.59M | 58.11M | 40.98M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | 348.52M | 924.66M | 1.03B | -8.75M | 234.57M | 226.17M | 147.16M | 44.36M | 115.80M | -141.15M | 121.27M | 157.12M | 137.10M | 194.10M | 150.16M | 452.96M | 490.87M | 385.71M | 162.37M | 111.72M | 27.51M |

| EBITDA Ratio | 15.18% | 27.69% | 29.54% | 13.15% | 14.99% | 14.12% | 9.94% | 5.47% | 8.76% | 1.30% | 7.10% | 11.05% | 10.21% | 15.30% | 15.80% | 25.70% | 41.52% | 62.17% | 37.44% | 59.15% | 50.76% |

| Operating Income | 124.27M | 710.07M | 725.81M | 33.35M | 71.76M | 108.36M | 38.57M | -39.31M | 10.36M | -80.32M | 38.48M | 87.01M | 63.51M | 135.98M | 109.18M | 434.53M | 488.84M | 385.71M | 162.37M | 111.72M | 27.51M |

| Operating Income Ratio | 5.41% | 21.64% | 24.42% | 2.27% | 4.53% | 6.81% | 2.59% | -3.62% | 0.82% | -4.67% | 2.25% | 6.03% | 4.73% | 10.72% | 11.49% | 25.70% | 41.52% | 62.17% | 37.44% | 59.15% | 50.76% |

| Total Other Income/Expenses | -15.17M | -21.45M | 120.54M | -239.55M | -45.53M | -34.81M | -36.42M | -46.25M | -28.62M | -198.20M | -26.51M | -33.17M | -67.54M | -29.58M | -20.18M | -68.83M | -15.82M | -23.81M | -171.03M | -7.76M | -4.82M |

| Income Before Tax | 109.10M | 702.50M | 846.35M | -206.19M | 26.24M | 73.55M | 3.26M | -85.56M | -17.36M | -278.53M | 11.03M | 53.85M | 32.18M | 104.79M | 112.00M | 412.41M | 473.02M | 111.43M | 147.92M | 104.00M | 22.69M |

| Income Before Tax Ratio | 4.75% | 21.41% | 28.47% | -14.02% | 1.65% | 4.62% | 0.22% | -7.87% | -1.38% | -16.21% | 0.65% | 3.73% | 2.40% | 8.26% | 11.78% | 24.39% | 40.18% | 17.96% | 34.11% | 55.06% | 41.87% |

| Income Tax Expense | -279.00K | 641.00K | 1.54M | 2.03M | 1.11M | 1.26M | -354.00K | 985.00K | 1.18M | 1.22M | 1.17M | 1.62M | 197.00K | 453.00K | 1.72M | 3.62M | 889.00K | 1.14M | 779.00K | 485.00K | 0.00 |

| Net Income | 109.38M | 701.86M | 844.81M | -208.23M | 25.12M | 72.28M | 3.61M | -86.55M | -18.54M | -284.96M | 1.52M | -158.47M | 31.98M | 104.34M | 110.28M | 409.12M | 472.13M | 110.29M | 147.14M | 103.56M | 22.69M |

| Net Income Ratio | 4.76% | 21.39% | 28.42% | -14.16% | 1.58% | 4.54% | 0.24% | -7.96% | -1.47% | -16.58% | 0.09% | -10.98% | 2.38% | 8.23% | 11.60% | 24.19% | 40.10% | 17.78% | 33.93% | 54.82% | 41.87% |

| EPS | 0.02 | 0.14 | 0.18 | -0.04 | 0.01 | 0.02 | 0.00 | -0.03 | -0.01 | -0.11 | 0.00 | -0.06 | 0.01 | 0.04 | 0.04 | 0.18 | 0.22 | 0.06 | 0.08 | 0.07 | 0.02 |

| EPS Diluted | 0.02 | 0.13 | 0.16 | -0.04 | 0.01 | 0.02 | 0.00 | -0.03 | -0.01 | -0.11 | 0.00 | -0.06 | 0.01 | 0.04 | 0.04 | 0.18 | 0.22 | 0.06 | 0.08 | 0.07 | 0.02 |

| Weighted Avg Shares Out | 5.34B | 5.04B | 4.72B | 4.68B | 4.57B | 4.40B | 4.08B | 3.29B | 2.63B | 2.62B | 2.66B | 2.66B | 2.66B | 2.65B | 2.55B | 2.32B | 2.16B | 1.82B | 1.75B | 1.48B | 1.09B |

| Weighted Avg Shares Out (Dil) | 5.41B | 5.47B | 5.42B | 4.68B | 4.66B | 4.48B | 4.16B | 3.29B | 2.64B | 2.62B | 2.66B | 2.66B | 2.66B | 2.65B | 2.56B | 2.32B | 2.16B | 1.83B | 1.77B | 1.49B | 1.09B |

Pacific Basin Shipping Ltd. (PCFBY) is on the Move, Here's Why the Trend Could be Sustainable

Here's Why Momentum in Pacific Basin Shipping Ltd. (PCFBY) Should Keep going

Source: https://incomestatements.info

Category: Stock Reports